5000 BTC sell order on Bitstamp triggers market-wide flash crash

A massive 5,000 BTC dump on Bitstamp was the likely culprit of a Bitcoin flash crash that happened earlier this morning.

Apparently, somebody put up a giant sell order of 5,000 BTC at a low-ball price of $6,200 which in turn caused BTC to nosedive to as low as $6,250 (-20%) on the exchange:

While the king coin quickly recovered to the $7350 range, the dump sent shockwaves through the market, toppling BTC to an average of ~7100 in a matter of hours.

So what the hell happened?

There are three main theories circling around. Some say the dump was nothing more than a system glitch:

While others believe the whole thing to be a horrible case of fat fingers:

The majority of the crypto community, however, is of the opinion that this is clear-cut whale manipulation.

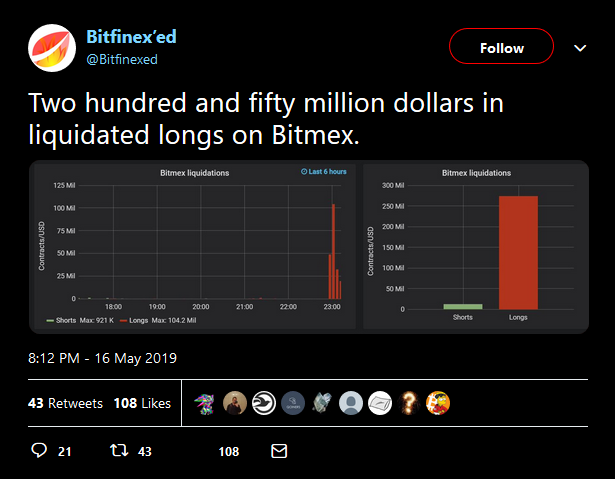

Many seem to think that whoever set the sell order could’ve held high leverage short bets on another exchange like BitMEX. In theory, the dump would’ve then caused a massive liquidation of long positions, putting the whale safely in green. And speaking of BitMEX longs:

And while many are convinced the dump is just whales frolicking, some point to the same being the case with most of this week’s market-wide uptrend:

In the meantime, Bitcoin managed to recover to the $7400 range, though it’s still currently -7% for the day. But hey, better than -20%, right?