IRS issued crypto taxation guidelines

The Internal Revenue Service (IRS), US, has issued new guidance for taxpayers who engage in transactions involving cryptocurrencies.

It’s the organizations first update in five years and it asks more questions than it answers.

The main point of confusion appears to be tax obligations following hard forks and airdrops of new cryptocurrencies.

What will likely be most annoying is that holders will be obligated to pay tax on an asset that they didn’t necessarily ask for.

Jameson Lopp says on Twitter:

Today's IRS guidance is a hot mess

Another opinion:

The people at the IRS are clearly confused about the difference between a hard fork and an air drop. I'm surprised it appears that they didn't get even a single crypto-capable person to point out their confusion.

And:

Airdrop a coin and send every member of the Senate and Congress certified mail of their private key. The day of airdrop buy 0.000000001 coin for $10,000 to set the market cap. Write to the IRS with the list of these new crypto rich and note their tax due

Previous significant taxation events in cryptocommunity.

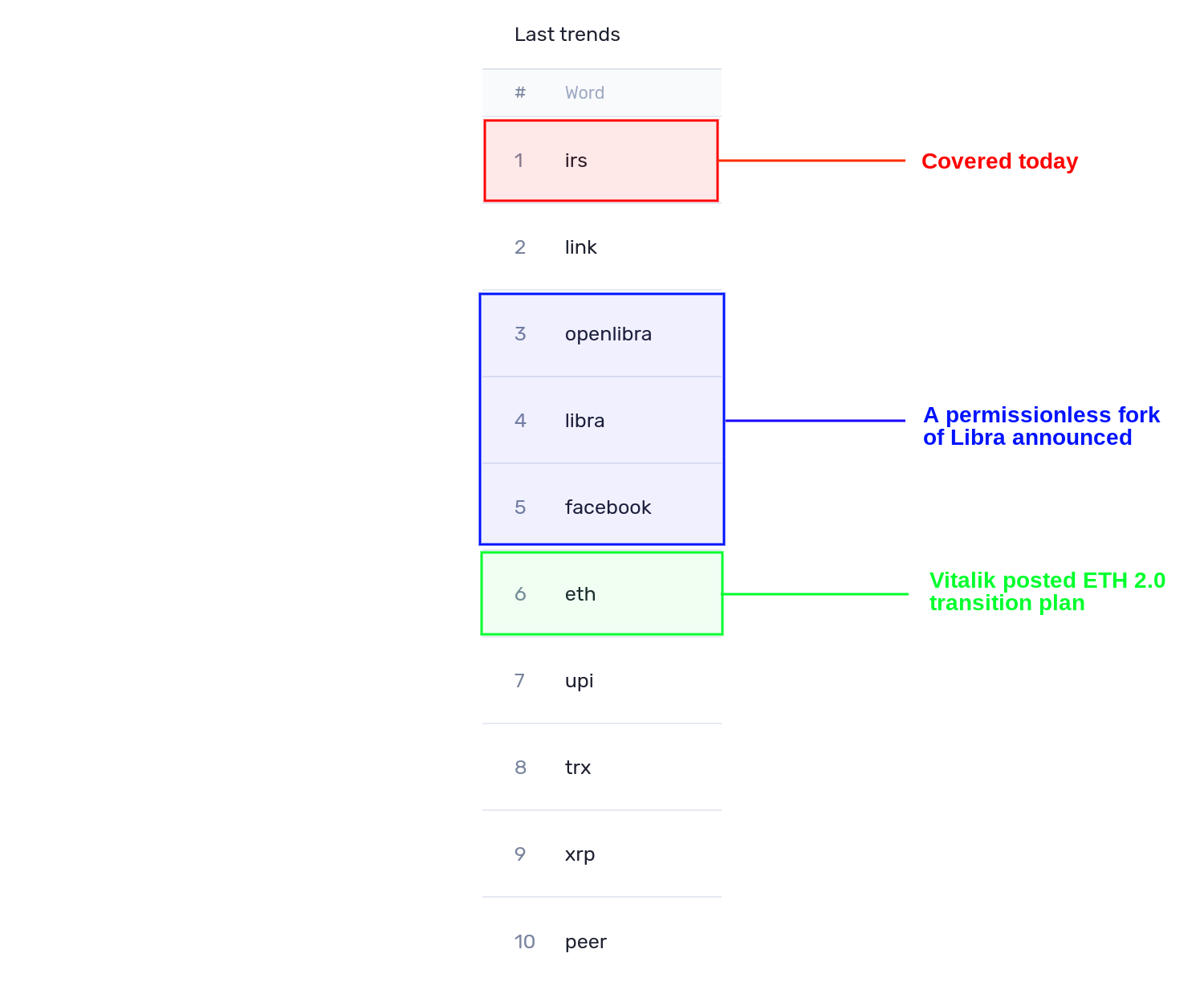

According to Santiment "tax" social volume chart there were two significant spikes.

First one, on the picture above, were growing concerns on how to approach the taxation of 2017 bull run incredible gains and losses. Talks reached it's peak and then stopped exactly on April 17, 2018 - the U.S. tax deadline.

.png)

Next peak happened on July 28, 2019 and is connected with IRS sending out warning letters to more than 10,000 people.

Still the IRS clearly has yet more clarification to offer on taxation topics.

May be we’ll get it in another five years.

Conversations (0)