Litecoin's LTC20 is Less Than 3 Months Out: How Big of a Deal Is It?

The LTC20 halving coming up on August 10th will be a significant event for the Litecoin network. Most experts expect the event to have a positive impact on the price of Litecoin, and we would be included in this belief. This certainly doesn't mean, however, that the long-standing asset will lead the markets over the next two and a half months with an overwhelming ascension. Market cycles and news events will always play a factor in LTC's price.

Taking place on block 2,140,000, the reward for mining Litecoin will suddenly drop from 12.5 LTC to just 6.25 LTC. Reduced supply and increased demand would make logical sense, based on history.

Just as we have seen the price of Bitcoin rise in each of their halvings (with the last one occurring in 2020), it is likely that Litecoin will follow suit. But as you may likely know, prices don't just stay flat and then suddenly have a major reaction before a long anticipated event in crypto. It's often a gradual rise in excitement that often has a "baked in" process well before the day or week actually approaches.

So what exactly is this halving about? Well just like BTC, Litecoin has a an event every four years that essentially makes it so that the amount of Litecoin that is created each time a block is mined is cut in half. This essentially creates:

- A rush to mine as much as possible just prior to the halving by miners

- More value on each existing LTC, with the universal knowledge that there will be a slower production of each coin moving forward

These factors typically create rises in price. And timing out when surges can happen will often come down to the crowd's own enthusiasm and knowledge of the event. Below, we can see the frequency of LTC discussion (in blue) and discussion of the halving (in red).

As we can see, right around May 1st is when discussions began to heat up about LTC20. And 2 weeks later, the enthusiasm really took off. This was what we can consider to be the "crowd discovery" of the event, with forums and posts beginning to see increased interest, reminding traders that this event was within 3 months away.

And look at how on-chain transaction volume has seen a gradual ascension as well, starting right around May 8th.

If this trend of increased on-chain volume continues, it will absolutely be a strong sign that some big players are beginning to jump in on their LTC investments in anticipation of the halving.

Similarly, the amount of unique addresses interacting on the Litecoin network absolutely skyrocketed, suddenly reaching a greater than one-year high just as its price was bottoming out. This was obviously a great signal that addresses were stocking up on what may be the only "discount" before August 10th.

Even though active addresses have calmed down over the past 5 days, it still wouldn't be too surprising to see a quick rebound in this metric. Additionally, the amount of unique tokens (known as circulation) may follow with some rises of its own, which it hasn't shown any signs of yet.

On a more short-term time scale, we may need to see some of the profits cool off a bit. Right now, the 30-day and 365-day MVRV ratios are well above 0%, indicating that average traders are well above water and thriving at the moment. You want to be investing in assets, typically, when average traders are in pain (the opposite of thriving).

Most realistically, because of this, we could see a path where the average trading returns on the short and mid-term time scales cool down for a week or two for Litecoin. And then, as we get within two months of the August event (around mid-June), don't be surprised to see an even bigger wave of anticipation for LTC 20.

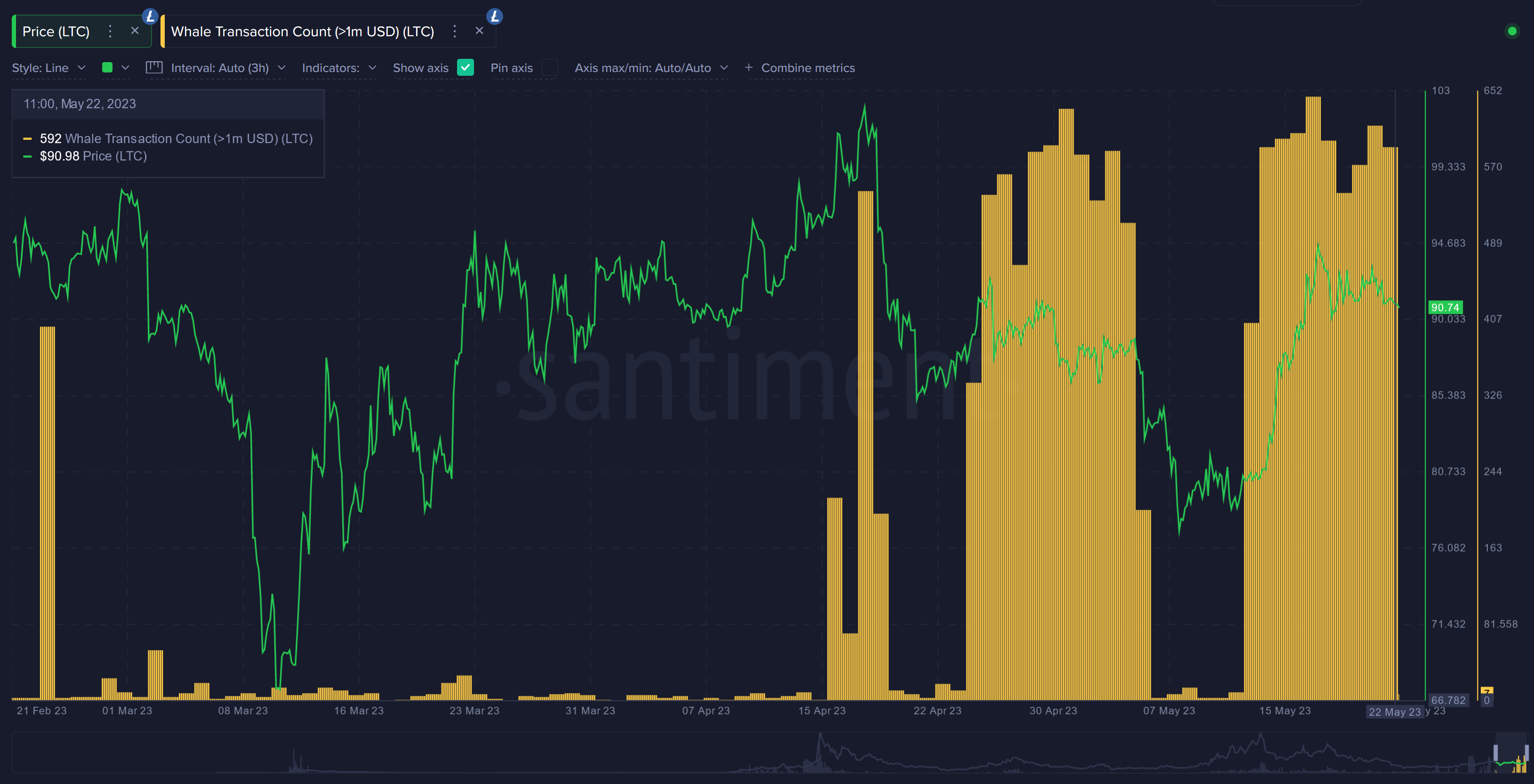

Lastly, don't be surprised if whales push up the price above $100 before an opportunity is given for one final dip. Halving events are known for creating some pretty shocking anomalies. And it has been interesting to see separate waves of 500-600 $1M+ daily transactions on the LTC network. And then all of a sudden, the amount drops by 95% for a week (as shown below).

When planning for events that are historically bullish, there is always the chance that the crowd can get tricked if there is too many unanimous assumptions that history will repeat itself. But dollar cost averaging in to an asset that you believe will rise, whether it's this halving event, Bitcoin's next year, or some other positive news announcement, is rarely a shameful strategy.

Pay attention to the news cycle, particularly if a major influencer begins to discuss LTC quite aggressively all of a sudden. There will be opportunities to find optimal price points to invest in, but if you try to be too precise, you may miss out!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.