ETH in anticipation of big events

As many of you probably already know, FED rate decision and the US GDP data for Q2 will be announced this week. Let's see how ETH holders are preparing for these releases.

1) Average fees:

Here we see that competition for block space has been getting less and less intense over time, which means market participants aren't feeling any FOMO these days.

2) Supply on exchanges:

Notice a sharp spike just recently, which stands for 0.5% of total supply, or approximately 500k ETH added to the exchange wallets. Looks like people are seeking to exit their positions, whether for the reason of price declining, or anticipating the negative data releases.

3) Active addresses

A huge spike in address activity appeared today, the largest one ever in fact, but on lower time frames this activity looks very coordinated, so take this with a grain of salt. This might be some kind of a large scale airdrop farming operation. If you know what can be the source of this activity, please share in the comments.

In the end, 2 more metrics to add to the general market picture. These metrics strictly speaking aren't ETH-related, but they help to understand the overall sentiment.

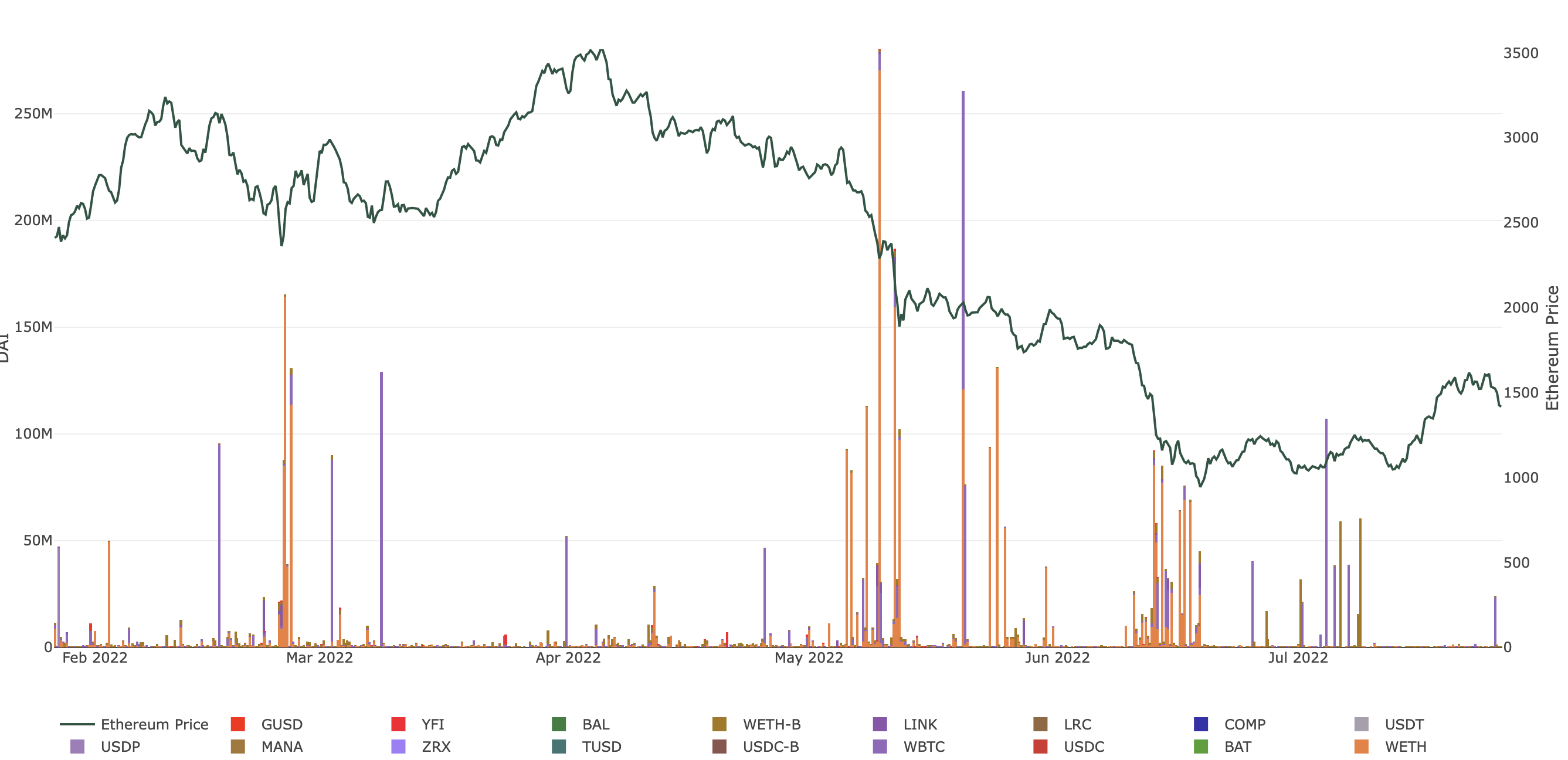

You can see that almost no new debt has been created in the last 3 weeks, and some repayments took place today, This shows that market participants are cautious and prefer to reduce their exposure.

Conversations (0)