Interpreting Crowd Reactions to Grayscale's Victory Over SEC

The cryptocurrency crowd has been rejoicing over the fact that Grayscale won its case against the SEC. This result was an immediate positive for cryptocurrencies not just due to the fact that Grayscale will be exposing many new interested parties to crypto, but also because it means that the SEC is more likely to approve other cryptocurrency ETF's in the future. As we have covered in many previous insights, more exposure vastly increases the probability of market caps increasing, and therefore boosting prices.

The SEC had previously attempted to deny Grayscale's application to convert its Bitcoin Trust into an ETF. This made people worried that the SEC was not going to approve any cryptocurrency ETF's, assuming this denial was upheld. However, Grayscale's victory signals the likely inevitable expansion of more and more exposure from future offerings and ETF's to institutional traders, many of which had currently been hesitant to get in to the sector due to its steep learning curve and difficulties in comprehending exchanges they are unfamiliar with.

As we can see, the crowd really didn't pay much attention to this lawsuit whatsoever until Bitcoin (and all of crypto) began soaring as the news of Grayscale's victory began to spread. Naturally, the average traders out there began to discuss what the price surge was attributed to. Then, the topic of Grayscale's ETF began to trend all over crypto platforms once again for the first time in 2 months:

In familiar fashion, look at how much the sentiment changed almost instantly as a result of this news. Particularly on Telegram, the top chart shown in the graphic below, you can see that mentions of "buy, buying, bought, or bullish" has suddenly hit a 2-month high:

Other platforms had slight reactions, but not nearly as big as Telegram's, which is most known for very reactionary takes and lots of FOMO. Ideally, the major "buy" enthusiasm will need to calm down a bit to imply that market caps are likely to continue rising from here... even if the only notable buy spike still persisting is on Telegram.

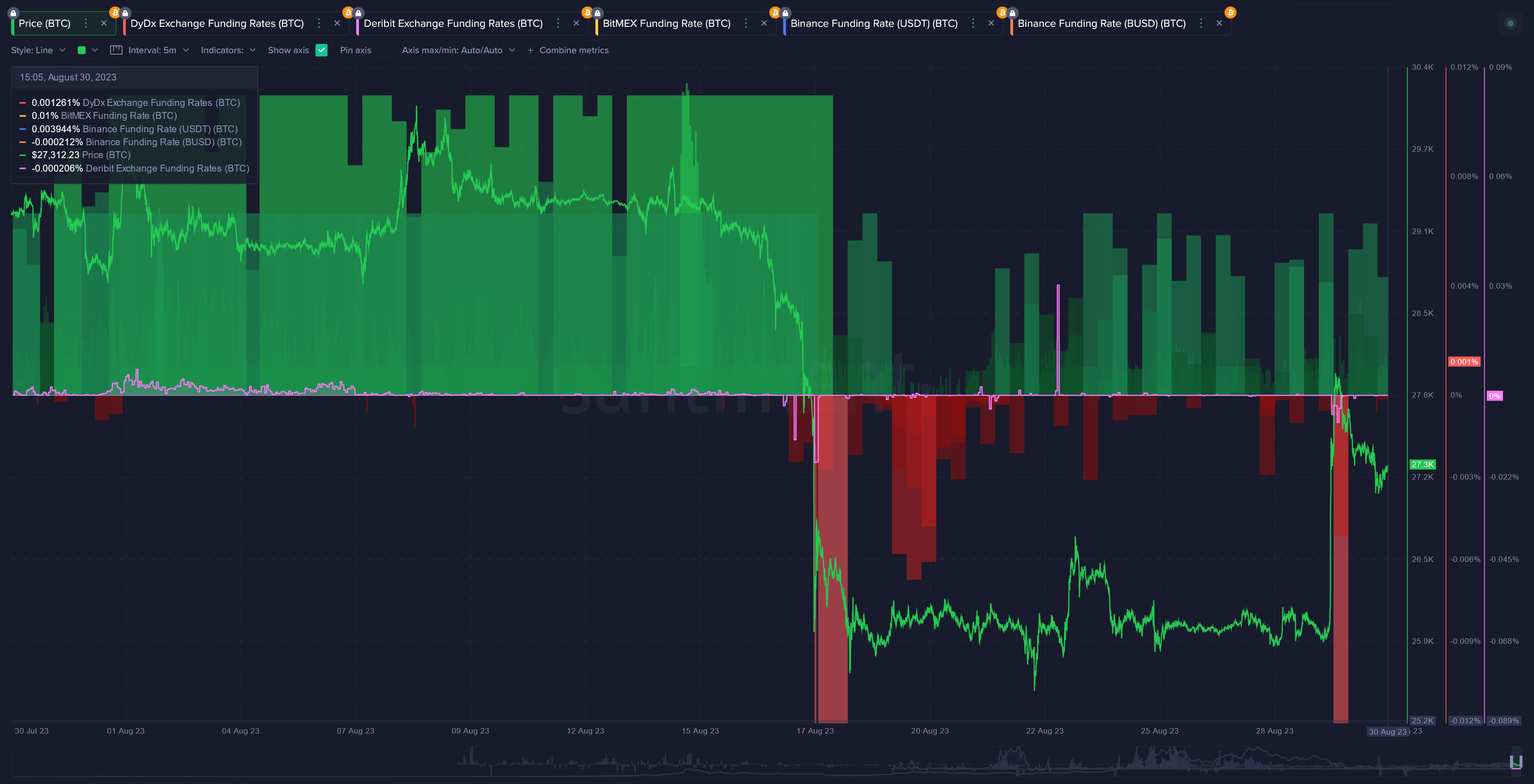

It is also interesting to see how Bitcoin's perpetual contract funding rate saw major signs of shorting, indicating traders were expecting prices to drop back down following yesterday's euphoria. In a rare sight, these shorters were correct, and it appears many made some money by betting against Bitcoin's price after it exceeded $28K. Now, we're seeing primarily longs once again.

Finally, take a look at the percentage of discussions attributed toward Bitcoin rather than altcoins right now. The spike in BTC's social dominance yesterday was the highest in 6 weeks. Generally, more discussion about the #1 market cap asset is a good thing for the crypto sector. And it is still seeing an above average level of attention, indicating that there is a certain fear of more speculative assets right now, based on this crowd indicator.

If history has taught us anything, it is that this positive ETF news is indeed a good thing for crypto. However, the rallies that result from this good news is generally reflected by very sudden price reactions that are short-lived and almost designed to get hopeful traders back in and trying to buy at the tops.

Several factors will be in play to determine whether Bitcoin and the rest of crypto can rebound back to their year-high levels (which many are still within reach of). But ETF news alone can only provide so much of a boost until major players decide to begin purchasing crypto in large droves once again. That remains to be seen, and we'll have more updates on that very soon!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.