YFI - How are things looking now?

Assets covered: Yearn (YFI)

Metrics used: Price, Network Growth, Supply on Exchanges, MVRV 7D, Daily Active Addresses, Social Volume

Chart: https://app.santiment.net/s/7cMtDkOW

Price

After bouncing off the lows of $25,000s in July, YFI is finding quite a bit of resistance in the $40,000 levels and is currently ranging between the $36,000 to $40,000 channel for August.

It's currently at risk of losing the $36,000 support levels after being tested for the 3rd time now in a month. Whether this will break largely depends on whether BTC continues downwards as most alts out there are still following closely to BTC's price action.

Compared to other DeFi darlings, YFI has underperformed since the bounce in July - Most DeFi darlings have gone to make a +100% gain since.

It comes as no surprise as there seems to be no significant development or speculative event for YFI. The last one was the WOOFY event, which saw YFI hop on the meme dog coins mania to create a "cheaper" version of YFI called WOOFY.

Since then, it's kinda a ghost town now. Even on-chain data shows the lack of interest in YFI over the past few months as we will observe next.

Network Growth

YFI's Network Growth data is seeing its lowest levels since Genesis. Quite apparent that since the Top in May 2021 (the WOOFY mania), there's just no strong interest in YFI anymore.

Daily Active Addresses (DAA)

We are also seeing YFI's Daily Active Addresses declining even as the price moves up. This divergence is generally not a healthy one. In a healthy market, we should see growing DAA along with the price as participants get engaged with the token price action.

Supply on Exchanges

The recent May top saw a huge increase in YFI's supply on exchanges as market participants begin to take huge profits. It wasn't until early August that we observe a sharp declined in YFI's supply on Exchanges, which is a good start for now as it suggests that participants might be accumulating again.

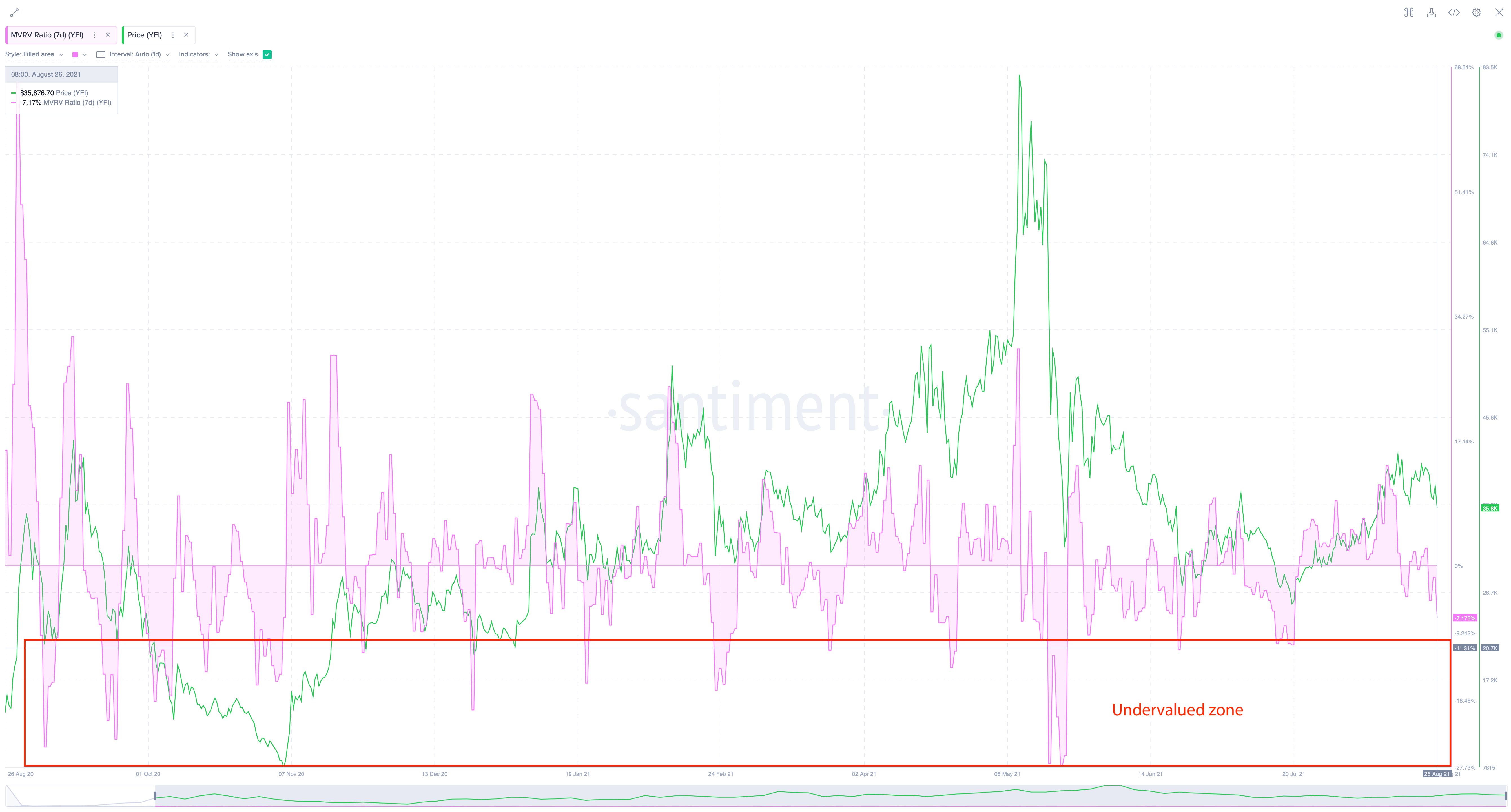

MVRV 7D

YFI's MVRV 7D which measures the short-term profit/loss of holders is showing that we are heading into the undervalued zone, which historically has shown to be decent accumulation points.

Social Volume

YFI's social volume is lacklustre compared to what how things were 1 year ago when it first launched. Gone are the excitement and shilling of YFI as the crowd moved on to other more exciting categories like new L1s, L2s, NFTs, Gaming, etc.

Summary

Overall, YFI's performance been rather underwhelming, there's just not much excitement in YFI any longer as most of the crowd have left to speculate on other more profitable coins.

The recent rise is likely due to BTC's rise lifting up the entire crypto market, YFI has yet to find strength on its own and that's probably due to lack of speculative events to engage market participants.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)