ETH hits new ATH - where to next?

The $1500 resistance is officially broken, as ETH surged by +12.9% over the last 24 hours and once again entered into price discovery.

While the exact catalyst remains unclear, some point to Grayscale reopening its Ethereum trust to new investors on Monday, after more than a month of closed doors. According to some reports, the trust has already added more than $37m worth of ETH since leaving hibernation, suggesting solid institutional interest in the second largest cryptocurrency.

Whatever the reason, the new ATH breach has already left a clear imprint on Ethereum’s fundamentals, which show growing signs of short-term profit taking and new HODLer activity. Let’s explore.

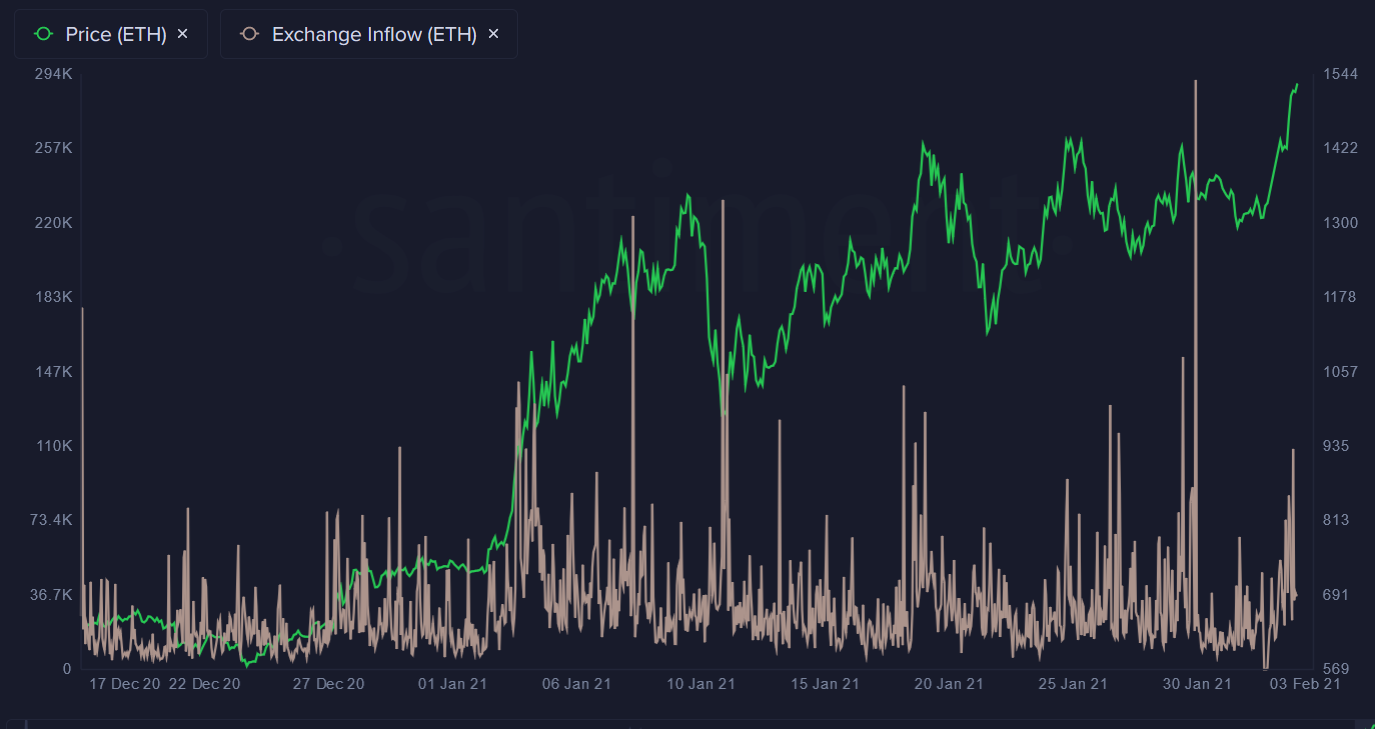

Perhaps unsurprisingly, its first break above $1500 prompted a quick uptick in ETH’s exchange inflow, with more than 227,000 ETH moving to known exchange wallets in the past 4 hours:

There’s more of this Insight

Choose your subscription plan

Years of market experience, compressed in each report

Since 2017, Santiment has been an industry leader in on-chain data, social intelligence and behavior-based analysis of the crypto market.

Our tools have a proven track record of timing price tops for cryptocurrencies, helping traders find profitable exit points and mitigate HODLing risk.

Our previous TOP calls:

What you get with Sanbase Pro:

- Members-only daily market insights and analysis

- 30+ on-chain, social & project indicators for 900 cryptocurrencies

- Custom alerts for the coins' price, on-chain & social trends

- Santiment Spreadsheet plugin with 10+ pre-made market templates

- Personalized asset watchlists and weekly performance reports

Gain unfair advantage with Sanbase Pro

Subscribe to Sanbase Pro for access to exclusive insights, market-beating metrics, strategies and templates!