CRV - How are things looking?

Assets covered: Curve (CRV)

Metrics used: Price, Network Growth, Supply on Exchanges, MVRV 7D, Daily Active Addresses

Chart: https://app.santiment.net/s/YFuPB5I_

Price

Since bouncing off the lows in July, CRV is continuing to make higher higher and higher lows with rising volume. Generally, this is a good and healthy sign for an uptrend.

However, it's hitting resistance area at the moment, which is around the $2.50 levels. A clean break and retest to flip this level to support would set it for a bullish continuation towards the previous ATH in April.

Supply on Exchanges

With the recent price spike, we observed quite a strong spike in CRV Supply on Exchanges as well, which could prove to be a strong sell pressure ahead.

MVRV 7D

CRV's MVRV 7D which measures the short-term profit/loss of holders is showing that we are heading into the danger zone, as all short-term holders are in the profit at the moment -Which could incentivise them to take some profits.

Network Growth

CRV's Network growth is rather encouraging after some stagnation since mid-July. It is currently making higher highs, a continuation will bode well it indicates new participants coming in.

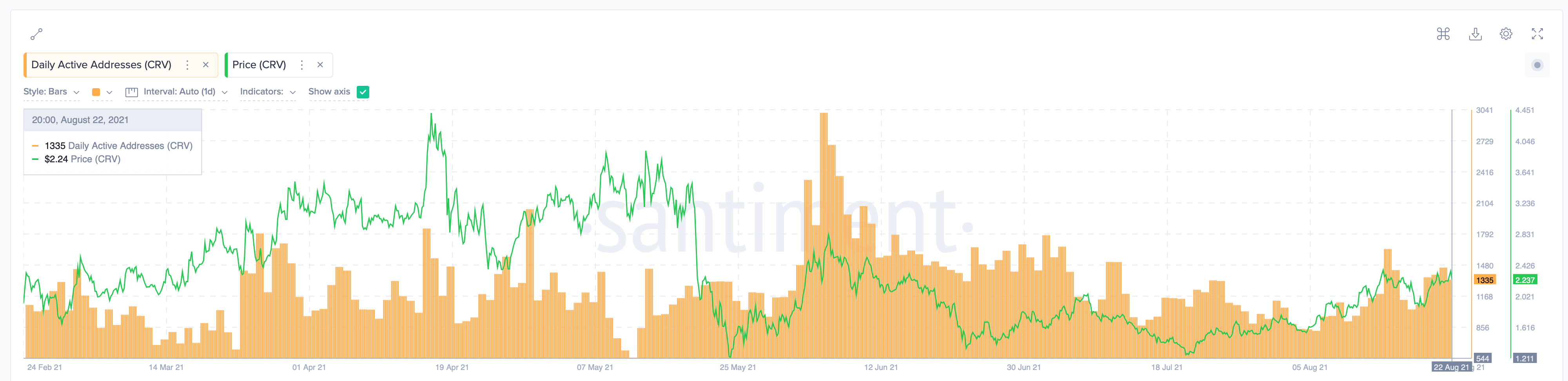

Daily Active Addresses

CRV Daily Active Addresses is also picking up nicely, indicating that increased interest in CRV, which a good sign of a healthy network.

Summary

Overall, things are looking pretty decent for CRV at the moment. Granted, there's a few hurdles to tackle, e.g Sell pressure and the resistance at $2.50.

But those might just be a matter of time as long as BTC doesn't nuke.

Conversations (0)