CRV - Where's the bottom?

Assets covered: CRV

Metrics used: Daily Active Deposits, Supply on exchanges, Top Non-exchange Top holders

Summary: CRV is trying to find a bottom, conditions remain challenging but some positive sign are starting to show.

In the quest to search for a bottom, CRV bounced off a new all time low yet at around $0.33 USD and surprisingly made its way up to $0.623 USD (+88.7%) with high breakout volume.

So.....is the bottom really in?

Let's take a look.

DeFi bloody season

Before we dive into CRV, it's important to note the current climate around crypto.

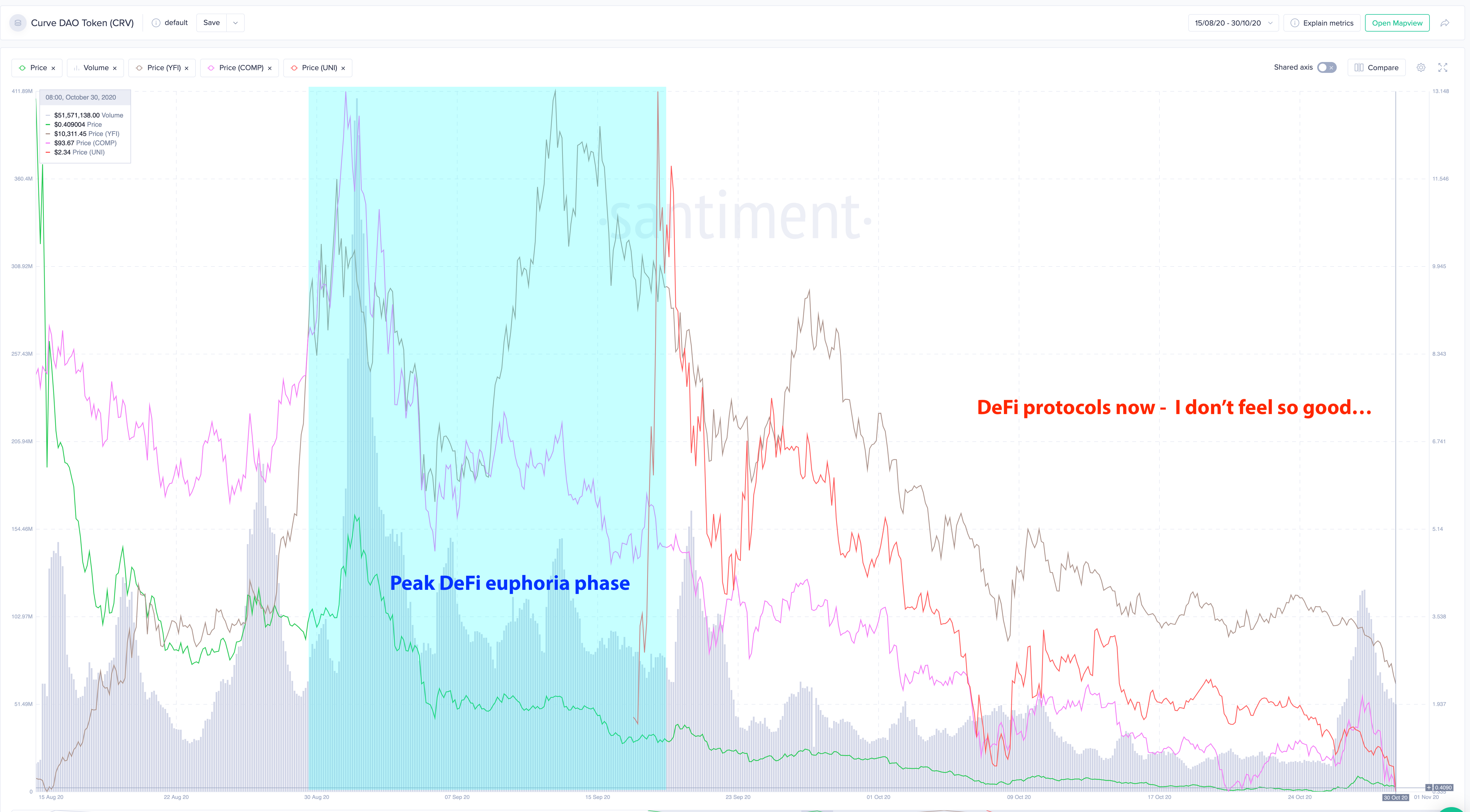

If you have not gotten the memo, we are in full DeFi bloody season and no, DeFi darlings like COMP, YFI, UNI and CRV are not spared either. With all them them seeing more than -72% drops (and still making lower lows) from their respective all time highs in less than 2 months.

While most coins saw a rally up to all time highs, all CRV had was a downtrend since listing and this is due to the amount of sell pressure/inflation factors which we will cover later.

For now, given the macro-environment factors as we lead up to the elections/new covid cases spike, there's a lot of uncertainty, gone are the "DeFi to the moon" sentiment and in comes further panic.

Until the uncertainty is taken out of the picture, it is likely that we trend down further, looking for a capitulation and period for consolidation before things have a chance to turn around.

CRV Tokenomics

Total supply 3.03B

Circulating supply: 116,767,035.92

Total CRV locked: 33,852,215.10

The total supply of 3.03b is distributed as such:

- 62% to community liquidity providers

- 30% to shareholders (team and investors) with 2-4 years vesting

- 3% to employees with 2 years vesting

- 5% to the community reserve

The initial supply of around 1.3b (~43%) is distributed as such:

- 5% to pre-CRV liquidity providers with 1 year vesting

- 30% to shareholders (team and investors) with 2-4 years vesting

- 3% to employees with 2 years vesting

- 5% to the community reserve

Do note that the initial release rate will be around 2M CRV per day.

With the high inflation, there'll be strong sell pressure until the protocol matures (it's only a few months old) and significant demand in a thriving cryptomarket arrives.

Speculators/investors should be aware of this else get risk getting rekt as we have seen when CRV first started trading at $37.25, giving it a FDV of $123.59 Bn.

Oh, how things have changed since more supply entered circulation.

The real winners here are the shorters but... once things unwind (like the during latest rally), those shorts can quickly turn into liquidations that pushes the price further upwards.

The way CRV tokenomics is structured, it actually discourages buying from the market. Instead, it's more worthwhile to obtain it by being a liquidity provider on Curve.fi.

You can learn more about the tokenomics here.

Top Holders

Top non-exchange addresses continue to offload tokens since launch and should continue to do so given the inflation and vesting schedules. However, do note that Top non-exchange addresses also includes the veCRV contract address that locks up CRV.

So, let's take a look at some notable Top Holders

Founders

0xd2D43555134dC575BF7279F4bA18809645dB0F1D - Holds 759.58M CRV (worth over $300M atm) , Founder Vesting wallet (4 years) that distributes to the following founder addresses:

- 0x9b44473e223f8a3c047ad86f387b80402536b029 - Holds 0 CRV, most of it is sent to veCRV contract for locking CRV up and to 0x4ce799e6ed8d64536b67dd428565d52a531b3640

- 0x32d03db62e464c9168e41028ffa6e9a05d8c6451 - Holds 0 CRV, most of it is routed back to 0x9b44473e223f8a3c047ad86f387b80402536b029

- 0xf89501b77b2fa6329f94f5a05fe84cebb5c8b1a0 - Holds 0 CRV, most of it is routed back to 0x9b44473e223f8a3c047ad86f387b80402536b029 and 0x4ce799e6ed8d64536b67dd428565d52a531b3640

- 0x7a16ff8270133f063aab6c9977183d9e72835428 - Holds 0 CRV, most of it is routed back to 0x9b44473e223f8a3c047ad86f387b80402536b029 and 0x4ce799e6ed8d64536b67dd428565d52a531b3640. But..... it recently moved around 345,479 CRV to Binance.

- 0x4ce799e6ed8d64536b67dd428565d52a531b3640 - A common address that founder wallets interacted with, holds 36.16M CRV currently. Looks like a reserve for now.

The Curve team is the #2 largest receiver of CRV (1st is LPs) based on the token distribution mention earlier. Is that too much skin in the game?

Either way, it looks like Founders are mainly locking up their CRV for veCRV as well as stashing it in 0x4ce799e6ed8d64536b67dd428565d52a531b3640. Even though one of the address sold CRV, it's not that huge of an amount.

So that's one less large holder to worry about for now....

Investors

Each time the Investors vesting address distributes CRV, the price tanks shortly after. With the latest release being a very timely one at the top of the CRV.

E.g below are two recent recipients from the Vesting address sending to Binance:

- 0x39362b3ca91d40aff08ebccbdd121090f3bb3ef3 - Sent

783,732 CRV - 0xd4a39d219adb43ab00739dc5d876d98fdf0121bf - Sent 2.3M+ CRV in the past 30 days

For now, this is probably the key group to take note of when it comes to sell pressure. It'll be a good sign if there's an uptick in Investor locking up their CRV.

Locked CRV

CRV holders can vote lock their CRV into the Curve DAO to receive veCRV. The longer they lock for, the more veCRV they receive. Vote locking allows you to vote in governance, boost your CRV rewards and receive trading fees.

Again, do note that 1 CRV != 1 veCRV, it depends on how long you lock it for.

1 CRV locked for 4 years = 1veCRV

1 CRV locked for 3 years = 0.75veCRV

1 CRV locked for 2 years = 0.50veCRV

1 CRV locked for 1 year = 0.25veCRV

You can read more about veCRV here.

Currently, the veCRV contract has locked around 34.79M CRV (22.86% of circulating supply), with an average lock time: 3.63 years from 2,950 unique addresses. In crypto time, this is as good as burning CRV.

The team remains the single largest CRV vote locker with 14.70% of the entire veCRV distribution. That said, it's good to see that veCRV is still somewhat decentralized enough with veCRV 42.24% belonging to Other addresses.

There's also been a nice growth in CRV being locked up in the past week, likely due to admin fees (collected from 50% of all transaction fees) that are going to be distributed to veCRV holders going live soon.

Fee accrued so far for 41 days: $1.89M

Admin fees will be paid out in 3CRV (LP token for 3pool) and is currently awaiting for the DAO approval.

While all the inflation is a nightmare, it's actually positive to see that more CRV are being locked up (essentially burned due to avg lock time) and the increase in # of locks. Should this continue to trend upwards, we might just find temporary bottom.

But this largely depends on whether Curve.fi continues to generate enough fees to incentivize participants. Which is a little challenging at the moment given the DeFi slowdown and new competitors arising.

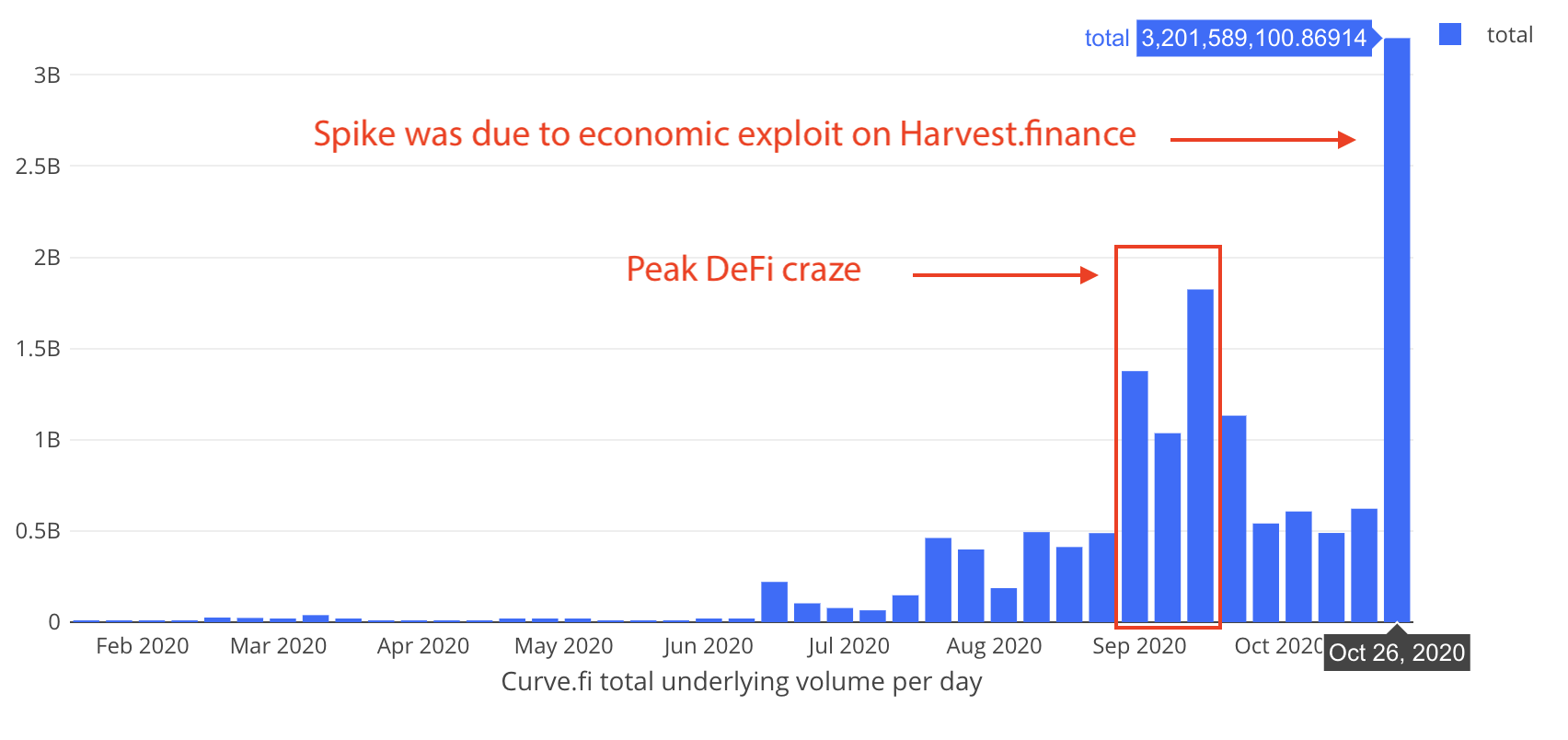

E.g Liquidity have fallen quite a bit since peak DeFi craze in in mid-Sept.

It's likely that a fair amount of USDC went from Curve.fi to Barnbridge. The usual USDC supported pools on Curve.fi is having a max of 42% APY and this requires locking in a good amount of CRV in order to get a 2.5x boost to hit the max APY possible. Meanwhile, Barnbridge is giving > 50% in APY.

Trading volume too saw a drop since mid-Sept but a recent spike raked in a good ton of fees for Curve.fi. This was due to an economic exploit on Harvest.finance.

Coin supply on exchanges & Daily Active Deposits

Looks like Coin supply on exchange is trending up with no signs of slowing down, with a total of 58.87M CRV (> 50% of circulating supply) now on exchanges.

Zooming in, we can observe that each time there's a spike in Coin Supply on Exchanges or Daily Active Deposits (DAD), price takes a tumble.

In the start of October, DAD was very active and slowed gradually until the latest rally, which saw highest DAD spike (220 Unique Deposit Addresses) for the entire month, sure sounds people really wanted to exit.

Still no signs of accumulation yet, the current market participants behaviour is Get Token and Dump (via Farming or Vesting) whenever possible.

This includes yield aggregator protocols like YFI, PICKLE and FARM have strategies that continue to farm and dump CRV.

Going forward

CRV is still plagued by its high inflation and a DeFi bloody season. Recent data shows that market participants are still dumping CRV as soon as they get it and it's not slowing down for now.

However, recent growth in locked CRV is a positive sign.

A new DeFi wave could see renewed interest in Curve.fi, bringing much needed new liquidity and trading volume that'll help CRV price find equilibrium. Late shorters might get caught off guard and boost price further.

Till then CRV may struggle to hold prices at these levels.

Conversations (0)