A few most 'painful' DeFi tokens during latest crash

Assets covered: ENJ, COMP, AAVE, MKR, UNI

Metrics used: Exchange Inflow, Network Profit Loss

It has been a nice dump recently. How did you feel about it?

Some traders panic sold. Some didn't care. Some bought more.

Today we'll take a few top DeFi tokens, apply "panic detectors" and sort coins by average panic level of holders during recent crash. In other words, we'll find out what was the amount of pain felt by different coins and how we can see it in Santiment metrics.

Basically just a couple of metrics will be applied:

- Exchange Inflow.

- Network Profit/Loss.

First one shows how many tokens are moved from non-exchange to exchange wallets, suggesting holders are intended to sell. Second one computes the average profit or loss of all coins that change addresses daily. For each coin that moves on-chain, NPL takes the price at which it was last moved and assumes this to be its acquisition price. Once it changes addresses again, NPL assumes the coin was sold.

Let's go!

1. "Panickers" #1 are spotted in

ENJ

What do we see here are three strong spikes of ENJ being deposited to exchanges and significant loss drops throughout the dump.

2. Less 'panic' detected in

COMP

Exchange Inflow spikes are not that strong as in ENJ. Network Profit Loss showing some average possible losses for Compound holders.

3. Average 'panic' spotted in

AAVE

Why? Exchange Inflow is high, but spikes are not that strong compared to previous action. NPL dumping more than average, not too heavy overall.

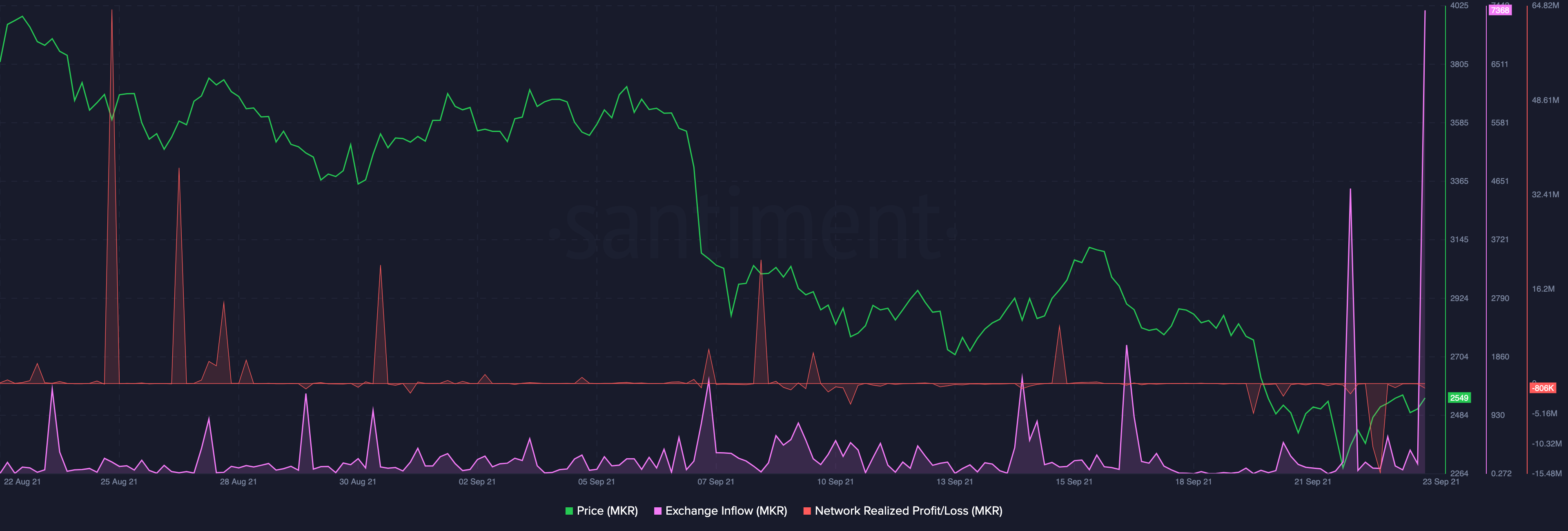

4. A bit stronger hands in

MKR

Just one single spike of exchange inflow during the dump. Perhaps just a few large transactions. Not so massive as for tokens above. Network Profit/Loss showing also one single dump, suggesting possible losses for a limited amount of MKR transactions participants that day.

5. Finally, a minimal "panic" is visible in

UNI

Exchange Inflow is high, but looks like the previous UNI bottom attracted even more tokens to exchanges (one spike vs two spikes). Network Profit Loss dumps a little bit, showing some possible loss related to UNI transactions. Again, previous dump felt harder for UNI. Lessons learned.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.