SUSHI - Not just an opportunistic clone anymore

Assets covered: YFI

Metrics used: Price, Daily Active Deposits, , Social Volume, Coin supply on exchange

Summary:

When SUSHI first launched in Aug 2020, many saw it as an opportunistic attempt at drawing liquidity away from the market leader Uniswap, making a quick buck for everyone that participated and would eventually die off once the heavy incentives (very generous ones too, think > 200% APY) are gone.

5 months on, SUSHI has gone on to show that it's not just another AMM and is now a formidable Uniswap competitor.

Let's take a quick look at how things are.

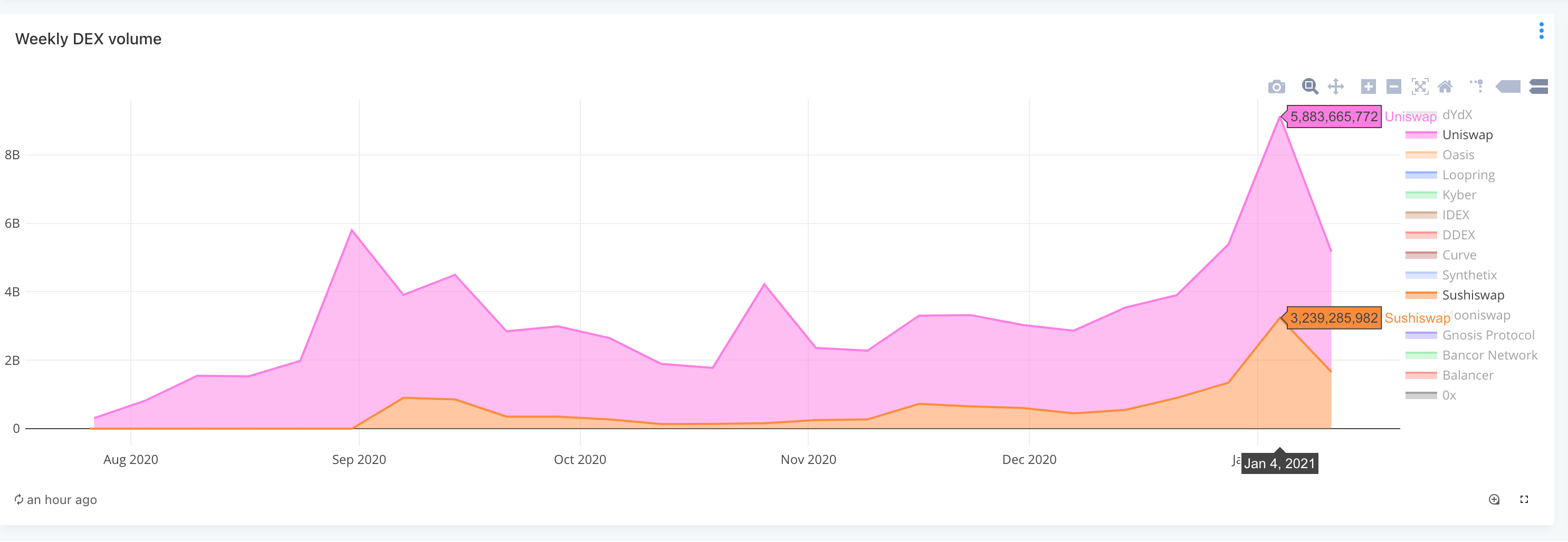

DEX Volume

The start of the year saw the highest DEX volumes over the past few months. For the week of Jan 4th, Uniswap remains the market leader with $5.8b and in 2nd place.... Sushiswap with $3.2b (its previous volume top was $900M).

Sushiswap is quickly narrowing the amount of trading volume with more than 50% of Uniswap's. Interesting thing thing to note as well is that, Sushiswap has only 569 pairs as compared to Uniswap's 28,428 pairs.

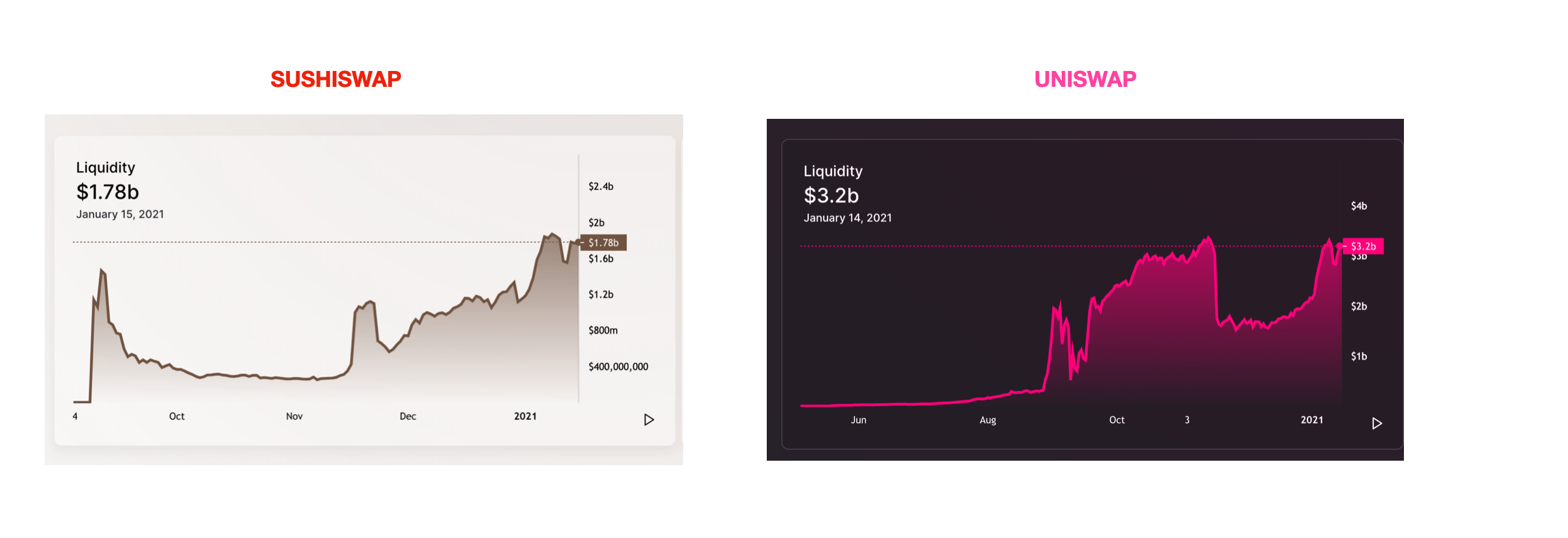

Liquidity

Sushiswap now has $1.7b in liquidity, which is more than 50% of Uniswap's $3.2b. This liquidity is expected to grow further with the launch of Bentobox and other initiatives for 2020.

Yield farming & Fee accrual

Uniswap ended their UNI yield farming incentive in mid November 2020 and have been operating pretty well as a market leader without it.

Uniswap V3 (scheduled for Q1) might be bring some surprises, however, fee accrual to UNI holders is still not live currently. The earliest we can expect for the fee switch to be turned on will be in March 2021.

Meanwhile, Sushiswap still has their SUSHI yield farming incentive running, however 66.6% of the earned SUSHI is vested for 6 months.

SUSHI holders can already stake their tokens for xSUSHI which allows them to earn Sushiswap fees. You can learn more about the APY here.

SUSHI's price action been pretty impressive so far.

Clear uptrend, dips were being bought up quickly and trading volume keeps growing with each new high made (consistent volume too.)

Most of the early speculators and weak hands have been flushed out in Q4 2020, leading to a stretched out accumulation period and it was off to the races since.

It's now setting its sights on that previous ATH of $10.88, not too far away with SUSHI trading at $6.40 now.

SUSHI's social volume is surprisingly low compared to what we've seen when it first launched. More so when the price has just been rallying since November 2020.

It's almost like people are in disbelief, ignoring SUSHI and not talking about it at all. A good sign so far as it opens more room for SUSHI to grow. Remember, the crowd tends to come in last.

Perhaps when it breaks ATH?

This is also not to say that there won't be corrections along the way for SUSHI, there'll be as we have seen before but it's definitely not a sign of a blow off top. It'll come eventually with the strong Social Volume and insane Price.

Looking at the Daily Active Deposits (DAD), it seems to confirm the theory that perhaps crowd isn't in yet as the current DAD pales in comparison.

Either that, or no one is really interested in depositing any SUSHI.

Coin supply on exchanges been decreasing since December 2020 with no strong inflow currently, suggesting that everyone (perhaps not the crowd) is just holding it. Likely staking it to earn fees from Sushiswap.

No one's in a hurry to dispose of SUSHI now as compared to when it first launched.

Going forward

Overall, SUSHI is looking strong in price action and onchain metrics.

The crowd is seemingly no where to be seen and SUSHI holders are not eager to dump anytime soon especially when Sushiswap's volume picks up, the fee accrual gets very attractive.

With the roadmap ahead for 2021, there'll be enough speculation to drive this further.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)