Origin Protocol: bottom found, where's the top?

This is the second time Origin Protocol appears on radar.

A relatively fresh token started trading around a month ago.

And we've covered this beginning here - https://insights.santiment.net/read/original-matured-tokens-released-on-binance%3A-origin-protocol-4813

Naturally speaking OGN also been flashing in Emerging Trends just a few days ago:

.png)

Red dots pretty much like bees attracted to sweet tops, isn't it?

Each actually represents a case when Origin Protocol is inside Top 10 emerging words list.

A top marker.

Project's social volume (amount of it's mentions) is usually heavy inflated for tokens in Emerging trends. What about this time?

This time as well.

It's a second top marker.

By the way exploring context word cloud may also give an idea of possible price direction:

"Buy", "pump", "moon" - expect opposite if this is what the crowd is talking about. Especially when these talks are emotionally charged.

Alone "dump" in word cloud doesn't have enough power.

Third top marker 👆

Next metric to check is the Mean Dollar Invested Age.

It's available for Sanbase Premium users with no limitations.

.png)

It usually tends down on tops. Marking something like hodlers exit area.

Details of this metric - https://insights.santiment.net/read/%F0%9F%93%A2-mean-age-653

Fourth top marker here.

Moving to Exchange Flow Balance:

Wow. Quite clear picture here. Unusually big amount of withdrawals are followed by price increase. Like around 22 Jan 20. And opposite: price may crush below tons of deposits. Explanation here is short - rising sell pressure proves to be too much for bulls to absorb.

Super easy to remember:

balance down -> price up, balance up -> price down, always opposite.

Fifth top marker found.

Santiment has a new feature deployed - a histogram on transaction volume:

When turned on, it's possible to see what kind of tokens been transferred on a given date. Screenshot above shows that yesterday's transactions were heavily populated by tokens last moved on February 6th and 9th. What does it probably mean? Speculators, short term traders. Jumped in early, sell quickly at some profit.

Anyway, transaction volume spike is usually working like a confirmation of top.

Sixth top marker here.

Moving to Sandata.

How is it going with project's development?

Origin Protocol Github activity is seen on this chart:

What's going on here? Token deployed to Binance, now team chilling on Bali?

Top holders. Whales world.

This deep whales habitat area expanded till price began to rise. Then it's gone.

That whales didn't wish to stay with OGN.

They dumped all the stuff to exchanges:

Creating sell pressure.

Fair to say those are stories of moving $3-4M in total.

Top marker? Looks like yes, may be.

Summary:

I don't know what can make OGN continue it's surge.

Marketmakers know.

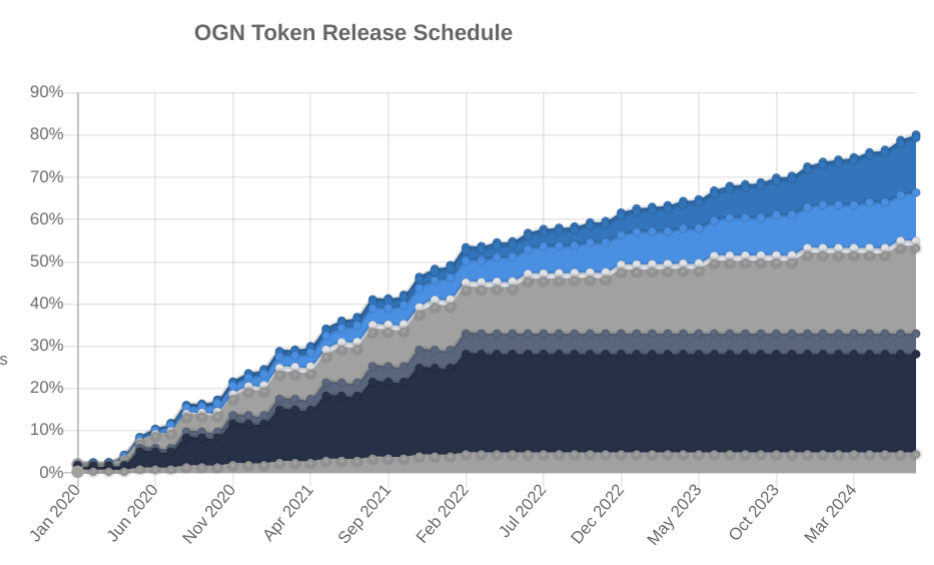

And by the way. Lots of token unlocks ahead:

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Garry Kabankin!

Get 'early bird' alerts for new insights from this author

Conversations (0)