Maker is DeFi too! Can follow newborn tokens

Compound, Balancer... You can check 'oldies' some times when considering to enter DeFi market. Maker for example. An 'oldie' but 'goldie'. Not overheated lately.

It's not overhyped. Onchain metrics are healthy. Now they went down, but still looking good.

This post will not be overloaded with dozens of metrics. Today we will show you when to stay away.

Daily Active Addresses will be the only indicator.

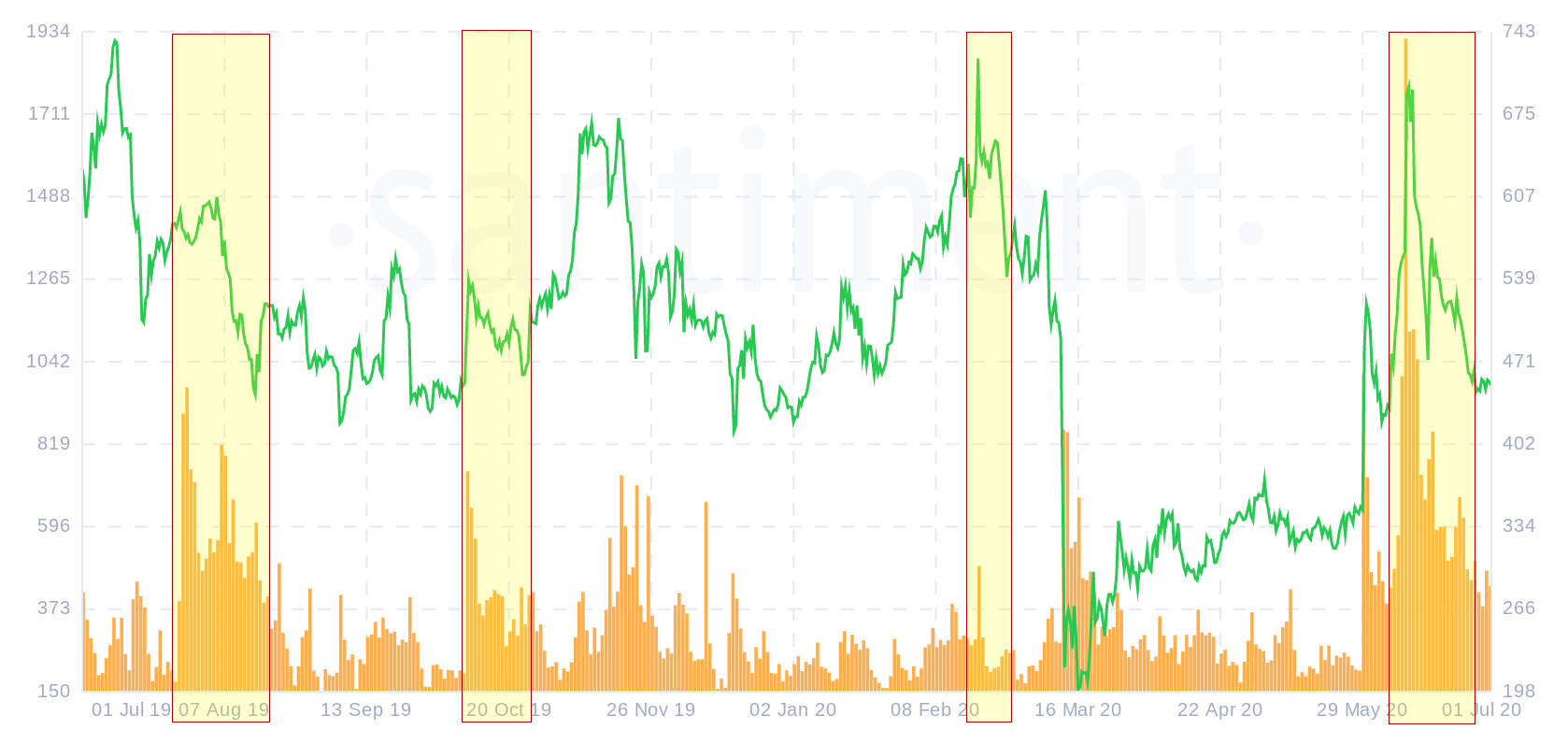

Here you can see the same pattern repeating over and over again. When the rapid DAA spike (orange bars) is not followed by a new higher one, then the price is not able to rely on it and dumps. Because of "the new blood/money" are needed to support the rally. Daily Active Addresses 'energy' should be increasing to keep bringing price higher and higher.

The spike itself is ok, it's natural, it brings speculators, but if on the very next day you see a drop in activity, this is where price goes down too.

Like the recent example on the right. Divergence was very clear. Price tried to push one more time but DAA was like half then before. That's it! Dump.

Rest assured it would happen again.

Now zooming from 12 to 3 months:

Once again, DAA and onchain metrics are healthy. Now they went down, but still looking good.

If you're considering to open a position, keep in mind at the moment it looks ok. Current levels or below are good. Network is active but not overheated. DAA seems like trying to spike again.

Daily Active Addresses might possibly evolve to bullish divergence with price. But needs to increase first.

Not an investment advice.