DigixDAO giving back it's $100M treasury

The DigixDAO announced that it would be dissolving and returning ether managed by the DAO.

Story of DigixDAO

The DigixDAO launched in early days of Ethereum as one of the first prominent projects in the Ethereum ecosystem. It was the subject of the first Ethereum-based token sale, in March 2016, resulting in the sale of millions of DGD tokens in exchange for 466,648 ETH.

The goal is to create and support an Ethereum token backed by the value of gold. DigixDAO relies on a native token (DGD) to govern the Digix network and protocol, supporting a second token (DGX) which had its value directly tied to one gram of gold.

The gold is cast from bars from the London Bullion Market Association and is maintained by a third-party company also called Digix.

The total DGX supply is determined by the gold sitting in vaults maintained by Digix, which charges a demurrage fee and transaction fee for those trading DGX.

The DigixDAO and DGD holders manage this network, by exercising voting rights that allocate Ether to projects and teams building on and supporting the Digix. As compensation for their efforts, DAO members also received a portion of the demurrage and transaction fees generated by those trading DGX.

Members of the DigixDAO have requested that a DAO provides its holders with the ability to create a mechanism that lets members withdraw their contributions to the DAO.

The request was put to a vote and as a result, on or around March 25, the DigixDAO will dissolve and DGDs will become redeemable for ether.

Voting details (Project Ragnarok) - https://community.digix.global/#/proposals/0xe7d5d8aefc5f73c4c8bbc716f0c3c2dd52d5282d18217db331da4435b8e6966e

Long story short, at the end of March DGD tokens will be legit to be exchanged to ETH from project treasury (one of the biggest in Ethereum ecosystem). Exchange rate is expected to be 0.193 ETH per DGD. Current market rate is 0.179. Easy 7% profit for anyone?

Farewell DGD, long live DGX

Let's see what happens with a token sentenced to be exchanged to ETH at a fixed rate, higher then current.

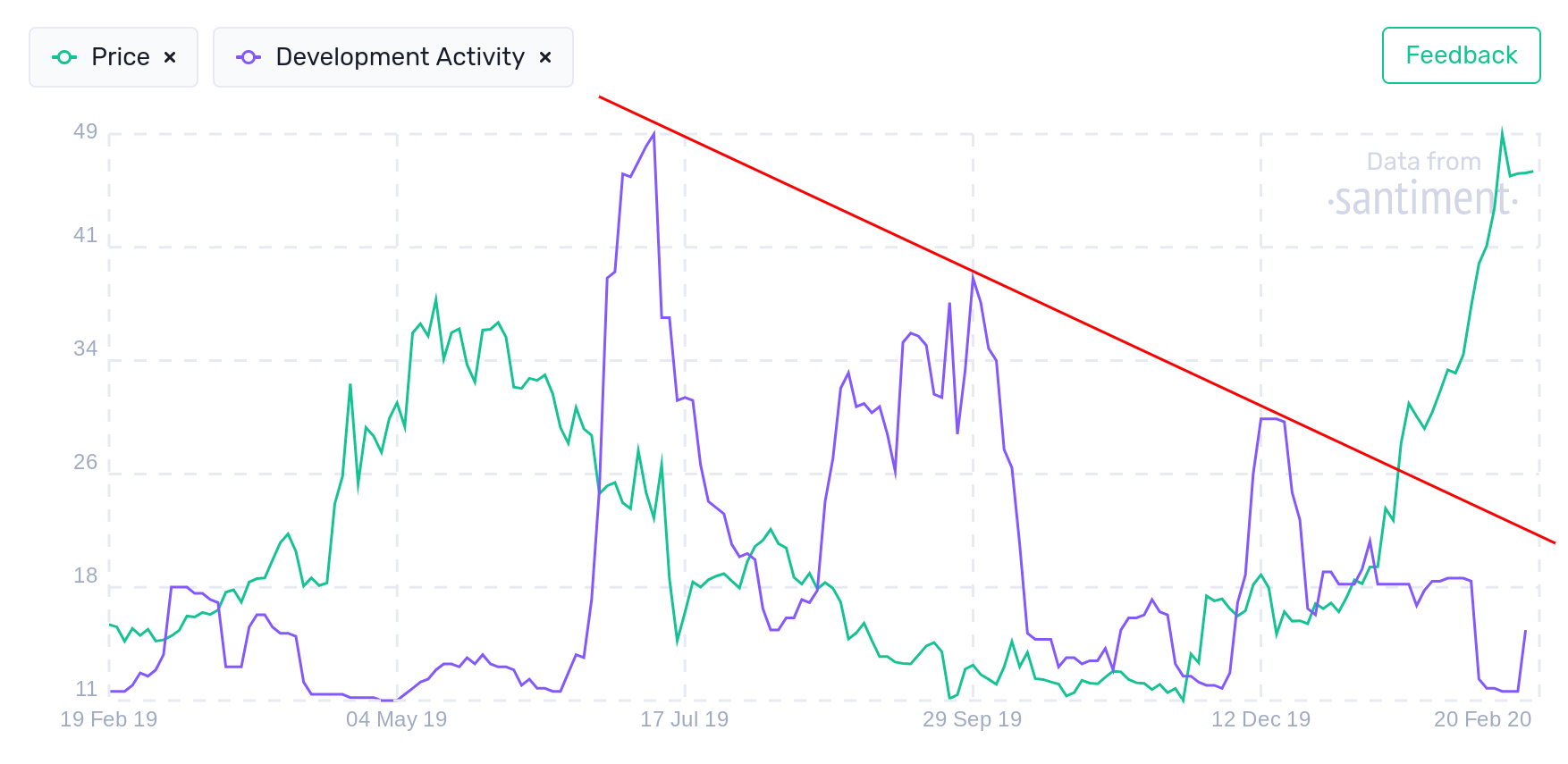

- 1. Price and social volume.

- January 25th was the day voting passed and...

...no one noticed? Just 5 mentions of DGD that day. Price gained 60% since voting.

The second social volume spike happened on February 11th and consists mostly of emotional "DGD BULLISH" of those who noticed price surge.

2. Trading volume and token circulation:

Nothing till around February 20th when community recognized dissolution and fake airdrop news appear.

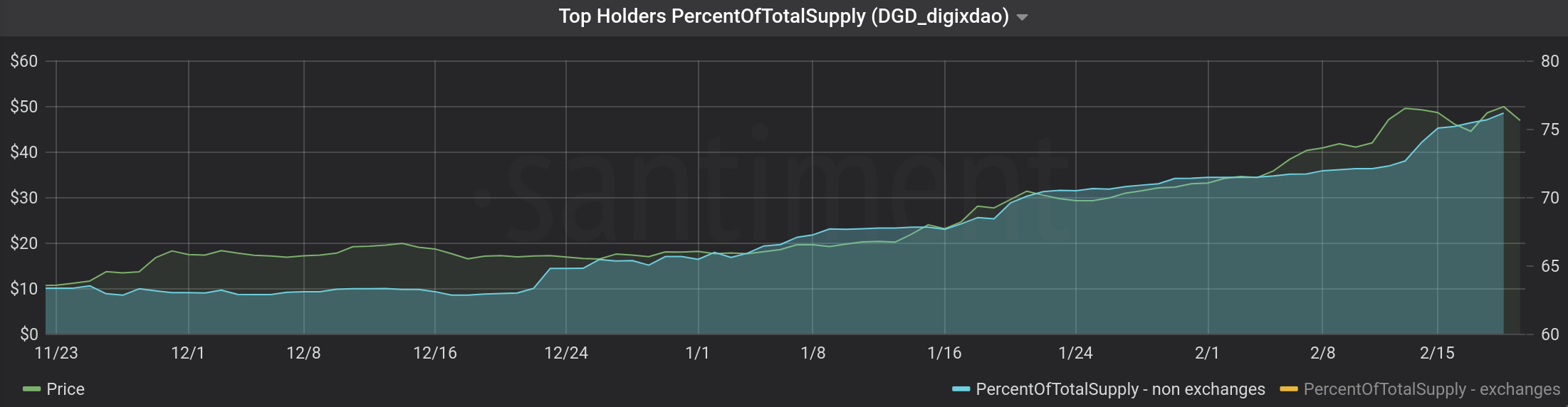

3. Percent of total supply being held by top 10 holders:

That's interesting. They don't care and keep accumulating DGD to exchange it to ETH at the end?

4. Checking with DGD on exchange wallets:

Percent of DGD total supply on exchanges decreased to 11.4

While non-exchange wallets holding up to 75.7% of total supply and keep accumulating:

5. Meanwhile there is a specific segment of holders offloading their DGD:

These are the ones holding from 1 to 1000 DGD ($50-$50,000).

6. MVRV:

Already topped and going down. It's a price top marker.

7. DAA:

A single spike with no continuation - top marker again.

8. Percent of active coins slowly increasing:

Is in steady downtrend last months.

That's it for now.

Thanks for reading and using Santiment!

Conversations (0)