Delirium Over Ethereum

We're now closing in on three months since the mid-September Ethereum merge. And in short, traders don't know what to make of the 2nd largest crypto asset by market cap. On one hand, it's seeing promising signs with key whale accumulation. But on the other hand, actual on-chain activity and utility continues looking unimpressive.

In our latest deep dive on Vitalik Buterin's baby, we'll look at whether prices are on the cusp of recovery... or whether sub-$1,000 ETH can again be a possibility.

Shark & Whale Activity

To kick things off, Ethereum's key shark and whale addresses are painting an interesting picture. Over the past year, just like Bitcoin, millionaire addresses have mainly shed much of their supply while conditions have looked poor.

But one month ago, we have seen these large ETH addresses begin to change their tune for the first time in a long time. Since November 7th, Ethereum addresses holding 100 to 1m coins have accumulated back 1.36% of the overall supply, and an increase of 2.09% more overall ETH (than they had previously) to their bags.

Due to this rise in large address interest in ETH again, we can consider this metric as a bullish argument.

Social Volume & Dominance

The amount of discussion related to Ethereum, like most assets, continues to dwindle as more and more months go by since the November, 2021 all-time high. This isn't necessarily a bad thing, since it's a natural progression of weak hands dropping out of crypto in general.

However, what is interesting is seeing Ethereum talked about so little relative to other top assets. Since late October, ETH is actually being talked about at the lowest percentage relative to the top 100 assets in crypto, since December, 2020. This indicates that the #2 asset in crypto is actually sitting a bit under the radar at this point.

The lack of interest since the merge is indicative that whales, as mentioned above, could push up prices with little resistance, making this a bullish metric.

MVRV (Average Address Trading Returns)

The average return among long-term (365d) addresses that have been active in the past year points to still a great amount of pain. 13 months ago, Ethereum was on the doorstep of $5,000 before prices dramatically fell off a cliff. Many people still have -50% or more in percentage losses on their ETH investment.

As long as the 365-day trading returns are at -25% or more (and it's currently at -30%), then there is a cap on how much further downside there can be, based on seven years of ETH history.

On the other hand, mid-term traders could still see prices moving either way. Late November is where prices bottomed out, and the asset is actually +17% since November 22nd. To many, it certainly doesn't feel this way, however. Because of the long-term upside indicated by MVRV, this metric points to bullishness.

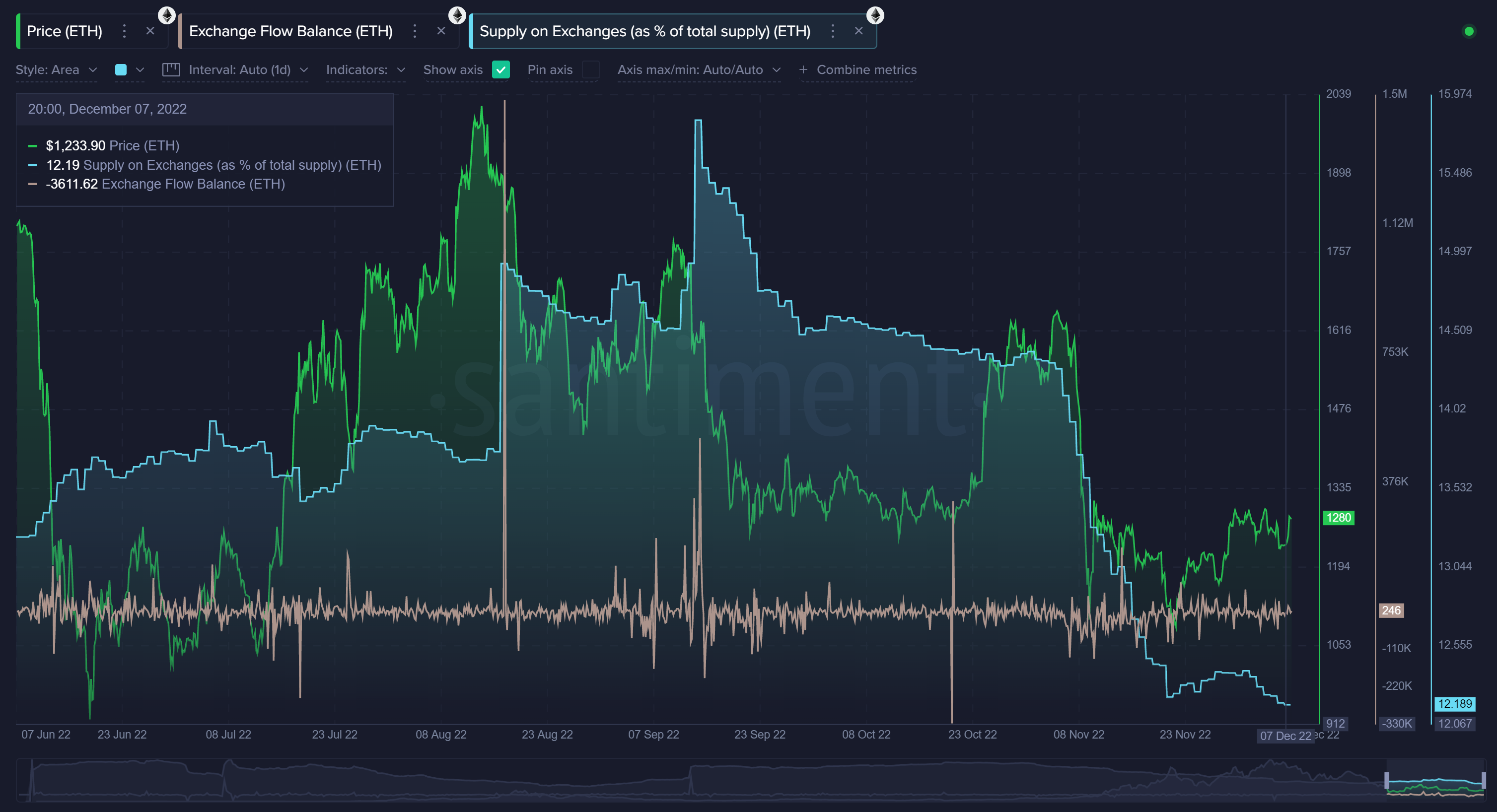

Supply on Exchanges

The supply of Ethereum sitting on exchanges has fallen massively in just the past month. And even more impressively, the 12.1% of ETH on exchanges is now at a 4-year low. The last thing we'd want to see, especially after a 75%+ drop in 13 months, is for supply to be moving on to exchanges, implying more sell-offs could be awaiting.

It isn't to say that future sell-offs can't be around the corner, but the more the supply of ETH on exchanges declines, the better of a case that can be made that we're nearing a bottom. For that reason, we certainly have to consider this metric as a bullish indicator for Ethereum.

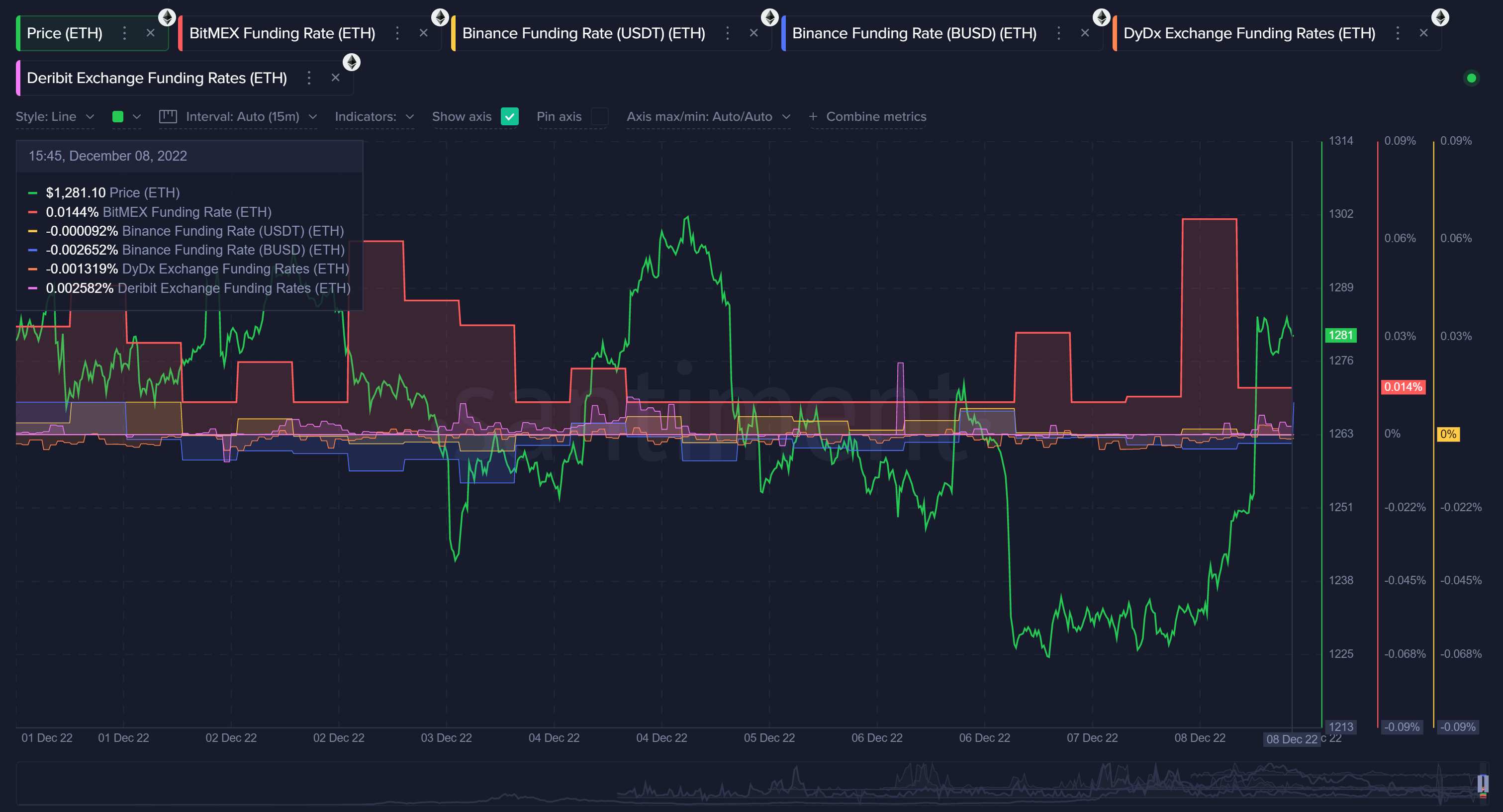

Funding Rates (Perpetual Contract)

We saw some major shorting from traders in mid-November following the FTX implosion, which generally leads to short liquidations and price rises. And that's exactly what happened with the +17% rise in three weeks. However, funding rates have been fairly flat for ETH since.

We will need to see signs of either a bit of greed or a bit of fear bias in order to conclude which way the next exchange liquidations will have an impact on pushing ETH prices. For that reason, since funding rates aren't breaking either way as of now, this is a neutral metric for the time being.

Network Realized Profit/Loss

Due to the three-week rise in Ethereum's price, we're seeing a bit more short-term profit taking than short-term losses right now. It makes sense. The realized profit spike above that you see from yesterday was actually the largest daily spike in nearly three months.

Not to say that history will repeat itself, but after the last major realized profit spike immediately following the ETH merge, prices fell 19% in four days. For that reason, we have to look at this, at least from a short-term perspective, as a bearish indicator.

Conclusion

Overall, Ethereum's on-chain and social metrics are about as mixed as the crowd's perspective is. Whether or not it's currently a promising investment really depends on timeframe. Long-term? Yes, it is safe to say that Ethereum is very likely closer to its upcoming 3-year low vs. its 3-year high. But are we at maximal pain? Probably not yet.

But as we saw in early November as the FTX implosion news broke, an argument can be made that the FUD needed for a mid-term bull run already exists as well. We'll continue to monitor Ethereum's metrics together, and keep you posted on any major anomalies as they happen!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Conversations (0)