Ethereum Revisits $2k - Will it Hold?

Not to be outdone by Bitcoin's big milestone cross of $30,000 for the first time in 10 months, Ethereum has now returned above $2,000 for the first time since August 14, 2022. The 8-month high is a refreshing return above a key psychological support level for traders. But now interested traders are wondering whether this is just a temporary tease, or just the beginning of a longer rally as ETH hikes back toward its all-time high in November, 2021.

Average trading returns are important to keep an eye on, as ETH is a zero-sum trading game, just like any other asset. We like to look at a 30-day MVRV of 15% or more as a danger zone that indicates a probable sign of a correction. As of now, ETH is at 9.95%. So yes, this MVRV being well over 0 does indicate a higher risk of a drop. But it is not quite at the level where we should be extremely concerned.

On the long-term side, the 365-day MVRV is +29%, which is the highest it has been since December 27, 2021. This is a larger concern, with traders really showing heavy profits and not a lot of pain that is typically needed for prices to rise.

Another thing to keep an eye on is perpetual contract funding rates. Specifically, Deribit is the exchange that has been showing wild swings between shorts and longs throughout the past 3 months in particular.

After some longs were popping up on the exchange, the price began to top as expected. But once funding rates became neutral, ETH began to rise alongside BTC. As of now, we are actually seeing quite a bit of disbelief. Shorting is quite prevalent, and this ultimately is a good sign that there could be more liquidations to add a bit more rocket fuel for prices to rise.

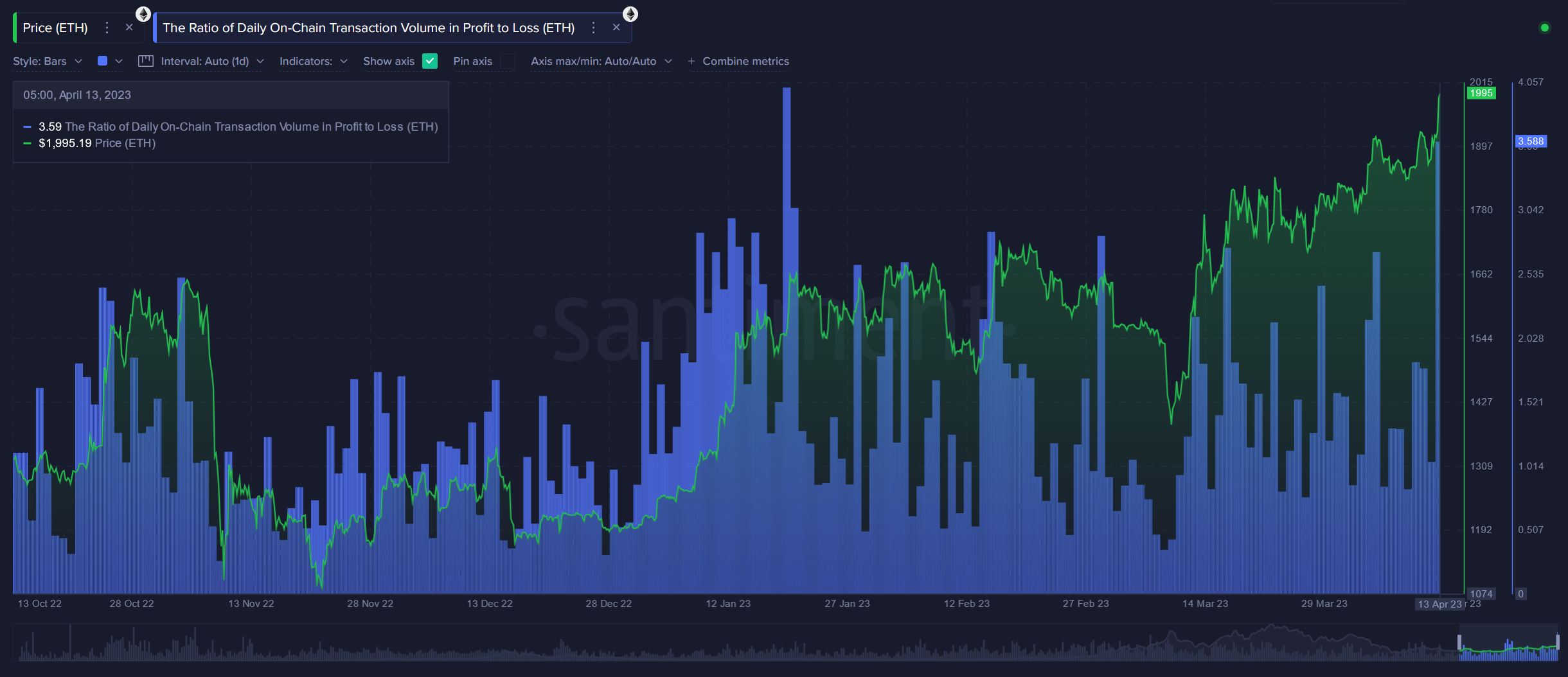

With ETH jumping above $3k, we are seeing the highest spike in the profit vs. loss transaction ratio. There are 2.59 times as many transactions in profit vs. transactions in loss today. And this is the highest ratio since January 20th, when we did see a minor correction following. We do interpret this as a short-term bearish signal, as this heavy profit taking can temporarily push prices down, historically.

Lastly, we can take a look at shark and whale addresses and how they're behaving during this phase in market cap growth. Ethereum can be a bit hazy in terms of which tiers provide the best alpha, because staking and defi can be so prevalent. But typically, addresses holding anywhere between 10 and 100k is the sweet spot we try to analyze.

- The 10-100 ETH tier has been profit taking for about a month straight now, and their supply held has been fading slightly

- The 100-1,000 ETH tier has been following suit, and the drop has been noticeable ever since mid-March

- The 1,000-10,000 ETH tier is actually looking quite strong, and unlike the lower two shark tiers, we have seen this line continuing to increase over time

- The 10,000-100,000 ETH tier has declined swiftly, and the amound held has dropped to levels not seen since October, 2022

Overall, this is a slightly disappointing outlook with 3 of the 4 tiers showing signs of decline over the past month.

There seems to be a few more indicators pointing to bearishness at the moment, but this certainly doesn't mean that the overall 2023 outlook for Ethereum isn't still optimistic. Being just 7 months past the successful merge, there are plenty of reasons to still be excited about the #2 market cap asset. But don't be surprised to see some limboing above and below $2k for a period of time as bulls and bears battle.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.