YFI - Return of the DeFi darling?

Assets covered: Yearn.Finance (YFI)

Metrics used: Daily Active Addresses, Historical Balance, Coin Supply on Exchanges, Daily Active Deposits

Summary: YFI rallies but will it have legs to go further?

So, Altcoins finally got a relief rally after a brutal meltdown since mid-September. The past 2 weeks saw some pretty decent gains across the board, with +50% on average, and some going as high as +700% (DNT) if you manage to nail the bottom.

In the past 7 days alone, we saw the DeFi segment leading the charge, with AAVE +116% and YFI +96%.

Today, we'll take a look at YFI and how it's been since our last post signalling a possible bottom was nearing.

Notable events

- Whale that shorted YFI few weeks ago has closed his short after Crypto Twitter went short hunting - attempting to force liquidate the whale. Anyone that participate in Longing YFI during this time, reaped a nice reward.

- Polychain doubling down on YFI, bringing their total holding to 470 YFI ($8M or 1.6% of the total supply).

- Release of veCRV backscratcher vault - So instead of mining CRV and dumping it, the vault leverages on veCRV (by locking mined CRV for 4 years) to boost all vaults and get paid in 3CRV (a yield bearing LP token for 3pool).

- Change in vault fee structure - removed yVault withdrawal fees and changes the fee structure to be a 2% Management fee and a 20% Performance fee on profits.

- More v2 progress - Learn more about the them here.

Daily Active Addresses (DAA)

Nice to see that the DAA is increasing again but the spikes following a large rally remain a concern as it tends to indicate crowd coming in and subsequent falling DAA suggests that less speculators are coming in to prop the price up.

Should the next weeks see a price spike and lower DAA, that'll be a big warning sign that a top might be in.

Daily Active Deposits (no. of addresses that deposited YFI) spiked with each price spike, indicating that a number of holders are quick to offload whenever possible.

Coin Supply on Exchanges

While we did see increase in Daily Active Deposits, it appears that they are likely to be small holders aka the crowd as Coin Supply on Exchanges is not showing a huge spike in YFI.

In fact, it looks like it topped out in mid October and been trending down since, which is a good sign so far as this takes some sell pressure off.

So question now is, where are they going? In the next section, we'll take a look at two significant holders to keep an eye on.

Top holders

The top 10 YFI holders consists of YFI governance, AAVE lending pool, Exchanges (CEX & DEX), Polychain, and a mysterious Binance-related wallet that received YFI around 2 days ago. Perhaps a fund via OTC?

From the list, two addresses worth looking at are YFI governance and AAVE Lending pool.

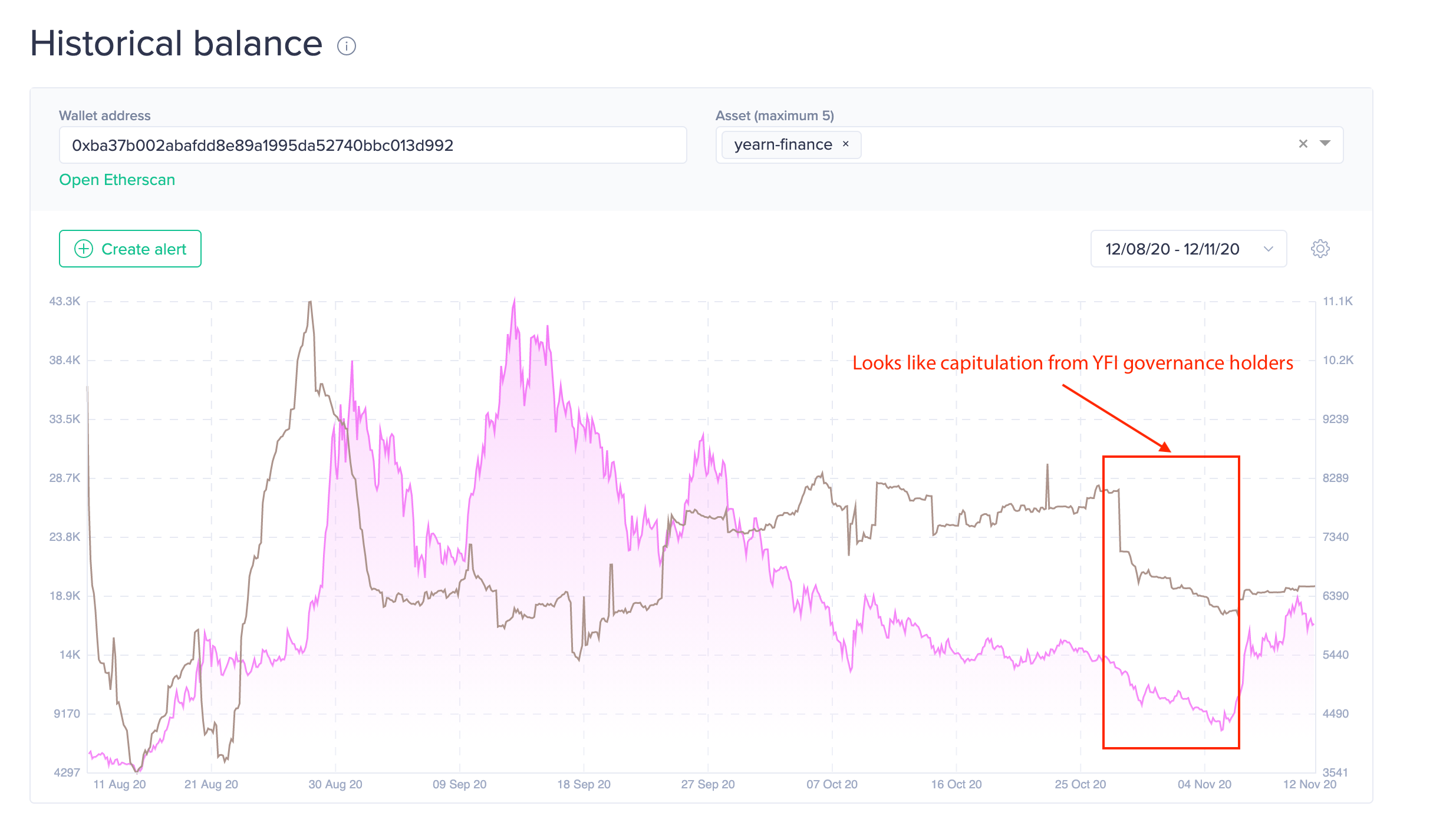

Probably holders with the strongest faith in YFI would be the ones that staked their YFI in the governance address. But the meltdown eventually got to some of them as we can observe a huge drop in YFI balance and the price crashing shortly after.

Looks to me like capitulation.

YFI governance balance has since gone back up but remains relatively stable. Would like to see increase in balance over the next few weeks for any indication of strong belief in YFI. For now, it just looks like there's no strong benefit to stake YFI in the governance contract and perhaps people have been burnt.

For this address, we need to consider the two participants - Lenders and Borrowers.

In general, YFI outflow from AAVE usually suggests that people are borrowing it for selling (opening a short position) in hopes of buying back lower and only returning it when they are done. Like what we've seen from mid-Sept to early-Nov

Vice versa, large inflow to AAVE suggests that people are bullish on YFI and confident enough to use it as a collateral to borrow other assets on AAVE. Like what we've seen from August to Mid-Sept.

Now, you might be wondering, according to the chart, it looks like there's still quite a number of short positions outstanding since ATH (ard 8444 YFI) but in reality, if we look at the market size now, it shows that:

The YFI Market size is currently at 3,272.48 YFI (around -61% from the ATH) and 1,184.50 YFI been borrowed.

This suggests that in the midst of the DeFi meltdown, lenders have removed a lot of their YFI collateral (likely to sell it as price falls) and borrowers were happily borrowing whatever is available as well to short..this then likely created a cascading event that pushed YFI's price down into oversold category.

So lenders likely got burnt, and I'd like to think that the confident lenders pre-YFI dump have all capitulated, resulting in a YFI distribution to new holders. Polychain thanks you for your sacrifice sir.

Going forward

Signs of a bottom is there, given the capitulation we have seen and the price rally is showing strength. It still needs some retest for confirmation.

YFI distribution looks to have occurred, with new holders acquiring it around the $7700 - $11,000 range.

Conditions are there for further upside but it'll also depend on what BTC does over the next few weeks. If it ranges, it's a go ahead for alts to party. Else, it's a no go.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)