Markets PUMP to Kick Off the Week, Despite the Continued War FUD

Bitcoin nearly scraped $44k on a very encouraging Monday for cryptocurrency. After an extended period of BTC ranging between $34k to $40k, patient traders were pleased to see a breakthrough in this resistance level. Altcoins followed suit on today's pump, with many prices returning to mid-February or earlier levels.

This price pump, as many often do, came as a big surprise to traders who were collectively becoming increasingly negative about crypto's future. As we have discussed in recent insights, the threat of war was already causing trader stagnancy. But when the rumor of war officially evolved into full-blown factual news, prices swiftly dropped. However, less than 24 hours after Putin's official announcement, market caps had already made up for their losses and then some.

Since this recovery, as stated above, markets had been somewhat indecisive and staying in a ranging pattern for most of the past few days prior to today's breakout. However, commentary had noticeably shifted very negative, according to our social platform data we collect.

Historically, when a week of this level of FUD and negative posts from the crypto crowd occurs, prices have a tendency to bounce higher. It hasn't been surprising to see that this breakout occurred immediately following the lowest point we've seen weighted social sentiment hit since October, 2020.

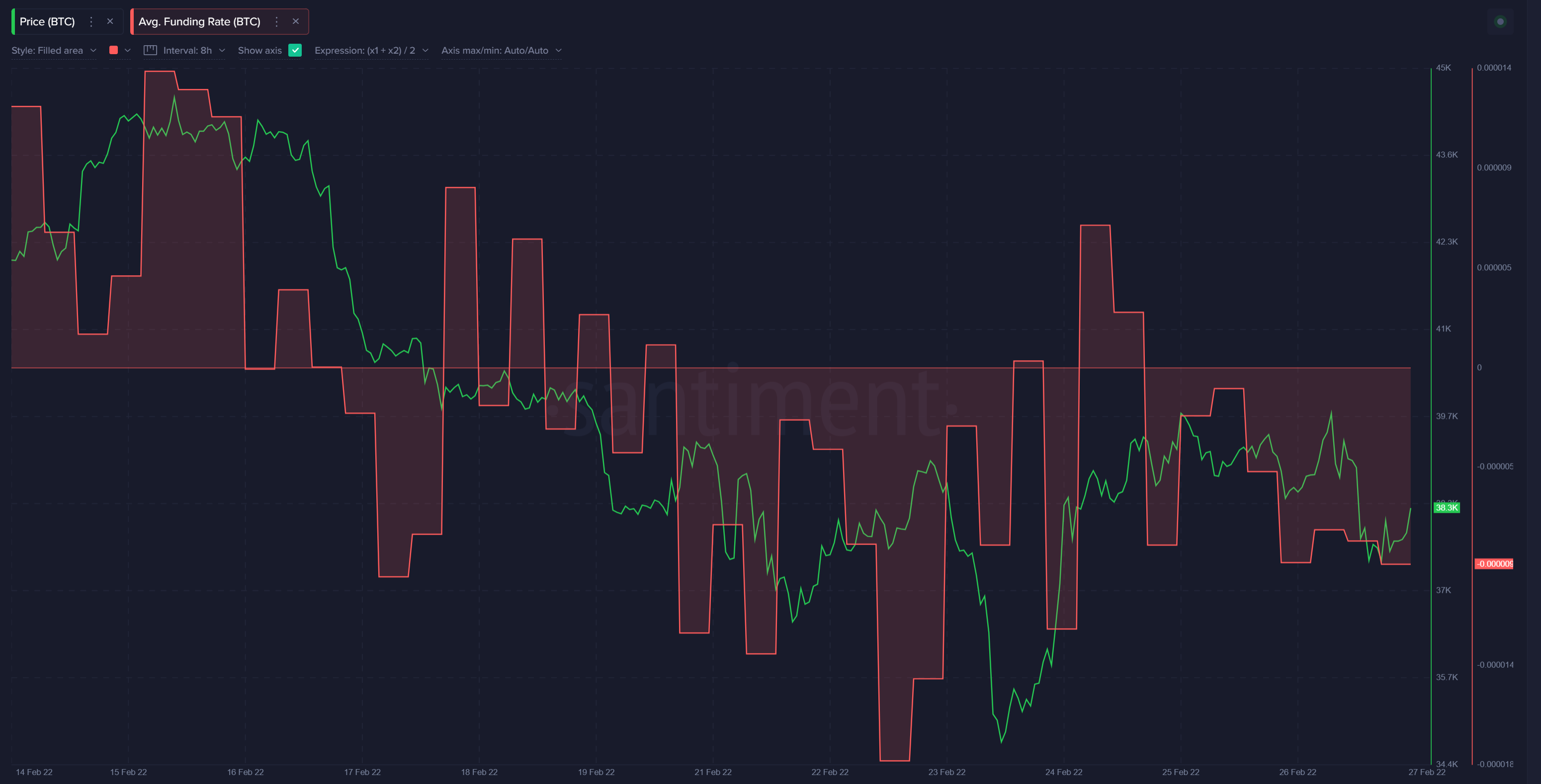

On top of this, we can clearly see that traders were putting their money where their mouths were on social media. Exchange contract perpetual funding rates had been skewing negative for much of the past 10 days even prior to the war becoming official. This indicated that traders were shorting the markets more than longing.

Those who were betting for Bitcoin's price to drop were caught off guard, and many were liquidated Monday.

On a more granular level, we are seeing that Bitcoin funding rates (in blue) are staying very slightly short right now. Meanwhile, altcoin funding rates (in purple) are back to their highest level of longs in a few days after they have followed Bitcoin's lead with major pumping firing off at the time of this writing:

Crypto markets continuing to pump will be decided, among other things, by traders' greed or fear now that we have seen a very nice recovery. Of course, it's important to keep in mind that volatility will be a factor with positive and negative war news shifting the market with every new report.

Don't forget that Bitcoin's current close relationship with the S&P 500 is a concern as well.

Any breakout away from this kind of correlation, which today was a very good early sign, is excellent as a signal for a continued breakout for BTC and the rest of crypto.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.