A case for Maker's Upward Move

Maker is a good project and one of the pioneer in DEFI space. Currently their stability fee is 14.5% which CDP holders have to pay in makers. Let us look at few charts below:

Above chart shows MVRV Long/Short diff. MVRV long/short is in negative zone. Last time when it was in negative zone was in Jan/feb'19 and afterward Maker appreciated around 80%. Now again it is in negative zone with current prices of 480$.

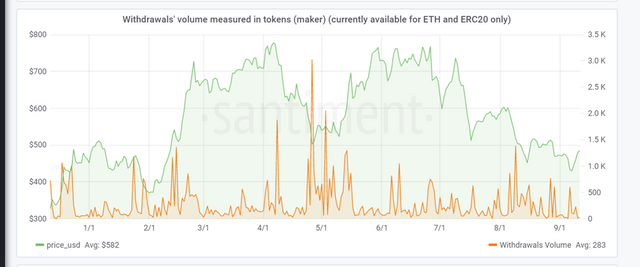

Withdrawal volume from trading exchanges also tends to show higher volume in last few days. This also is a positive sign that upward move could be possible from here.

Above chart shows maker's system collateralization ratio. And current collateralization ratio is also in similar range as was back in jan/feb'19.

Above chart shows price movement with its 11 days simple moving average. The close price has just traded above its 11 days SMA as it did last time in jan/feb'19.

Based on this analysis - it is reasonably safe to assume that from here onward Maker is expected to move up.

Conversations (0)