Here's what August’s busiest ERC-20 Dapps have been working on🏗️

Each month, we shine a spotlight on the 10 ERC-20 projects with the highest-recorded developer activity for the past 30 days, as calculated by Santiment.

Development Activity is an often-underrated indicator of project success, as it demonstrates the month-to-month commitment to creating a working product, continuously polishing and upgrading its features, and staying true to the long-term roadmap.

In this report, we are focusing only on ‘pure ERC-20’, i.e. those projects that are (currently) committed to developing on Ethereum, and have as of yet no working mainnet or an imminent token swap.

You can check out the latest dev activity ‘power rankings’ for all ERC-20 assets on Sanbase, by filtering the ERC-20 projects by Dev Activity (30d).

As always, we asked all of this month’s top 10 most active ERC-20 dapps what they’ve been working on for the past month. Here’s what they told us:

1. Gnosis

“Products built on Gnosis hit several milestones in the month of August.

The Gnosis Safe Multisig passed the $1 Billion mark in held funds, making it one of the most trusted platforms to store digital assets on Ethereum.

Meanwhile, volume continues to rise on Omen prediction markets, with over USD 320K equivalent staked on an Ethereum 2.0 launch market.

On Gnosis Protocol DEX, several independent, successful IDOs took place, and we’re beginning another GNO incentivization program for stablecoin liquidity providers.”

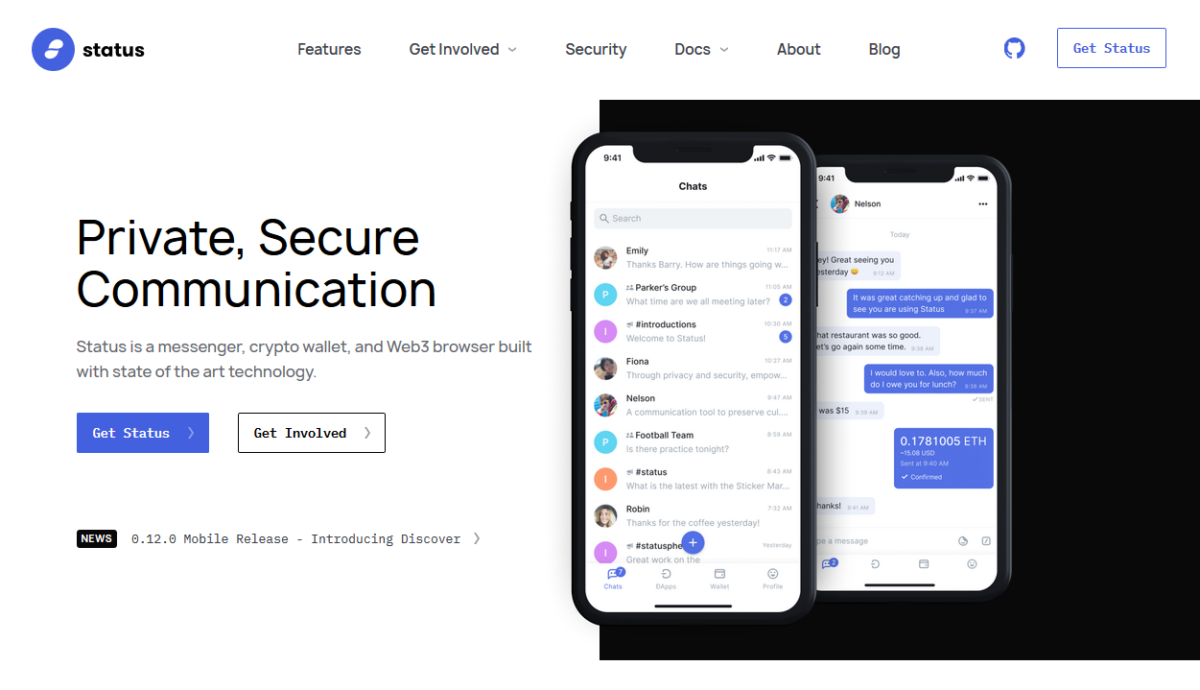

2. Status

“Looking back at August, here’s what we achieved in the month:

- Status app:

- Desktop alpha 4 is now launched

- On mobile, v1.5 saw its release, introducing lots of highly-requested fun enhancements to improve the social experience: images, audio messages, and emoji reactions.

- Nimbus - Medalla Eth2 testnet launch kept us busy this month; after a bumpy start for our validators, by the end of August we were tracking the head of the chain and validating 🎉 Our attestation rate is above 95% on a modern desktop computer.

- Keycard - work on our open source payment network has continued, with payment network logic and preloaded cards code complete. Next up, we’re working with LeapDAO on Layer 2 solutions for faster transactions and cheaper gas costs.”

3. Aragon

Here's an excerpt from Aragon's latest community update:

“August was one of the most action-packed months in Aragon’s history.

Major roadmap updates, novel governance experiments, and a new aragonOS release to name a few.

- The Aragon Network DAO is coming! 🦅

The Aragon Network is the cornerstone of the Aragon project. And it’s almost here!

- New Aragon DAO AUM record: $350M 📈

More and more DeFi protocols are calling Aragon home!

- ANT liquidity rewards, part deux 🤑

Following the smashing success of the first round on Uniswap, this time we are using Balancer to help mitigate slippage and improve the UX for receiving the rewards. Read more →

- Curve DAO 🌈

One of the most highly anticipated DeFi DAOs launched on Aragon: CurveDAO. Curve does over $100M in trading volume every day. Curve has parameters that can be governed by its users to improve the protocol and adjust to changing market conditions.

- Conviction Funding 🗳

This is a Big Deal. Conviction funding is a truly novel way for open, permissionless communities to allocate resources for various purposes fairly. We put up 9k ANT, about $75,000, requesting proposals from the community and having ANT holders vote on their favorites. So far, two proposals have been accepted of the 17 proposals, with more proposals rolling in every day. About 5 more weeks to go! Read more →

- New ANT controller 🎛

ANT has been updated to be safer as we move closer to the Aragon Network DAO governing the whole Network. Read more →

- aragonOS 5 released 🦾

After two years, we announced a new release of aragonOS. With it, comes a new flavor of Disputable apps that seamlessly integrate with Aragon Court and Agreements. Check it out →

Check out more updates from the Aragon team here!”

4. Maker

Here’s an excerpt from Maker’s latest community update:

“August has been almost all about the Dai debt ceiling. We saw a few increases to the ceiling in the past several weeks, beginning with a historically large increase in late July, when MKR holders voted to raise it to 568 million. Shortly after, we saw another increase to 688 million. Now, as of this writing, the Dai debt ceiling stands at 588 million, with total Dai in existence over 435 million. Those and other milestones plus an explanation of the vital role of the Dai debt ceiling were published in a blog post a couple of weeks ago (link below).

Also in August, discussions began concerning an upgrade to the Liquidation system of the Maker Protocol, and we shared the winners of the Maker Foundation’s first internal hackathon.”

Read more about the latest Maker developments here.

5. Keep Network

“The Keep team was hard at work in August, with a number of initiatives and milestones for the Network as well as for tBTC, to which Keep is a contributor.

Most exciting is that the team is preparing to deploy tBTC’s latest release candidate, rc.1. At launch, the latest version is fully audited, open-source, and insured, with unprecedented security measures in place.

Playing for Keeps, which lets people learn to stake and win KEEP by contributing to the community, has passed the halfway point with 7 million KEEP awarded so far. Judges for the first three months included Cosmos’s Zaki Manian, DTC’s Spencer Noon, and Bison Trails’s Viktor Bunin as well as Keep’s own Matt Luongo, who ran a two-week sprint in August.

Finally, the Keep Stakedrop, which will let people stake ETH to earn KEEP is underway. Those interested can learn more by following the Keep #tbtc channel on Discord.”

6. Santiment

August was chock full of quality-of-life updates for our Sanbase users:

- We continue to upgrade the Santiment Screener with new features. This month, we’ve added 5 new metrics to the Screener filters: Market segments, Transaction volume in USD, 180d token circulation, Bitmex perpetual contract funding rate and 1y dormant circulation. You can now also edit and save all your Screeners, and filter most metrics not just by absolute numbers but by % change as well. If you haven’t already, make your first Screener here→

- One of our most popular on-chain metrics, Token Holder Distribution now has a merge tool, allowing you to combine different holder cohorts of BTC, ETH or any ERC-20 coin in a single group. You can now also filter holders not just by absolute numbers, but by a percentage of the total holder pool. Try it now→

- Stablecoins are still at the heart of most DeFi platforms and yield farming protocols. On the product side, we’ve started work on our own Stablecoin Hub, providing real-time information on the top stablecoins’ market size, on-chain activity, speculative demand and much more. The Stablecoin Hub will be live soon, so be sure to follow our Twitter or join our Discord for the latest updates!

7. Synthetix

“The Synthetix community is incredibly excited to announce that we’ve undergone a complete visual brand refresh. Alongside the refresh we also have a list of exciting highlights:

- We have a launched a brand new website and updated the branding on all Synthetix related assets as part of our visual brand refresh

- We have optimized our documentation to enhance the developer experience

- Launched a primer on Synthetix Futures

- Executed our Pollux release which included our volume incentive program which enables developers to earn fees from building with Synth swaps, as well as flexible contract storage, improved iSynth freezing mechanisms, and much more.

- Transitioned to Chainlink as our primary oracle provider

- Completed dHedges’s first trading competition and launched a second trading competition

- Reached over one billion in the total value locked in Synthetix

Synthetix is the derivatives liquidity protocol for developers. Our vision is for developers to leverage Synthetix’s ability to tokenize assets across industries to gain access to important markets inside and out of the cryptocurrency ecosystem, unlocking a new world of highly accessible, unstoppable financial tools.

Expect much more from the Synthetix community soon. Stay up-to-date on Synthetix by following us on Twitter or join the community on Discord.“

8. Augur

Here’s an excerpt from Augur’s recent development update:

“Augur v2 launched on Tuesday, July 28th. After the first hour it became clear that the user onboarding process was too complicated and expensive. The intent was to provide a solution for onboarding new and non-native crypto users, allowing them to trade with only DAI and abstract ETH away from their experience. In practice this “solution” resulted in unexpected consequences in user onboarding causing a difficult and frustrating experience.

These design choices were made when gas prices were much cheaper and the cost was ~$5.00. As launch approached, gas started getting more expensive, and thus the cost kept increasing. Eventually at some points it reached as high as $100!

To that end, we realized and acknowledged these shortcomings and worked around the clock to ship what we’re calling the ‘V2 Redo’ release. We’ve removed this onboarding process and replaced it with the traditional, native and familiar ‘click-and-connect’ Web3 account process. You can now use Augur today just as you would any other Ethereum application. Bring your MetaMask or Web3 wallet, select connect, and you’re off to the order books - no fees or activations required.

Thank you to all Augur users, we hope you give Augur v2 another shot.

Augur v2 Redo Release: https://augur.net (Start Trading Now button)

Augur v2 Recovery Release: https://augur.net (Recovery v2.0.10 Release link)“

9. UMA

“The UMA team started a liquidity mining pilot last month, which attracted 20mm in locked ETH. This comes after the first few tests on the health of the protocol and optimistic oracle have been successful.

Not only has liquidity mining resulted in more eyes on the project and a healthier community, but it has also shown that these contracts can really hold the weight of funds.

We are working closely with a handful of development partners, both established and up-in-coming, to roll out new products in the start of Q3, including a way to permissionlessly leverage Bitcoin.”

10. Band Protocol

"Band Protocol's engineering efforts have continued to spearhead towards the official launch of BandChain GuanYu on the Mainnet which will bring full oracle functionality to partners, developers and decentralized applications in the production environment.

We have also continued to work closely with our partners to migrate oracle scripts from the testnet to BandChain Proof-of-Authority Mainnet, ensuring that the data feeds have the highest security guarantee and optimizations for gas costs."