Istanbul Fork, or a Brief History of Recent Parity Controversies

Over the weekend, Ethereum has successfully completed its 8th-ever hard fork, and the second one of the year. The Istanbul upgrade went live on block 9,069,000, introducing six new EIPs, or Ethereum Improvement Proposals to the network. As noted by ConsenSys:

“Istanbul brings upgrades that will alter the cost of various opcodes to prevent spamming blocks and improve overall denial-of-service attack resilience. This upgrade will enable greater Ethereum and Zcash interoperability as well as with other Equihash-based proof of work cryptocurrencies. There will be various changes to opcodes (operation codes), which will also increase scalability performance for solutions based on zero-knowledge privacy technology like SNARKs and STARKs.”

The Istanbul fork was non-contentious, as all Ethereum clients have unanimously agreed to the new software. However, it wasn’t all smooth sailing ahead of the transition.

While all the clients released the version compatible with Istanbul months in advance, Parity sent an urgent message to its client’s users three days before the fork, instructing them to conduct an emergency patch on the pre-released Parity Ethereum update before Istanbul:

The reason for the patch was purported to be that one of the Proposals - EIP 1344 was not initially included in Parity’s version. Over on reddit, rumors quickly spread that the Parity devs forgot to include the mentioned proposal altogether, calling into question the $5 million grant to Parity Technologies authorized by the Ethereum Foundation earlier this year:

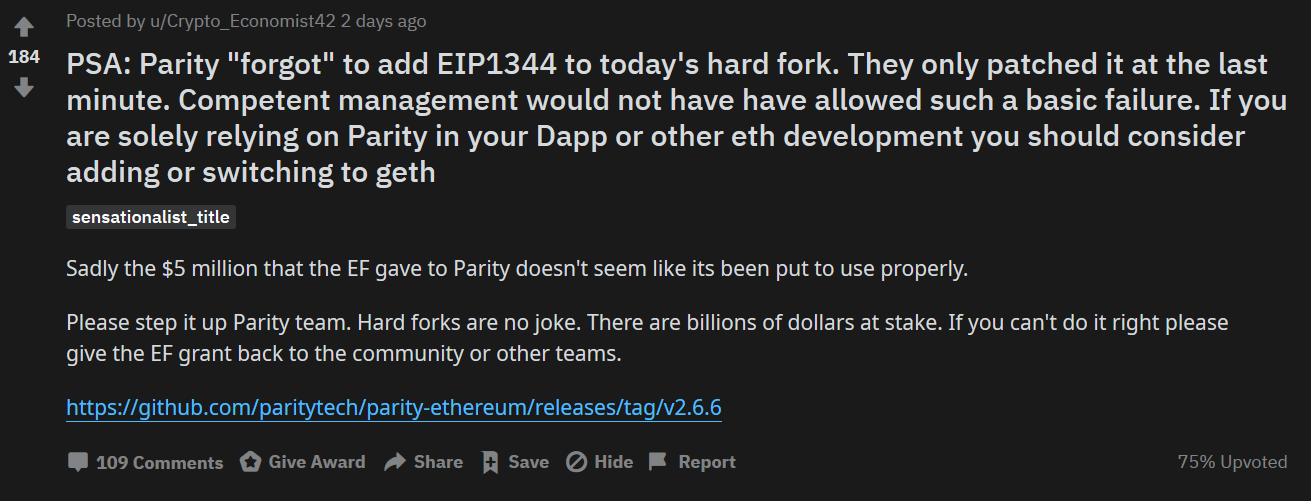

The drama propelled Parity to our list of top 10 emerging words on crypto social media over the weekend. For a quick breakdown, the word cloud in the upper left corner sums up the community sentiment about the Istanbul mishap pretty succinctly:

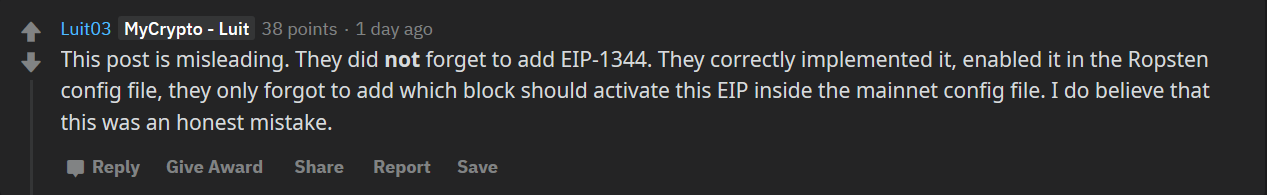

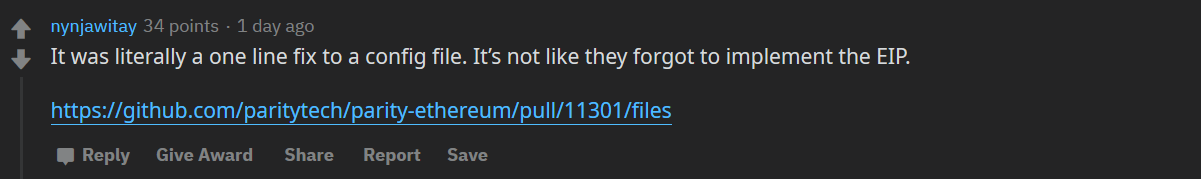

The ‘Parity forgot EIP1455’ claim was soon proved false, however, as Luit, one of MyCrypto’s developers explained deeper in the thread:

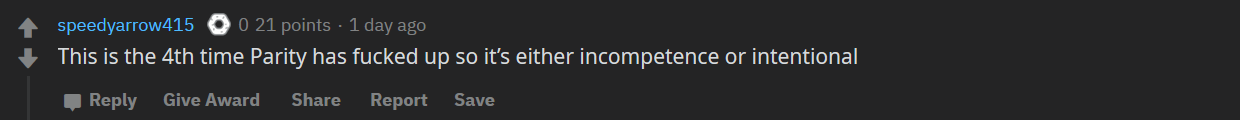

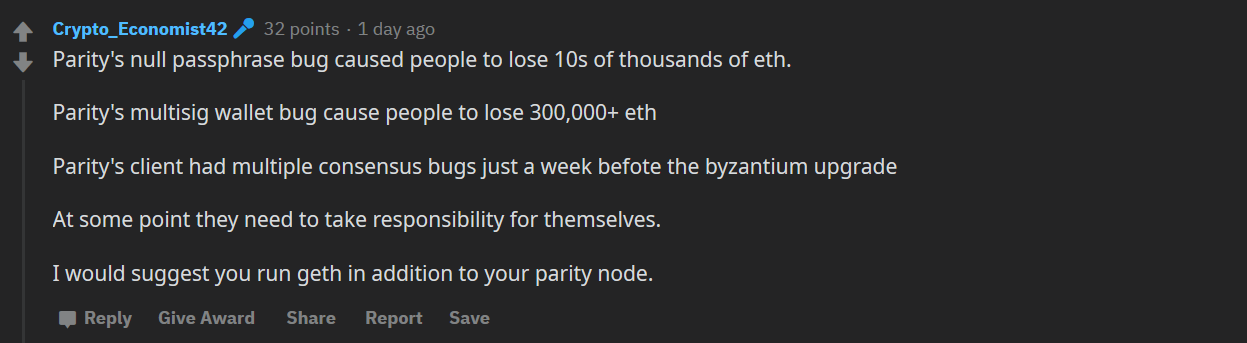

Regardless, the blunder has once again split the community wide open on the issue of Parity and their ongoing contributions to the Ethereum ecosystem. Some have pointed out that this is not exactly the first time that the company failed to deliver, and that their patience is wearing thin:

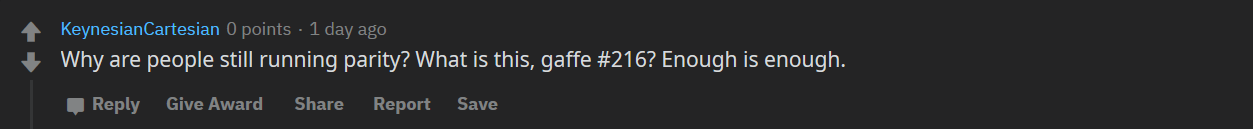

Some even decided to take it a step further, questioning if the latest gaffe was more than an honest mistake:

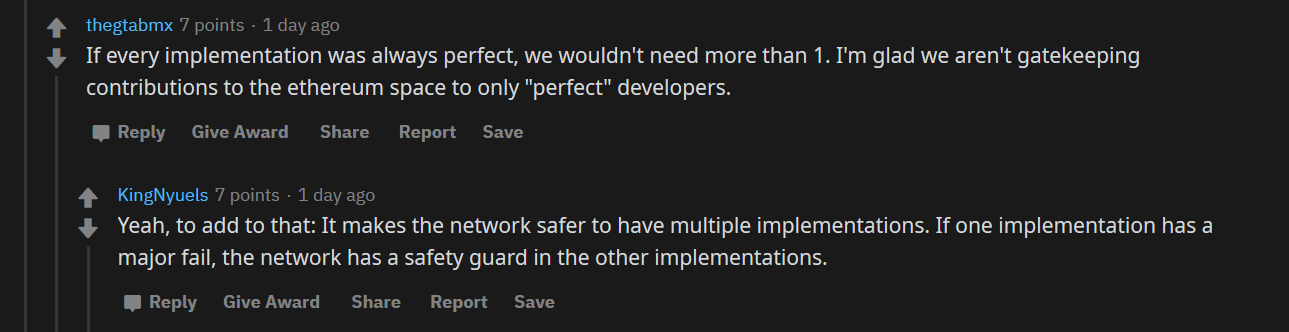

Still, not everyone was ready to throw Parity under the bus on this one. While some

underscored that this is a much smaller issue than is being purported:

Others applauded the diversity of clients and developers working on Ethereum hard forks:

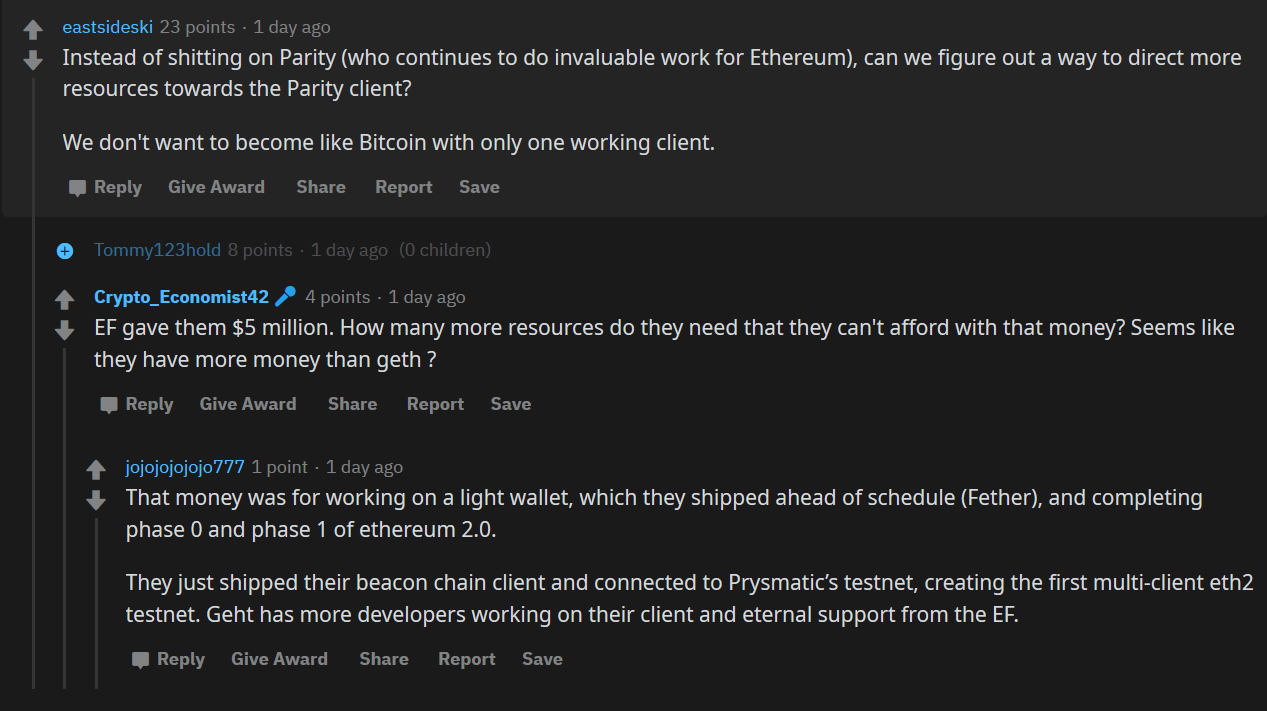

And even lobbied further funding for Parity, based on what they’ve done with EF’s grant so far:

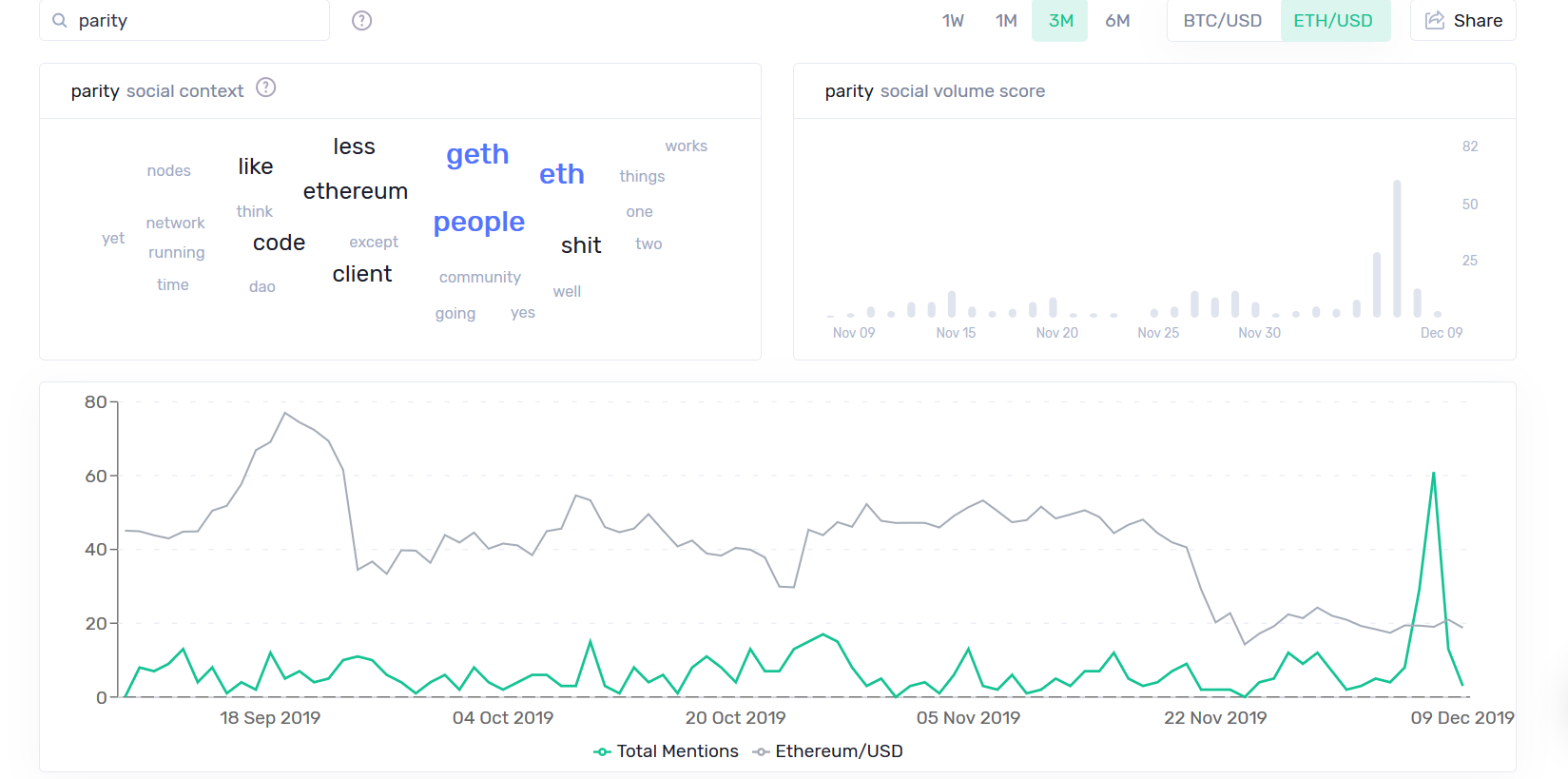

Based on our social data, this is the 4th time this year that the community spotlight was on Parity, judging by the spikes in ‘parity’ mentions on crypto social media:

As expected, the spikes on graph point to various Parity-related ‘controversies’ as of late:

-The April 12th spike correlates with the announcement of ‘Dothereum’, a now-forgotten copy of Ethereum built using Polkadot, which was itself developed by Parity Technologies. At the time, a select few legitimately believed Dothereum could grow to become a credible alternative to Ethereum and criticised Parity for a potential conflict of interest. We covered the Dothereum ordeal in detail here.

- The early March spike correlates to an interview with the Parity CEO Jutta Steiner, in which she said that the controversial Create2 Ethereum function - added to Ethereum with the Constantinople update - would have prevented the Parity multisig freeze. We covered the Create2 'bug' and its connection to Parity here.

- The April 12th spike correlates with the announcement of a-filled departure of Afri Schoeden, an Ethereum Core developer and release manager at Parity from social media, after he said that “Polkadot delivers what Serenity ought to be” and got accused of conflict of interest by the crypto reddit. We covered the Afri saga here and here.

Meanwhile, anyone expecting an Istanbul pump was likely left disappointed. The second biggest coin did briefly hit a week-high $152 over the weekend, but quickly dipped into its general $148-$150 range that it’s been wading in for several weeks now: