FARM - The rise of Farmer Chad

Assets covered: Harvest.finance (FARM)

Metrics used: Price, Volume, Daily Active Addresses

Summary: Is DeFi really dead? Or are market participants getting more efficient in yield farming. A look at Harvest.Finance (FARM) hitting an ATH in TVL while others wane away.

Say Hello to Farmer Chad

Some say that the DeFi bubble has burst and it's done for good - With DeFi darlings like YFI (and all other Y variants), UNI, CRV, PICKLE all losing its shine and token price going down the drain.

However, one particular farm is showing otherwise. In comes Farmer Chad's playground - Harvest.finance.

As always, there are inherent risks involved :

- Smart contract exploits/bugs/hack

- Collateral getting liquidated

- Stablecoin de-pegging

- Secondary protocol rugpulls

So please, do your own research.

Now, with that out of the way, let's take a quick look.

What's Harvest.finance?

Similar to YFI (and other Y variants) and PICKLE, Harvest.finance is a yield aggregator protocol that automatically farms the highest yield available from the newest DeFi protocols, and optimizes the yields that are received using the latest farming techniques.

The team remains anonymous so the only real way to get an understanding of how credible they are is by.... well... "test in production" as Andre would say. What you see now, is how good they are.

Read more about the different farming strategies here.

Contracts have been audited and you can read more about them here.

What is FARM?

FARM is a cashflow token for Harvest, where holders receive cashflows from revenues on AUM, currently set to 30% profit sharing.

This happens when the doHardWork function is called and FARM is market-bought and distributed to those staking their FARM in the profit share pool.

Token supply and distribution

- FARM has a current circulating supply of 236,853.415

- FARM has a total supply over 4 years of 690,420 (was initially 5M but vote was passed in Sept to change it.)

- 14,850 FARM has been burned in week 3

- 5,846.9 FARM has been burned in week 4

- 70% of the FARM tokens will be distributed to capital and liquidity providers

- 10% of the FARM tokens will vest to the Operational Treasury to pay for additional development and promotion

- 20% of the FARM tokens will vest to the Development Team

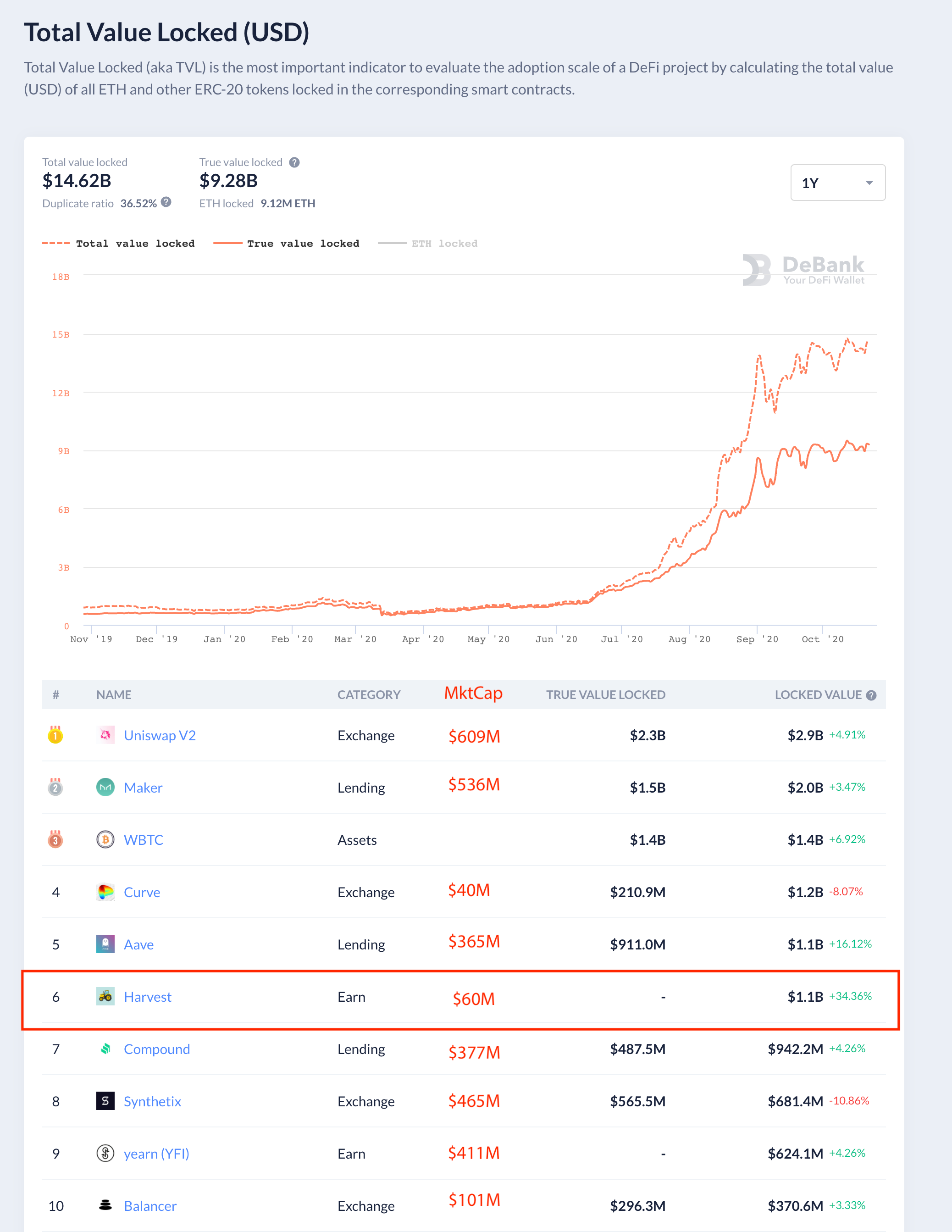

Total value locked (TVL)

FARM's TVL grew from $273M to over $1Bn in less than 2 months and during a time when DeFi was declared dead.

Perhaps the DeFI market is getting more efficient since the fall, seeing money flow into most capital efficient protocols. Given the amount of TVL, market seems to agree that $FARM is currently the most popular one. ....for now.

With its current TVL, the marketcap of FARM is rather low compared to other major counterparts. E.g YFI @ $411M and FARM @ $60M.

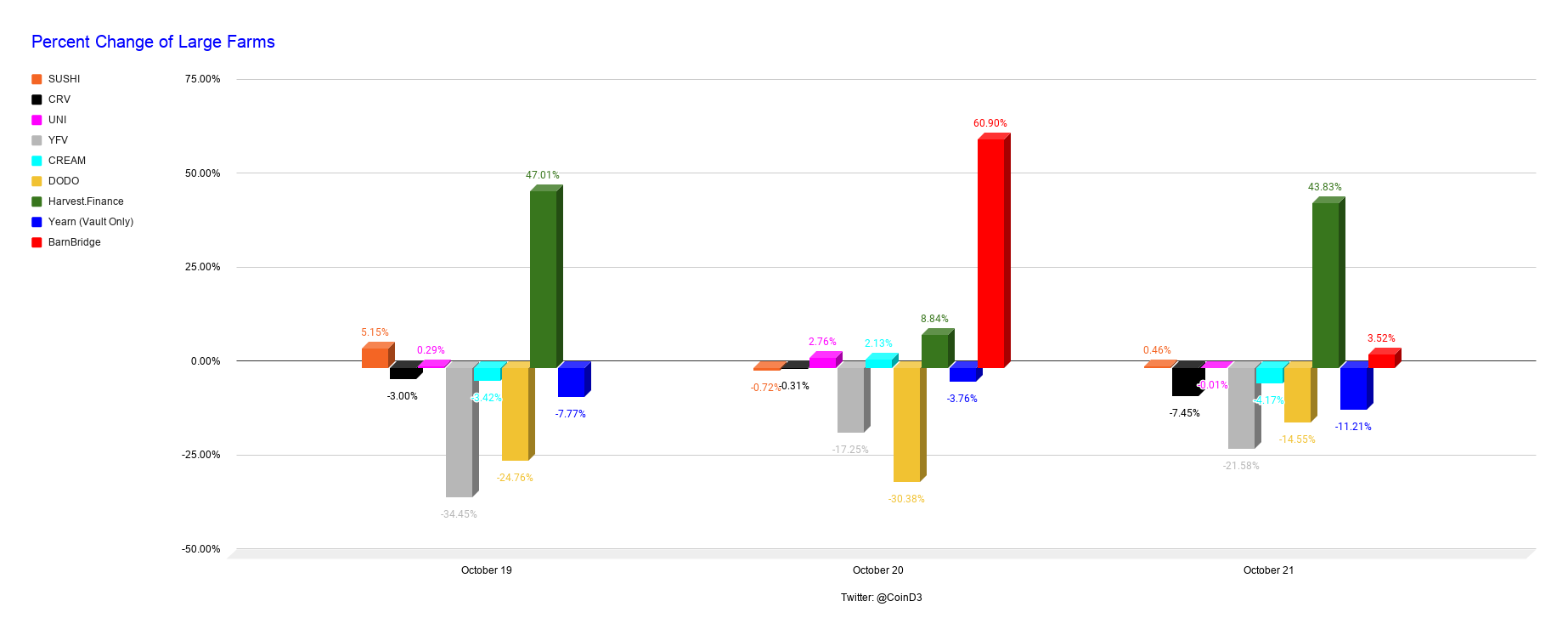

Here's a nice visual on how TVL changed for large farms this week alone.

Biggest losers in TVL: YFV, DODO, YFI

Biggest winners in TVL: FARM, BOND

Not surprised if most of the TVL from the biggest losers went into the biggest winners.

FARM is legit becoming a serious contender in the space of automated yield protocols but as for how long this will last, it's really up to anyone's guess. While YFI has its fair share of dramas, development seems to be strong and new vaults might be introduced to remain competitive. The same applies for PICKLE (minus the drama).

Where the safest and highest APY is, TVL shall flow.

Price

While most of DeFi was in a general downtrend and bleeding out, it appears that FARM might have bottomed out around 2 weeks ago and started an uptrend since.

It saw a nice runup with high volume break out (ATH vol) above the $284 resistance level and into the $325 levels. But the failing volume and failed attempt to flip $284 into a support level is casting some doubts for continuation.

Daily Active Addresses (DAA)

With the recent price spike, we also saw the biggest spike in Daily Active Addresses, followed by a significant drop in DAA, it tends to signal that the crowd is involved, which usually isn't a good sign of things to come. Remember, they tend to buy the local top (So is the case here too).

That said, FARM seems to have found renewed interest if you take a look at the DAA activity, it normalized (or died off from initial hype) 2 weeks ago, which is usually a good time to accumulate. Going forward, if DAA is able to normalize again, it'll be a good sign for accumulation and another leg up if market conditions allow.

Token holders

Majority of FARM (49.8155%) is currently in the Profit sharing pool, which provides an APY of 135.50% and it's auto compounding. This makes sense for any FARM holders to be utilizing this pool than just leaving it in their own wallet.

There's no lock-in period and anyone can withdraw at anytime.

This also makes whale watching simple as anytime a huge amount of FARM departs from this pool likely means that there's an intention to sell as observed in the screenshot above.

Here's an example of a whale that just moved 11,449 FARM worth $1.9M (which he acquired at $130) out of the pool and into USDC today.

His sell-off seem to tanked the price due to huge slippage which then saw the price dip to $165 before bouncing back to the $230s. And now, he's buying it back up at around $240s, moving them to the Profit share.

From the erratic behaviour, it looks like there wasn't as huge of a profit made especially when he's cashing out with huge slippage in both sell/buy (he didn't sell at the very top). It's actually a pain for a whale to be in a low-cap coin.

Strange behaviour, perhaps the whale was reducing risk due to this FUD:

It did work since a good amount of FARM left the profit share pool and made their way to USDC. That said, FARM was quickly bought up.

Eitherway, it's a wallet to keep a close eye on.

Speaking of wallets, there's another worth looking into and that's the Dev fund wallet, which, according to some community members, uses a VWAP bot that periodically sells FARM to pay the devs and have been doing so since Sept 22.

Looks like every week, the Dev fund will receive FARM and it's gradually sold into USDC (regardless of price), which then goes through Tornado.cash for mixing (to maintain anonymity). Some parts of the USDC was also converted to ETH.

However, it looks like the amount of FARM the Dev fund is decreasing, likely due to emissions change.

Going forward

FARM is currently leading in the automated yield aggregator protocol category with over $1Bn in TVL and growing. However, competitors like YFI and PICKLE might have something up their sleeves in the coming weeks. E.g YFI with v2 vaults.

Depending on how things go, capital will migrate, leading to a drop in TVL.

While audits were done and there's a timelock applied to the contracts, there's still lingering risks associated with Anon devs and admin key resting solely on one of them. It'll help if the team provided more assurance.

Sell pressure is present and whales do make a big impact due to lack of significant liquidity for them to exit, which results in huge slippage. Only source of liquidity is via Uniswap at the moment. Listings on major exchanges would certainly help.

As long as FARM's vault strategies provides the best yield in the space, it might just survive.

Enjoy the yields while they last!