BTC: still indecisive after the drop

Assets covered: Bitcoin (BTC)

Metrics used: Weighted social sentiment, Funding rate, Exchange Inflow, Transaction volume, Network Profit Loss, Age Consumed, MVRV, Supply distribution

"Buy the dip"

This of one of top social trends a day after BTC dropped to 53K.

The crowd is almost never right, we've already covered how to read this sort of calls here.

Let's take a look what other social and onchain metrics are telling us about BTC.

Weighted Social Sentiment

Wss did another leg down, as expected. It's basically lowest since October. This metric, calculated from thousands BTC related posts on Twitter says that people are as bearish as on previous BTC bottoms. Price rarely dropped deeper after that.

Funding Rate

BTC derivatives funding rate almost went into the negative territory the first time since January. Currently we're above breakeven, nothing too crazy. Seems that the derivatives market is still not super bearish. And not super bullish as well. Given the dip we would at least expect it to be neutral but for the time being it seems like derivatives market is still not concerned about the dip.

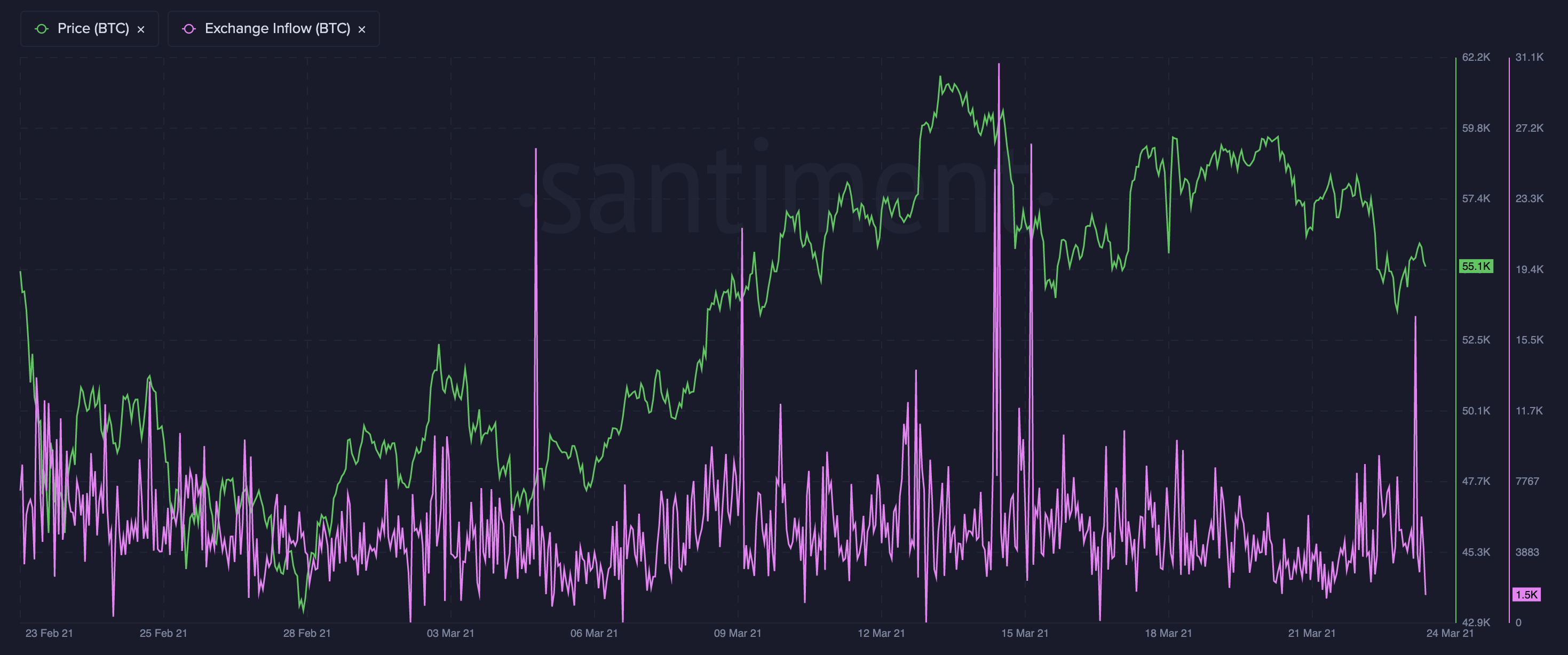

Exchange Inflow

We can definitely see an uptick in exchange inflow. Means there is more BTC being moved to exchanges, probably suggesting short term sell offs because of the dip.

Transaction volume

There are a couple of spikes in Bitcoin onchain transaction volume. Basically the highest since previous bottom. A bit of a panic moves perhaps. Or exhanges reshuffling own wallets (BTC).

Network Profit Loss

Two spikes telling us about someone panicking and taking profits at current levels.

Age Consumed

Big spikes seems to be mostly because of increased transaction volume. In general there is a few of them in the past 24h so some long term holders a starting to be a little bit spooked. It's definitely not one guy that had a bunch of very old coins that moved. But the spike in NPL isn't really explained by AC. May be explained by the uptick in transaction volume overall.

MVRV

We were fairly low a day before. And now MVRV 30d is almost back to breakeven. Actually we dipped just around 0% mark before we bounced back. Not undervalued just yet, but we're definitely getting there.

Regarding longer 365d MVRV we're at two-three weeks low, kinda in the middle way from zero to top. Or from top to zero.

We can also notice that both previous BTC rallies had stronger MVRV dumps. 365d MVRV droped around 60% from both occasions, currently we're still relatively high. It's not in the danger zone anymore at least, somewhere in the middle of the road. Could allow for another correction but at the same time it could easily make a new high at this point.

Ok, at least MVRV is slowly stabilizing.

BTC Supply Distribution by balance of addresses

No signs of panic either in whales:

Or retail guys:

No trend shifts, no significant behavior changes.

Overall, we don't see any serious Bitcoin sell off or accumulation at the moment.

Watch this space.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.