A Year in Crypto: Santiment's 2019 Market Report

This report was produced using Santiment’s growing suite of market and network analytics tools - Sanbase and Sandata - which help users analyze the crypto market and find data-driven investment opportunities.

Santiment provides clean and reliable on-chain, social media and development information on over 1000 crypto assets, and develops unique metrics, signals, strategies and reports on top of our custom datasets.

A lot of people wonder - was this a good year for crypto?

The answer, as usual, is - it depends. It depends on both the relevant parameters as well as the coins, projects and networks that we choose to feature and focus on in our end-of-year tallies.

Does your definition of a ‘good year’ mean that BTC is worth more today than it was on January 1st, 2019? If so - it was another terrific year for crypto, as the king coin’s market cap grew by a cool 92% over the past 12 months.

And while that might be good enough for Bitcoin maximalists, it would be a gross oversimplification of the collective state of the industry.

In this report, we will break down the past year in crypto from 4 different but equally important angles and datasets that Santiment specializes in - financial, social, development and on-chain.

Without further ado, let’s jump right it.

Part 1: On Financials

Risk-adjusted returns

Though it may not feel like it right now, the total crypto market cap grew by a formidable 56.7% in 2019. The biggest culprit, of course, is Bitcoin, which continues to act as a reliable proxy for the entire crypto market. To date, the top coin gained 92% compared to January 1st, 2019, much of it in the first half of the year.

Other strong performers on the year among the top 20 coins include LINK (+507.5%), BNB (+125.9%) and - to a lesser extent - LTC (23.7%).

Not everyone in the top 20 had a good market year, though. Despite a strong Q2, Ethereum has failed to sustain its summer momentum, and is currently hovering just below breakeven point (-0.7%).

The ‘biggest loser’ award goes to XRP, which is currently down -47.7% on its December 2018 valuation.

Raw returns are, of course, an imperfect measure of an asset’s performance. For serious investors, it is often equally important how risky the asset proved in the observed time frame.

This is where the Sharpe ratio comes in, which adjusts the performance of an asset based on risk, or how bumpy the road to these end returns has been.

The higher the Sharpe ratio, the better, as it either means that the returns were relatively high but the associated risk was low, or that the risk was high but the returns proved even higher.

That said, here are the top 20 coins (out of those that reached top 100 by market cap) by Sharpe ratio in 2019:

The best Sharpe ratio among cryptocurrencies in 2019 goes to Seele, an Ethereum-based project that describes itself as ‘blockchain 4.0’. Other notable mentions on the list include Chainlink (#4), Tezons (#8), BNB (12) and of course, Bitcoin itself at #13.

For added context, it’s also worth calculating a variation of the Sharpe ratio called the Sortino Ratio, which only takes into account downside volatility. The premise here is that most investors will actually welcome upward spikes - no matter how big - so those are omitted from the Sortino ratio.

In other words, the Sortino ratio only analyzes the size and volume of the coin’s downswings relative to its returns. Here are the top 20 coins by Sortino ratio in 2019:

As evident, the list of crypto assets by the Sortino ratio remains fairly similar, with only a few minor adjustments to seeding (such as LINK overtaking the third spot).

You can check out the Sharpe and Sortino ratios for any coin with our pre-made template, available to all Sanbase Pro subscribers.

Best days to trade in 2019

In traditional investing, it’s a well-documented phenomenon that certain days of the week tend to be more profitable than others. But which days proved the best for crypto traders in 2019?

A few months ago, we created a backtesting template that calculates any coin’s average returns for every day of the week.

Using Bitcoin as a proxy for the whole market, we can see that 2019 had clear winners and losers in terms of daily performance:

Saturday was the best day for BTC in 2019, with average returns of 1.02%, followed by Tuesday (0.63%) and Thursday (0.52%). I guess Bitcoin loves even days?

On the other hand, Friday was by far the worst time to get into BTC, with an average loss of -0.88%, followed by Wednesday (-0.35%) and Monday (-0.04%).

The daily 2019 trends are not Bitcoin-specific either: the same pattern has held true for major altcoins like Ethereum throughout the year, with the main difference between the two marked by their Sunday performance(s):

Compare the above chart(s) with Bitcoin’s daily average performance during 2018, when all but a single day were sitting comfortably in the red:

Outliers: Most and least correlated coins to BTC in 2019

In terms of general market trends, this has been another year largely dictated by Bitcoin’s massive gravitational pull. Whenever the Big Kahuna crashed, the rest of the market - for the most part - went down with it. For better or worse, this is still how crypto works in 2019.

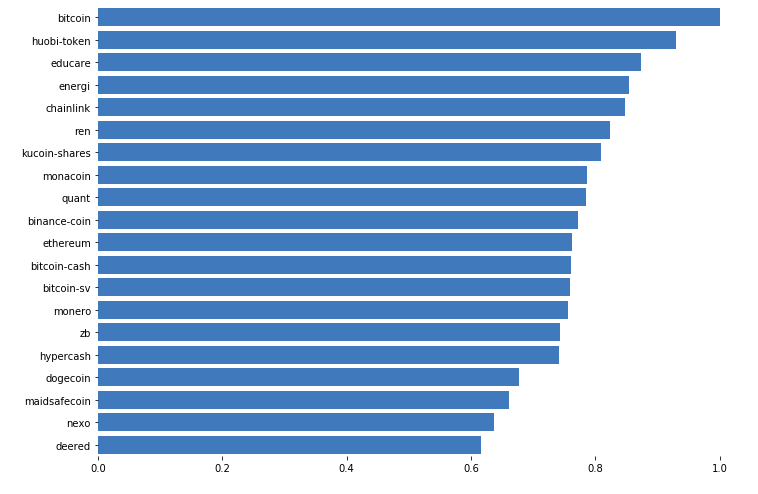

Given Bitcoin’s March-July bull run, it’s no surprise that some of the year’s top performing coins - including LINK and BNB - exhibited a relatively high correlation to Bitcoin throughout the year. These are the top 20 crypto assets with the highest correlation to BTC in 2019:

And while true decouplings are rare, there was a number of outlier coins that managed to successfully buck the BTC trend and chart their own voyage. Below are the top 20 least correlated coins with BTC in 2019:

Unsurprisingly, a number of stablecoins including USDC, TrueUSD, Paxos and Tether sit atop the ‘least correlated’ list, as their price action is more-less fixed. Joining them, however, is a mishmash of independent assets like Electroneum (ETN), Waves (WAVES), Zilliqa (ZIL), Steem (STEEM), 0x (ZRX), Augur (REP), and Decentraland (MANA), all of which recorded negative correlation to Bitcoin in 2019.

And while it’s healthy to see coins start to decouple from general market trends, this also means that most of these assets skipped on Bitcoin’s Q2 and Q3 bull run, and had a pretty abysmal year as a result.

ETN, the highest-ranked non-stablecoin on the list, is currently down 56% on the year. Similarly, WAVES has lost over 77% of its January 1st value, while ZIL is down 75% for the observed time frame.

Part 2: On Development Activity

It has been a busy year for blockchain developers, tasked with everything from mounting scalability challenges to facilitating new and burgeoning use cases like DeFi. At Santiment, we developed a custom approach for tracking the development activity of crypto projects - one which eliminates skewed github data and obvious ‘stat padding’.

Based on our methodology, these are the top 20 most actively developed crypto projects in 2019:

Cardano tops the list of the ‘busiest’ 2019 projects, which ought to come as little surprise to those following the team. The much-awaited Cardano Incentivized Shelley testnet - a big step towards network decentralization - went live on December 13th, and already boasts over 500 staking pools.

A hair below is Ethereum, whose developers continued to make strides toward Ethereum 2.0, a major network upgrade tentatively scheduled for 2020, which is expected to move the platform away from Proof-of-Work and to a more scalable, energy-efficient Proof-of-Stake system.

As a result, a record amount of development activity has been recorded in Ethereum’s GitHub repository between February and June of this year.

Speaking of Dapp platforms: although the ‘EOS vs Ethereum’ is still a popular narrative, the data makes it seem far less complicated. In 2019, there has been a massive discrepancy in the combined development effort of dapps building on the two platforms:

According to our data, Ethereum-based dapps have invested about 34 times more development resources over the last 12 months compared to their EOS counterparts.

In particular, the top 10 ERC-20 projects by development activity for year 2019 are:

1. Status

2. Storj

3. Gnosis

4. Aragon

5. Augur

6. Golem

7. 0x

8. Loom

9.Poa

10. Raiden

The good news for both platforms, however, is that their dapp communities' long term development trends continue to veer positive.

Here’s the development activity of ETH and EOS-based dapps plotted separately, from January 2018 onwards:

2019 has clearly been the more active year for applications building on both networks, with the exception of the last few months (seems like EOS dapps took an early holiday leave).

Dev Activity by Market Segments

Regardless of their native platform, this has been a big year for DeFi-centered projects, whose aggregate development activity has charted new highs throughout 2019:

Among the year’s most actively developed DeFi-related projects are Maker, Metamask, Lightning Network, Kyber Network, and Augur. For more information, check out the top DeFi projects by development activity over the last 30 days live on Santiment’s Buidl Heroes.

Similarly busy has been the stablecoin market, whose development activity chart from 2018 onward, interestingly enough, seems to mirror Bitcoin’s price action:

Not all market segments have been growing though. The development of privacy coins, for example, has continued to trend downward since its March 2018 peak:

The development work on some other projects, like exchange-based coins, has mostly plateaued in 2019, bar for the late winter push:

Part 3: On Social Trends

While there’s been no shortage of storylines and drama in 2019, the overall activity on crypto social media has declined compared to years prior.

Based on data collected from 1000+ crypto-specific social media channels, the total amount of talk, comments and messages notably dwindled after the July 2019 top, and has been trending south for the first time since Bitcoin’s all-time-high:

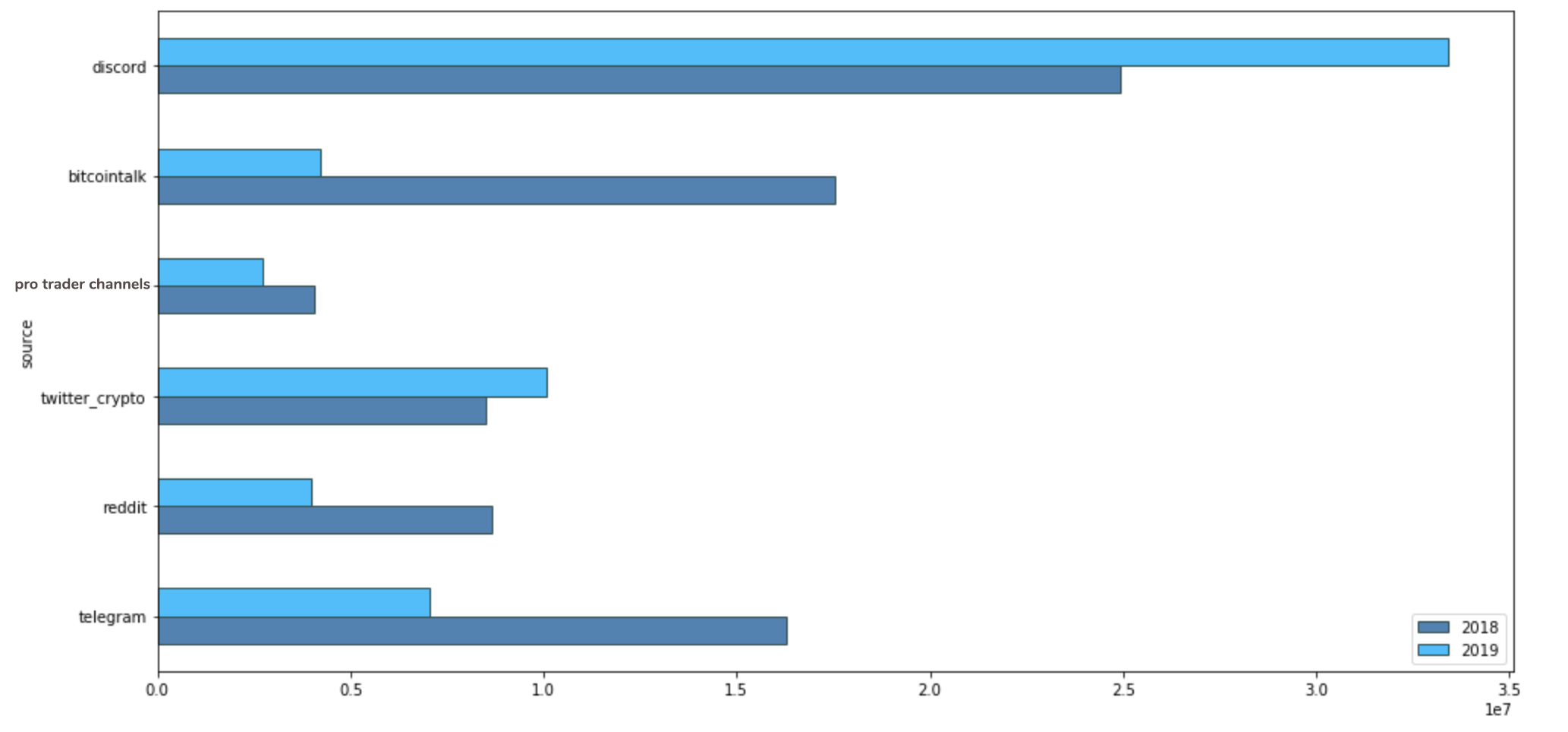

Compared to 2018, the amount of crypto-related chatter has declined - sometimes substantially - on a number of social networks including Telegram, Reddit, BitcoinTalk and Private Trader Chats.

On the other hand, two social networks have recorded increased engagement among crypto enthusiasts in 2019 - Discord and Twitter:

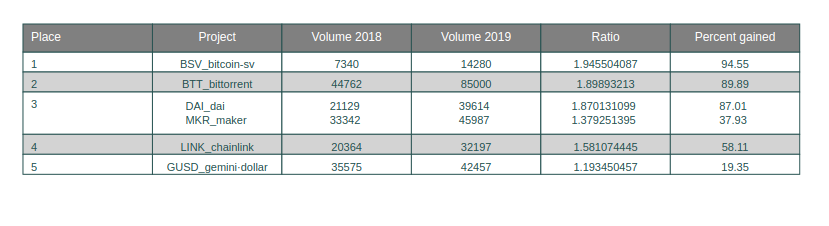

In terms of coin-specific data, the following five projects gained the most social volume in 2019 compared to the previous year (out of projects with at least 10000 messages in 2019):

- 1. Bitcoin SV - between CSW suing twitter influencers and BSV getting delisted from Binance, it was a tumultuous year for the Bitcoin fork

- 2. BitTorrent - the first-ever IEO, hosted on Binance Launchpad back in February

- 3. Dai + Maker - easily one of the most popular DeFi projects in 2019

- 4. Chainlink - an ERC-20 project with strong community backing, and a favorite among speculators

- 5. Gemini Dollar - which launched in late 2018 and has lost 95% of its market cap YTD

Of course, not all of the abovementioned chatter is organic. If you’ve spent any time on crypto social media over the past year, you know it’s still very much a spammer’s paradise.

Some communities, however, take it on a whole other level. These are the top 10 sources of crypto-related spam in 2019, broken down by project and channel:

Chainlink, Bitcoin and Ethereum mark the year’s biggest offenders, with their BitcoinTalk and Reddit communities accounting for the lion’s share of spam. Other notable entries include Dogecoin on Discord, as well as Ethereum Classic, BCH and XRP discussions on relevant subreddits.

BTC and ETH

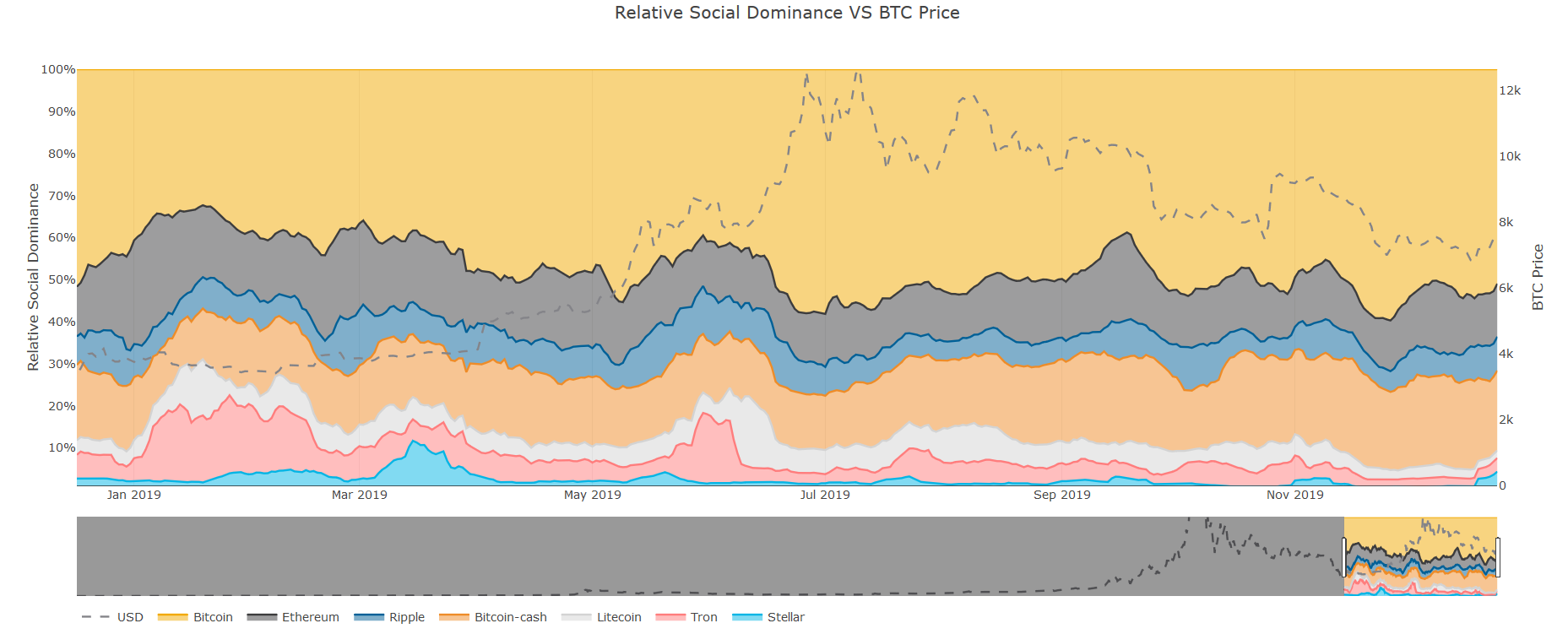

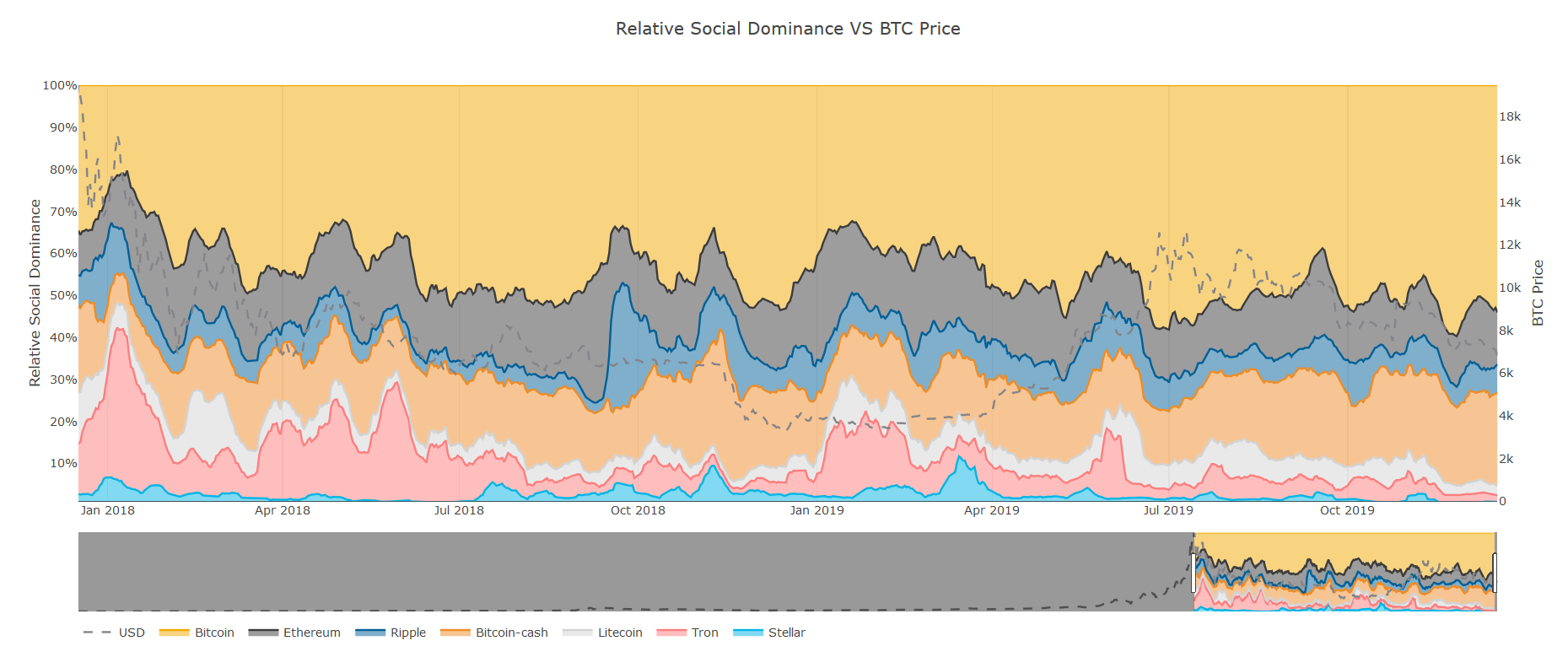

Bitcoin and Ethereum remained the most popular assets on crypto social media in 2019, averaging a combined social dominance of ~70% when compared to other top 10 coins:

Bitcoin’s own social dominance was second-highest (at 58%) during its June 25 top, but actually peaked at just over 59% on November 25th, when the coin briefly dropped below $7000.

Otherwise, the relative chatter among the top coins has mostly mirrored its 2018 trends, down to the massive January spikes and subsequent declines in Tron-related chatter, which occurred both years:

For glimpses into how the crowd actually felt about Bitcoin throughout 2019, we turn to our proprietary social sentiment algorithm. The below chart shows the balance between positive and negative Bitcoin sentiment on crypto social media, adjusted for the amount of ongoing chatter:

The crowd was most bullish on BTC back in May, after the coin broke the $8000 mark for the first time in over 18 months. The sentiment shifted to bearish quickly thereafter, but spiked into positive again around June’s $13000 peak.

The crypto community has remained relatively bearish since July, briefly changing their tune only after BTC ballooned over $9000 in late October.

On the year, however, the bullish sentiment seems to have prevailed. Out of the most popular words used alongside BTC in 2019, bullish keywords such as ‘buy’ (#3), ‘bought’ (#15) and ‘long’ (#16) still managed to edge out bearish queries like ‘sold’ (#19), ‘short’ (#36) and ‘sell’ (#41).

Emerging Narratives

To top off our social data section, 2019 brought some notable shifts in market-wide narratives and community talking points.

If there was any doubt that the ICO era is dead and gone, the daily mentions of ‘ICO’ and related keywords have dropped to historical lows over the past 12 months:

Even the ICO’s goofy cousin, IEO, only managed to capture the crowd’s imagination for a few early months. Since the May’s all-time-high in mentions of ‘IEO’ on crypto social media, there’s been a waning interest in the topic, which has been slowly approaching its pre-2019 levels:

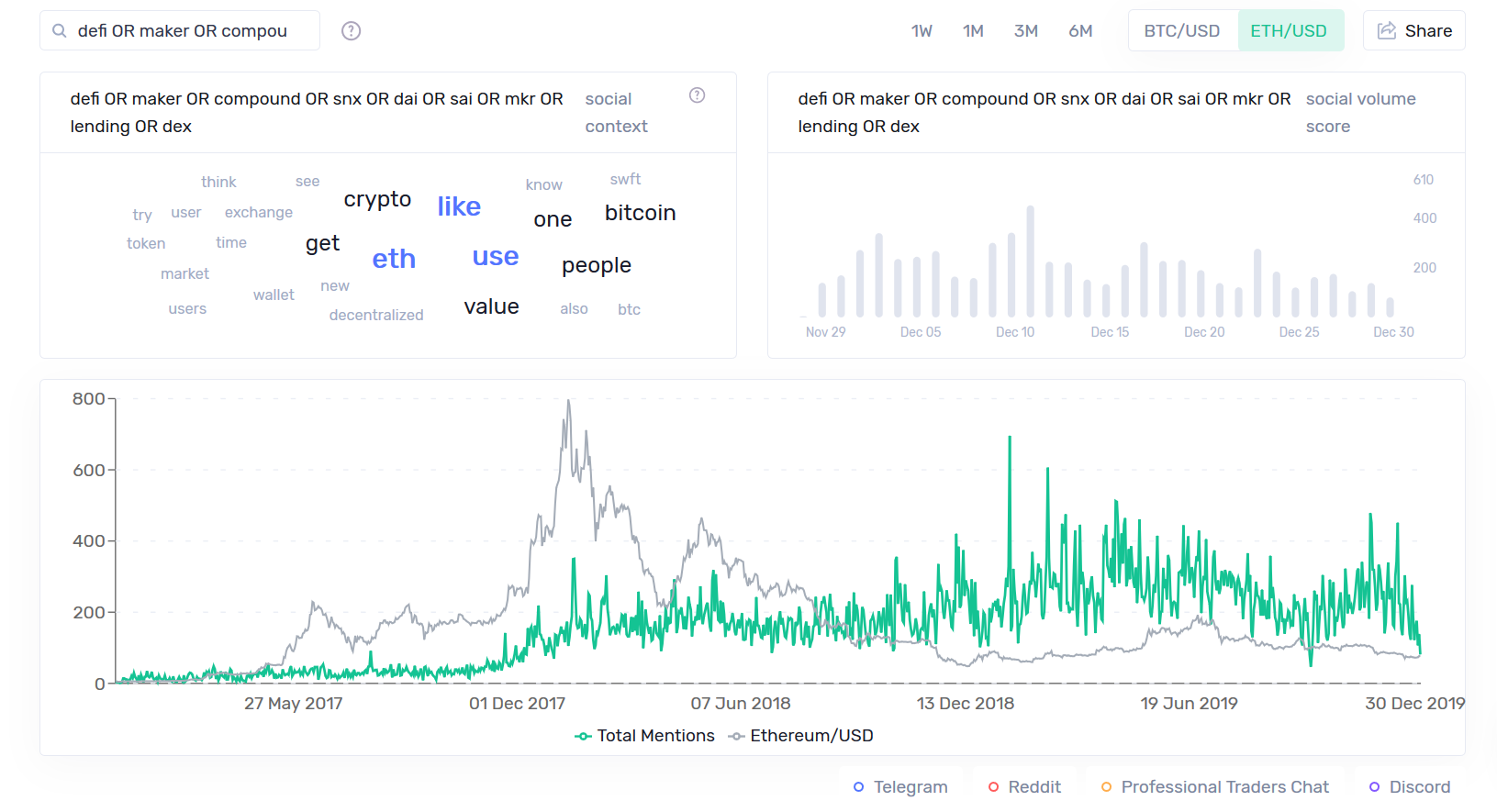

On the other side of the coin, mentions of ‘DeFi’, ‘lending’, ‘yield’ and related queries have all experienced a surge in 2019, as the crowd moves to new and developing use cases for the blockchain:

Part 4: On On-chain Activity

In this report, we’ll focus on 3 main on-chain parameters, their respective trends in 2019 as well as direct comparisons to their 2018 numbers:

- Daily Active Addresses (DAA for short) - the amount of unique addresses active on any day

- Network Growth - the amount of new addresses created on the network

- On-chain transaction volume - the total amount of tokens across all network transactions

First off:

Bitcoin

Despite the idea that Bitcoin continues to evolve into a ‘store of value’ commodity and away from a ‘means of payment’ asset, its on-chain data for 2019 hardly reflects that narrative.

Over the course of 2018, Bitcoin boasted an average of 665,960 daily active addresses, or DAA. In 2019, that number actually went up to an average of 718,807 DAA (a 7% increase) offering an interesting rebuttal to the ongoing SOV rebrand.

Keep in mind that the 2018-2019 comps include the major spike in Bitcoin’s daily active addresses throughout January 2018 - 1.25m DAA at its peak - which make its year-over-year gains in DAA smaller than they would be otherwise:

This, of course, needs to be put in context of historical market conditions: over the course of 2018, Bitcoin lost more than 72% of its value. In 2019, its market cap grew by 87%. Furthermore, the SOV proponents might enjoy the fact that only 39.8% of Bitcoin’s total circulating supply was active over the last year - compared to 45.2% in 2018:

Bitcoin’s yearly high in daily active addresses correlated with its June 26th price peak, as BTC tested the $13000 mark for the first time in 18 months. On the day, a whopping 1.038 million addresses interacted with the world’s biggest cryptocurrency:

And while more addresses interacted with Bitcoin in 2019 than the year prior, there has been a parallel decline in its on-chain transaction volumes.

A total of 269 million Bitcoin were transferred between addresses throughout 2018. This year, that number dropped to 247 million BTC - an 8.2% drop.

Perhaps surprisingly, Bitcoin’s on-chain transaction volume did not peak on the same days as its daily active addresses. Instead, it peaked a full week earlier - on June 18th, after BTC broke the $9000 barrier:

Ethereum and ERC-20

An increase in Bitcoin’s on-chain activity in 2019 corresponded accordingly with the coin’s improved market conditions. It’s been less of a stellar year for Ethereum, however, whose market cap is currently just below breakeven for the year.

In that context, perhaps it’s not too surprising to see Ethereum’s on-chain activity decline across the board in 2019. This year, Ethereum’s daily active addresses decreased by 22% compared to 2018, with an average of 252,339 addresses interacting with the coin daily.

For the year, Ethereum’s DAA peaked at 475k on June 1st, mid-way into its summer rally:

It’s not just DAA that experienced a decline, either - the total number of new addresses created on the Ethereum network also took a hit this year. In 2018, over 28M new addresses were added to the Ethereum blockchain. In 2019, that number is down to 19.9M addresses - a 29% decrease.

Part of the reason is certainly the massive amount of new addresses added to the network in January of 2018, which still eclipses all on-chain activity since:

There’s also been a corresponding drop-off in value transmitted on the Ethereum network in 2019. A total of 1.2B ETH were exchanged between addresses on the network in 2018; this year, that number’s been cut by a full third - down to 830M ETH overall.

For the year, Ethereum’s transaction volume peaked on May 16th - after ETH broke $260 - when 7.9M ETH ($2.07 billion at the time) was transferred on the network:

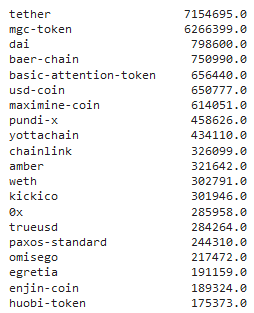

As for the projects building on the Ethereum network, it’s been a strong year for a select few. These are the top 20 ERC-20 coins by daily active addresses in 2019:

Unsurprisingly, ERC-20 Tether takes the cake, with 7.1M in combined daily addresses.

The rise of USDT-ETH can be traced back to several major exchanges either abandoning the Omni Protocol altogether or introducing support for its ERC-20 counterpart:

- On February 27th, Huobi announced support for deposits & withdrawals in Tether ERC20

- On July 3rd, Binance announced it would phase out Omni-based Tether and open only ERC-20 wallets for the stablecoin

- The same day, Poloniex announced support for ERC-20 Tether

Some of the projects on the list - like the second-ranked MGC Token - owe their sky-high on-chain activity not to mass adoption, but organized airdrops and short-lived hype. MGC’s yearly DAA chart says it all:

That said, many projects on the list have recorded legitimate - and impressive - on-chain activity in 2019, including DAI, which has spearheaded the DeFi movement this year, boasting 798,600 combined daily active addresses.

Other notable mentions include Basic Attention Token (656k addresses), USDC (650k addresses), Chainlink (326k addresses) and 0x (285k addresses), to name a few.

In terms of new addresses created on the network in 2019, the list is more-less the same, with slight differences in seeding:

USDT Tether is once again the undisputed champion among ERC-20 coins, with just over 2M new addresses created this year. Excluding, shall we say, suspect coins like MGC, number two on the list goes to BAT, with 383k new addresses created, trailed by DAI at #3 with 379k.

Part 5: On DeFi

While this topic alone deserves a dedicated report, it’s been too big of a talking point in 2019 to ignore altogether. Instead, here we’ll briefly focus on two main questions:

- Is DeFi for real?

- Does Ethereum have real competition in the DeFi space?

The TL;DR on the above would be - ‘yes’ and ‘doesn’t look like it’, respectively.

Here are just a few simple, yet massively telling charts on DeFi’s status quo in 2019.

A Quick Look at DeFi Fundamentals

At its core, DeFi disrupts the root of the traditional financial quandary - unhealthy debt. Money can be created and its supply can grow in DeFi, but only under one condition: the underlying debt should be “healthy”.

If one creates too much DAI and turns out to be wrong about the future of the crypto market - he is punished, his collateral sold and his debt covered. If the turns out to be right - he’s rewarded. It’s that simple and it works.

It’s been working for over a year now in the crypto industry, while the traditional markets continue to struggle with the same underlying issue(s). For example, the ‘too big to fail’ entities have effectively forced the government to ‘save’ unhealthy debt on a never-before seen scale. Just the other week, US FED printed yet another $500 billion.

Here comes chart #1:

The supply of DAI/SAI over the last 2 years. We’re on the cusp of hitting yet another major milestone - 120m tokens. The entire supply is covered by ‘healthy debt’ - ETH. Should the same trend persist and DeFi continue to make strides among retail holders, a 500m DAI/SAI supply by the end of 2020 is not out of reach.

Much of the DeFi movement is open-sourced, with Ethereum-based developers putting increased effort into building a new, decentralized economy on the platform.

Here goes chart #2:

We’ve shown this graph already earlier in the report, but it’s telling enough to warrant a repeat viewing. The amount of development effort invested into DeFi-centered projects continues to improve, regardless of market conditions and short-term price action.

Finally, let’s briefly touch on the social attention and intensity of defi-related chatter over the last few years. Below are the combined social volumes of various defi-specific keywords on crypto social media, as well as their macro social trends:

While the overall crypto chatter declined in 2019 compared to the year prior, DeFi talk has maintained a healthy incline, especially in Q2 and Q4 of 2019.

It’s clear to us that DeFi is well on its way to replace the ICO era. Notably - both of them were/are happening predominantly on Ethereum. But where the impact of initial coin offerings was much more immediate and volatile (due to the amount of money involved), the DeFi effect is not as visible just yet, but we believe it’s coming - likely even in 2020.

Regardless of the uninspiring ETH returns in 2019, the BUIDL pressure among DeFi-centered dapps remains strong, and the community keeps pushing for innovation. This exact combo - price stagnation married with strong fundamentals - reminds quite a bit of the end of 2016, as the ICO wave had already started before the price action started to catch up.

Closing Thoughts

Market ebbs and flows are perfectly natural - especially for a nascent industry like crypto. The purpose of this report isn’t to officiate 2019 as either ‘bullish’ or ‘bearish’, but to shine an important light on the general market, social, development and on-chain conditions and trends over the past 12 months, and make you a better-informed industry participant in the process.

If you liked what you read, be sure to check out our growing suite of network and market analytic tools - Sanbase and Sandata - which were used to produce this report.

For more market insights, join our Discord server where the Santiment team and our community members analyze and add context to the most important market events every single day.

Conversations (0)