BCH to impose 12.5% tax on all block rewards. What does the community say?

Well, they had us wait til late January, but looks like we finally have our first BCH controversy of 2020. And boy is it a doozy.

In a post titled ‘Infrastructure Funding Plan for Bitcoin Cash‘, Jiang Zhouer, the CEO of the largest BCH mining pool laid out an ambitious plan to finance the future development of the network - by forcing all miners to pay 12.5% of their rewards to a Hong Kong-based company.

Stressing the need for a robust support network to help incentivize BCH developers, Zhouer said he understands the proposal is controversial, but bills it fairer than any of the alternatives, such as corporate donations:

“The corporate donors have an undue influence on developers” laments Zhouer, “here’s a typical case: the Blockstream employed and exerted influenced over Core’s personnel, which has led to the centralization in BTC’s development, it has hindered BTC’s blocksize increasing in accordance with Satoshi’s plan to a certain extent, resulting in a long-term community disputes and ultimately leading to the split of BTC and BCH.’

The solution? A network-wide fee of 12.5% on all miner rewards, supported and effectively imposed by several major mining pools - already labeled by some as the BCH mining cartel - including BTC.TOP, Antpool, BTC.com, ViaBTC and Bitcoin.com.

Per the announcement, in order to ensure miner participation in the plan, the above mining pools will orphan any and all BCH blocks that decide not to adhere to the Zhouer’s tax.

‘This is needed to avoid a tragedy of the commons’, assures Zhourer, referencing an economic problem where individual users, led by their own self-interest, make independent decisions that are deemed contrary to the common good.

To disburse funds to BCH developers, a Hong Kong-based corporation has been set up by the cartel. Asked about this corporate middleman in a subsequent AMA, Zhouer failed to provide much additional info:

It's important to note that Zhouer’s post is not a proposition as much as a pronouncement - the 12.5% tax is set to be activated on May 15 through a ‘totally not a soft fork’ soft fork, and last for 6 months.

The news quickly made waves in the community, as you can tell by the latest emerging words on crypto social media based on our data:

In particular, Sanbase recorded more than 1280 new mentions of ‘BCH’, ‘miners’ and ‘cartel’ on crypto social media in the past 24 hours:

As expected, r/btc - the main Bitcoin Cash subreddit - has already been flooded with related threads and scorching hot community takes. Although the sentiment on other social platforms (like Twitter) has been predominantly negative, r/btc has stayed fairly divided on Zhouer’s proposal so far.

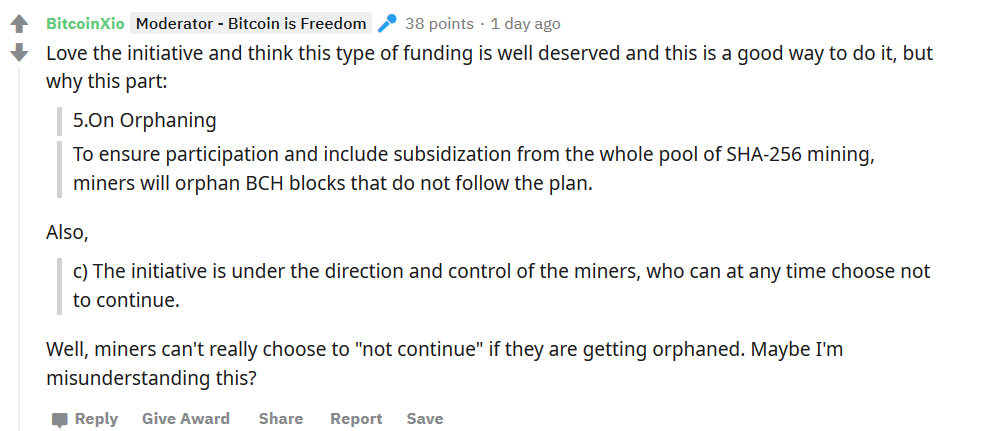

A number of users have expressed their tentative approval of Zhouer’s plan, while still raising concerns about some of its features:

Still, a sizable part of the BCH community vehemently disagrees with the proposal - and for a number of reasons.

Out of many, two closely-related issues seem to bother the BCH community the most. The unapologetically centralized nature of the cartel’s decision has received a lot of flack. In his post, Zhouer even sings accolades to Deng Xiao Ping’s ‘non-debate theory’, which he credits for China’s massive economic growth:

“Non-debate, is to gain time to work hard. When you debate, everything becomes more complicated and it wastes time. Nothing can be done. Don’t debate, and just try. Be brave and experiment.”

Shockingly, praising a philosophy that negates the need for community opinion has not sat well with said community. Many have accused the pools of authoritarianism, and fear that the move will set a bad precedent for the security and decentralization of the network:

Piggybacking on this argument, some have also labeled the upcoming 12.5% miner fee as a mandatory network tax, forced upon smaller miners without giving them any choice in the manner:

Many have also taken issue with the Hong Kong-based entity tasked with overseeing the developer funds. A number of users believe the company is bound to fall under China’s de facto control:

While others think that a decentralized entity would make for a much more reliable ‘middleman’:

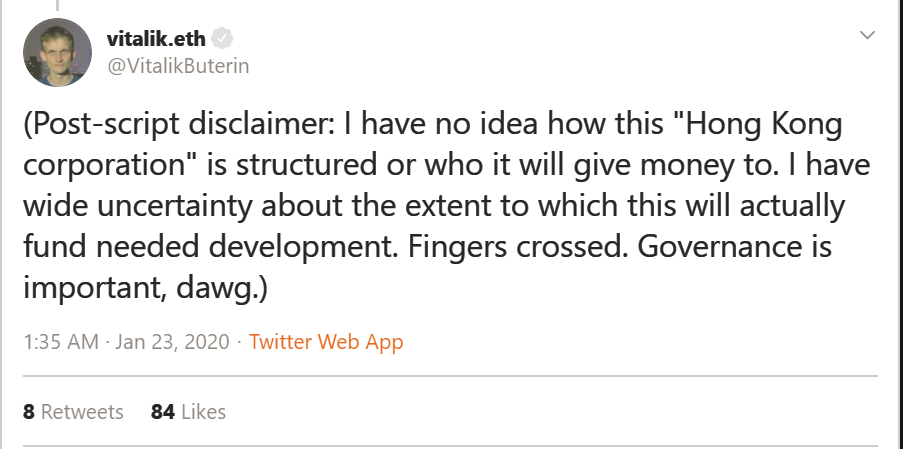

And although he’s applauded the attempt to tackle the issue of public goods on the blockchain, even Vitalik expressed doubts about the HK company and the overall plan’s future effectiveness:

Furthermore, some also worry about the lack of any built-in guarantees that the 12.5% fee will actually be reversed after the planned 6 months:

As well as pointing to various ways that this could end up triggering another round of hash wars on the network:

Given all of the above, the announcement has generated a non-surprising amount of FUD, as some bears are already lamenting the death of BCH:

At the time of writing, BCH is down 6.29% on the day, though it’s hard to say how much of it is actually tax-related and not due to general market sways - Bitcoin is also down 3.28% in the last 24 hours, with most of the other top 20 coins firmly in the red.

Seems like tumultuous times might be ahead for the Bitcoin hard fork. To keep track of the market's reaction, here's a quick signal to let you know the next time BCH appears on our list of top emerging trends.

Major spikes in social chatter (especially during an uptrend) can have a negative impact on the coin's short-term price action. And given the past 24 hours, we might be seeing a fair bit of BCH chatter over the next few days.

Conversations (0)