Mainframe pivots to DeFi, MFT pumps 75%

If you ask the Mainframe team, the DeFi season is here to stay - and they want in.

Originally billed as a decentralized communication platform promising a censorship and surveillance-resistant communication protocol, the Mainframe project has struggled with a confident product-market fit and wider adoption of their MFT token, with the company CEO stepping back a few months ago in favor of a change in leadership and direction.

Well, the new direction has been announced earlier this week and it can be summed up in four simple words, courtesy of Mainframe’s new CEO Doug Leonard:

Yes - more than 2 years after their ICO, the Mainframe team has decided to undergo a complete product 180, hoping to ride the ongoing wave of decentralized finance solutions all the way to the bank. Which is fitting, because a ‘bank’ is exactly what the team is now pledging to build.

“With Mainframe, you can be the bank”, promises a promotional video embedded on the project’s (now entirely revamped) home page.

Mainframe uses a bond-like instrument, representing an on-chain obligation that settles on a specific future date. Buying and selling the tokenized debt enables fixed-rate lending and borrowing — something much needed in decentralized finance today.

The Mainframe whitepaper pitches a decentralized lending platform built on 3 main stakeholders - the Lender, the Borrower, and the Guarantor, which in Mainframe’s system will be able to buy the collateral at a discount in case of liquidation:

“If the price of the collateral asset falls relative to the target asset before a yToken expires, some of the vaults and thus the yTokens they back may become undercollateralized”, reads the Mainframe whitepaper: “To prevent this from happening, Guarantors pool together the target asset type or a supported derivative, like Compound’s cTokens. Guarantors have the benefit and obligation to purchase the base asset at a discounted rate. This role is economically similar to writing a put option on vault collateral with the exercise price equal to the vault’s liquidation point. Although it is anticipated that with proper incentives, Guarantors will enter and exit the pool freely, liquidity is not guaranteed.”

For the sake of brevity, everyone interested to learn more about Mainframe’s proposed ecosystem should check out their new whitepaper. Safe to say, the protocol’s biggest unique selling lies in the addition of the Guarantor role, as explained by their CEO:

At this stage, however, all of the above is little more than an idea and an 11-page whitepaper. It’s no surprise, then, that Mainframe’s surprise pivot triggered a barrage of ongoing questions over on the team’s discord, with a two-part AMA already scheduled for later today:

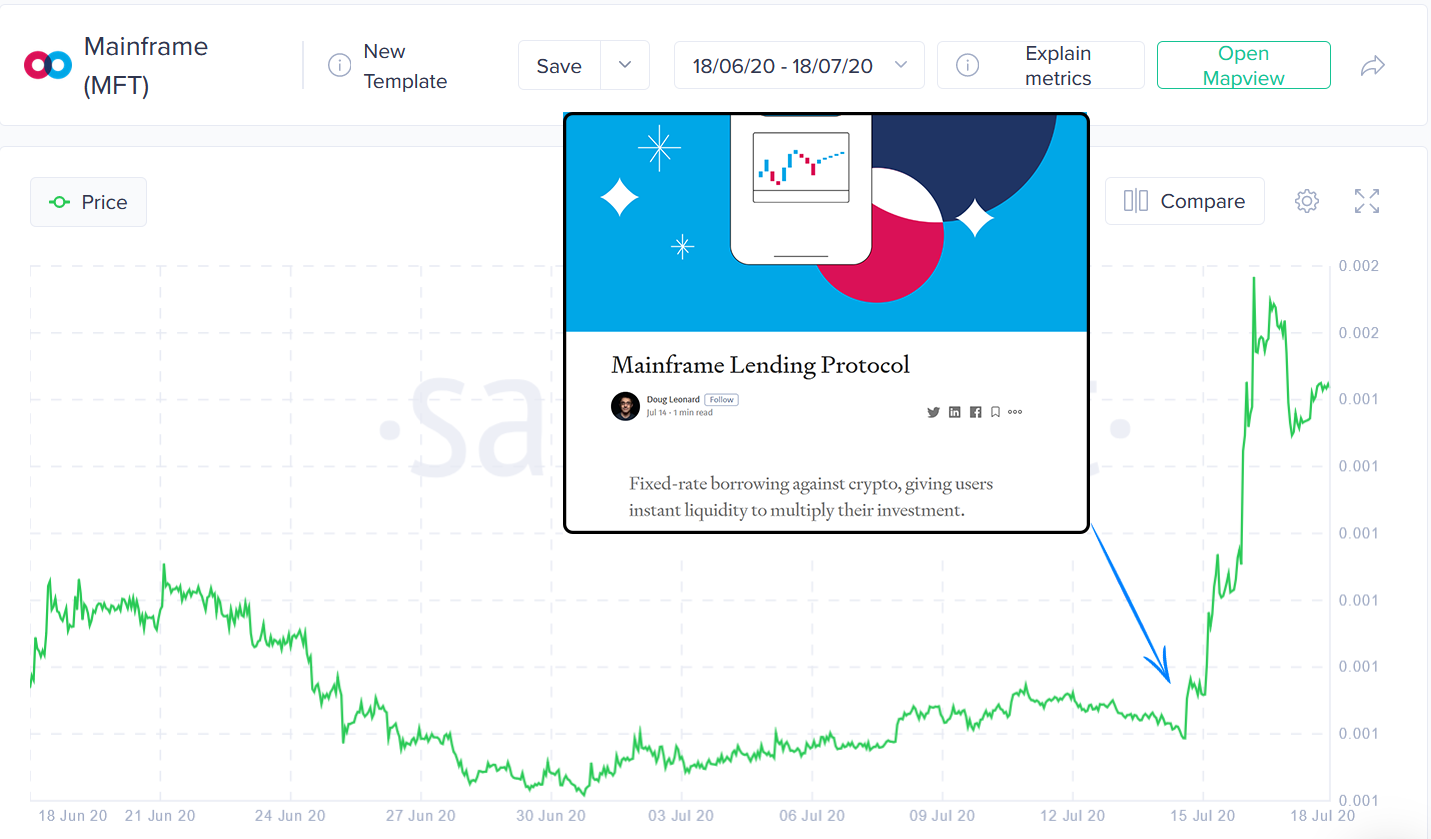

A hail Mary attempt or not, the news have been welcomed with open arms by market speculators so far, with the price of MFT gaining +74.5% in 48 hours and climbing to a year-high 17.4 satoshi before retracing slightly:

The pivot also seems to have jolted new life into the Mainframe’s token on-chain activity, with 197 unique addresses interacting with MFT yesterday (a 4-month high), along with 55 new addresses created on the network:

Unsurprisingly, the last 72 hours also saw a string of spikes in MFT’s age consumed, indicating renewed movement of previously dormant MFT coins, as long-time holders or ICO investors begin reacting to the news:

Perhaps most interestingly for MFT speculators, there’s been a strong inflow of MFT tokens entering centralized exchanges following the pivot announcement, with over 427 million MFT (~$612,000 at the time of writing) moving to known exchange addresses:

According to our Top Holders metric, the move has likely originated from several large MFT holders, as the collective balance of the top 100 non-exchange MFT addresses shrunk by just over half a billion in the past 5 days:

Several hawk-eyed users over on MFT’s discord tracked down this address which currently holds about 26.5% of MFT’s total supply, and has moved around 900,000,000 MFT in the last 4 days, much of it to Binance:

The initial assumption was that the above is one of the team’s wallets, and that the Mainframe staff is already cashing in (cashing out?) on the pump:

The FUD was quickly dismissed by Mainframe’s CEO who disclosed the actual owner of the address - Upbit. It appears the rally opened up some tasty arbitrage opportunities between the two exchanges, with several large MFT holders taking advantage of the action:

Still, it should be noted that there’s certainly been an uptick in unique MFT-related deposit addresses in the past 48 hours, suggesting that some holders are indeed taking advantage of the pump and looking to take profit:

Even with that in mind, though, there’s little evidence of any sort of mass exodus among MFT holders or major capital flight as the coin continues to rally. The ‘retail’ sector of MFT holders has continued to grow in the past week as well, with addresses holding 10k-100k and 100k-1m MFT both experiencing a strong uptrend since the announcement:

Now this is pretty interesting to see, as these types of pumps - especially in projects with fairly dormant price action like MFT - tend to trigger a wave of opportunists and profit takers in no short amount of time. That, however, has yet to materialize on MFT’s charts.

The fact that many are continuing to HODL MFT even after a 75% pump is certainly a testament of the ongoing DeFi hype, and the market-wide sentiment that anything and everything DeFi-related will continue to grow for months to come. Even the Mainframe CEO seems to agree:

What could prove problematic for MFT’s price action is its current MVRV ratio, which tracks the average profit/loss of addresses that acquired MFT in a certain time frame.

Most recently, MFT’s 30-day MVRV peaked at 1.32 on July 15th, indicating that short-term MFT holders were - on average - 32% in profit on their initial investment.

As a rule of thumb, the higher the MVRV ratio, the more likely it is that holders will start to exit their positions and take profit. As a result, analyzing MVRV levels around previous price tops can reveal the ballpark profit margins at which MFT’s short-term holders were comfortable selling in the past:

As you can see, MFT’s short-term MVRV tends to peak anywhere between 18%-38%, which I’d consider a ‘danger zone’ for its price action. The 32% peak hit a few days ago fit squarely in that range and, unsurprisingly, preceded a quick short-term downtrend.

Since the retracement, MFT’s 30-day MVRV shrunk to 1.23 which is still relatively high, but gives some space for the price to grow before ‘weak hands’ start offloading again.

Even more concerning, however, is MFT’s 365-day MVRV, which is currently at an all-time high 1.50, meaning that long-term MFT holders are currently - on average - 50% up on their initial investment:

Like I mentioned, the higher the MVRV gets, the more likely that holders start dumping their bags and taking profit. MFT’s long-term holders were never - on average - this much in profit, nor did they ever wait this ‘long’ before starting to cash in. How much longer will they wait? Watch this space.

Regardless, Mainframe’s pivot (and the MFT token’s activity since) is the latest sign that the DeFi craze is nowhere near over, with those that missed the first wave of AAVE, KNC, COMP and related pumps actively on the lookout for new entry opportunities to the space.

This is not to say that Mainframe can't or won't deliver on what they've promised in their now-revamped whitepaper. At the very least, it sure looks like the market wants it to. Still, the fact that a project can release a DeFi-centric whitepaper on a Monday and increase its coin’s value by 75% on a Friday with not much more than a plan and a prayer is undoubtedly reminiscent of early to mid 2017. Stay safe out there.

Conversations (0)