Dealing with "bear markets". A way to "hedge", reduce the risk(s) and earn

Whether or not you believe we are officially in a bear market, there are some great ways to maintain your position for a potential recovery while mitigating your risk of further downside.

Hedging is a well known approach to "remove" the risk, yet, in crypto this hedging can (and probably should) be done in many different ways.

One of the possible ways described below.

What I wanted to test in this experiment (and also "journal" the results on sanr.santiment.net) is to deploy something which seemed to be logical for me in the current market environment

I was thinking along these lines

- we are a bit more than 2 months into bear market

- all previous pump attempts were rejected, crowd gets more and more cautious

- means - there is a decent level of "concerns" in the market

- in such an environment, if markets were to rise, both "majors" (BTC and ETH) would benefit the most

- if markets were to continue to drop, altcoins like LINK, 1INCH, and BADGER would get hit harder than "majors"

So, let's see how it performed.

Running such experiments is now easier with the new SanR protocol (sanr.santiment.net)

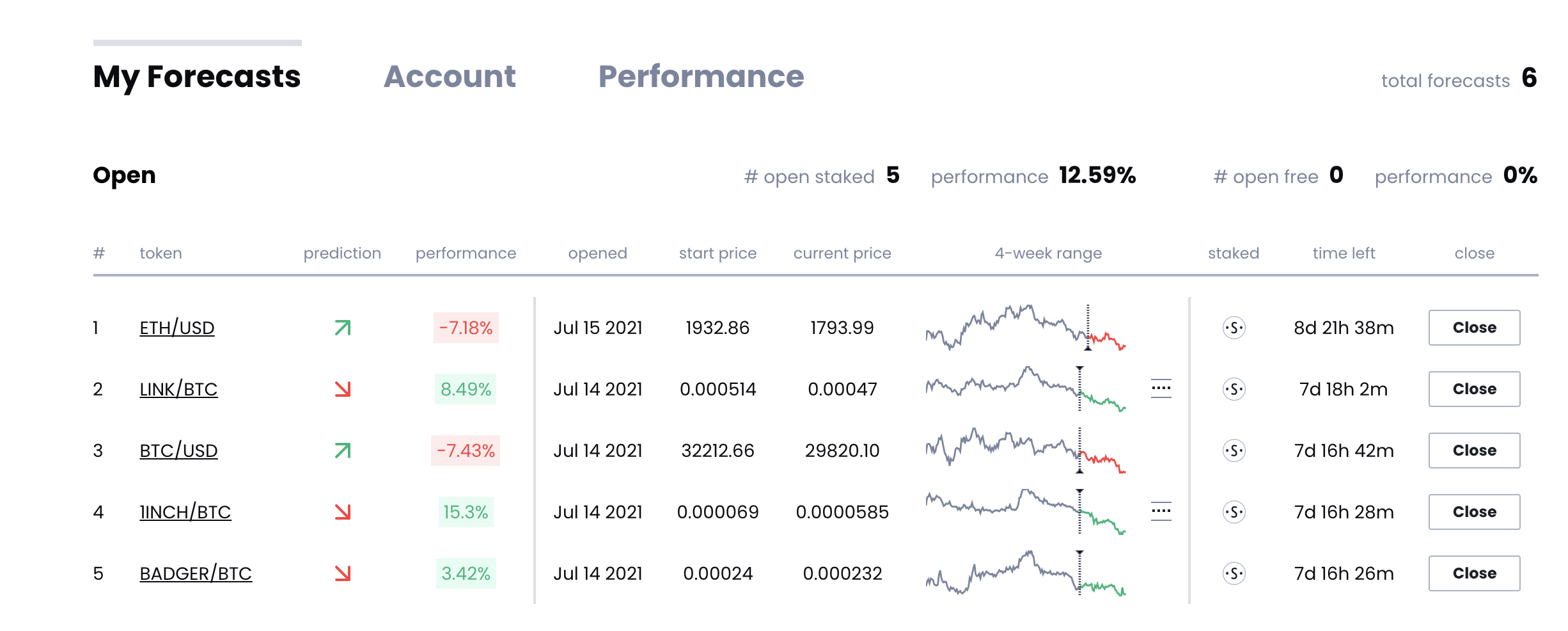

I created 5 "signals" there on the 14-th and 15-th of July.

- San.Rise for BTC and ETH

- San.Set for LINK, 1INCH and BADGER

How did it perform?

As the market kept crashing, both BTC and ETH were (as expected) showing negative results. Yet, the "shorts" (San.Set) on all alts were doing well. All together we started to show positive results (around 18%), see the visual below:

After around one week market started to recover. Our performance initially suffered a bit, it went down to around 12%, see below:

And then, exactly as expected, the performance grew rapidly to almost 30%. ETH and BTC did outperform alts. That is especially impressive result, taking into account that we had 2 longs vs. 3 shorts:

That was the time I was considering to close the experiment. But as it was the middle of EthCC in Paris with plenty of talks, meeting and parties, I had to postpone the writing till tomorrow. The final results are:

That was an interesting experiment, which showed that navigating the bear market can be as profitable as the bullish one. Also placing our newly developed SanR platform into action was a good test as well.

You can try to use it yourself - sanr.santiment.net

There are currently plenty of smart people there testing and trying out their skills in "sonaring" the market.

Here is the link to the account used for that particular experiment. More experiments and showcases are coming.

Conversations (4)

I think i might have an exaplanation. I noticed the same and tried to understand what is happening. I think this behaviour is much linked to the total bitcoin market cap and global sentiment. When bitcoin is falling people start selling alts in order to have some cash. For what you might say ? For buying bitcoin and etheruem at their lows. So when they reach these lows people spend that cash on 2 main coins and alts continue to fall because all the cash goes to BTC and ETH (global market cap grows). Once BTC and ETH are well enough, people start to buy alts. And like 1-2 days after recovery its alt paradise, every alt is positive.

Please share your thoughts ;)

Author

That's a good way on thinking. One important point - this behaviour (cashing out to buy "majors" - BTC and ETH at the moment) happens closer to the cycle bottom. When we aren't bottomed yet - crowd will still try to play the alts, as it was the best strategy during the last phase of the growing market. So, the crowd always takes the "what worked the best recently" (in the past) and applies it to the present.

I'm sorry to mention but i don't understand the objective of this exercise. The author has basically gone long on 2 cryptos, BTC and ETH, ceterus paribus, esp with USD. And then gone short with exactly the same 2 cryptos on other 3 altcoins as the underlying base.

With exposure to the same 2 cryptos, and them being both highly correlated themselves, i don't see how this can be a hedge. Yes, naturally, when they (let's call them the Anchor coins(BTC and Eth)) go up, the Altcoins go down. Even with a 1:1 exposure, it could be seen as a hedge of somewhat, but here we have a 2:3 exposure, and with a bearish bias, may i suspect.

I'm also curious on why only BTC was chosen as the underlying for all the altcoin pairings, when we have Eth exposure too?

The author could have cherry picked the coins or have it backtested with various permutations, so with hindsight vision, this is pretty beautiful. However, it seems rather ineffective imo in acting as an independent hedge. I would like to see a setup where we can see the downside capped with an independent hedge, while bearing full rewards on the upside.

Look forward to suggestions and advise pls

Author

Great point with "cherry picking" and "backtesting with a hindsight"!

The whole point we'be built the sanr.santiment.net platform is to avoid such things.

Each "signal" was created and stored on the blockchain. Means - it was made live!

Please make sure you understand this part. It's crucial.

As for the rest - the setup (rather an experiment) was made to test out some signals we were witnessing on our data.

In order to avoid "cherry picking" and "hindsight" we did what is decsribed.

BTC and ETH are chosen as these are the only majors now. Majors in the "crypto market vs. fiat"

The other three alts were chosen because we saw some signals on on-chain data. We will reveal more on it later.