BTC finally breaks out to $11k

Assets covered: BTC

Metrics used:

- Social volume

- Weighted Social Sentiment

- Daily Active Addresses (DAA)

- Mean dollar invested age

- MVRV (30D)

Summary: BTC looking decent so far (on-chain and price action )for as long as legacy markets allow.

Why Hello $11,000s

After ranging for almost a month and making multiple attempts to break and close above cleanly above the $11,000 mark, BTC finally did it.

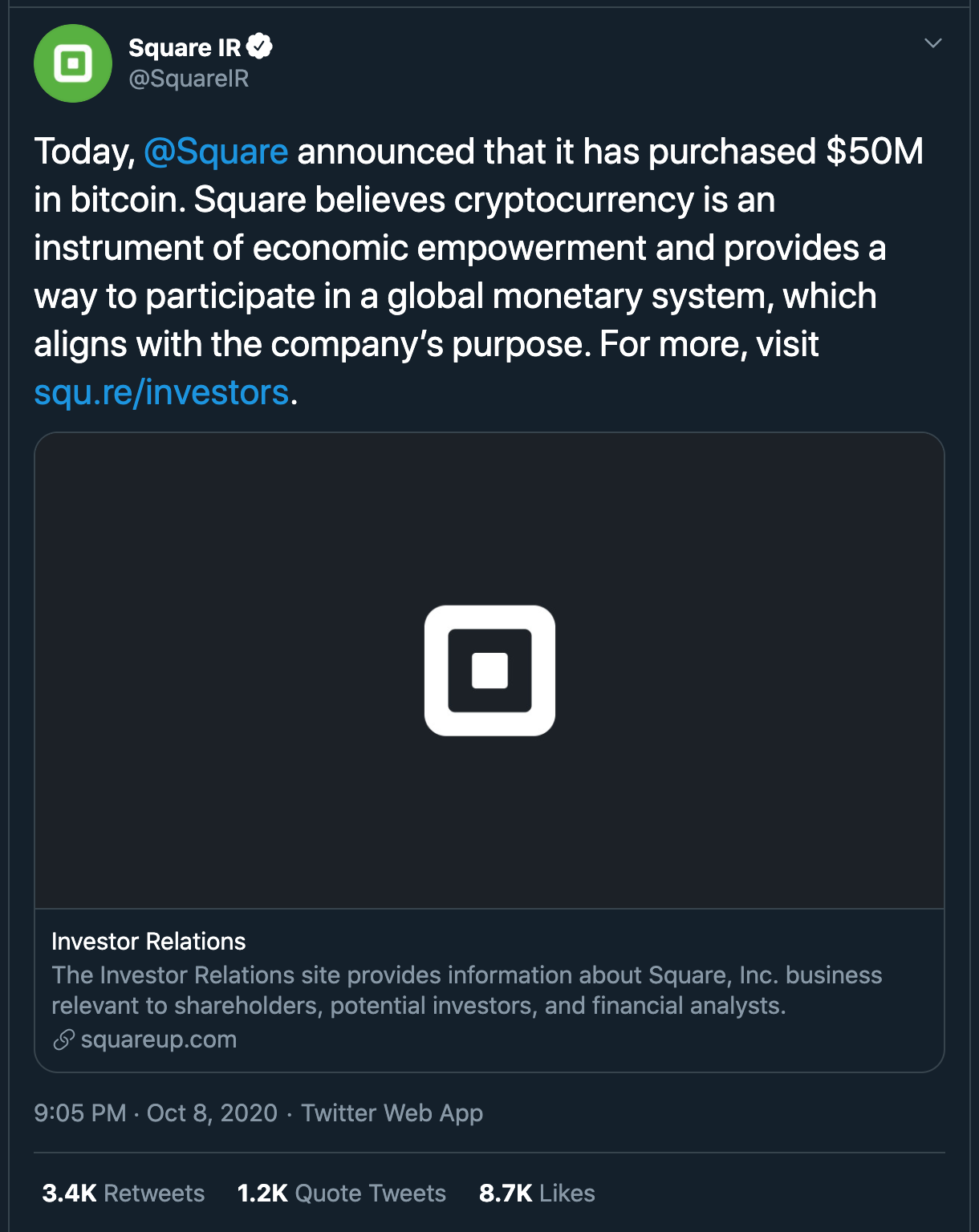

This came shortly after Square's announcement of their $50M investment in Bitcoin, find out more how how they did it here.

With this, it brings the total amount of publicly traded companies that have exposure to BTC to... 11 - holding a total of 592,806 BTC (approx $6.6Bn) or almost 3% of BTC's total supply according to this site.

It's a good start so far, will we see this trend continue?

BTC and correlation to legacy markets

The macro environment factors (U.S elections, Stimulus, etc) still plays a strong factor in the direction of BTC as its correlation to the SPX continues - Suggesting that if the SPX continues to rally, it is likely we see more people being risk-off and spill unto BTC, and by extension, the entire cryptomarket.

This correlation for the past few months have even prompted folks to call it the Digital S&P instead of Digital Gold.

So far BTC's price action is looking pretty good but uncertainty still remains with legacy markets reacting to pretty much every tweet that Trump makes. With the election drawing closer, one thing that's certain is volatility.

It is believed there's money sitting on the sidelines and once elections are over (which removes a good amount of uncertainty), they will have to flow somewhere. Some might have jump the gun before then if opportunities pop up (e.g oversold conditions)

What the metrics are telling us

Social volume & sentiment

Social volume did spike a little but nothing too major as compared to previous breakouts, suggesting that the crowd isn't exactly too excited about it. Perhaps in disbelief?

Weighted Social Sentiment

On the sentiment end, the crowd is still generally in the negative side, nothing too bullish, which is good as it signals that we are certainly not near the top, giving more runway for the upside.

Daily active addresses (DAA)

The Daily active addresses for BTC is really impressive so far as it continues to increase towards what we have seen back in late 2017 (where the top was).

However context here is important. Back then, the market was in full-blown Euphoria and calling for BTC to be $100k after a huge rally.

Now, are 2 years of bear market, we are seeing DAA almost hitting that again and we are not even near an insane rally of 2017 magnitude, suggesting that the network usage is healthy and increased adoption. As price grows, it is very likely that we see DAA break above 2017 highs and it needs to remain steadily above it and grow for continuation (like what we have seen in 2016).

So far, HTF suggests that BTC is gearing up for an exciting 2021 and 2022 if this continues.

Mean dollar invested age

We are continuing to see Mean dollar invested age (MDIA) increase steadily, which is usually a good sign as it shows that BTC is being hodl'd for longer periods. Bias is bullish for now but as a rally forms, it's important to note how mean dollar invested age changes as we have seen in the past, a rally followed by drop in MDIA precedes a significant fall in price.

MVRV (30D)

MVRV (30D) is showing that we are creeping into a zone where short-term traders tend to take some profit off the table. If BTC continues to pop, the chance of a healthy correction increases significantly (The higher the MVRV 30D is, the more likely).

Going forward

Overall, BTC is showing strength in both price action and on-chain metrics. Crowd sentiment remains skeptical of the push, which makes it ideal for disbelief and BTC to go even further.

However, short-term corrections are likely to happen but HTF suggests we could be in the continuation of a new cycle if conditions allow.