Bitcoin's Historic Run Above $56,000, and the Bullish and Bearish Cases From Here

Bitcoin has soared to an all-time high of $56,287 just a few hours ago. In the past three months, the price has jumped +219%, meaning you would have more than tripled your investment if you opened a BTC position on November 19th and held. So where do our metrics indicate we go from here?

Bullish Cases

Mean Dollar Age

Dormant coins continue moving, as age of invested dollars gets younger.

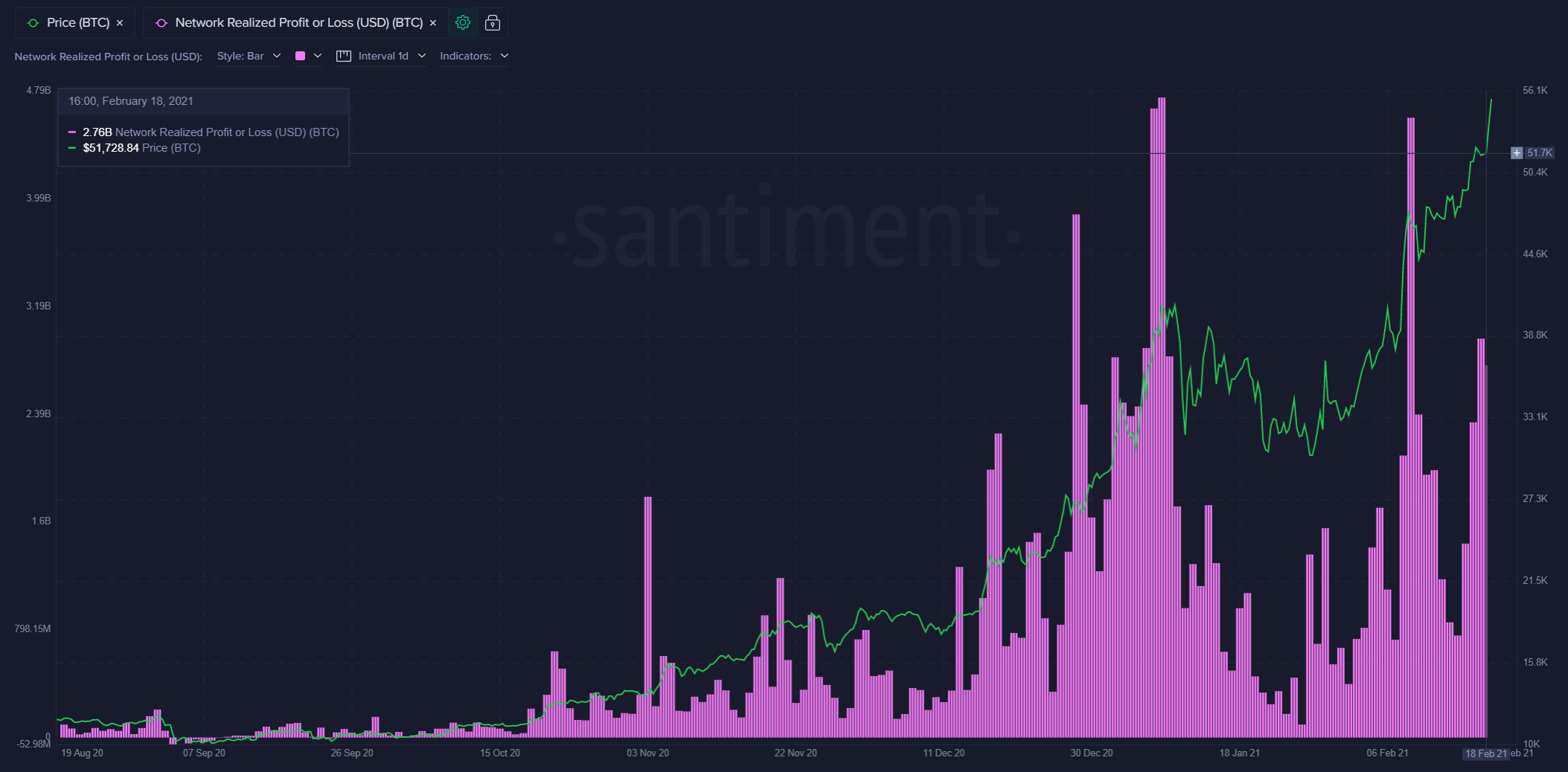

Network P/L

Realized profit isn't at the same peak level it was a week ago.

Exchange Supply

Bitcoin's supply continues encouragingly moving off exchanges.

Bearish Cases

Bitmex Funding Rate

Bitcoin's ratio of longs vs. shorts on BitMEX is indicating a very high percentage of longs, meaning long traders are paying a premium to short traders.

Whale Holder Addresses

The amount of whale addresses continues to decline after $45,000 on February 7th.

NVT

Based on the green-yellow bars on the right side of this chart, NVT is showing a semi-bullish divergence.