BTC shoots past $10,000 with mixed crowd sentiment - So what's next?

Well well, looks like it didn't take long for Bitcoin to hit the $10,000 mark since it reclaimed $9,000. In fact, it did all that within a week!

While some were expecting BTC to just tap $10,000 and fall back just like the first time $9,000 was hit, Bitcoin surprised all shorters by spiking all the way to $11,105 USD on Saturday 22nd June, making an ATH for the year so far and is still currently above $10,000.

RIP Shorters - Thank you for the boost, Arthur Hayes sends his regards.

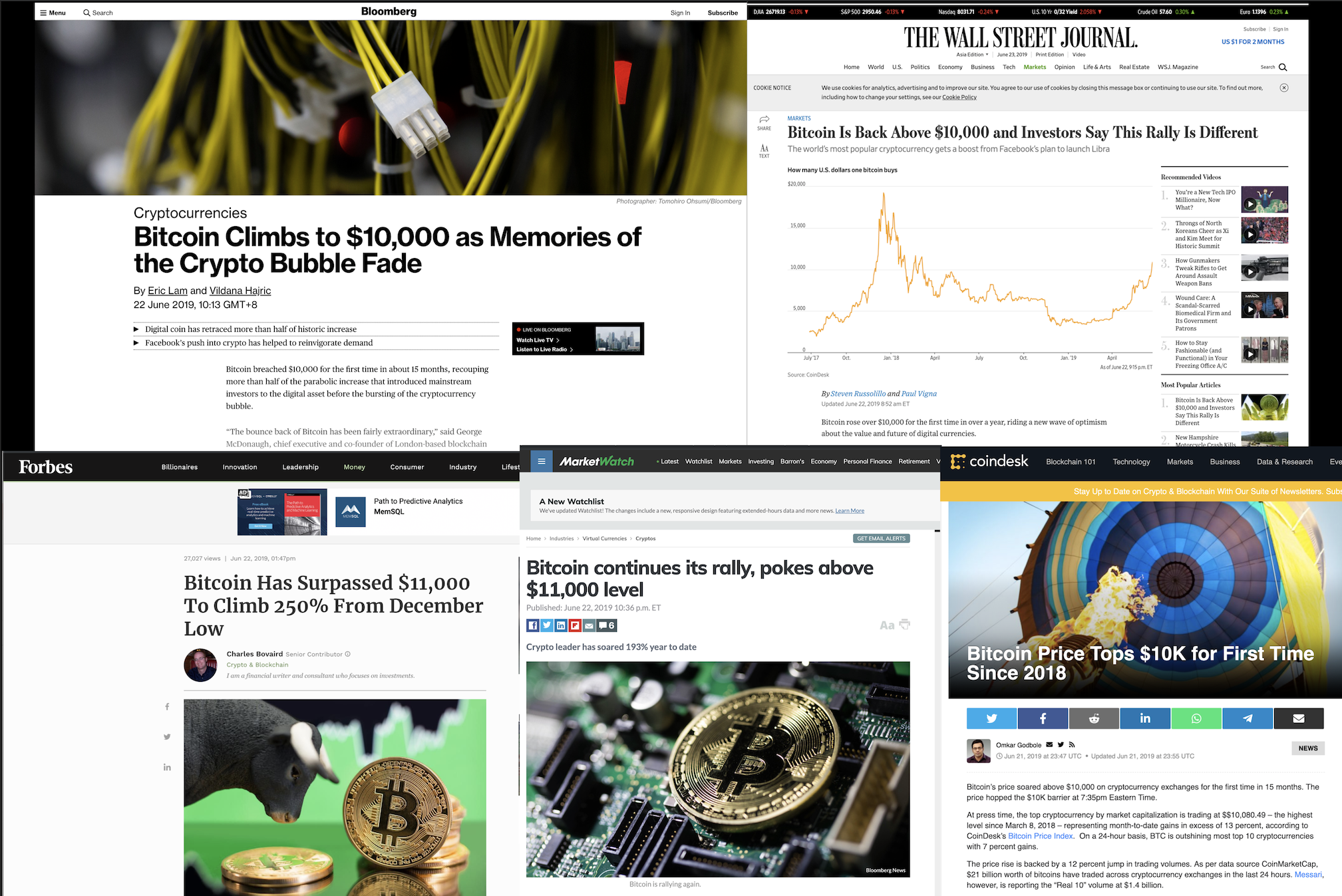

Reaching $10,000 again is a huge milestone for Bitcoin as many see it as the point of FOMO for retail investors when news of it eventually hits mainstream media. And so...it did over the weekend.

The crypto community remains excited about this milestone and naturally so after being beaten down for what felt like eons during the bear market. Most are convinced that Bitcoin has long since bottomed out (back in Dec 2018) and we are in a bull market with price expectations getting higher. Even parabolic charts are out.

According to Peter Brandt, should Bitcoin be on a parabolic advance, we should see it hit $100,000.

To get a sense of how excited the crypto community is, just take a look at #BitcoinIsBack on Twitter.

We are also starting to see ATH social volumes this year for terms like:

- 10k - 2882 mentions

- 20k - 737 mentions

- 100k - 424 mentions

That being said, such level of excitement does come across as a Déjà vu moment for some. Remember how excited the crowd was in Dec 2017 when Bitcoin was about to hit $20,000? Yeah, it does somewhat echos that currently.

Mike Dudas sums it up best:

The exact same god damn feeling as Thanksgiving 2017. Anyone who says otherwise is lying to you. React accordingly, whatever that means for you. At this point, everything is a guess mixed with a finger in the wind.

While the majority are excited, we are also seeing spikes in"pullback" mentions. Perhaps from more level-headed investors/traders or the "disbelief" group, there's a certain sense of cautiousness/skepticism lingering.

It's also not the first time we see such a spike so far this year. We have observed "pullback" mentions spike when BTC was going:

- $4,000 to $5,000

- $6,000 to $7,000

So far, BTC ignored all calls for a pullback and continued on its path. Will BTC surprise everyone again? Perhaps and if so, keep a look out for when the BTC price rises and social mentions of "pullback" drops significantly. It may indicate crowd's overconfidence and if excitement spikes as well, we may very well see euphoria and entering into a high risk zone.

Surprisingly, Bitcoin interest outside of the crypto community seems to be rather low as compared 2017. Perhaps the bear market killed all moon bound hopes and the current rally just seems like a "sucker's rally".

To put things into perspective, check out the Bitcoin search interest over time on Google:

Interest levels are no where near when Bitcoin first hit $10,000 in 2017 and heaps away from peak popularity when Bitcoin almost hit $20,000. Perhaps it'll be a little while more until new retail money flows in.

We previously introduced a new indicator -MVRV Long/Short difference that worked pretty well in identifying the end of the bear market.

We revisit the indicator again and here's what our CTO Valentin observed:

We are sitting on 41.55% now, which is far from the historical tops, but we are also missing a “long term holders cashout” phase, where price is going sideways or up and the ratio is decreasing. I'd be looking for this phase to happen before warming up my cold storage

After we go through such a distribution phase I’ll expect to have a final push and then the question is how high the ratio will get. History shows that as the marker matures, the highs are getting lower, so I would expect something like 60-80% top.

Such sideways/consolidation period should see altcoins thrive, eventually kicking off a proper altseason that many are looking forward to. Till then, BTC leads the way.

Conversations (0)