BTC uncertainty and where could we go from here

Assets covered: BTC

Metrics used: MVRV Long/Short Difference, MVRV, Age Consumed, Dormant Circulation, Exchange Inflow, Exchange Funds Flow, Holders Distribution, DAA Price Divergence, Distribution of Bitcoin on Ethereum, Mean Coin Age, Mean Dollar Invested Age

The idea of this insight is to give a general overview where Bitcoin is at the moment and what the onchain and social data is showing.

Starting with one of the custom on-chain indicators available on Sanbase, Bitcoin’s MVRV Long/Short difference. It's our addendum to the popular MVRV ratio, and looks at the disparity in the ROIs of long-term vs short-term Bitcoin holders. Details.

The metric basically saying that long term holders are overtaking short term holders. We're staying at relatively high level around +15%. Last time we saw MRVR L/S crossing 0 was around 28th of May, was a pretty good bullish call. It took some time before this call paid out. And crossings doesn't really happen often. Now it's a good time.

MVRV 30d still relatively low:

6% is ok. Anything above 12...20% in terms of short term profit is dangerous. We're approaching it a little bit, but we're not there yet, could go higher.

Meanwhile the long term MVRV are approaching danger zone:

MVRV 365d at +21% is looking a little bit dangerous. We are high. Now it depends on traders general sort of confidence in the market. We have seen it growing higher, during bull cycles, but in mini cycles we do tend to see a stoppage or consolidation around these levels for long term holders.

The Age Consumed remains a reliable volatility marker:

Spikes are visible before pumps. And on the other hand it's earmarking a local tops.

Last spike on the right is first since October 7th market bottom.

Dormant Circulation currently is not really high:

But quite an interesting spikes of Dormant Circulation on the chart: Aug 1 before mini top, Sep 1st before correction, Oct 7th before the spike, Oct 12 before we started consolidating, Oct 19 before the bounce there have been some old bitcoins moving on the blockchain.

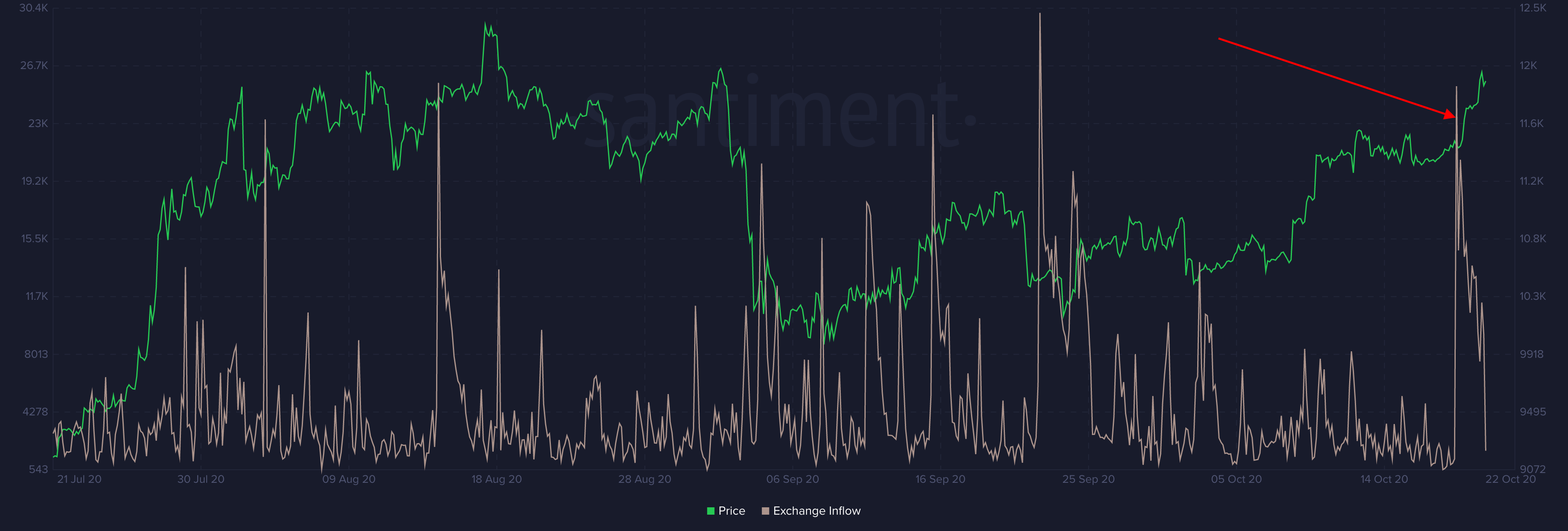

Exchange inflow:

There was a spike recently, quite big. Seems like some longterm hodlers were moving their coins to sell here, but it hasn't really driven the price down, in fact exact opposite. Why? Exchange Flow Balance has an answer:

It shows much more withdrawals then deposits. Actually biggest delta since market bottom on September 3, coinciding with a local bottom.

Takeaway:

The Age Consumed spike + Exchange Inflow spike + Dormant Circulation spike = strong signs of increased volatility

Next: whales seem to be accumulating once again:

Amount of BTC holders owning more than 100 coins is increasing.

BTC holders distribution, the same cohort, 100+ coins:

Fairly serious decline during top period, and more whales coming back into BTC around Sept 23 local bottom. Last week it's going up again.

DAA Price Divergence:

What do we see here: 1 - sea of green, rally; 2 - consolidation period; 3 - sea of red, pointing we did not have enough fundamental support for that price push; 4 - green area at the bottom pointing to bounce back; 5 - consolidation again.

It seems that currently DAAD model is pointing to period of market uncertainty, general indecisiveness. Although we have seen red bearish signals last days pointing to fact that as the price grows the amount of onchain activity has not been able to follow.

If things doesn't change, we are getting into danger zone of breaking the top and a strong reversal. The risk of such event is increasing. Just pay attention to the data. Because the price action shows we are ready to break the last top of 12k. If DAA are not following up, we will see dump. Because higher DAA means the crowd is in, FOMO in. If they are not FOMOing, then who is going to buy?

Addendum

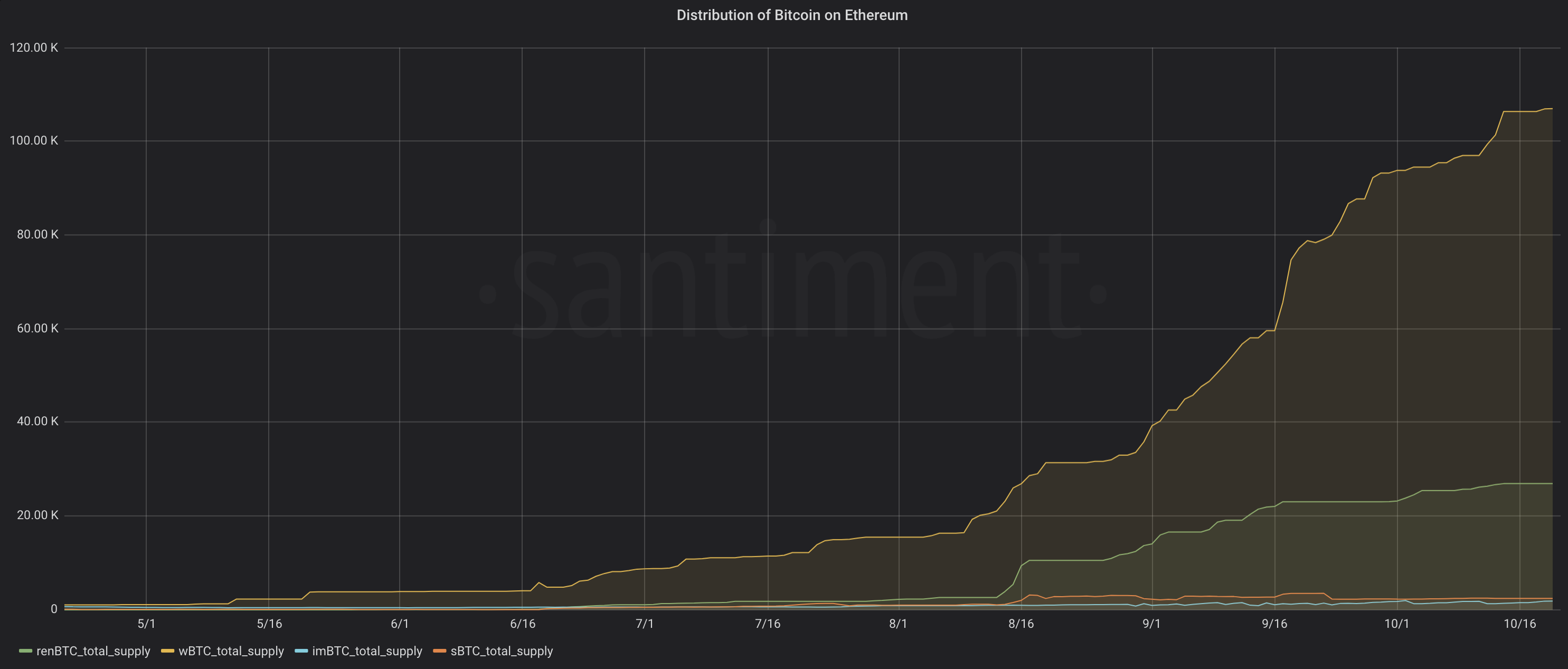

Cryptopotato is saying the reason why BTC miner rewards are decreasing is because of rising amount of BTC on Ethereum. And decreasing interaction with Bitcoin on its own blockchain.

First, let's look at the amount of Bitcoin locked on Ethereum:

It's rising indeed.

Second, let's use the Mean Coin Age chart:

It points to accumulation since, which is good.

Third, the Mean Dollar Invested Age:

A down slope in the middle says relatively expensive coins being moved, people taking some profits. And then accumulation stage started.

So, look, people are hodling Bitcoin. Quite a lot. And the amount of Bitcoin that actually is not being used on BTC blockchain is rising. But still very low amounts to affect miners.

Take care.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Garry Kabankin!

Get 'early bird' alerts for new insights from this author

Conversations (0)