BTC - Bloody Wednesday

What a crazy week it has been. Looks like we had one of bloodiest day in crypto since the great Black Thursday crash of 2020.

Let's take a quick look at how things are now.

BTC continued its downtrend after topping out at $64,000s and reached as low as $30,000 in a flash crash (the largest trading volume this year) on 19th May, Wednesday.

It has since bounced and is attempting to stay afloat $39,000s for a chance to break into the $40,000s.

BTC has now corrected by -53.7% since its ATH.

Coin98

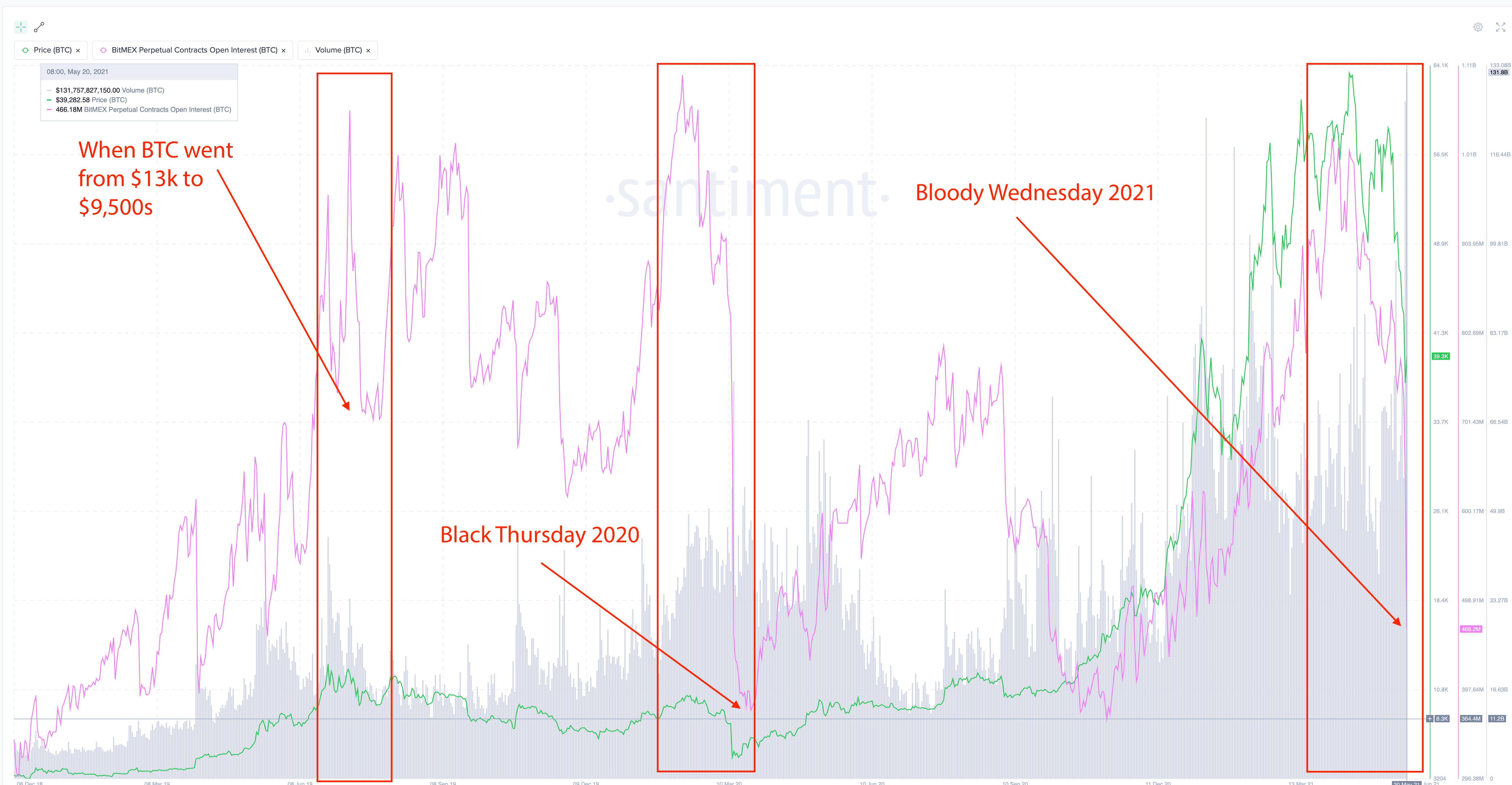

Above is a comparison of major corrections in BTC's history.

Such violent moves in a short timespan are not normal and is usually a result of forced liquidations by over-leveraged traders (each of them them cascading upon one another). Even those that longed early or had decent margin maintenance % were at risk and eventually copped out.

To make matters worst, most exchanges couldn't handle the load and went offline. Anyone that wanted to top up their collateral couldn't and anyone that wanted to close their positions earlier, couldn't either.

All they could do was...just watch themselves get liquidated.

To get an idea of how bad things were Derivatives, let's take a look at Open Interest and Funding rates.

Bitmex's BTC Open Interest dropped significantly during the flash crash and is the largest drop in OI in 2021. While it's not Black Thursday's OI drop, it's very very close.

This is a result of positions being closed (mostly force liquidated).

Bitmex's BTC funding rate is finally showing a huge spike in negative funding at -0.25%. For comparison, Black Thursday 2020 spiked to -0.38%. We are certainly very very close to negative sentiment in the space.

Considering that for most part of the year, BTC's funding rate has been largely over 0%, we are now seeing overwhelming Shorters than Longers. Which is great as Shorters are now at risk instead of Longers and if there's significant move upwards, they become the buy pressure (forced liquidations upwards).

It'll be Bloody Wednesday in reverse.

BTC's MVRV 90D shows the average profit or loss of those holding BTC tokens which moved in the last 90 days, based on the price when each token last moved.

And it recently fell into the major undervalued zone (based on historical bottom zones). This is generally good as the risk reward is looking pretty decent now, assuming that we have not entered a bear market like the one we see in 2018.

While key metrics for determining whether we are bottoming are showing very healthy signs, Social volume remains a little concerning as most people are talking about "Buy the dip".

It's the strongest spike in "Buy the dip" mentions too. Ideally, we want to see a drop is such mentions as it'll signal that people lost hope in the markets.

That said... the crowd's been calling for "buy the dip" with every major drop, and they have been rather wrong over the month. One day, they might just be right.

Going forward

While it's been a bloody week so far, overall, the cryptomarket is showing signs of bottoming out.

Huge liquidations, Negative funding rate as Shorters are increasing their risk and MVRV 90D in undervalued zone. If we are still in a bullmarket, this major wiped out will prove to be a great opportunity for scooping up.

There are warning signs of crowd still being some what bullish (or perhaps it's just a coping mechanism aka Denial). A drop in price after rising, and drop in mentions of "buy the dip" would be ideal as crowd loses hope.

Give it a few weeks for the market to decide where we are going next. Until then, stay safe out there. Leverage kills.