Ethereum is the Hot Topic in Crypto Again... What are the Bullish vs. Bearish Cases for Where Things Go From Here?

There are some undeniably significant reasons to be excited about Ethereum being on the cusp of breaking $500 for the first time since July, 2018. Assets are being moved to offline wallets for safe keeping by traders at unprecedented rates, and miners balances are dropping, both of which are generally solid bullish signs. However, there are several concerning things going on, according to Santiment's fundamental metrics that, our community is taking note of. Prices topped out at $485 today, while the amount of daily addresses interacting on the ETH network are moving in the opposite direction.

Below, we've highlighted three cases for bullishness, and three cases for bearishness, according to our metrics. Let us know what you think in the comments at the end of this insight, and ping us on Twitter to ask us about discount codes for your first month of full access to all of Sanbase PRO's great features to analyze the markets yourself using Santiment tools like these:

Ethereum's Cases for Bullishness

1) NVT Model Shows Ethereum Receiving Highest Token Circulation Since December, 2018

The Santiment NVT vs. Price Model is indicating that August closed out on a fourth straight month of a bullish signal, with a continued trend of rising token circulation (unique tokens transacting on network) more than keeping up with a rising market cap that is at its highest level in 25 months (July, 2018). The model you see above is not a trailing indicator that colors bullish or bearish signals in hindsight based on how prices moved. It is most effective in predicting where things will look in the future month, as it's proven some great leading indicator potential. To read more about how it works, visit the article that dives into it here! With a Sanbase PRO account, you can check out this model any time for dozens of assets.

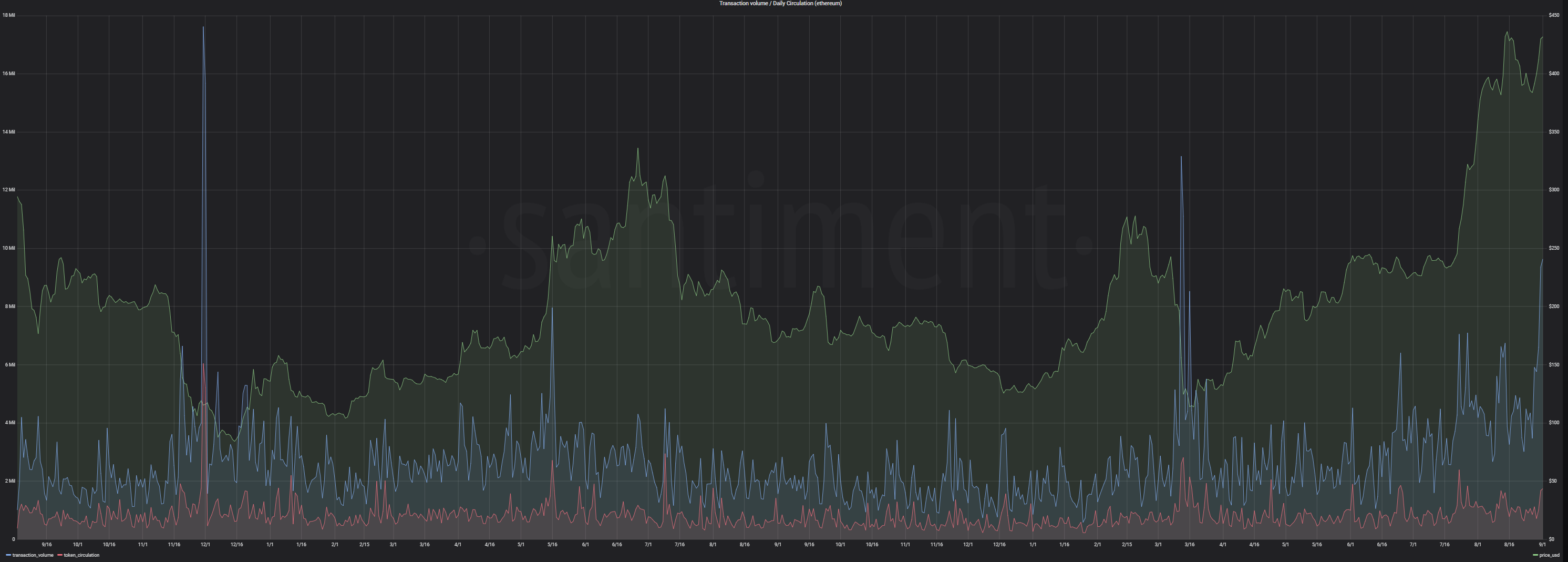

2) Ethereum's On-Chain Transaction Volume Bursts Through 5-Month Highs

On top of the impressive token circulation noted in our NVT model, we have also recognized that Ethereum's on-chain transaction volume has surged to 5-month highs and has hit 9.63M at the time of this writing on the current day. The last time these levels have been reached was March 13, 2020, just a day removed from Black Thursday where dip buys and FUD were in full effect. This does not always necessarily equate to price rises, but considering ETH's rise of +10% today, there certainly was a correlation this time around.

3) Coin Supply Continues to be Offloaded From Exchanges, Particularly to Whale Addresses

Ethereum's total coin supply being kept off exchanges continues to rise, rising to 94.5M tokens. This is a +3.63% rise since bottoming on March 24, which is a more significant jump in capital than one may initially expect after factoring in the total market cap of ETH.

Arguable even more interestingly, the top 100 non-exchange addresses have increased the sum of their token holdings by +8.2% in just the past 35 days (jumping from 23.1M to 24.8M total among these holders. Generally an increase in assets on non-exchange addresses is a bullish signal, particularly with whale holders. It signifies confidence in the longevity and sustainability of an asset among investors who have the most at stake, and more importantly, the greatest impact on the markets.

Ethereum's Cases for Bearishness

1) ETH Price May Be Surging, But Daily Active Addresses are... Not

It doesn't take a fine-toothed comb or monocle to see that, in spite of Ethereum's price soaring, its unique addresses transacting on the network on a daily basis has been moving the wrong direction. To justify higher prices, we typically look for at least a rough parallel in movement between price and DAA. But this kind of stagnation in address activity means that prices will eventually have to come down if the activity stays at this active address output not seen since April. Alternatively address activity will need to ramp up in a hurry to two-year highs like we saw in early August.

If we take a look at how things look on the Santiment Daily Active Address vs. Price Divergence Model, available to Sanbase PRO users, we can see that a clear shift has happened. Right around the turn of the month in late July/early August, our signals started outputting red, bearish signals. These, particularly, those colored in bright, neon red, indicate that there is a deficit in expected DAA at these price levels. The longer the red bar, the more of a deficit there is. At the time of this writing, we are projected to see the 2nd "ultra bearish" signal in three days. You can match these green/red signals with the DAA chart above it to get a pretty good sense of why the model is reacting the way it is.

2) One-Year Holders of Ethereum Averaging Unusually High Investment Returns

MVRV is a wonderful metric for understanding the psychological sentiment of traders and investors at any moment in time. In the case of those who entered into (or added on to) positions in Ethereum one year ago, the euphoria is extraordinarily high at the current moment, sitting at +63% on average.

Due to crypto markets being a zero sum game, combined with FOMO, FUD, and non-optimal trading moves, the MVRV for any timeframe and any asset hovers around 0% historically. So considering average one-year traders are so heavily in the black, there is still a hidden state of elation occurring even when social balance appears to have evened out.

3) Holder Distributions Show a Downturn in the Total Amount of Whales in the Highest Tiers

According to our data, the amount of overall top-tier holders are slipping. Particularly among the 1,000 - 10,000 coin bracket (-8.7% in the past 6 months), the slide has been quite noticeable. Also notable, the 10,000 - 100,000 brack has dropped a rather surprising -3.9% in the past 6 weeks alone.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from brianq!

Get 'early bird' alerts for new insights from this author

Conversations (0)