ETH vs ERC-20: A Tale of Two Market Caps

Disclaimer: The following is NOT investment advice. This research was conducted for informational purposes only. We do not offer investment advice and nothing we say should be construed as investment advice.

While Ether’s market cap has been endlessly scrutinized over these bearish months, the market capitalization of ERC-20 tokens has – somehow – managed to stay completely under the radar.

In fact, we were shocked to find just how little serious research and attention has been dedicated to the ERC-20 market as a whole up until this point. In preparing this piece, we couldn’t even find a freaking graph of the composite ERC-20 market cap – we had to build one from scratch!

Needless to say, we wanted to check if we – and everyone else – have been missing something all this time. So we decided to take a closer look at the size of the ERC-20 market, its sovereign evolution over time, and its – if any – correlation to the ‘parent’ (ETH) market cap.

Much of what you’re about to read has – to the best our knowledge – never been covered before, so you’ll be among the first to see it. Let’s dig in!

Building an ERC-20 Market Cap

To begin, we had to calculate the development of the entire ERC-20 market, in order to analyze how it changes over time and how it behaves relative to the ETH market cap.

To perform these calculations, we used data from all ERC-20 projects currently in our database.

(Editor’s note: It’s worth pointing out that Santiment does not in fact cover 100% of ERC-20 projects at the moment. That said, the ones currently missing from our database are either extremely small or brand new projects, making their combined market cap negligible at best.)

In the process, we created the world’s first composite ERC-20 market cap (that we know of). Drumroll please:

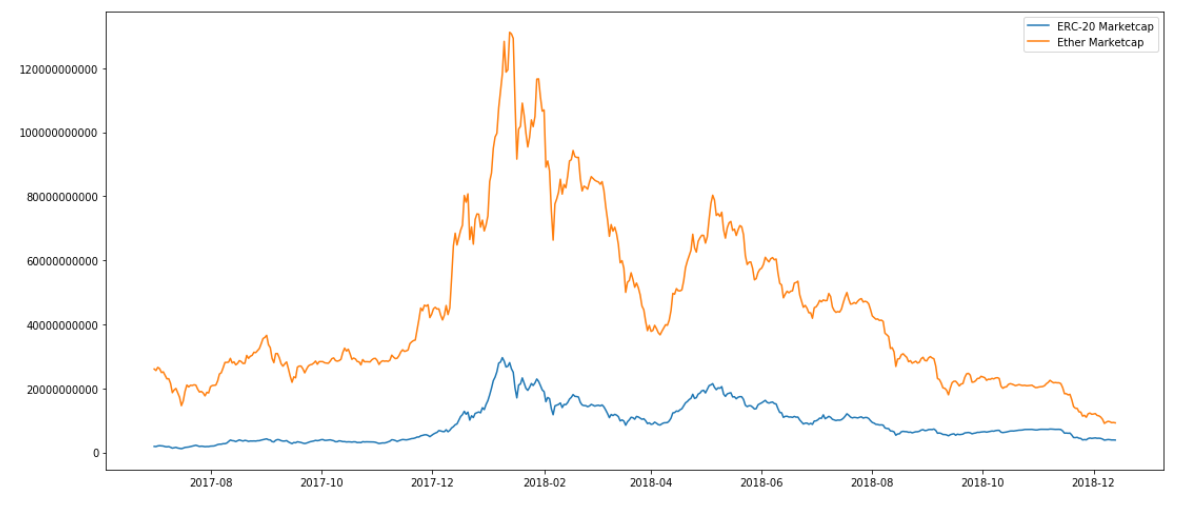

For anyone that has been obsessing over Ethereum’s market capitalization recently, the above graph will feel eerily familiar. Here are the two market caps plotted together, for the first time:

Several things become immediately clear here:

First, unsurprisingly, the ERC-20 market capitalization appears to move rather similar to the ETH market cap (more on this in a moment).

Second – and what is much more interesting – we can see that the two market capitalizations continue to move closer together over time. The reason for this, however, is not a gradual increase in the ERC-20 market cap, but rather a progressive decline in the ETH market cap – especially over the past 9 months.

ERC-20 Market Cap Growth

Next up, let’s see how the ERC-20 market has developed in size, viewed as a % of the total ETH market cap:

As it turns out, the growth of the ERC-20 market relative to the ETH market cap seems to be constant – almost linear.

In other words, despite all the market turmoil in the observed time frame, the whole ERC-20 market has been unceasingly catching up with the ETH market cap.

Which begs the question – if this is true, can’t I just buy all ERC-20 projects, short ETH, and expect a positive ROI? The short answer – no.

The long answer – since we’re looking at the market capitalization and not average price development, it’s unclear whether this growth is indeed propelled by existing projects increasing in value, or simply by new projects entering the market – or a combination of both.

For example, MKR and BNB have undoubtedly grown in value in the past year, and now comprise around $1bln out of the $14bln market cap. However, these types of projects are too far and between to present a united front.

Also, whatever the case, unless you’re a bona fide whale, investing in 700+ projects will *probably* break the bank.

Nevertheless, it’s fascinating to see an almost linear development of the ERC-20 market cap over time.

ERC-ETH Correlation

In what’s certainly the most intriguing part of our research, we also took a look at the correlation between the ERC-20 and ETH market caps:

For clarity, we’re using a rolling 7-day correlation window. Here’s a quick overview of the above graph:

- 1 means the two market caps move more or less alike

- 0 means the two market caps move completely independent from each other

- -1 means the two market caps move in opposite directions

It’s pretty clear that – despite frequent tremors – the correlation always seems to bounce back very close to 1, with an overall correlation of 0.78 for the observed time frame. This, of course, makes sense given how similar the two market caps move (see: first graph).

However, we can also spot several extreme spikes – especially during 2017 – where the correlation drops clean to zero or even turns negative.

After a fairly volatile 2017, the correlation between two market caps increased during the 2018 bear market (the red line indicates ETH’s peak price on January 15th), and stayed comparatively high for most of the year, barring the last few months.

This indicates that the correlation between the ERC-20 and ETH market cap tends to be lower during the bull market, and higher or more volatile during the bear market. Why is that, exactly?

Here’s our leading theory – during a typical bull run, everyone’s on the prowl trying to find that one project that’s going to moon next. This asset scouting prompts at least some amount of research and value-based investing, causing strong differences in the performance of individual projects.

On the other hand, when the crypto market goes down, it tends to go down HARD. When assets can lose 10% or more of their value in a day, most fairweather traders don’t care which projects are built on solid foundations and which aren’t – they just want the hell out. As a result, there’s a significant lack of project differentiation during a bear market.

This is precisely in line with our recent findings about investing in low correlation portfolios, where we discovered that assets with low correlation to the rest of the market performed very well during the 2017 bull run.

Conclusion

So what does this mean? Well, we wouldn’t go as far as calling the increase in ‘correlation volatility’ between ERC-20 and ETH market caps a bullish signal. This especially given the correlation dropped once again recently, and we’ve yet to see clear signs of market recovery.

However, what our analysis does show is that – following the massive FUD at the start of 2018 – we seem to be witnessing an increase in more selective project valuations, which is hopefully a sign of a maturing market.

Whether this trend continues given the current market turmoil remains to be seen.

Until then, here are our main findings once again:

- The ERC-20 and the ETH market cap exhibit similar behavior, and are moving closer together over time.

- The relative size of the ERC-20 market cap to the ETH market cap is growing constantly – likely due to a strong decline of ETH and an influx of new projects, rather than the existing projects increasing in value.

- The two market caps are very correlated, with an average correlation of 0.78

- Correlation is lower or more volatile during a bull market and higher during a bear market.

Do you agree with our theory on why the correlation spikes during the bear market, and dips during the bull market? Have another argument? Let us know in the comments!