KNC and the road to Katalyst release - What the network and its holders are up to

Takeaways:

- On-chain metrics suggests healthy network usage and demand for KNC as Kyber's major upgrade (Katalyst) nears.

- Assets covered: KNC

- Metrics used: daily active addresses, holder distribution, token age daily withdrawals, daily deposits, mean dollar invested age

As the price of KNC inches up, we are observing more than 2x spike in Daily Active Addresses (1870 addresses) and Network growth (1005 new addresses).

Let's take a quick look what's happening with KNC...

Often, such spikes are attributed to traders participating on centralized exchanges (CEX) as price moves.

However, the amount of CEX-related activity associated with these addresses were relatively low,

- Share of Daily Active Deposits in DAA - 1.93%

- Share of Daily Active Withdrawals in DAA - 9.79%

- Total CEX-related: 11.72%*

*Coinbase is excluded

Indicating that most of KNC activity could be around Kyber's actual network usage or trading on DEXes.

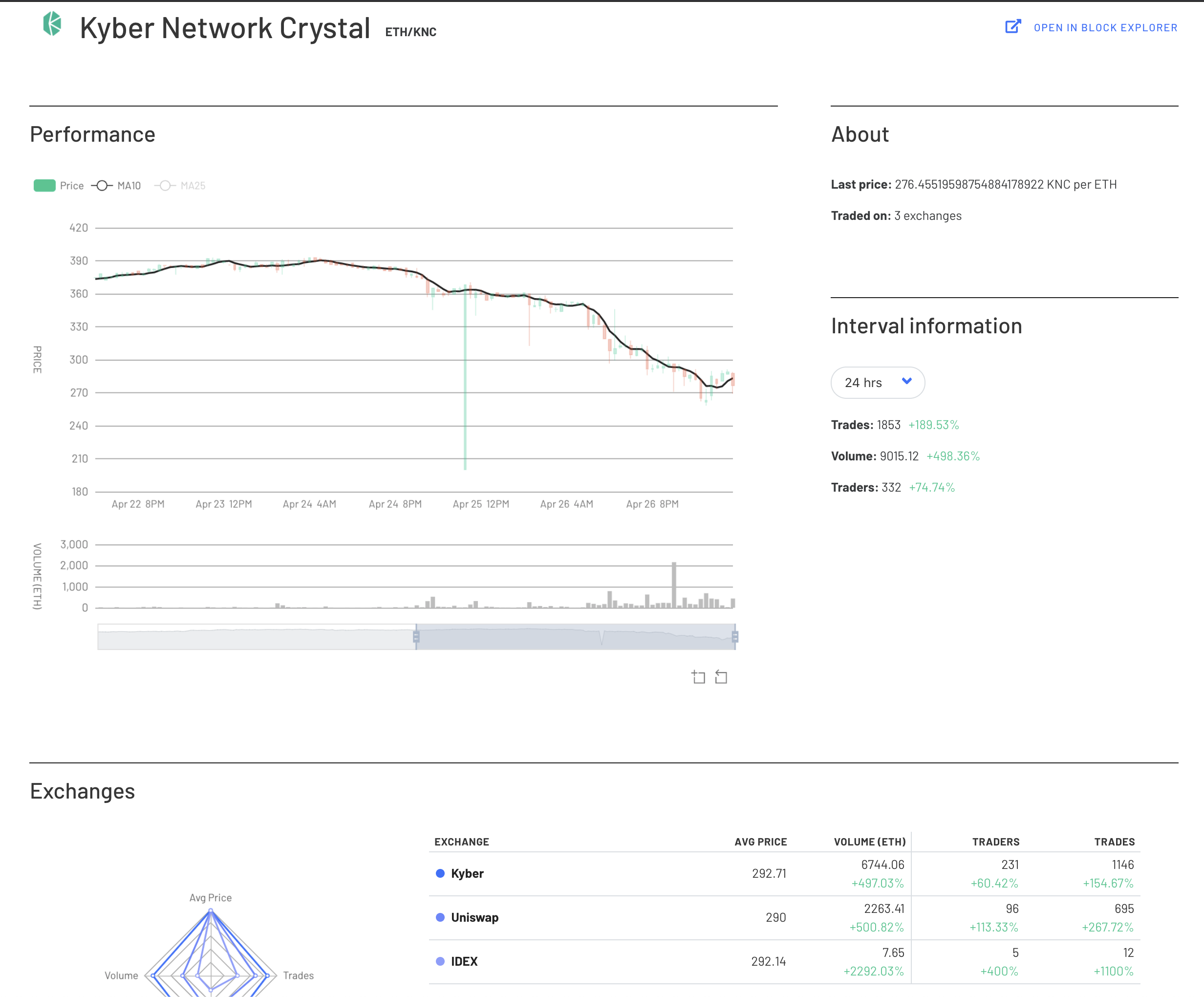

Jumping over to the DEX side of things,

KNC also comes in 3rd by trading volume on DEXes over the past 24hrs with a decent amount of trades accompanying it.

Besides trading, KNC is also being used as transaction fees on the Kyber exchange.

Looking at the 24hr DEX activity,

- Kyber exchange is the #2 in DEX trading volume over the past 24hrs.

With amount of Kyber exchange's trading activity spiking over the past few days and... the most traded token on there being KNC, followed by stablecoins and LINK.

Where to next?

Overall, Kyber's network usage is healthy looking and KNC is working as intended with very encouraging activity around it. Should this continue, KNC holders (staking) should benefit with the upcoming release of Katalyst sometime in Q2.

Given that we almost into May, speculators might be using this opportunity to stock up on KNC as it's required for staking/voting on KyberDAO.

Looking at the holders distribution where we can check the number of holders by number of owned coins, we can see that:

- 1,000 - 10,000 KNC (Retail) - nice uptrend since the Black Thursday meltdown.

- 10,000 - 100,000 KNC (Folks with decent money but not whales) - Most reduced their positions during the big run up in early March, it's not until mid-April that we saw new holders in this group increasing.

- 100,000 - 1,000,000 KNC (Whales) - The whale group grew exponentially since Dec 2019 (when Katalyst was announced) as KNC prices were cheap. Most have left during the big runup in March and during the Black Thursday meltdown. Likewise as the folks one tier before, it wasn't until mid-April that new whales started to appear. But not as much as seen in early this year. Naturally so, since Covid19 changed everything. Not many people would want to pile up on undertaking such risk.

There's certainly some accumulation going on with the different groups but people are remaining cautious in becoming larger holders.

One thing to note though, is that Mean dollar invested age saw a sharp drop recently.

If history repeats, we should see a slight drop in price and another potential leg up as speculators anticipate the release of Katalyst.