Is MATIC the new PnD king?

Looks like MATIC dumps are back on the menu.

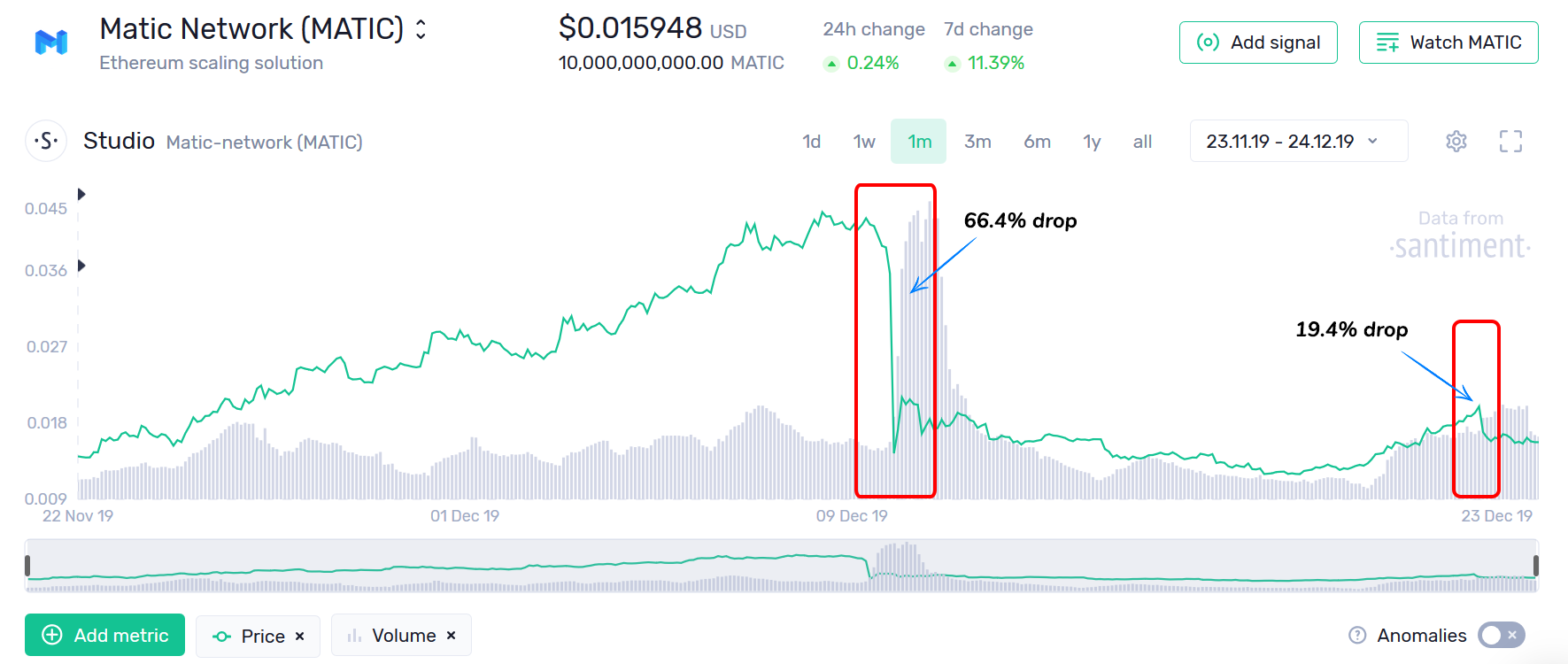

About 2 weeks after losing over 66% of its value in an hour’s time, MATIC treated its fans to another, mini PnD over the weekend:

This time, the coin crowned its solid 4-day uptrend with a 19.4% dump, taking place on early Sunday morning.

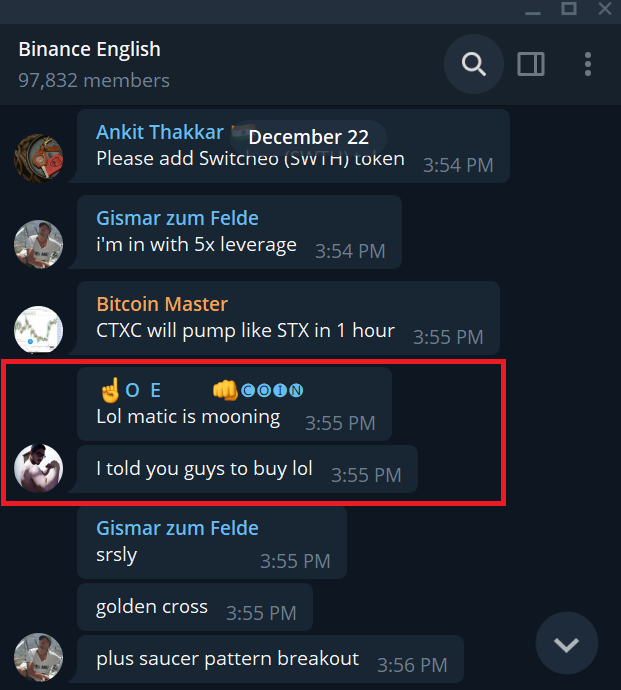

Leading up to the plunge, there was an almost familiar spike in bullish MATIC sentiment on crypto social media. The previous dump came after a massive 217% incline, and those that missed the MATIC action the first time around were gearing up for round two.

Exhibit A: the Binance Telegram channel in the hours before the collapse:

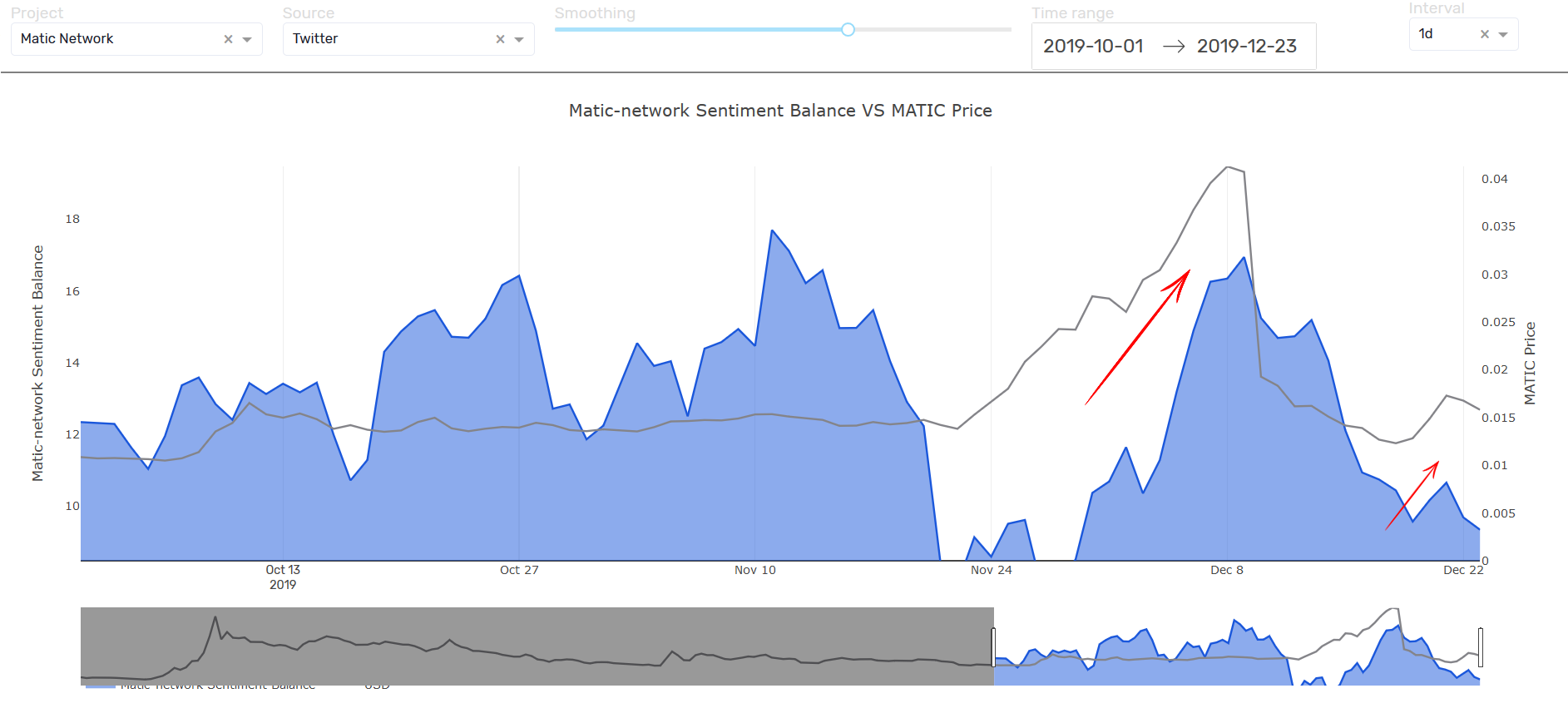

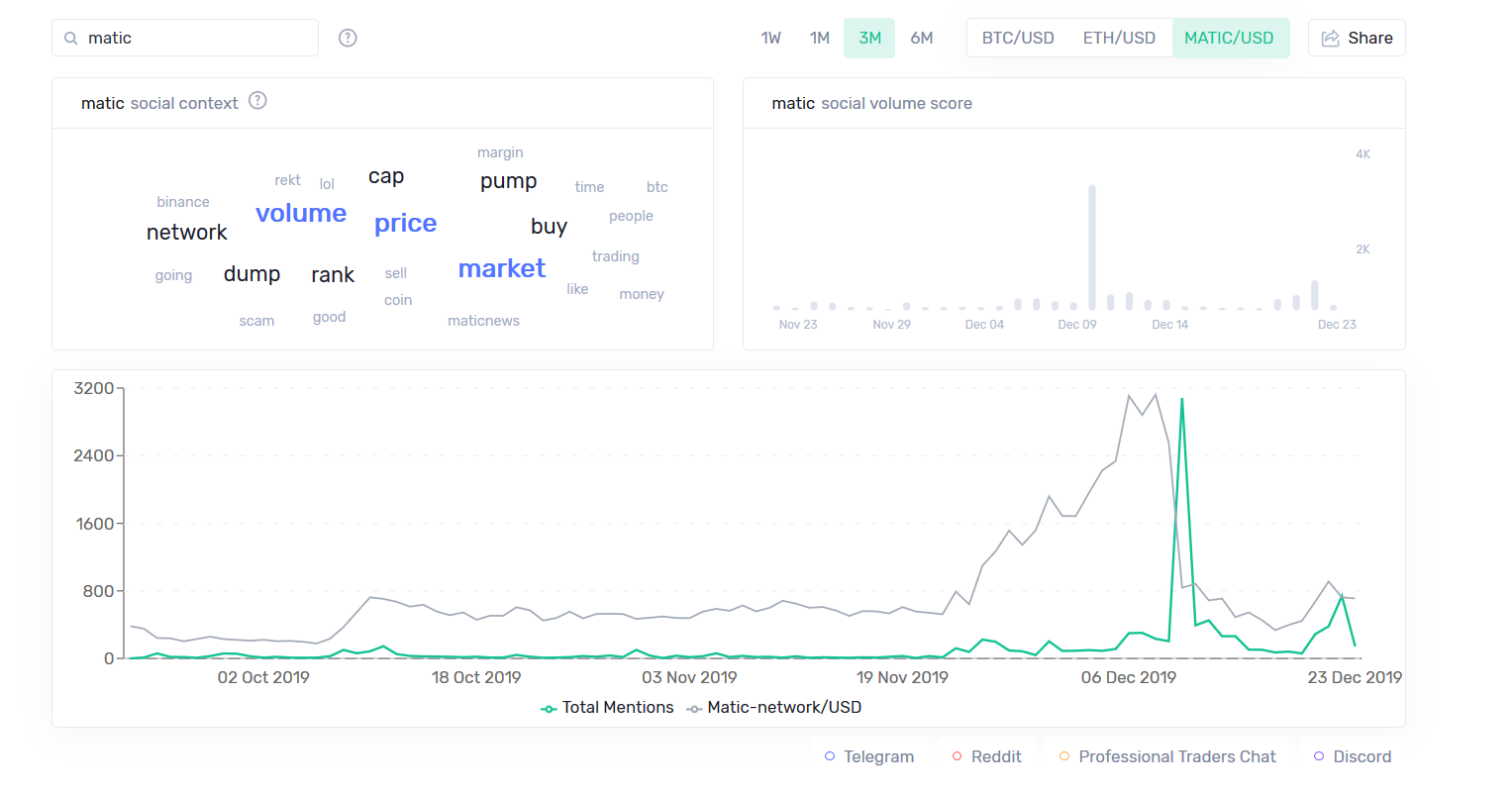

Exhibit B: the MATIC narrative on crypto Twitter also began to shift positive since the rally started, as recorded by our social sentiment charts:

And then - deja vu. The coin dumped almost 20% in less than an hour early Sunday morning (UTC), cementing its reputation as the new PnD king:

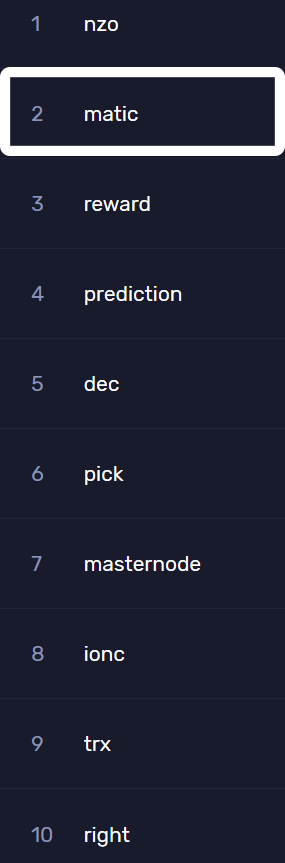

The dump made MATIC the weekend talking point, with over 880 new mentions of the coin recorded on crypto social media over the last 36 hours, according to our Social Trends:

As a result, MATIC also made a strong appearance on our list of top 10 emerging words on crypto social media, re-calculated each hour:

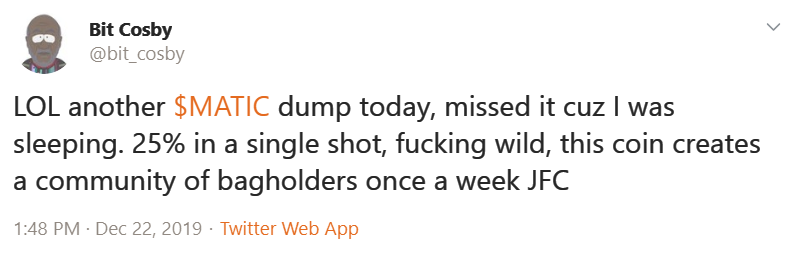

There was, however, one big difference in crowd response compared to the previous dump - not everyone was feeling sorry for the people that got burned this time around:

Schadenfreude aside, were there any warning signs of another incoming dump? Let’s take a look at the fundamentals:

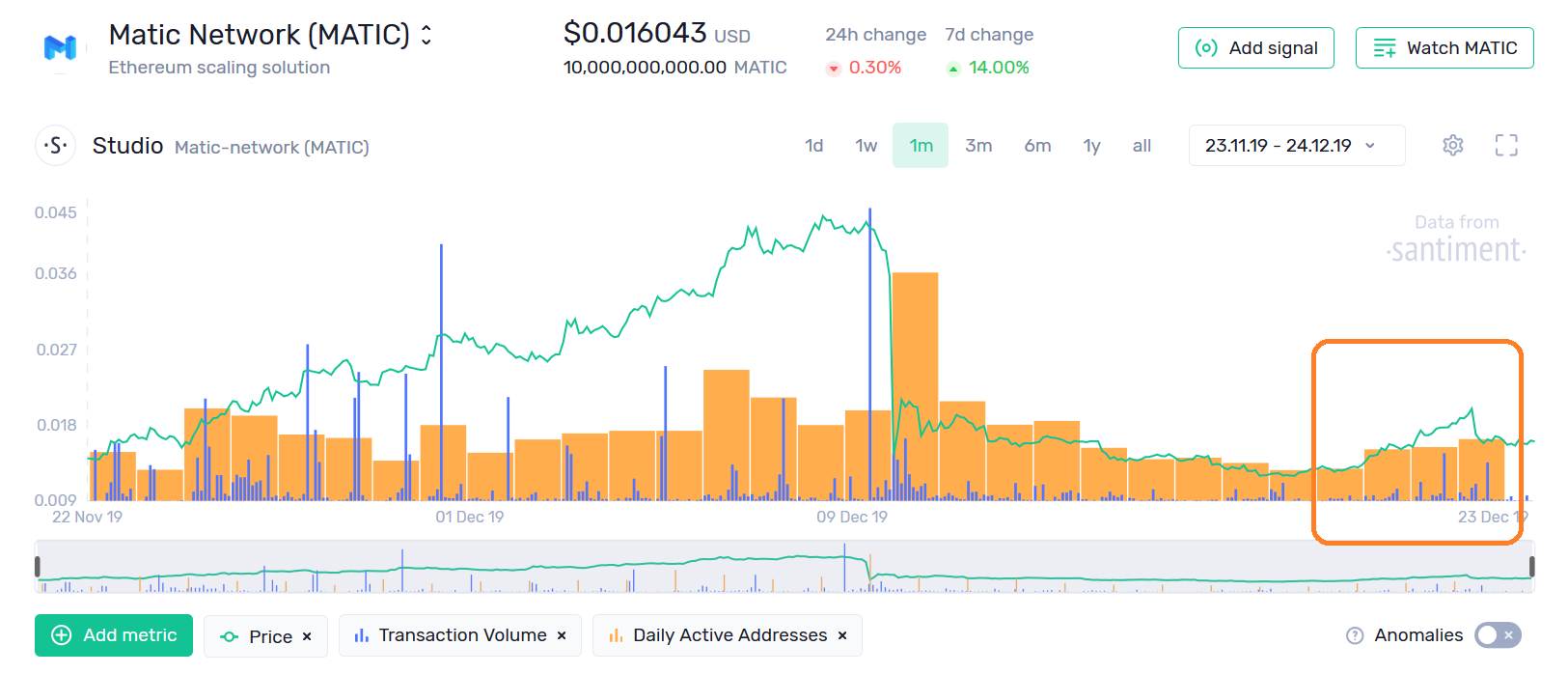

While the overall on-chain activity - the amount of daily active addresses and on-chain trx volume - didn’t seem out of place, and was likely enough to sustain the price even further up:

...there were still several red flags in our data that pointed to a forming top:

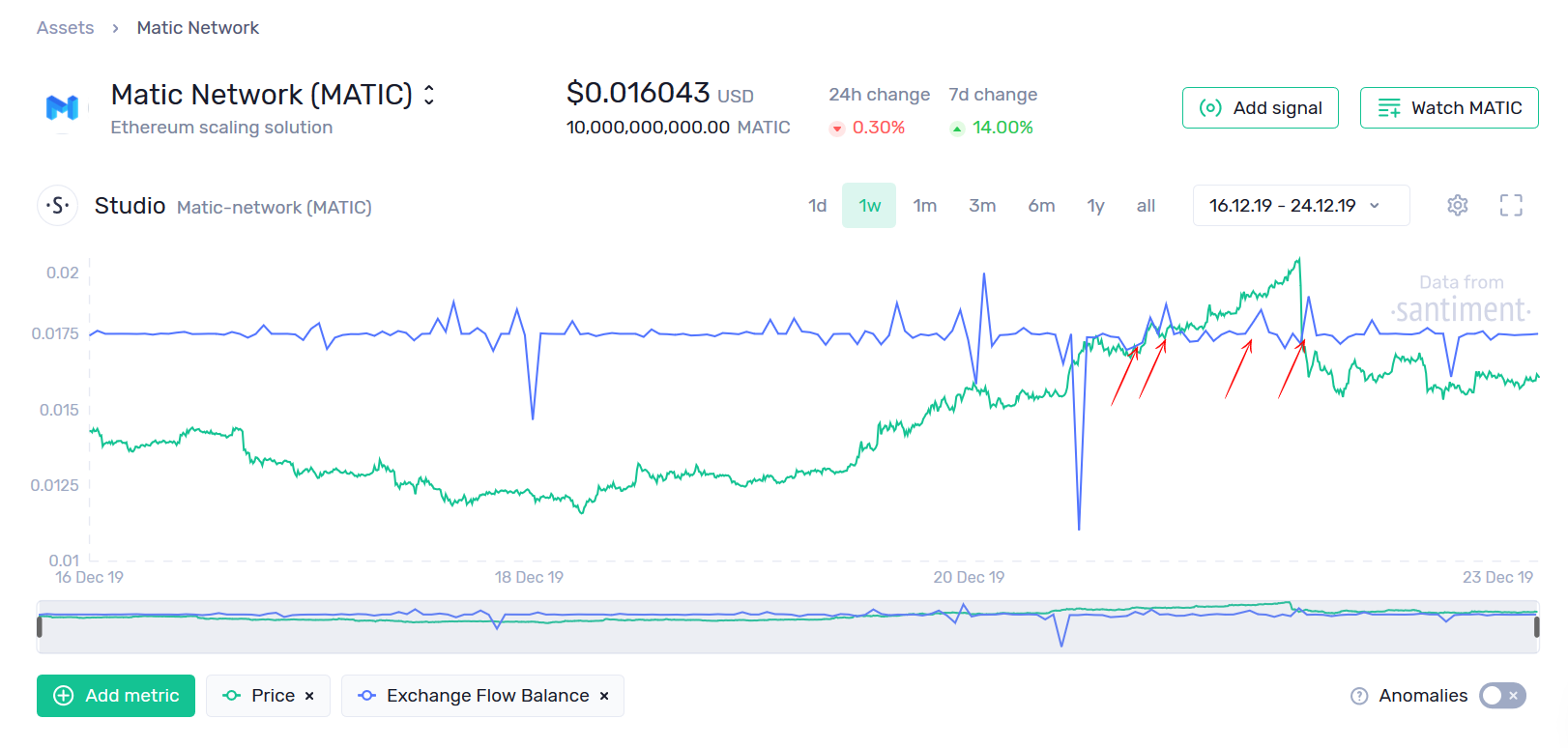

- To start, we've seen several quick-fire spikes in exchange flow balance in hours before the dump, signaling a growing amount of MATIC supply entering exchange wallets, i.e. bag holders moving in to sell:

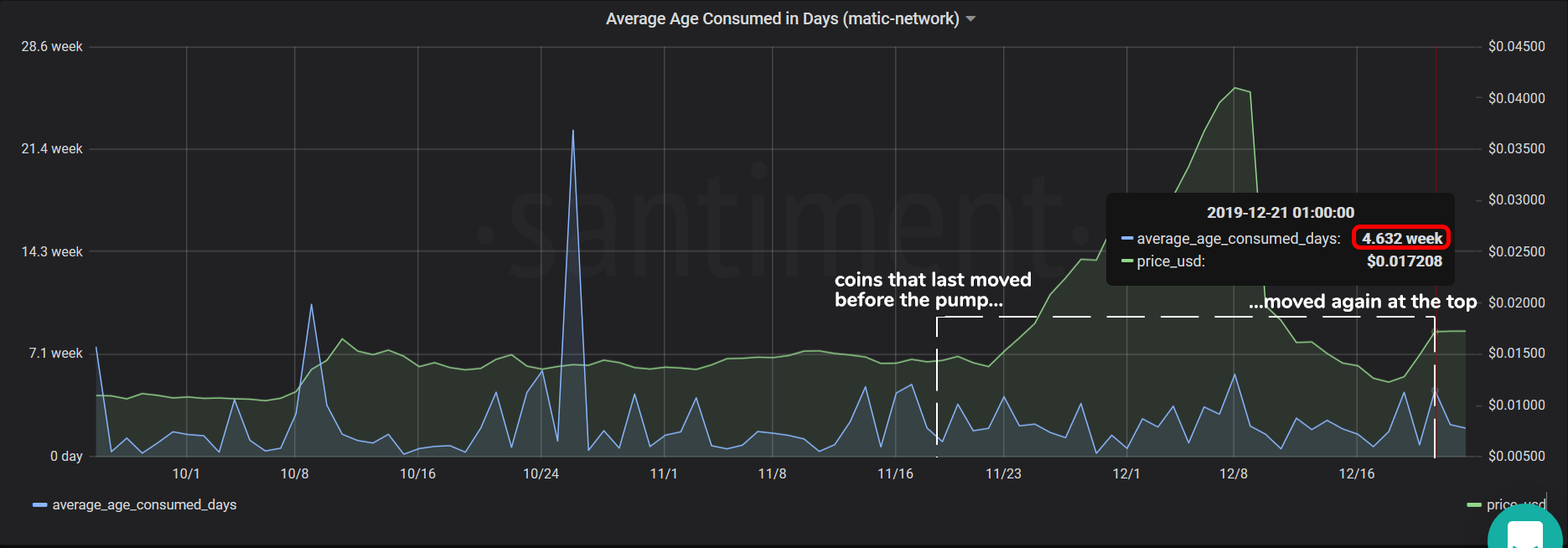

It’s also quite noteworthy that there were two consecutive spikes in Token Age Consumed in Days, with the average age of coins moved being 4.6 weeks.

This means that the coins that moved at these two spikes last moved in mid November, or right before the mega rally. In other words, this was likely some of the people that HODLed MATIC through the entire first PnD, now moving to take advantage of the second rally and take at least some profits before MATIC dumps again.

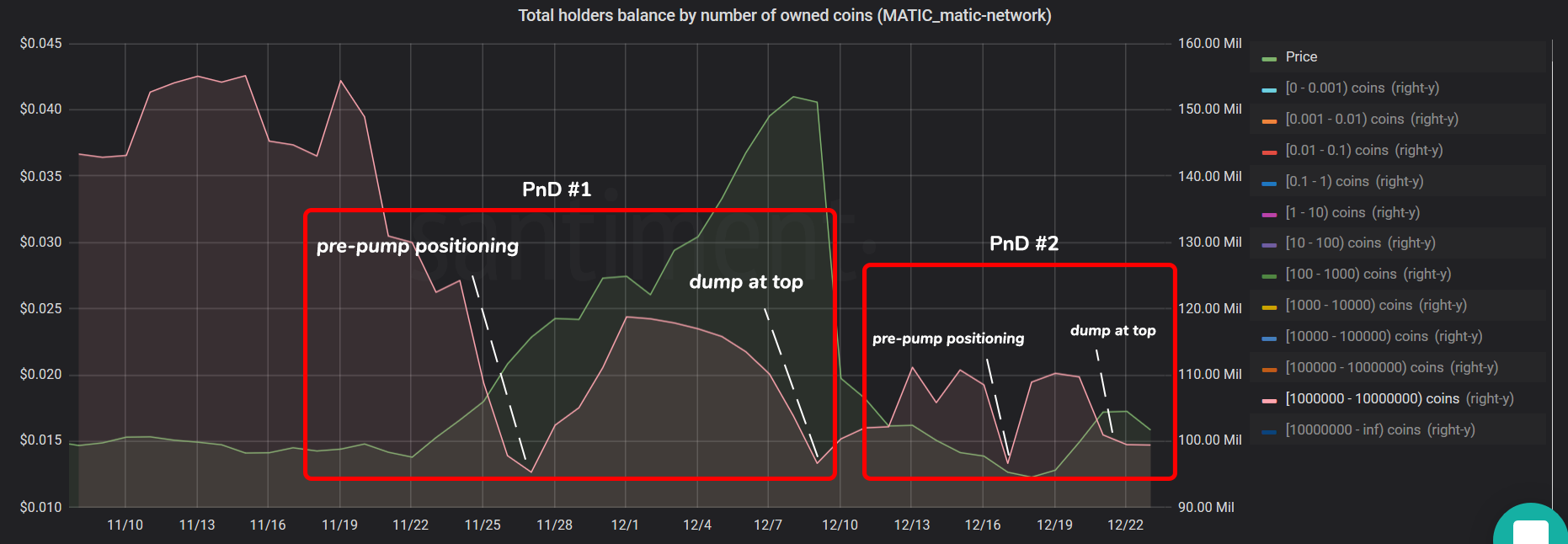

And finally and perhaps most notably, the recent MATIC whale behavior has mirrored their activity during the first PnD almost exactly. The below chart shows the cumulative balances of addresses holding between 1M and 10M MATIC over the last 2 months:

There were two telling dips in whale balances during both pump and dumps - the first at the very start of the rally, as whales and those ‘in the know’ likely moved into position, and then another one right at the very top, as whales offloaded the rest of their bags on the unsuspecting crowd.

It's a whale’s world after all.

So there you have it - although the general on-chain activity looked relatively normal, there were several red flags in our data that warranted increased caution.

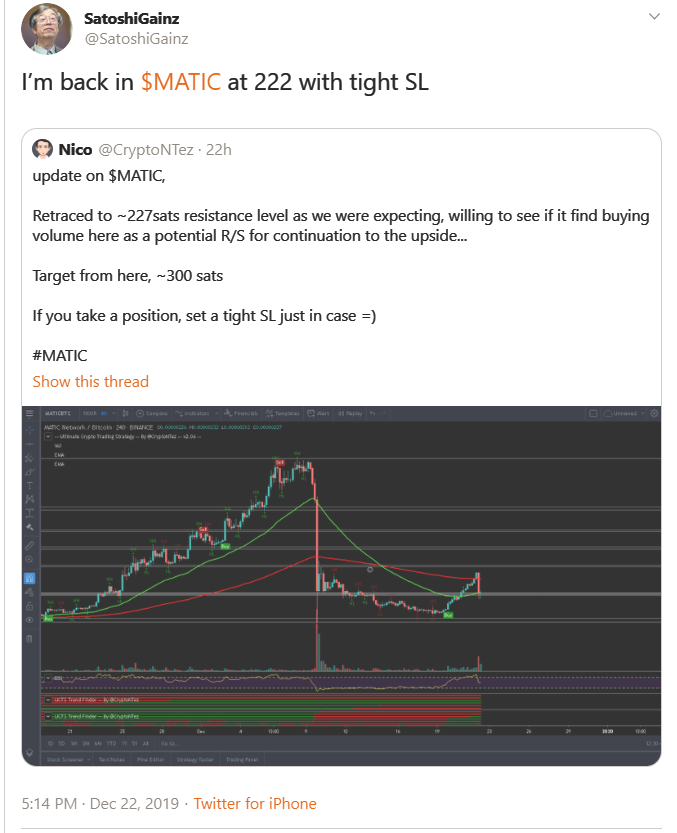

But caution is a rare commodity in crypto, as the crowd seems to have already started priming for PnD #3:

Stay safe out there!

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Ibis!

Get 'early bird' alerts for new insights from this author

Conversations (0)