Here's what 10 busiest DeFi projects in March have been working on 🏗️

Each month, we shine a spotlight on crypto projects with the highest-recorded developer activity for the past 30 days, as calculated by Santiment.

Development Activity is an often-underrated indicator of project success, as it demonstrates the month-to-month commitment to creating a working product, continuously polishing and upgrading its features, and staying true to the long-term roadmap.

In this report, we are focusing on DeFi-related projects with built-in tokenomics.

You can check out the latest dev activity ‘power rankings’ for all DeFi projects on Sanbase, by filtering our DeFi watchlist by Dev Activity (30d).

Here's what March’s busiest DeFi projects have been working on:

1. UMA

"Things are incredibly active in the UMA community and even across our neighboring communities. UMA has been seeing a stream of new faces from the Coinbase Earn program offered on Coinbase.

We just announced the airdrop claim and correspondingly launched a "Super Uman" campaign to organize and motivate our most active members to help increase TVL over the next three months.

Product development and protocol development are both advancing in sync. For example, our expiring contracts have seen renewed interest due to their perfect use for call and put options, and we have several new interfaces for use. At the same time, the protocol is ramping up for use as an optimistic oracle, which other teams (and even other chains) can use for market settlement. That is as long as a quote as we can offer as we must get back to work!"

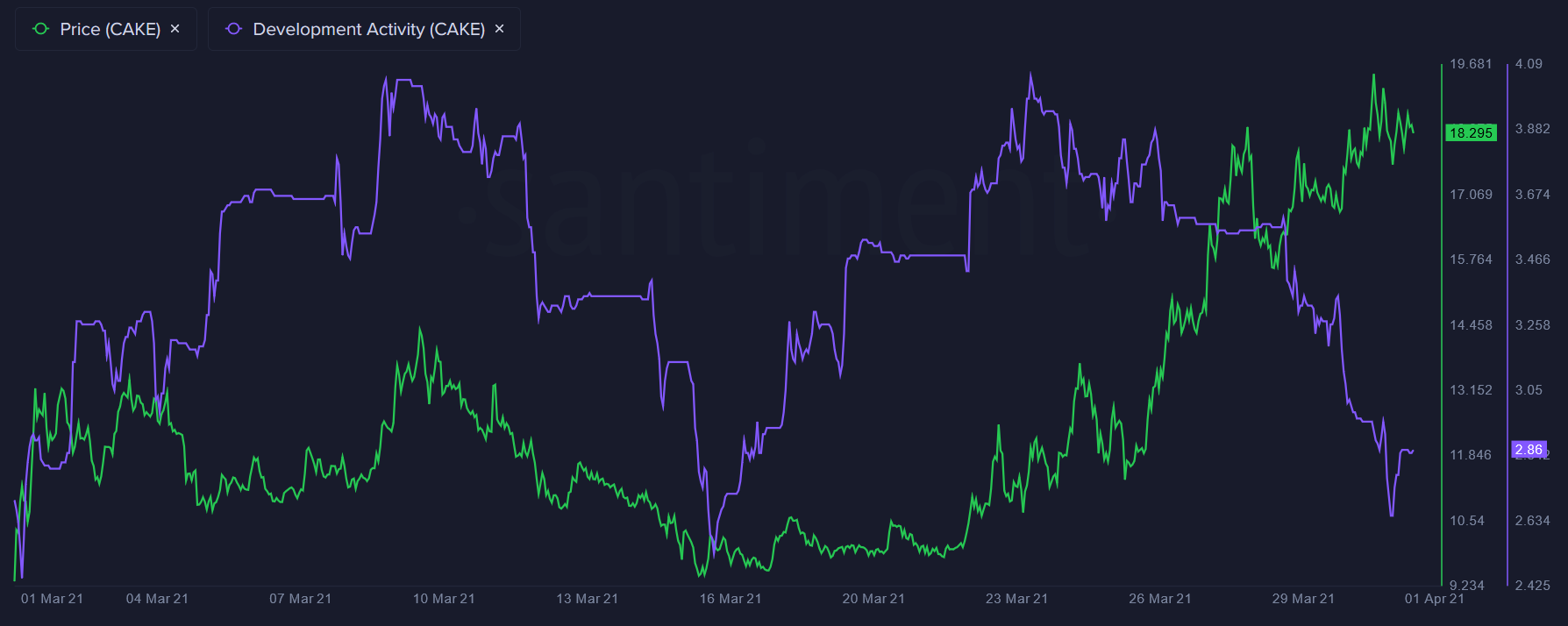

2. PancakeSwap

“The PancakeSwap team is currently working on exciting new developments to be released soon. These include auto-compounding, trading competitions, an entirely new model for our IFOs, a new and improved Lottery, prediction market and much more.

In addition to this, we’re also focusing a lot of attention towards improving our current user experience and existing infrastructure.

We’re working to resolve issues with PancakeSwap Info, make the platform more scalable, improve the reliability of our voting platform, integrate new designs into the site and more.” - Chef Chungus

3. Maker

Here’s an excerpt from MakerDAO’s recent community update:

“In March, the content spotlight was on DeFi and governance, beginning with a beautifully designed infographic illustrating the brief history of decentralized finance and ending with part one of a three-part blog series titled Informed Voting. Everything in between is also yours to discover!

The Maker Foundation Development Grants program is being sunset. The program successfully supported independent creators of infrastructures and apps for the Maker ecosystem. Read about it here and see what's next.”

Active Polls:

- Increase the System Surplus Buffer

- Appoint DeFi Saver as Oracle Light Feed

- Add LINK-A to Liquidations 2.0 Framework

Recently ended polls:

- Monthly MIPs Governance Poll

- Increase the Dust Parameter for Most Vault Types (voted YES)

- Increase the ETH-A Maximum Debt Ceiling (voted +12.5B DAI)

- Deploying the Optimism DAI bridge (voted YES)

Read more about Maker’s progress in March here.

4. Synthetix

“March was a month filled with L2 development and product improvements. Here are some high-level updates:

- Staking is now on L2

- We launched a new bug bounty program

- sKRW is now live on Synthetix

- We executed on our Serpentine release packed full of product improvements

- We launched a new liquidity incentive program for our sUSD and DHT pool

Synthetix is the derivatives liquidity protocol for developers. Our vision is for developers to leverage Synthetix’s ability to tokenize assets across industries to gain access to important markets inside and out of the cryptocurrency ecosystem, unlocking a new world of highly accessible, unstoppable financial tools.

Expect much more from the Synthetix community soon. Stay up-to-date on Synthetix by following us on Twitter or join the community on Discord. “

5. Bancor

Here’s an excerpt from Bancor’s recent community announcement:

- “The Bancor Vortex Burner has been deployed to the Ethereum mainnet

- The Vortex Burner collects 5% of swap fee revenue and uses it to buy and burn vBNT

- vBNT will now be burned with every swap — locking BNT in the protocol forever, and putting deflationary pressure on the circulating supply of BNT

- vBNT burning also lowers borrowing risk for users who wish to take leverage on their staked BNT

- The vBNT burn rate will become a critical part of the BancorDAO’s flexible monetary policy, and may be adjusted to collect up to 15% of swap fee revenue

The Vortex Burner introduces an adjustable fee taken from swap revenue generated by liquidity providers (BIP9 and addendum). For example, if a $100,000 trade is executed on a pool with a 0.2% pool fee, $200 is collected by the liquidity providers as commission. The vBNT burner takes a 5% portion ($10) and uses it to buy vBNT and burn it.

vBNT burning is designed to:

- Increase locked liquidity: a portion of every swap is permanently locked into the protocol

- Reduce the circulating supply of BNT: BNT is continuously bought and removed from circulation forever

- Increase lending capacity: By putting continuous upward pressure on the vBNT price, the burning of vBNT lowers borrowing risk for users who wish to take leverage on their staked BNT’

Learn more about the Vortex Burner here.

6. 0x

“Here’s an excerpt from 0x’s recent community update:

- Ecosystem snapshot (Slides 3–5): Statistics on network health from the past 30 days, sourced directly from 0x Tracker’s network insights tab, followed by an overview on recent ecosystem news, including new integrations with Dexguru, Parsec, and LinkSwap.

- Roadmap (Slides 6–7): Quick summary of the current 0x development roadmap, focusing on what has changed since last month and what is queued up next, followed by a reminder to check out the forum and join the conversations on governance and protocol development.

- ZEIP-83 recap (Slides 8–10): An overview of the expected impact from the latest upgrade, which focuses on gas efficiency and RFQ liquidity for better pricing, and batch fills to increase the likelihood that limit orders will fill, resulting in more protocol fees collected.

- Expanding Beyond Ethereum (Slides 18–20): Will Warren, 0x Co-founder, provided a detailed update on 0x Labs’ vision for peer-to-peer exchange across a network of networks and how that will play out in the coming months.

Check out all of this and more in 0x’s latest community and governance meeting!”

7. Thorchain

“THORChain team and Community have been preparing for Multichain Chaosnet, including work on the state machine, Midgard public API, THORNode stack and the interfaces.

Multichain Chaosnet is due for launch imminently and will support cross-chain swaps and Liquidity pools for 5 different chains; BTC, ETH, BNB, BCH and LTC.”

8. Augur

Here’s a few recent updates from the Augur’s Twitter account:

“Lots of new developments being worked on - simplified Augur AMMs, turbo fast resolution, L2 trading and more!

From Paul Gebheim: “Excited to have finally gotten a new set of Augur L2 contracts deployed to Offchain Labs arbitrum testnet (v4). Next stop UI!

Oh! And now we've got them on Polygon mumbai testnet as well. It's a good day. Goal is to support all L2, ultimately falling back to ETH mainnet to handle the big money disputes. Maybe next we can try Optimism?”

Read more about Augur’s roadmap on the project’s blog.

9. Uniswap

Here’s an excerpt from Uniswap’s recent community update:

“We are excited to present an overview of Uniswap v3. We are targeting an L1 Ethereum mainnet launch on May 5, with an L2 deployment on Optimism set to follow shortly after.

Uniswap v3 introduces:

- Concentrated liquidity, giving individual LPs granular control over what price ranges their capital is allocated to. Individual positions are aggregated together into a single pool, forming one combined curve for users to trade against

- Multiple fee tiers , allowing LPs to be appropriately compensated for taking on varying degrees of risk

These features make Uniswap v3 the most flexible and efficient AMM ever designed:

- LPs can provide liquidity with up to 4000x capital efficiency relative to Uniswap v2, earning higher returns on their capital

- Capital efficiency paves the way for low-slippage trade execution that can surpass both centralized exchanges and stablecoin-focused AMMs

- LPs can significantly increase their exposure to preferred assets and reduce their downside risk

- LPs can sell one asset for another by adding liquidity to a price range entirely above or below the market price, approximating a fee-earning limit order that executes along a smooth curve

Uniswap’s oracles are now far easier and cheaper to integrate. V3 oracles are capable of providing time-weighted average prices (TWAPs) on demand for any period within the last ~9 days. This removes the need for integrators to checkpoint historical values.”

Read more about Uniswap V3 here!

10. Radix

Here’s an excerpt from Radix’s recent community update:

“The crypto space progresses at great speeds, and the fact we are now into Q2 is testament to that. Looking back at the last quarter there is a strong sense of growing momentum, both with Radix and the industry as a whole.

This feeling of growing momentum is reflected across every aspect of Radix. In the last 3-months alone; the number of wallets holding eXRD has increased over 180%, our social channels have seen engagement double, Radix has been featured in multiple articles & by multiple influencers, Radix communities have been launched in a range of languages, and the whole Radix team have been pushing forward to reach the objectives for the year. It is amazing what has been achieved in the last three months, and I know I am not the only person to be excited at what is due to come in the coming months.

For everyone working on Radix, Q2 will be a very busy period with major milestones like the Olympia Betanet going live on April 28th, and the Olympia release launching later this quarter. Alongside the updates in the Radix Report, make sure to keep a close eye on our blog to keep up with the latest news, as there are a lot of updates due over the coming weeks.”

Read more about Radix’s recent development here.

-----------------------------------

Check out Sanbase for more information on development, social, and on-chain activity of all ERC-20 coins, as well as ETH, BTC, XRP, EOS and more!

Conversations (0)