Is Ether just now beginning to capitulate?

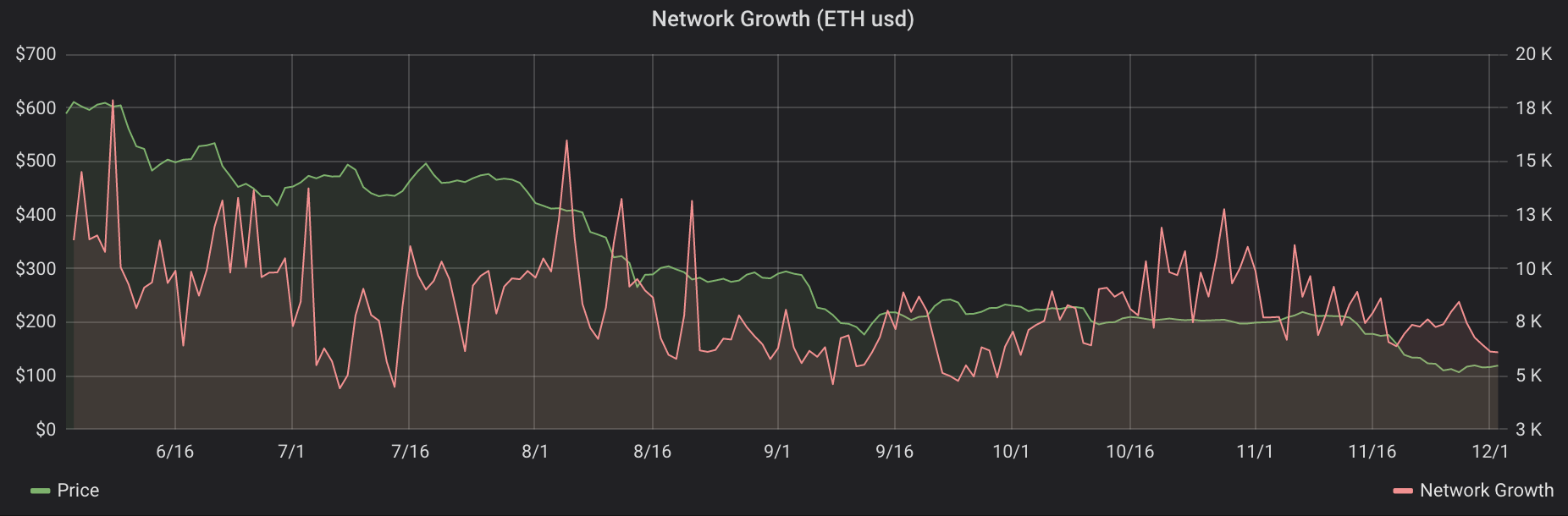

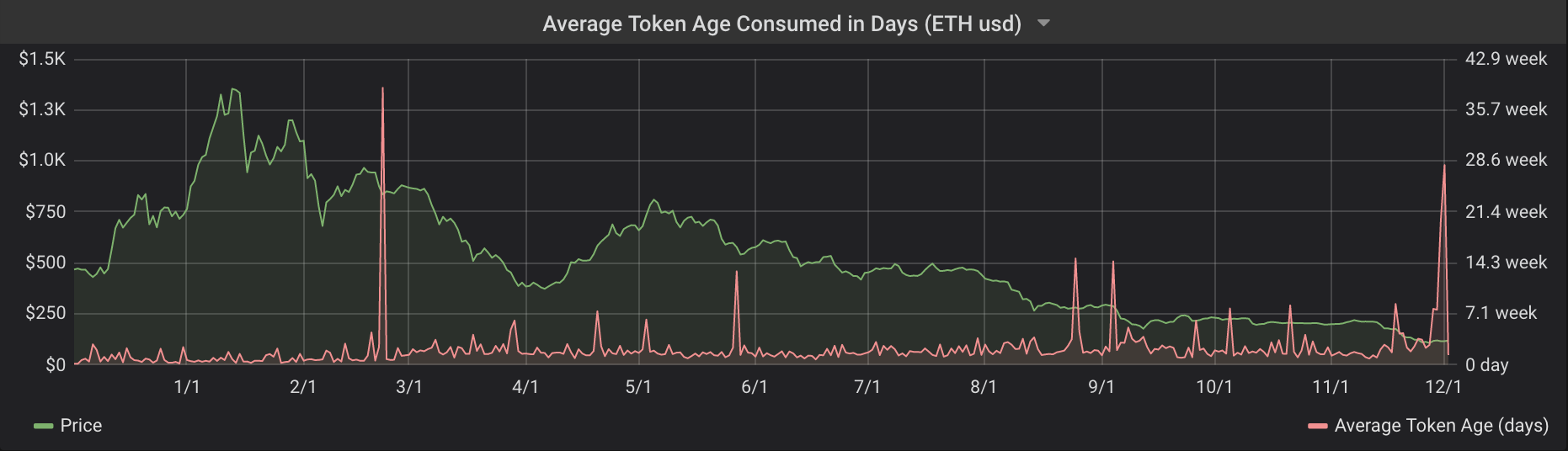

It appears as though ETH transaction volume, exchange flow (moving off exchange specifically) and aged token consumption have all seen significant spikes with in the past few days. Could we be witnessing some evidence that the ETH market is finally capitulating? Or are larger market players just maneuvering more as price continues to decline?

Recently, on 11/29 there was 925,936 more ETH that flowed out of exchanges than the 387,844 ETH that flowed in. At the time ETHUSD was priced at ~$119. A little over a month prior to this, on 10/21 there was another large spike in outflow. But are they related?

Here was can see that a majority of that movement on 11/29 was local to Binance. Also, considering the lows we have seen presently, I think it is safe to say that many bulls are no longer resisting the trend. So recent outflow likely isn’t related to the retail spot market deciding to, ‘buy the dip’ or ‘hodl.’

While initially trying to discern the possible cause(s) of recent activity I considered the following:

An interesting fact was that the average age of tokens consumed immediately after 11/29 outflow was ~29 weeks old, which dates back to early May. The USD price of ETH at that time was roughly $700. From then to the current price of $118 is about a 83% difference. Also, around the beginning of May was the peak of a what many might retrospectively view as the first macro bounce for ETHUSD. That said, it stands to reason that there would have been a lot of bag holders who bought that local top and could finally be giving up. So maybe buyers that thought the ‘correction’ was over in May are finally starting to believe in this bear market.

Now taking a closer look at the ETH outflow event on 10/21 when 999,939 ETH tokens moved off exchanges, a few things look different. At that time ETH was valued at ~$206. Yet the average age of tokens consumed on that day was just 8.3 weeks, the beginning to the end of that period represents ~50% difference in price towards the downside. But what is possibly most telling is that the velocity of tokens hit a 6 month low on 10/21.

So it seems to me that the activity on this date could indicate a mix between retail purchases and the first signs of capitulation. Simply put, bulls and bears coming head to head with neither having much edge over the other, for a change.

Lastly, if we glance further back towards the largest jump in aged token consumption things begin to line up. On 2/22/18 ETH was priced at $835, average age of tokens consumed on that day was ~38 weeks old. Correlating with that date roughly 1.83 million tokens left exchanges. Over the course of the next 45 day following that event, ETH shed >50% of its value. So what's next for the ETH market, could we be seeing lower lows still yet to come? Obviously only time will tell, although it is best to remember that the trend is our friend.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from dindustries215!

Get 'early bird' alerts for new insights from this author

Conversations (0)