Last Week in Crypto (according to Santiment Data)

In this edition:

- Maker & the tale of two community votes

- On-chain look at the CELR coin offering

- Crowd sentiment, or how to spot a forming top (featuring RVN)

1. Maker & The Tale of Two Community Votes

MakerDAO dominated the crypto headlines once again over the past 7 days, and for good reason. Just weeks after voting to raise the DAI stability fee to 3.5%, the MKR holders were tasked with yet another fee-related referendum, held on vote.makerdao.com between March 21-23.

Stability fees are a crucial mechanism for preventing DAI’s volatility and ensuring long-term balance between the stablecoin’s supply and demand. The new vote was stitched together by the project for a number of pressing reasons:

- DAI’s exchange price remains below $1

- High inventory levels among market makers and prop desks

- Previous stability fee hike had no visible effect

This time around, the ‘ballot’ presented 3 choices: don’t raise the fee, or raise it by 2% or 4%. The voting was approved on March 21st and completed on March 23rd, with the community choosing option #3 and marking the largest one-time fee raise in the history of the project.

While most crypto outlets covered the vote, few bothered with how it impacted the Maker network. So here’s the latest DAI stability vote, through the prism of Santiment’s on-chain metrics:

For starters, seems like the latest vote attracted a lot more attention compared to the one held between March 4-7, which ended up raising the fee from 1.5% to 3.5%.

The March 22nd spike presents a 75-day high in the number of daily active addresses on the Maker network, even outperforming the previous local top recorded on February 23rd.

What’s even more curious is the spike in Network Growth, or the number of brand new addresses created on the network. Was this such a historic event that it even prompted complete newcomers to visit the MakerDAO platform, join the vote and cast their ballots?

Eh, probably not. Looking at our Deposit Metrics, the above spike becomes a lot clearer:

Deposits are temporary addresses all coins go through before hitting the main exchange wallet. As we can see, there was an astronomic spike in the number of daily active deposits on March 22nd, indicating a rise in purely speculative activity on the same day(s) as the vote.

This is further confirmed by the chart directly below it, showing a correlating spike in the % of daily active deposits in all daily active addresses. In other words, that first spike on the DAA graph was mostly down to an increase in exchange-related activity, and not an unusually high voter turnout.

It seems some traders thought that the second vote in 30 days on DAI stability fees might have profound impact on the price of MKR, and wanted to unload their coins on time. A total of 1723 MKR (roughly $1,244,006) was found in deposit addresses on March 22nd alone:

This investor behaviour might have been influenced by historical precedent: MKR’s price dipped by ~7.5% in the 3 days after the March 4-7 stability fee vote, and it’d take about a week for the coin to bounce back to its pre-vote levels.

Except this time around, history did not repeat itself. At the time of ‘print’, the price of MKR is down just 1.2% from March 23rd’s daily high, and is actually still up 2.2% for the week. Maker’s governance coin is, once again, proving its worth as one of the top active ERC-20 tokens.

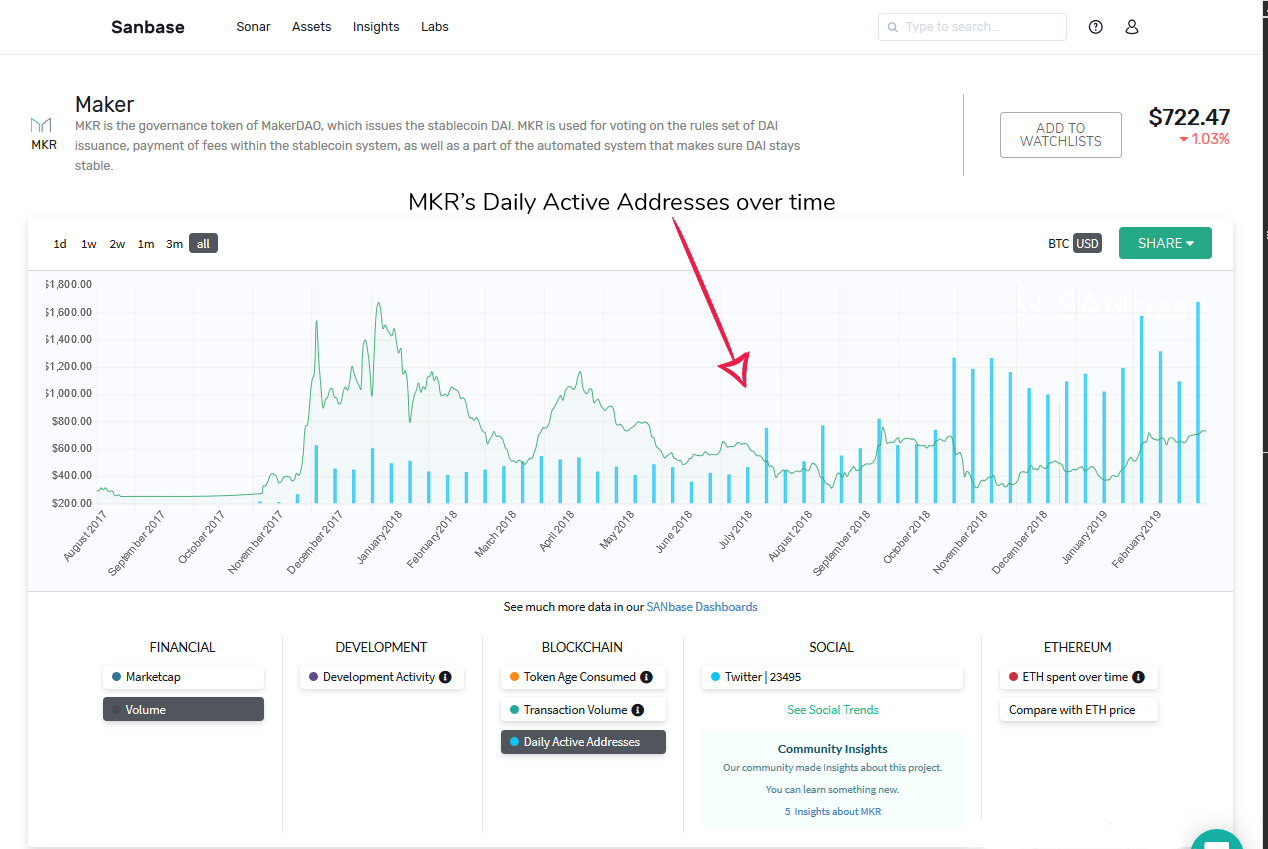

The health of the Maker network is also crystal clear when looking at MKR’s entire life cycle - from its initial coin offering until today:

The price of MKR is still down about 60% from its historical top, yet its number of daily active addresses has been on a slow and steady rise ever since July 2018. More people are interacting with the MKR token today than at any point during its $1654-per-coin days.

Maker is also one of the few projects I’ve seen that maintains a firm growth in social media mentions over time, with very few significant dips in the last 6 months. Seems like the Maker chatter never really dies down entirely:

Whether the March 21-23 vote finally solves DAI’s stability woes for good remains to be seen. For the moment, however, Maker is looking as stable as ever.

2. Is CELER the biggest IEO to date?

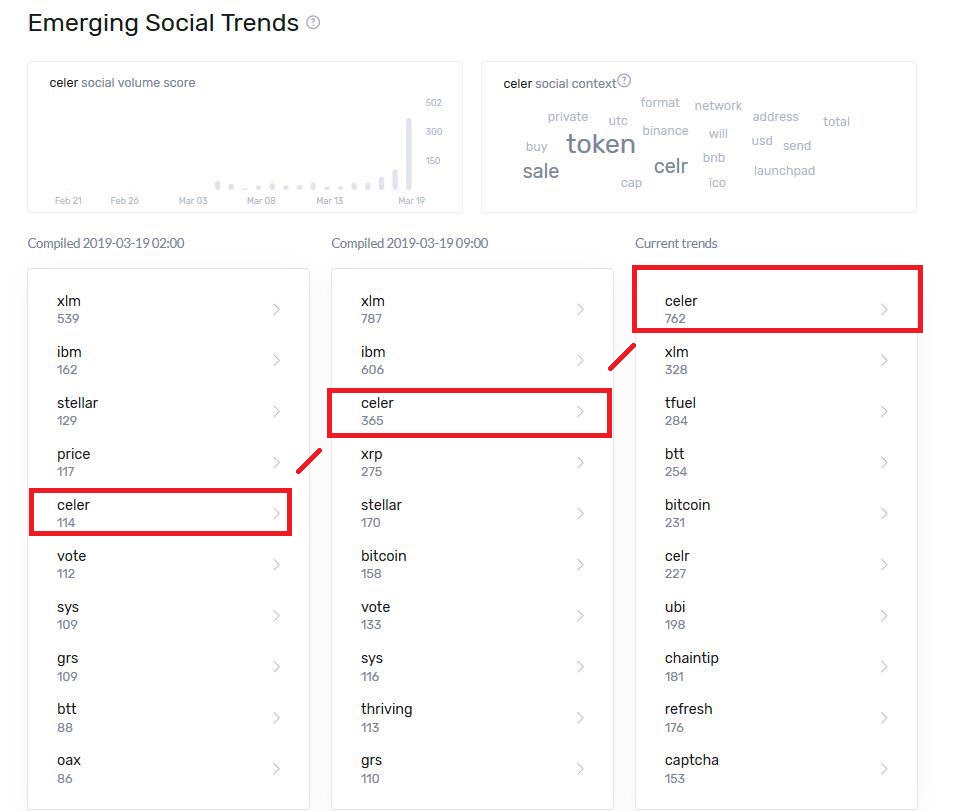

The much-anticipated token sale for Celer (CELR) finally took place on March 19th, attracting a grand total of 39003 participants, per the exchange. On the day of the event, the coin shot up on our list of top 10 emerging words on crypto social media, and would remain there for the next fortnight:

Hosted on the Binance Launchpad, this was the third ever Initial Exchange Offering (IEO), riding on the coattails of the previous high-profile IEOs for Fetch.Ai (FET) and BitTorrent (BTT).

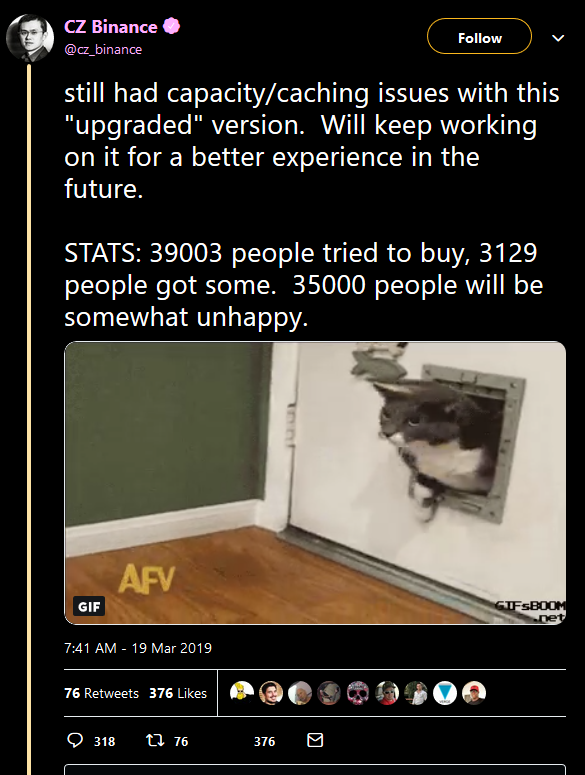

Much like the two, the CELER token sale was plagued by a wide variety of technical issues, system deficiencies and a frustrating lack of support.

In the end, out of the 39003 hopefuls, only 3129 were able to actually purchase CELR. Or as CZ put it, 35000 people that visited his platform on March 19th left ‘somewhat unhappy’:

Tone-deafness aside, CZ also made a peculiar side note - this was apparently “the highest buy demand sale” ever seen on Binance:

On first read, the claim sounds almost impossible. There was sooo much hype surrounding the BTT token sale, spearheaded by none other than BitTorrent CEO and shillmaster extraordinaire, Justin Sun:

The claim doesn’t appear to be supported by our social data either: there has been relatively little CELR-related chatter in the months and weeks leading up to the sale. Of course, the mentions exploded on the actual day of the event:

So is CZ right? Was this the highest demand sale ever hosted on Binance?

To find out, let’s analyze the last 3 months of on-chain data for BNB, the only coin you could use to purchase both CELR and FET (BTT could’ve been purchased using TRX as well)

Here is the number of Binance Coin’s daily active addresses over the last 90 days:

So far, CZ’s claim checks out. There is an indisputable spike in DAA on the day of the CELR token sale, orders of magnitude higher than what we’ve seen during either of the previous two IEOs.

Before we move on, keep in mind that all BTT-related data on these charts should be put in the appropriate context, as only a part of the BitTorrent token sale was facilitated via BNB. As mentioned, people could’ve also used TRX to participate in the BTT IEO.

For that reason, I’ll try to focus most of the analysis on FET vs CELR, as they both could have only been purchased with BNB (thanks CZ!).

Next up, let’s compare the Trx Volume and Token Age Consumed graphs for all 3 events:

The two charts reveal plenty additional info about the coin offerings. For starters, we can see a massive spike in Token Age Consumed (idle coins moving) on the day of the Fetch sale, with no such behavior observed during Celer’s IEO.

It would appear that BNB HODLers were way more interested in FET (and BTT) than CELR. This could be due to a combination of factors, including FET’s post-IEO performance (not good) as well as an avalanche of technical issues affecting the FET sale (also very bad).

It’s further noteworthy that FET overshadows CELR sale in total transaction volume, despite CELR’s supremacy in terms of daily active addresses. All of this tells us that fewer but richer wallets took part in the FET sale, while CELR appears to have been (or attempted to be) purchased by the broader trading public.

This is all further corroborated by our Deposit metrics. The number of individual deposit addresses active on the day of the CELR sale dwarfs both FET and BTT. However, the total amount of coins passing through those deposit addresses is higher in case of FET than CELR IEO, once again confirming our theory that fewer, but wealthier individuals participated in the Fetch.ai token sale.

So was CZ right? Was this Binance’s highest demand sale ever? According to our metrics - quite likely. Whether that excuses the plethora of technical difficulties that affected all 3 of their IEOs, however, is another question entirely.

For what it’s worth, CZ does at least seem to be acknowledging as much. Just a few days back, Binance announced a brand new format for all their future token sales, which you can read more about here.

Let’s hope the format switch ensures that another 35000 people aren’t left ‘somewhat unhappy’ come next IEO.

3. Crowd Sentiment , or How to Spot a Forming Top (featuring RVN)

How do you identify the last leg of a price rally? It’s a question we’ve been recently trying to answer with our custom-built social metrics.

So far, our Top Social Gainers tool has proven a fairly reliable top indicator. It gathers data from 100s of telegram groups, crypto subreddits, discord channels, private trader chats etc, and calculates the top 10 emerging words on crypto social media every few hours.

Lately, it seems that whenever I see a ticker climb our Top Social Gainers list, a downward correction is right around the corner.

The pattern is simple - price of the coin starts to rise (for whatever reason), people start talking about the coin, hype reaches its peak (i.e. the coin shows up on our list), price starts cooling off.

Such was the case recently with RVN, which topped our Top Social Gainers list back on March 4th:

Here’s our analysis of the event at the time: ”Yet another rally brings the crowd. This time, it's Ravencoin (RVN), that saw a nice 25% gain since Vertbase and Binance announcements “

A few hours after it made our list, RVN already experienced a minor dip, and we thought it was the pattern repeating as it has dozens of times before.

However, a few days ago (Sunday, March 24th to be precise), RVN joined our Top Social Gainers list once again. Turns out that March 4th was just the first leg of a much larger rally - the coin was now officially mooning.

Which got us thinking - can you distinguish an ‘interim’ top from an actual top by analyzing the differences in crowd sentiment during the two events? Let’s find out.

In our experience, there’s a subtle but telling difference in the crowd’s mood at the two junctions.

During the ‘interim’ top, we may still expect some concerns and confident skepticism about the rally. While the majority sentiment may well be festive, you can often spot a few FUD-spreading outliers, with no (or very little) pushback from the crowd.

As with many altcoins, most of the RVN chatter on Telegram occurs in Binance’s main channel. Here’s a few of the above-mentioned outliers around the time of RVN’s top on March 4th:

Similarly, several Twitter users announced retreating from the RVN trade as the local top was forming:

Real top, on the other hand, often brings about a more resolute crowd, and has a peculiar ‘aura’ of certainty around it.

Fewer concerns are voiced, and there’s a high expectation for the uptrend to continue ad infinitum. If the price just hit 10$, the next target is quickly set for 20$. You know the drill.

Again, here’s a collage of recent RVN-related moods on Binance’s main Telegram channel, this time during the Sunday rally:

Now, it’s important to note that the general mood is overwhelmingly rally-positive in both cases, with only the slightest differences.

The ability to distinguish between these variations in crowd sentiment is one of the most challenging tasks for present-day AI and machine learning technologies.

For now, these subtleties are best spotted with a ‘trained’ human eye. In fact, we discuss them quite often with our own community - you can join that and other coin-related convos over at Santiment’s discord (make sure to look for SAN clan - that’s where a lot of the magic happens).

That will do it for this week. Until next time, be sure to follow our daily breakdowns of the top emerging trends on crypto social media, based on custom Santiment data. You can find them every day on app.santiment.net/insights, as well as our ‘Community Insights’ Telegram group.

Talk to you soon!