Last Week in Crypto, As Told by Santiment Data

In this edition:

- The #Faketoshi saga, through the lens of our social data

- Afri Schoeden and the rise of Ethereum Maximalism

- The Wabi Gambit (or how we predicted a Holo pump)

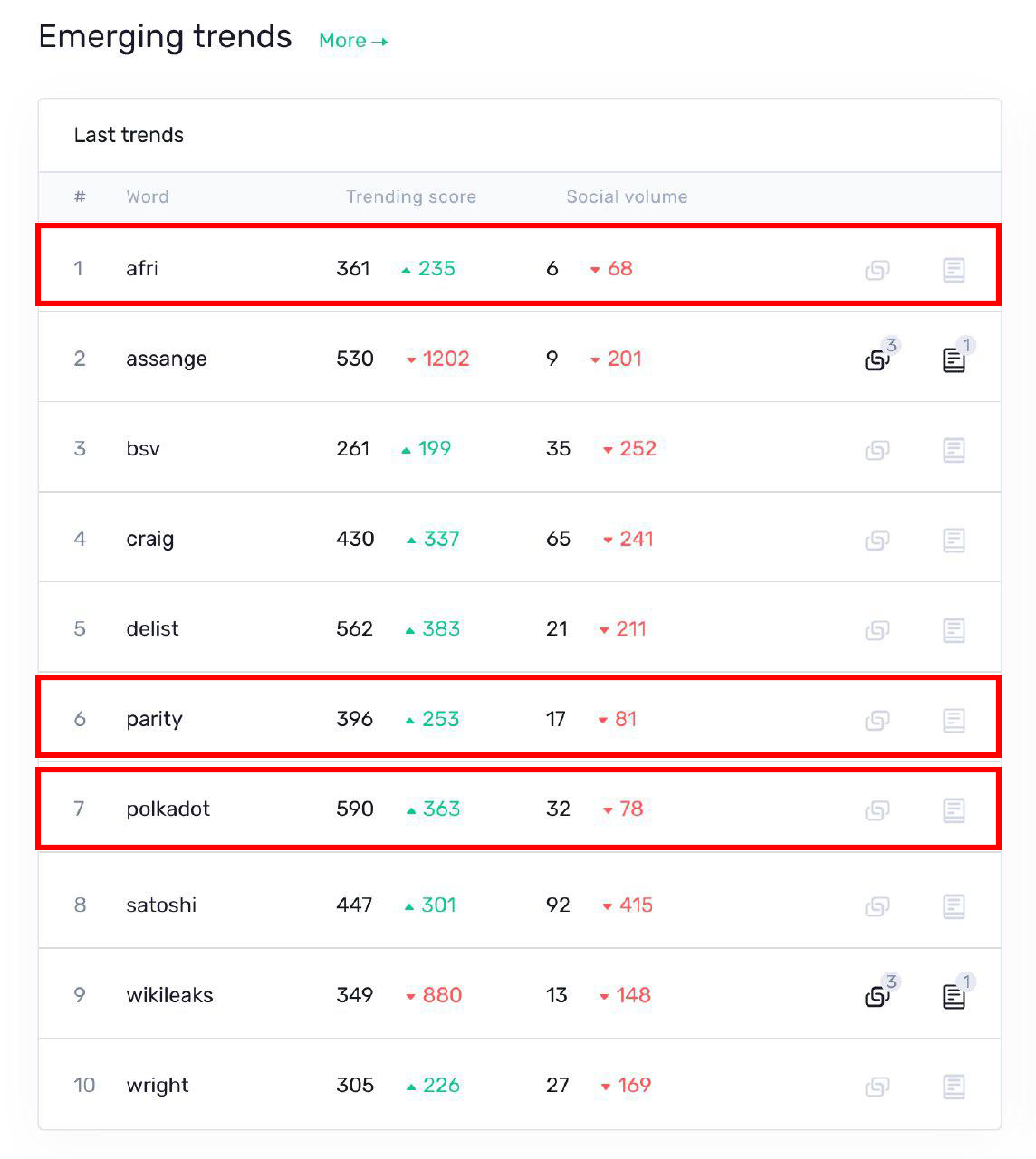

If you are for whatever reason not sure what the biggest story in crypto was in the past 7 days, here it is in one glorious list of our Top Social Gainers for April 15th:

For those that took a well-deserved sabbatical from crypto social media recently, a quick recap of the most recent drama:

Bitcoin SV, the Bitcoin Cash hard fork spearheaded by Craig Wright has been delisted from Binance, Kraken and Shapeshift after Wright threatened to sue an anonymous twitter user known only as @hodlonaut, and even offered a $5k reward for information on his real-life identity.

For years now, Craig Wright has claimed to be Satoshi Nakamoto, the mystery creator of Bitcoin and the original author of digital gold’s whitepaper. Save for the ardent BSV supporters, many in the crypto community remain unconvinced of Wright’s arguments to the fact, asserting that it wouldn’t be at all difficult for the real Satoshi to prove his identity should he opt to.

As CZ, Binances CEO recently put it:

Hodlonaut, a long-time member of the ‘crypto twitter’ and creator of the popular Lightning Torch, recently posted a series of tweets calling Wright a fraud and accusing him of dumping BSV on exchanges.

In the following days, Wright’s lawyers served Hodlonaut with legal papers claiming evidence of a ‘targeted campaign’ to harass and label the good name of Dr. Wright. As a result, Hodlonaut deleted his twitter account and retreated from the community, prompting a #WeAreHodlonaut hashtag and a crowdfunding campaign to help him cover the legal costs.

In the aftermath, Calvin Ayre - another vocal BSV proponent and a personal friend of Mr. Wright - also threatened to sue a slew of noted crypto community members, from Vitalik himself to a self-proclaimed “semi-respected journalist” Peter McCormack.

All of this culminated when CZ, the CEO of the world’s biggest crypto exchange, called Wright a fraud and threatened to delist BSV should the circus continue, making good on his promise just a few days later:

As expected, BSV responded with an immediate vertical red candle. The coin is currently down 30% for the week, tho the price seems to have stabilized for the time being at around $55 a pop.

Here’s how the whole ordeal looked from a social data standpoint:

This chart shows the combined mentions of ‘craig’ and ‘bsv’ on crypto-related social media channels over the last 3 months, plotted against the free-falling price of Bitcoin SV. At its peak (April 15th), there were 1600+ mentions of those two terms alone on the 1000+ channels that we track.

It’s notable that the biggest spike actually occurred fairly late in the downtrend - a slightly delayed ‘crowd realization’ of the full scale of the issue.

We also compiled two infographics (best viewed in high-res), showing various noteworthy events in the CSW/BSV saga over the last weeks, and how they correlate with the assets price:

While this was clearly a devastating blow for Bitcoin SV’s prospects, the project and its proponents are far from waving a white flag.

Not even a day after CZ threatened to delist the coin and 3 days BEFORE Binance went through with it, Jack Liu already aannounced partnering with OKEx to launch a new Bitcoin SV-based exchange named FloatSV, which hopes to capitalize on the growing #DelistBSV movement.

The exchange is already live and looking for users. However, while various crypto news sites covered the news, it seems that FloatSV has yet to make a lasting impression on the crypto community at large. To date, and across all 1000+ crypto social channels that we track, there has been a grand total of 3 mentions of ‘FloatSV’, ever:

Just like the coin it pledges to service, FloatSV faces a long uphill climb.

While the majority of the crypto crowd was busy watching BSV self-implode, another juicy, less-covered drama was engulfing the top Ethereum subreddits.

It reached its natural peak on April 12th, when our Top Social Gainers looked like this:

Unlike the BSV circus, the recurring Afri/Polkadot drama is anything but straightforward. Oh no. In my experience, the Ethereum reddit likes their drama weird and particularly heavy on vitriol, uncorroborated accounts and half-baked conspiracy theories. So strap in.

To understand the full scope of the Afri ordeal, we first need to take it back to February 18th 2019, the first time the word ‘Afri’ showed up on our Top Social Gainers list. I wrote on the event at the time:

“Afri, ETH Core developer and release manager at Parity, gets accused of conflict of interest, splitting the Ethereum community.”

For those of you unfamiliar with the stakeholders - namely Afri, Parity and Polkadot - here’s a crash course: Afri Schoeden was a long-time Ethereum Core developer and an embattled mod of r/ethereum. He was also a release manager at Parity, a blockchain company behind the popular Parity Ethereum client and several other, increasingly controversial projects (more on this in a moment).

Parity is perhaps best known to a wider audience for its ETH node and the major contract vulnerability found and exploited in their multi-sig wallet back in 2017, which resulted in ~$300M being frozen and effectively lost (including $90M from Parity’s founder and former ETH Core developer Gavin Wood).

There have been several attempts to retrieve the funds, including a week-long community vote on whether or not to implement EIP-999, a patch that would restore the disabled contract and un-freeze 587 wallets holding 513,774.16 ETH.

Some criticized the ‘exclusive’ nature of EIP-999 which would only affect Parity’s multi-sig library, and accused Parity of trying to enact changes that benefit them personally rather than the Ethereum community at large. In the end, the proposal was denied.

More recently, Parity has also been developing Polkadot, a blockchain interoperability framework where “independent blockchains can exchange information and trust-free transactions via the Polkadot relay chain, with the key tenets of scalability, governance and interoperability.“

Over the past few months, Polkadot has become increasingly labeled by the Ethereum community as the blockchain’s direct competitor, as some say it aims to tackle the same issues as ETH 2.0 (like safety and scalability), only with an earlier release date.

With that out of the way, let’s jump back to February 2019. Afri got into some hot water after a tweet asking people to change his mind about the fact that ”Polkadot delivers what Serenity ought to be”, Serenity being the much-anticipated centerpiece of Ethereum 2.0

This did not sit well with ETH maximalists, which quickly accused Schoeden of proselytizing Ethereum’s competitors while contributing to both projects and serving as a moderator of one of Ethereum’s biggest online communities (r/ethereum).

While Schoeden clarified that his comments were meant to encourage discussion rather than cement a narrative, that did little to dissuade the vocal minority that insisted on ‘conflict of interest’ and asked for Afri’s removal as a mod and his ostracism from the community.

As a result of the public infighting and ensuing harassment, Afri soon announced his departure as an ETH Core dev, maintaining that he never worked on Polkadot in the first place:

The whole drama split the Ethereum community wide, with a variety of Ethereum developers and crypto pundits siding with Afri, even signing an open letter to call for an end to “threats and toxic behavior”.

And for the next two months, everyone pretty much moved on. So what the hell happened on April 12th?

Part 2 of the Afri saga begins with the appearance of Dothereum, which calls itself ‘a permission-less, general-purpose, smart-contract parachain. Just like @ethereum but built on @polkadotnetwork”

Dothereum is a copy of Ethereum built atop Polkadot’s technology and...that’s pretty much all we can tell for sure.

There has been ZERO confirmed information about the project, no official statement from whoever’s in charge, and their website is a static homepage with links to Dothereum’s twitter and subreddit, both of which convey equally little information:

So naturally, parts of r/ethereum and r/ethtrader were able to quickly deduce that Dothereum was in fact Afri’s master plan all along, and is actually an upcoming hard fork of Ethereum whose main purpose will be recovering the funds that were lost in the Parity hack of 2017:

Yep.

Where to start? For one, Afri’s involvement with the Dothereum project remains mere speculation at this point. His Twitter account was deleted after the last Polkadot debacle, and he’s yet to make any mention of the project on his known reddit account. It seems that the only connection is an anonymous twitter account vaguely ‘associated’ with Schoedon:

For many on Ethereum’s reddit, this was the ‘smoking gun’ they were hoping for, so that the Afri slander could begin anew:

Afri’s involvement with Dothereum is only part of the wide-arching speculations surrounding the project. As mentioned, the community also seems fairly confident that this is all an elaborate ploy to recover the frozen Parity funds on the Polkadot platform. So far, Dothereum has received no formal backing from Parity, and Web3 Foundation iterated that they are in no way connected to the project.

Regardless, people are already hotly debating Parity’s “decision” to attempt wallet recovery via Dothereum, and have even compared this whole ordeal to Ethereum’s very own ‘CSW moment’:

Some have just gone full tinfoil hat about the whole thing:

There are other less malicious, more technical assumptions being made just as well. In one of the most popular threads on the topic, Dothereum is described as a Polkadot-induced hard fork of Ethereum. While some questioned OP’s familiarity with the concept of a ‘hard fork’, others described Dothereum as a ‘hard spoon’, more analogous to Cosmos:

In the end, nobody (still) knows what Dothereum is or will be. At present, it is nothing but a name, logo and two vapid social media channels. It’s as likely that it becomes an Ethereum killer as it is that Dothereum is a one-man passion project that will never gain any real traction or even a semblance of a following.

What it does reveal, however, is a growing protectionism and insecurity brewing in Ethereum's hardliners, (non-devs and those with mainly speculative in the project), which seem increasingly quick to jump on any perceived threat to their project’s market dominance, no matter how tiny.

The rise of Ethereum maximalism within r/ethereum and r/ethrader has been slow but steady, and is now dangerously close to becoming an uncodified community norm. As an example, parallel to the whole Dothereum drama, Ameen Soleimani, CEO of Spankchain, submitted a governance proposal to effectively force Aragon to build exclusively on Ethereum, in response to the project mentioning that they're considering building a complementary Aragon parachain on Polkadot:

Whether this hyper-loyalism ends up preserving Ethereum’s status in the crypto ecosystem or does the exact opposite remains to be seen.

As for Afri, he has ‘finally’ excused himself as a mod on r/ethereum mod just a few days ago, after a follow-up thread lamented the fact that he still holds the function. That said, given the community’s borderline obsession with the guy, I doubt this will be the last time we’re seeing his name on our Top Social Gainers list.

Last week, the project formerly known as WaBi (recently rebranded to Tael) became the latest recipient of an infamous Binance AMA pump.

Over the last two months, Binance has hosted a series of project AMAs on their main English Telegram group, highlighting some of the coins listed on their exchange and giving away a variety of project-related goodies.

Next up was Wabi, whose co-founders addressed the Binance community on April 16th:

We’ve covered this Binance AMA Effect before - it seems like any time one is hosted, the project experiences a surge in popularity on crypto social media, ending up on our Top Social Gainers list in the process. For some of them, the AMA hype also translates to a price rally, as was the case with Neblio not that long ago:

Now, it seems the projects too are starting to pick up on this correlation. Not leaving anything to chance, Tael even stepped in to help with the pre-AMA pump, teasing a big partner reveal during the event on April 12th:

As a result, the coin gained 69.7% in the 24 hours following the teaser tweet, and eventually grew to a 9-month high $0.48. It has also gained plenty in social volume, recording 470+ new mentions and making our Top Social Gainers list in the process:

Perhaps unsurprisingly, the price action proved less auspicious following the actual AMA, with Wabi down 24.09% since. The ‘big partnership’, in case you were wondering, is a collab with Rakuten, Japan's largest ecommerce platform, which will open a dedicated ‘zone’ for products inside the Techrock retail channel and "work towards the integration of Tael loyalty points":

The Wabi pump is only half the story, however, and is a great example of why you should always read our daily insights AND join our Discord channel, where we talk trading and often expand on our daily coverage.

I wrote about the Wabi pump in detail as soon as it happened, and suggested that Binance AMA pumps could well become a self-fulfilling prophecy in the future.

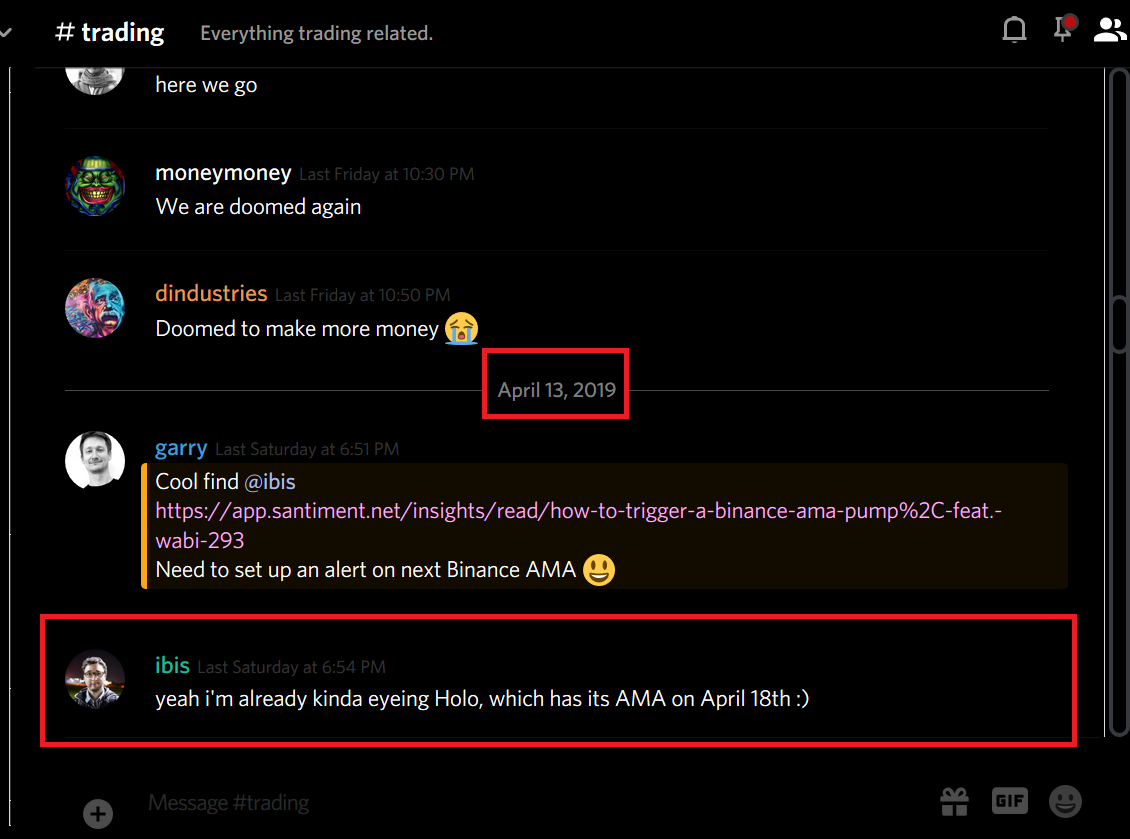

This prompted additional discussion in our #trading channel, where I mentioned I was keeping a keen eye on Holo, the next project in line for a Binance AMA, scheduled for April 18th:

Holo was also featured recently in our roundup of top 10 ERC-20 projects by Dev Activity for the month of March. We even contacted the project at the time to ask what they were building, which you can read all about on our blog:

Anyway, it’s April 18th. And here’s Holo:

You can join our Discord channel here.

Conversations (0)