Algorand: first days in bottom discovery mode

Algorand, a scalable and secure currency and transactions platform, raised over $60 million in a token sale on June 19th, using a Dutch Auction mechanism that ensures market participants set a uniform price per ALGO. All 25 million tokens were sold at a market drive price of $2.40.

ALGO got listed on a handful of exchanges within a day. Binance, Huobi, as well as Coinbase Custody have added the asset.

Price action since listing: -50% in USD.

Interesting thing regarding token circulation. ALGO is structured so that buyers will be guaranteed to get 90% percent of their money back in a year.

Given that buyers of Algorand can get 90% of their money back in a year, is it more accurate to say they raised $60m (the actual total) or $6m (the 10% that doesn’t need to be saved for the possibility of those redemptions)?

Coinmarketcap hasn't decided yet which amount to set. The same time Binance Info made some calculations, took into account unlocked tokens amount and figured out this way ALGO is rushing into top-10 assets.

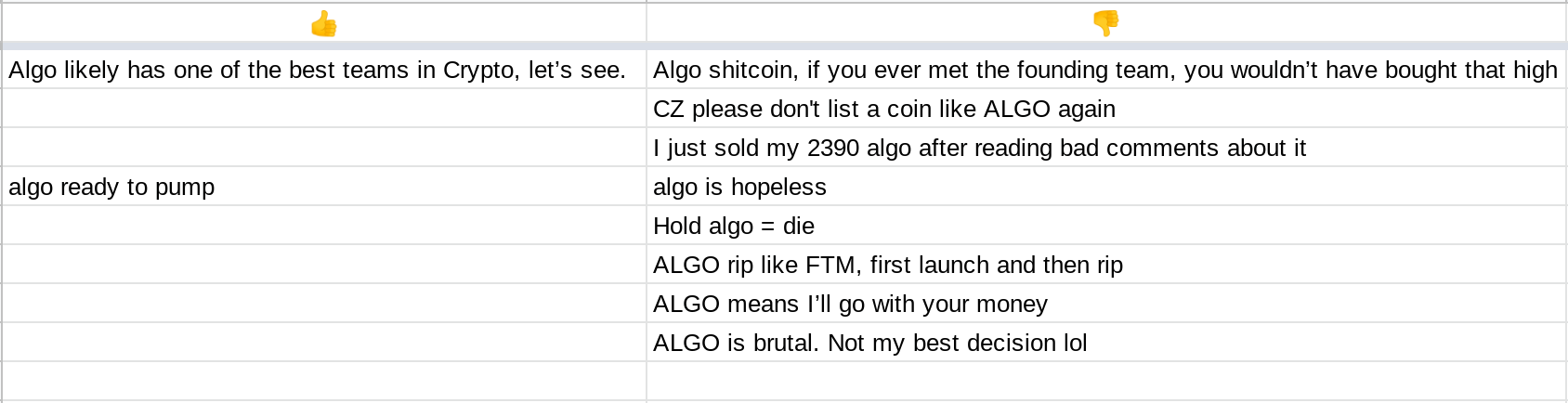

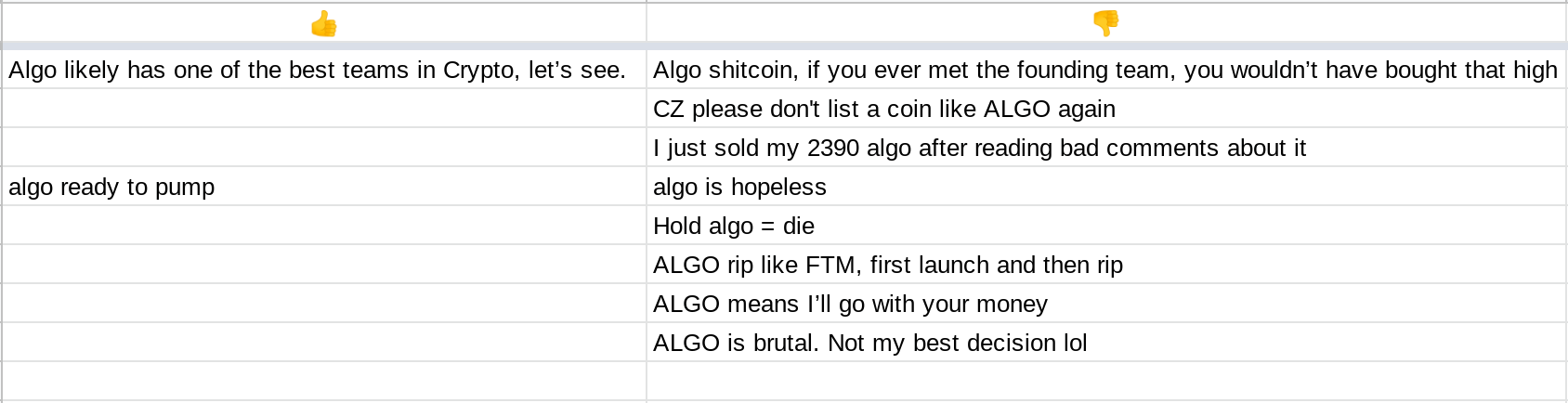

At first sight social buzz around ALGO seemed to be balanced on Monday - like similar amount of positive and negative. Then I made a table to check it:

Was pumped for a couple of days prior to Binance listing. Binance opened deposits, immediately became largest holder of ALGO. Then it tanked. Interesting project ruined by stupid token economics. 10B supply increasing monthly, zero demand..Hype killed by price action.. Dumb

Conversations (0)