'Panic markers' pop up in Bitcoin's on-chain data

Well well, if it isn’t the sky falling down on Bitcoin to start the week.

At the time of writing, the top coin is barely hanging on to the $31.5k support and the bears are already flooding my timeline with confident sub-30k calls.

But what does the data say?

First off, in my experience, Bitcoin’s on-chain data is usually pretty boring on Mondays, relatively speaking. This Monday, however, is looking like a real doozy.

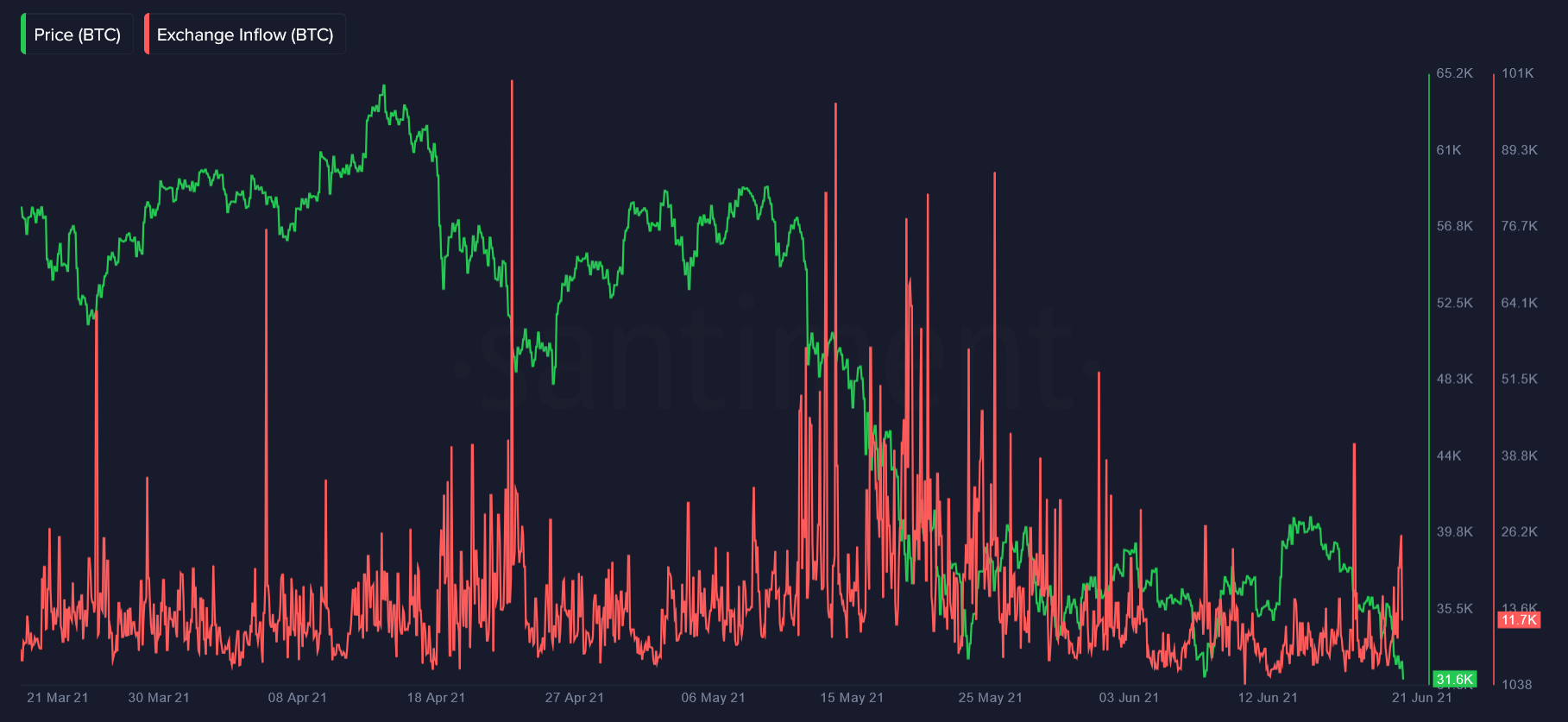

We’re already seeing a slow-but-steady growth in the amount of BTC moving to exchanges, pointing to a new wave of sell-offs as BTC gets dangerously close to a 5-month low:

At the same time, Bitcoin’s Network Realized Profit/Loss (NPL for short) has started the week with several strong dips, suggesting that coins that are active today are -