Is S&P dragging BTC down with it?

The S&P saw its biggest single day dip since the Black Thursday meltdown in March , falling by almost 6%, just short of triggering the circuit breaker. This comes after a "V" shaped recovery, which saw Robinhood traders bragging about outperforming billionaire hedge fund managers. Can't help but to be reminded that this "easy money" mentality reeks of Euphoria.

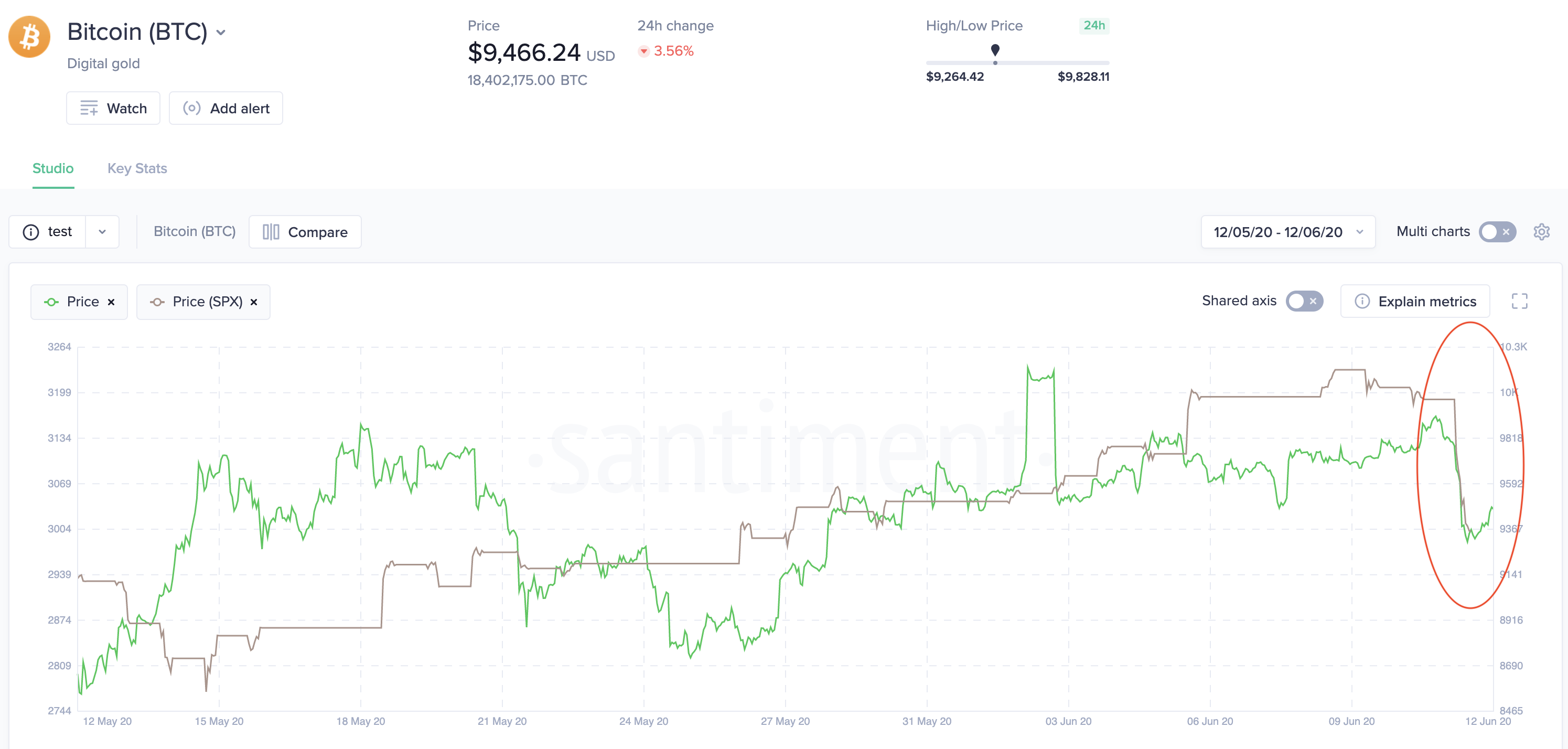

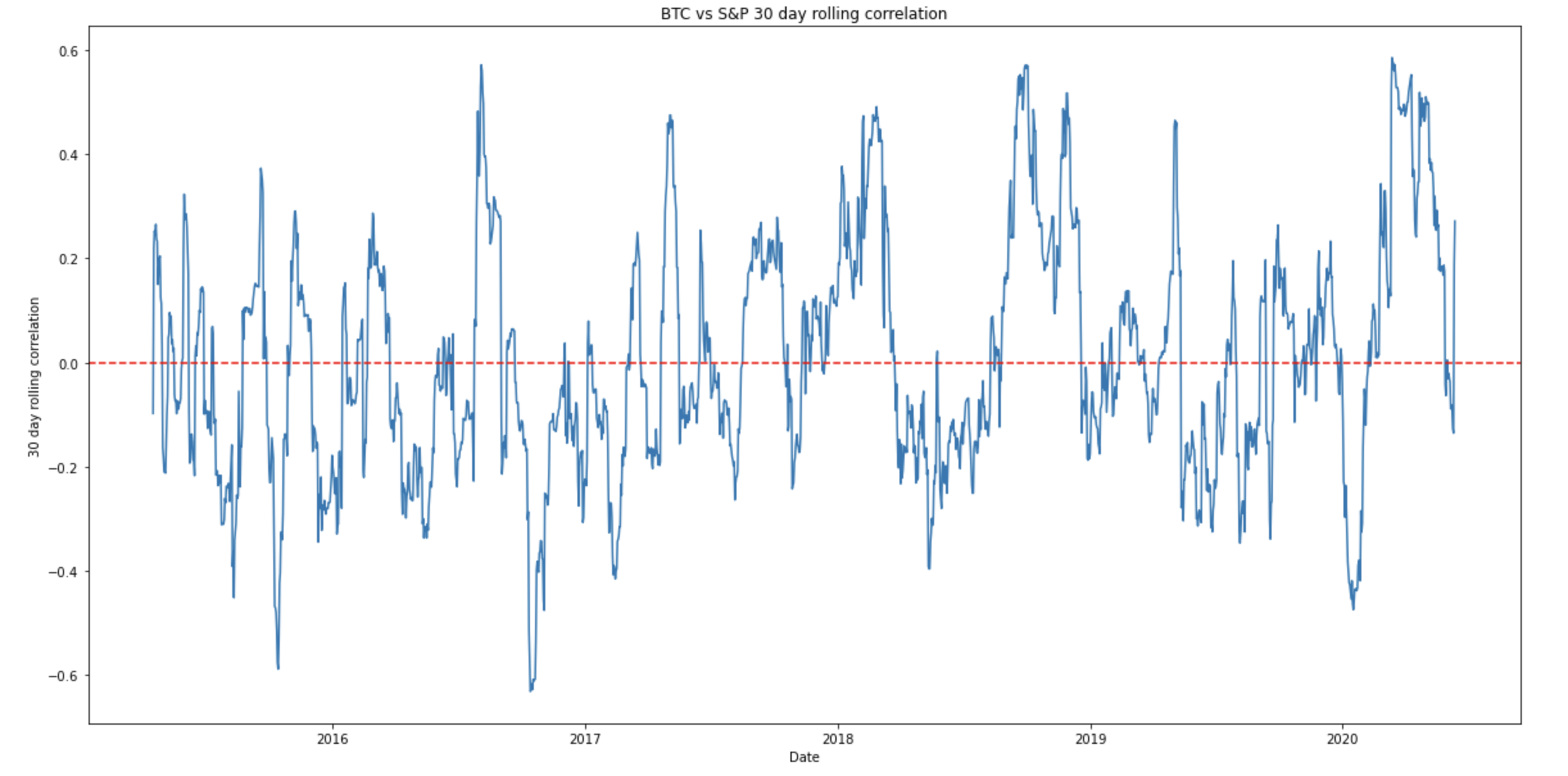

So far, BTC's been largely uncorrelated to the S&P for the past few weeks as it ranges between 8800s - 10000s, while the S&P continued to soar.

However, it seems that this recent dip in the stock market spooked the crypto space as well, with BTC falling by 5.5% to $9320.69 - possibly indicating that the BTC/S&P correlation is back.

In one of our latest insights (just right before the dip), we noted that BTC's NVT and DAA Price divergence wasn't looking that great and have rated BTC to be slightly bearish in the short term.

It is also important to note that macro factors are still at play (Unemployment, Riots, Pandemic, Alien invasion 👽) and while the markets have been pretty much irrational during this period so far, the current risk on sentiment can change to risk off in an instant.

That said, BTC's fundamentals for the mid-long term outlook remains intact for now:

- https://insights.santiment.net/read/making-a-cautiously-bullish-case-for-btc-5819

- https://insights.santiment.net/read/is-btc-finally-ready-to-break-and-stay-above-%2410%2C000%3F--5844

Coming weeks will be interesting as we observe whether the S&P and BTC correlation continues to grow.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)