ETH - Still not looking too good but will we survive?

Assets covered: Ethereum (ETH)

Metrics used: Price, Daily Active addresses, Network Growth, Supply on Exchanges, Multi-Collateral DAI repaid (WETH)

It has been a week since this post on ETH, let's take a look at how things are now.

ETH has broken down from the rising wedge formation we mentioned last week which saw a -16% dump before bouncing. It is trying really hard to save itself from breaking through the previous support at $1700s.

For now, as long as the $1800s hold, we've got a chance to make it back towards the $2200s to test the resistance trendline.

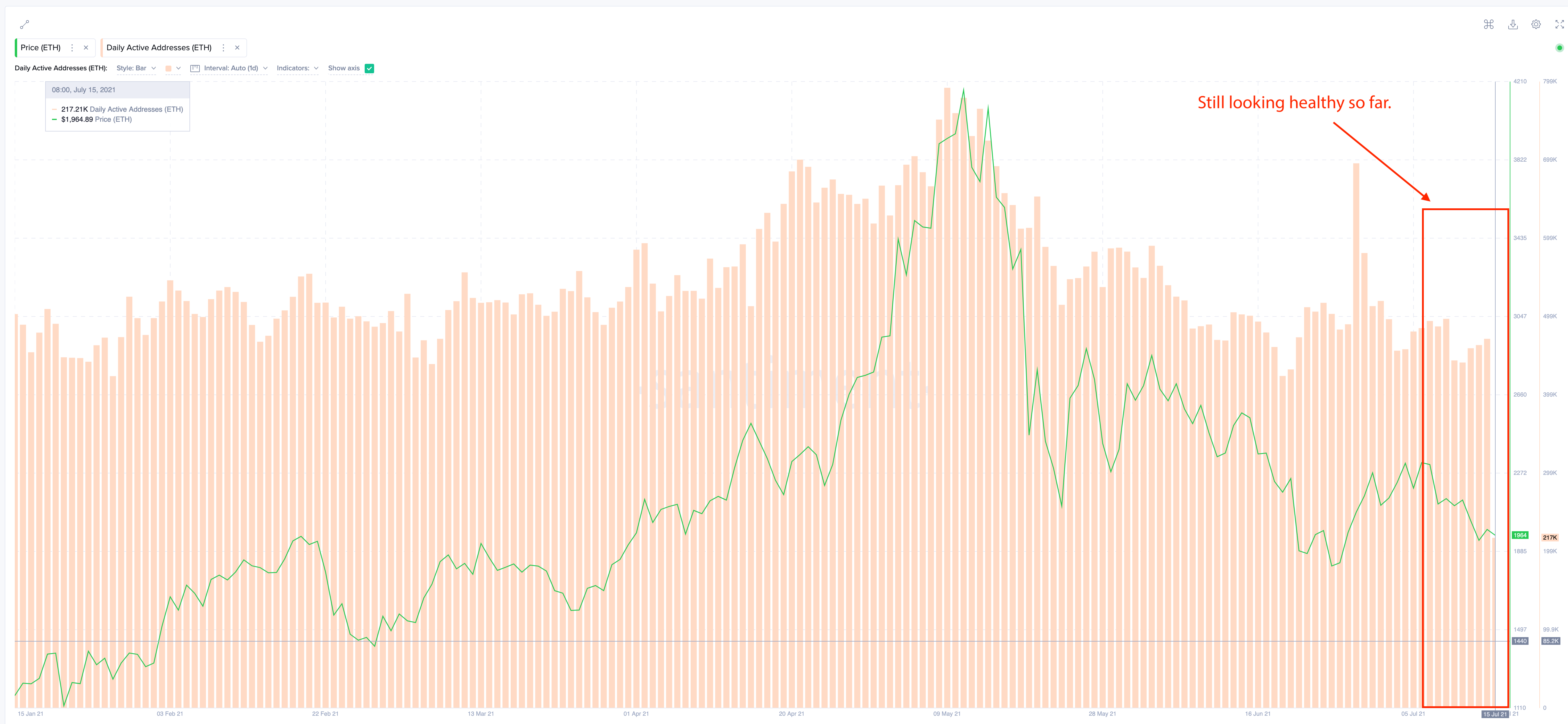

Daily Active Addresses (DAA)

ETH's Daily Active Addresses remain rather healthy so far, with an average of over 400k addresses interacting with the network since the start of the year.

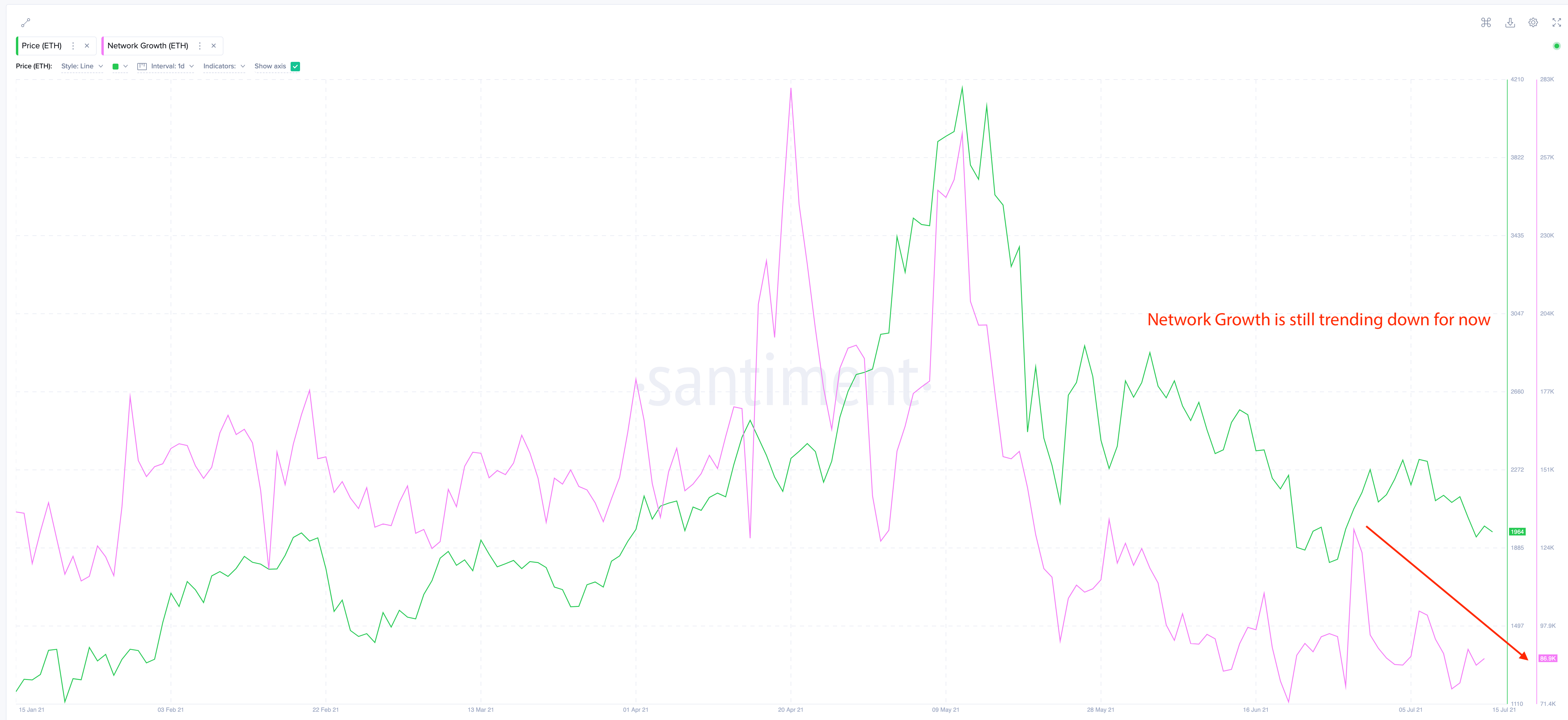

While this is encouraging, there's still more work to be done as Network Growth clearly shows a slowdown in new users.

ETH's Network Growth is still trending downwards for now, which isn't a good thing. Would prefer to see occasional spikes and higher highs in terms of network growth. If we do get that, a stronger bull case can be built.

Till then, the assumption is that we have exhausted new participants....until the next craze (whatever that may be).

We are seeing yet another sharp decline in ETH supply on exchanges, which is a good sign as it lowers the sell pressure. A continuation of this would shape a more positive outlook going forward.

Multi-Collateral DAI repaid (WETH)

One proxy to understanding what's the sentiment like in general is by looking at how much debt is being repaid in Maker.

The latest drop in ETH's price saw new spikes in debt repaid (collateralised by WETH) as participants get nervous about having their assets liquidated. Instead of adding more collateral, people are throwing in the towel.

This is usually a good sign of confidence waning, and if you observe the times this behavior occurred (repaying debt) on the chart, it often marked the bottom for a bounce.

In summary

ETH's price action continues to linger around a bearish bias, with it hanging on to a very important support now. Bulls really need to step in soon (for a bounce at the very least), else bears shall continue their downward trend.

On-chain metrics are showing some positive signs but it's still too early to say whether we bottomed out.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)