Bitcoin, Ethereum, and a Quick Take on the Health of Crypto Markets

Without putting in an abundance of research on several different crypto projects, you can often get a pretty good idea of whether your favorite projects are heading next just by studying the fundamental health of Bitcoin, and secondarily, the health of Ethereum.

Just like investing in a stock, profitable traders are constantly taking into account whether the global markets are safe to keep their precious capital invested in the first place. This is why we put so much emphasis on keeping tabs on BTC and ETH before opening positions in smaller cap assets.

With this being said, here is a comprehensive dive into how things are looking in terms of health for the two largest assets in cryptocurrency:

Bitcoin

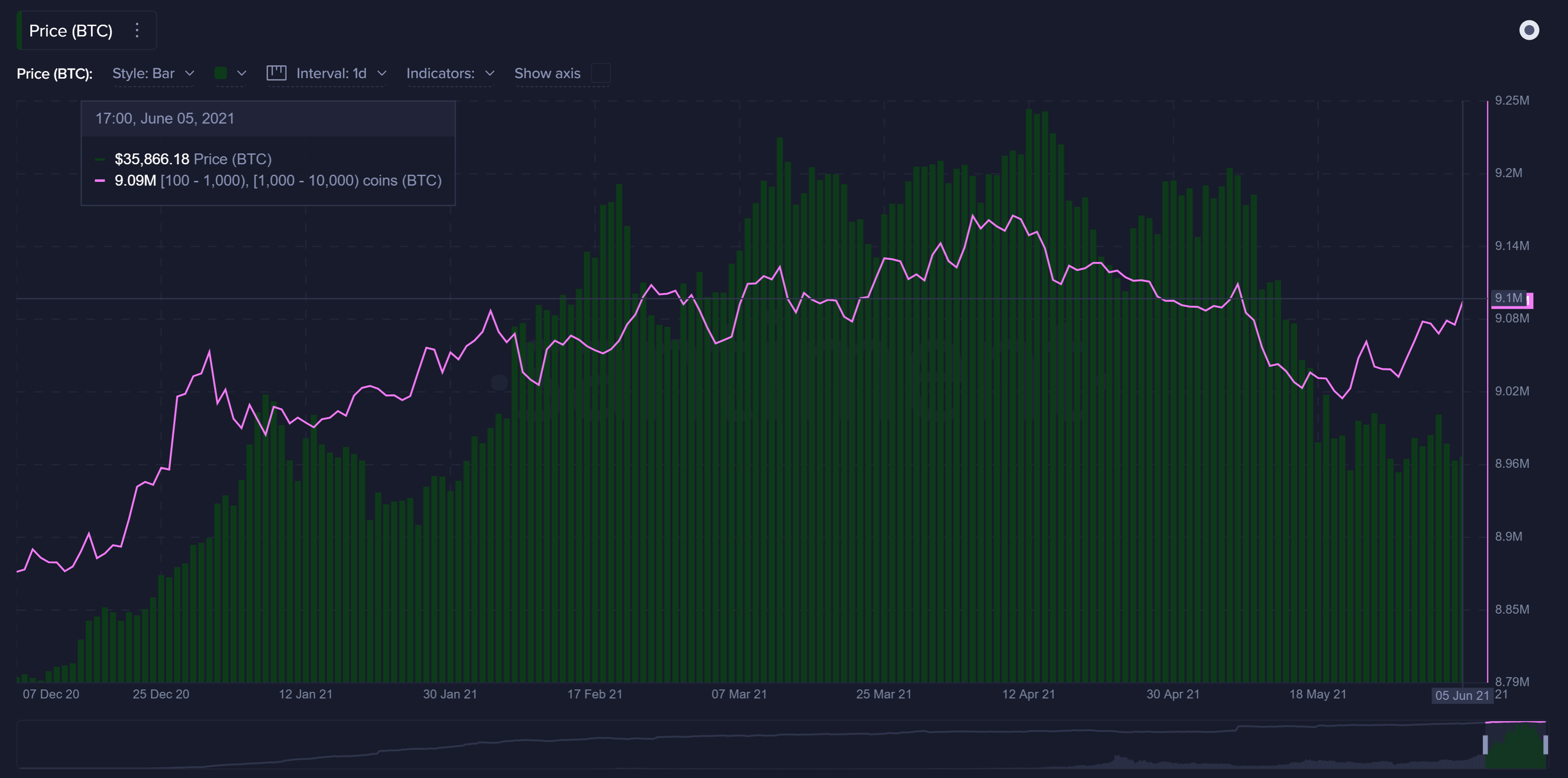

Whale Behavior

The key Bitcoin whale holder demographic we generally look at (addresses with 100-10,000 BTC held) has been rising steadily for about two and a half weeks now. This appears to be a dip that whales are buying with confidence.

NVT (Token Circulation)

Although it's early in June, the first week has not been pretty in terms of circulation. Very little amounts of unique tokens appear to be circulating on the BTC network right now, and this is a concerningly bearish indicator we're hoping to see improve as the month progresses.

Address Activity

Address activity has been declining in tandem with token circulation. So much so, in fact, that June 5th, 2021 was the lowest amount of addresses interacting on the BTC network in nearly one year (June 27, 2020).

Bitmex Perp. Contract Funding Rate

Bitmex's Perpetual Contract Funding Rate has been negative, indicating a clear growth in short positions. Seeing this is a clear reflection of the crowd becoming increasingly bearish is a sign that there may be openings coming soon to successfully buy into the crowd fear. Crowd bearishness equals fundamental bullishness.

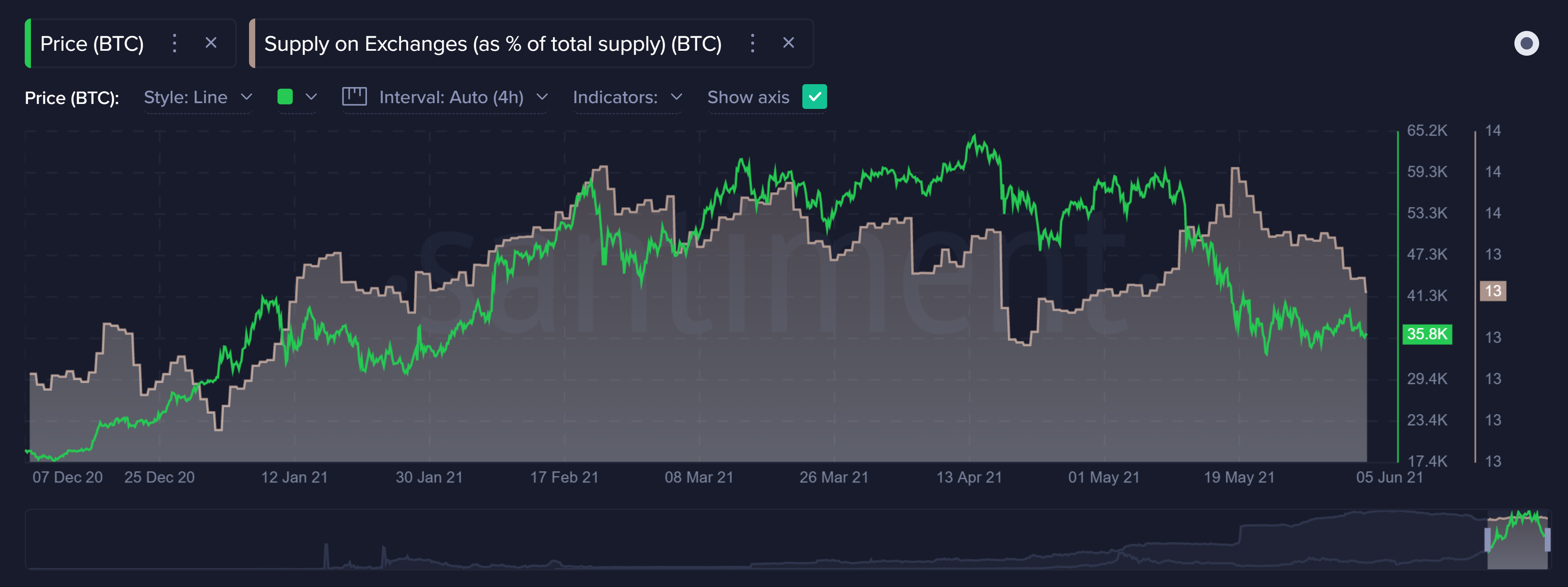

Supply on Exchanges

Bitcoin's supply on exchanges is declining once again after reaching a major spike just prior to the recent bottom two weeks ago. It's a bullish sign to see that BTC supply is again moving away from exchanges and locked into offline wallets for safe keeping.

Weighted Social Sentiment

Commentary toward Bitcoin is at its most negative sentiment since late April, and this is another bullish sign. When the crowd is in doubt, buying with confidence is justified.

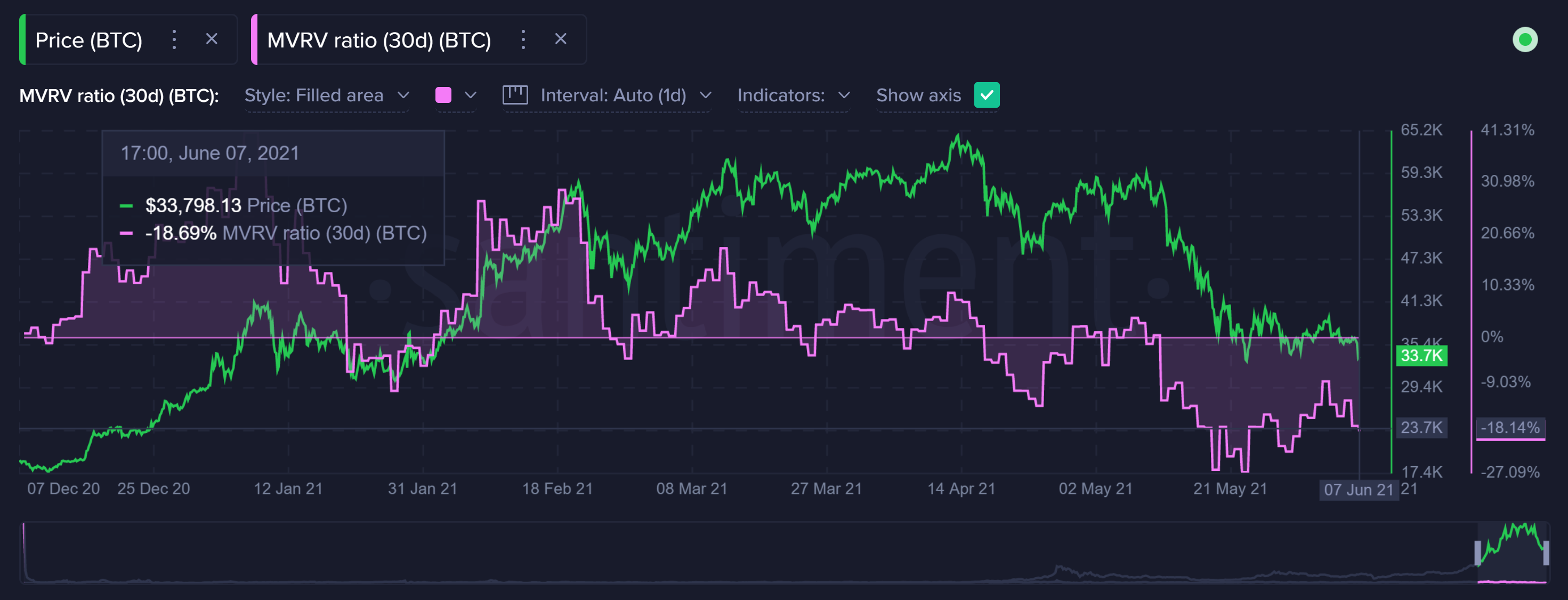

MVRV

Average trader returns are well into the negative range as would be expected after a 50% dip from Bitcoin's all-time high back in mid-April. A -18.7% 30-day MVRV is historically a bullish indication.

Ethereum

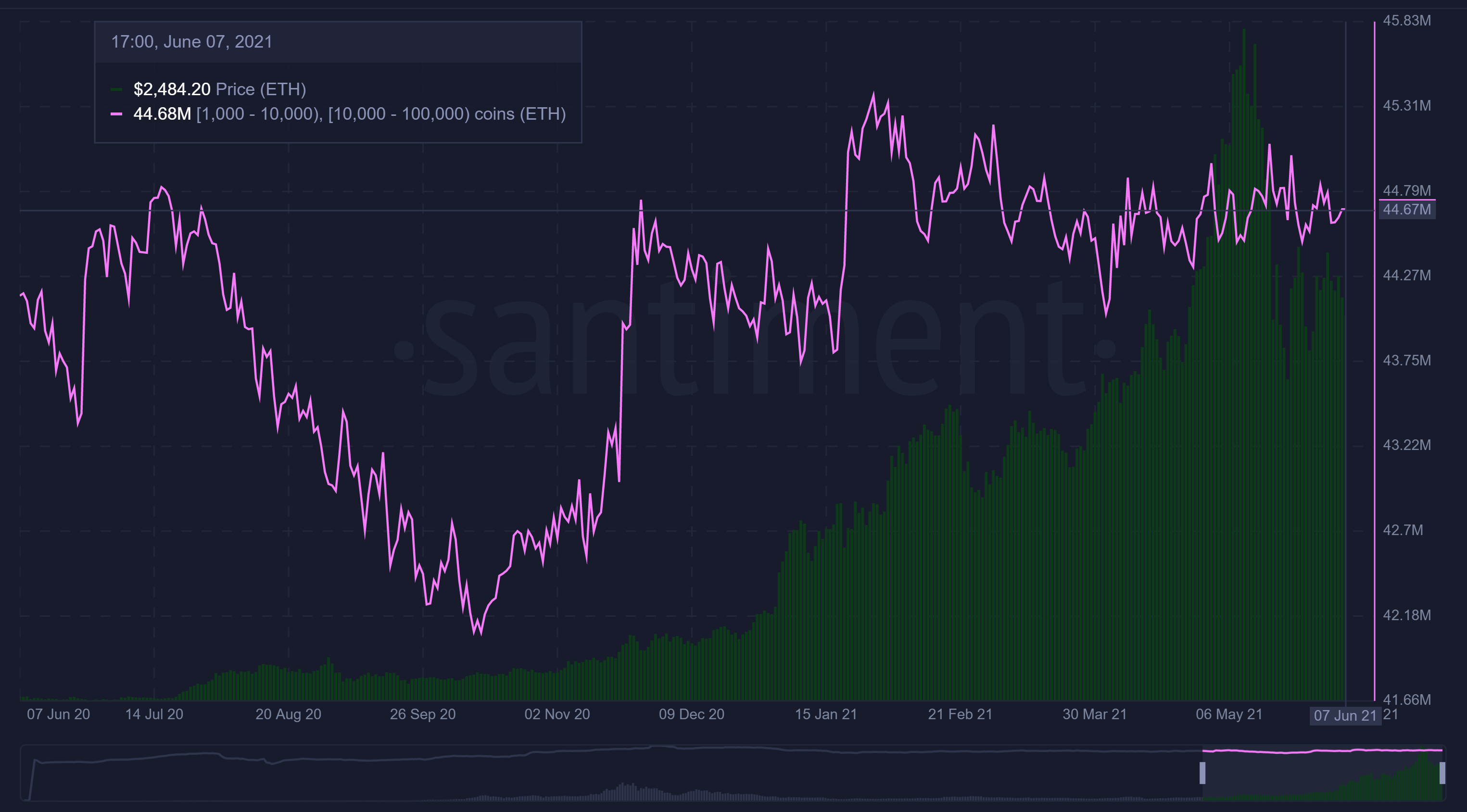

Whale Behavior

Ethereum whale addresses holding between 1,000 and 100,000 ETH token aren't really budging much during this ranging period in the mid $2,000 price level. This group of holders is still hanging on to the massive amount of tokens it first began accumulating at a rapid rate beginning last October.

NVT (Token Circulation)

The amount of circulation for Ethereum has been slowing down considerably in June, and dropping more than half of its market cap in less than a month has caused hesitation from traders. Our NVT model is showing its first bearish bar since April, 2020.

Address Activity

Address activity for Ethereum has been declining since mid-May's all-time high. And although it hasn't seen quite the sudden fall-off that Bitcoin is experiencing, this lack of ETH address interaction is a bearish concern.

Bitmex Perp. Contract Funding Rate

A BitMEX contract funding rate of just 0.043% is considered extremely low compared to Ethereum's normal resting average. There is plenty of doubt in the air for crypto's #2 asset, and the ratio actually went negative for the first time in more than a year earlier this week. This is indicative of crowd fear, which is a bullish event.

Supply on Exchanges

Exchange supply is essentially holding par right now, if not ticking down slightly again. A lot of Ethereum holders appear to be waiting to see what Bitcoin's next big move is, but right now, the long-term pattern of keeping ETH tokens off exchanges is still very clearly bullish.

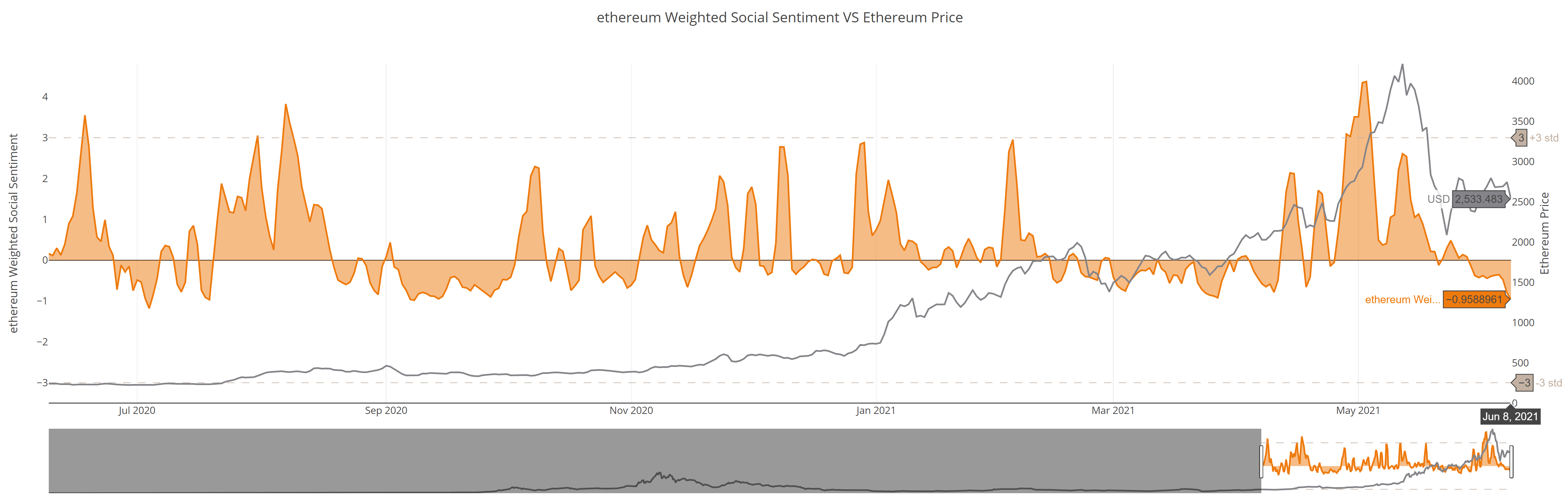

Weighted Social Sentiment

Ethereum's negative social sentiment is dipping down to levels that haven't been seen since October, 2020. This crowd doubt is extremely indicative of a capitulation event if it lasts for too much longer.

MVRV

Ethereum's 30-day MVRV is still quite low after the monster drop-off from its all-time high about 4 weeks ago. While it's at -13.4%, or anywhere in the negatives for that matter, it's going to be a less risky time to buy than usual.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.