BNT - Where are we now?

Assets covered: Bancor (BNT)

Metrics used: Price, Daily Active Deposits, Dev Activity, MVRV

Some notables

- Bancor's latest community call on June 22nd

- Bancor's elastic supply and how Impermanent Loss protection works

- How Bancor's Impermanent Loss protection fare against other AMMs

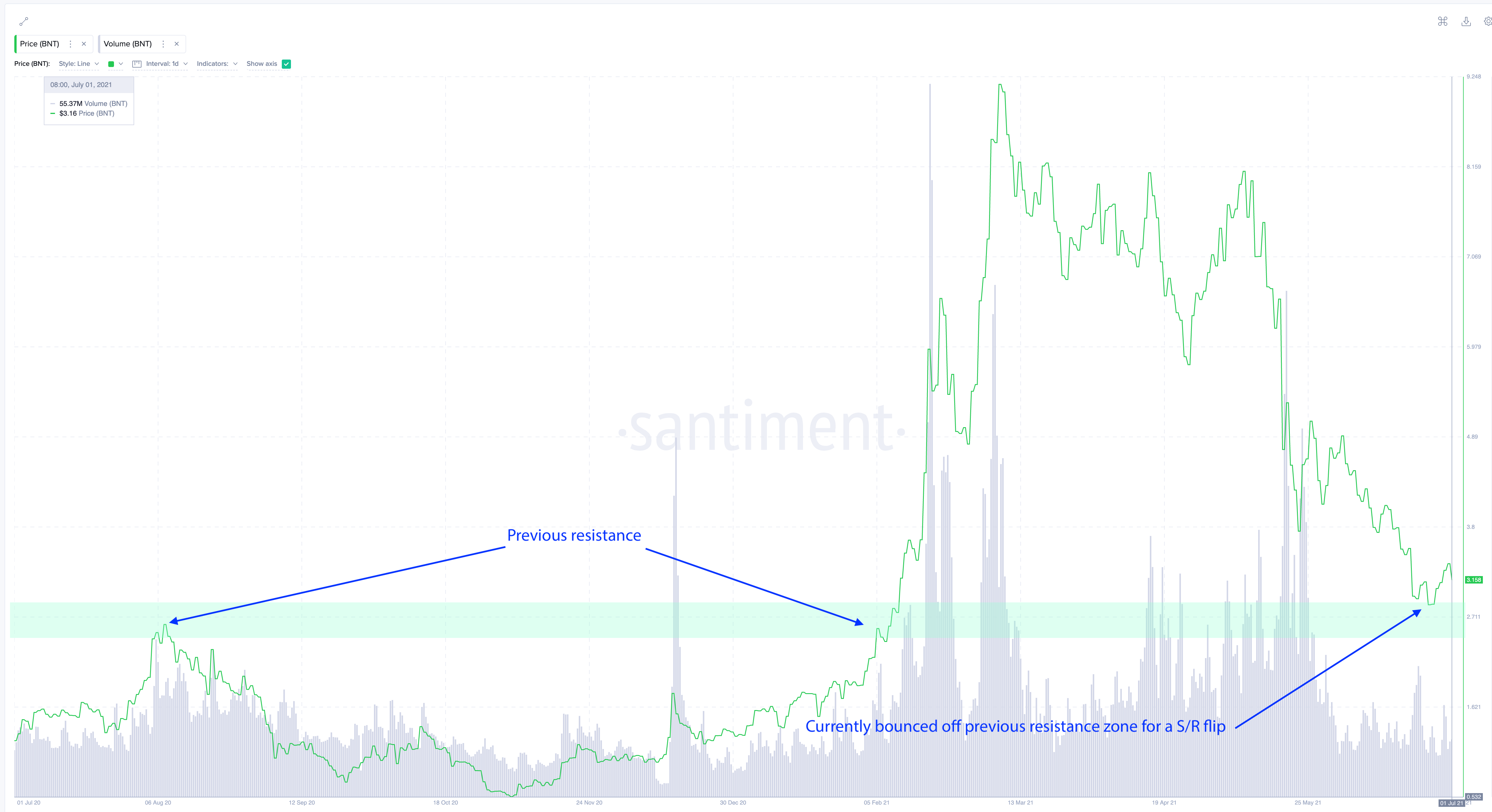

BNT has recently bounced off the previous resistance zone and is attempting to make this a resistance turned support. While it's encouraging for now, it's still too early to tell how things will fare out given the uncertainty around BTC's prices.

In Crypto's current state, anytime BTC makes a downward move, all altcoins tend to crap their pants and it is unlikely that BNT will be an exception.

That said... when we zoom out into the larger timeframe,

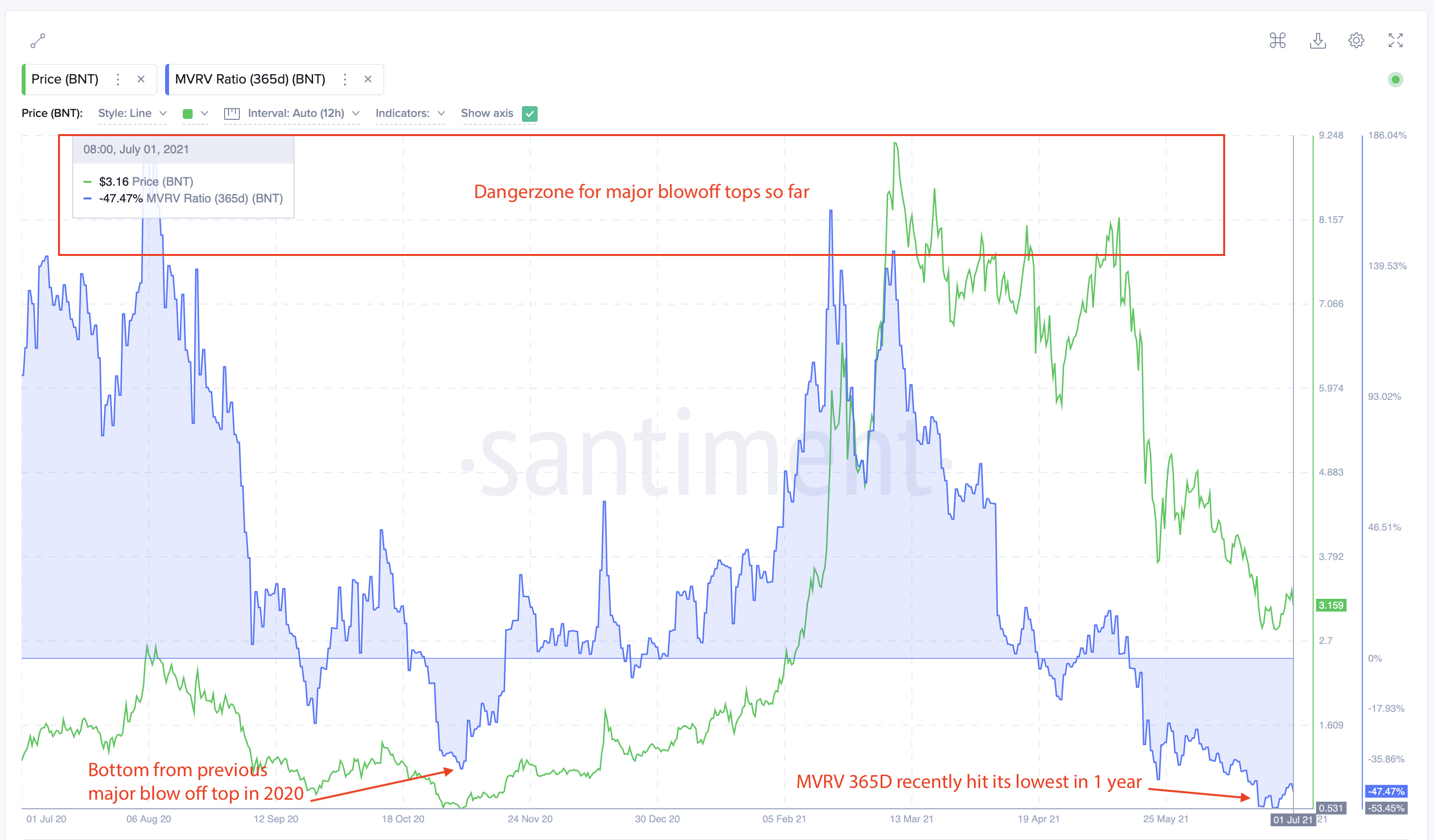

We can observe that in the previous major blow off tops in 2018 and 2020, BNT's price did see a relief rally before continuing its downward trend.

Assuming we are in a bear market, we might just we see something similar in this cycle.

One of the possible catalysts for this rally could be "buy the rumour" towards Bancor's V3 release (no date yet).

Bancor v2.1 since October 2020

While the announcement of Bancor V3 coming brings much excitement, the Development Activity following it was rather lacklustre as it declined the lowest level in 2021.

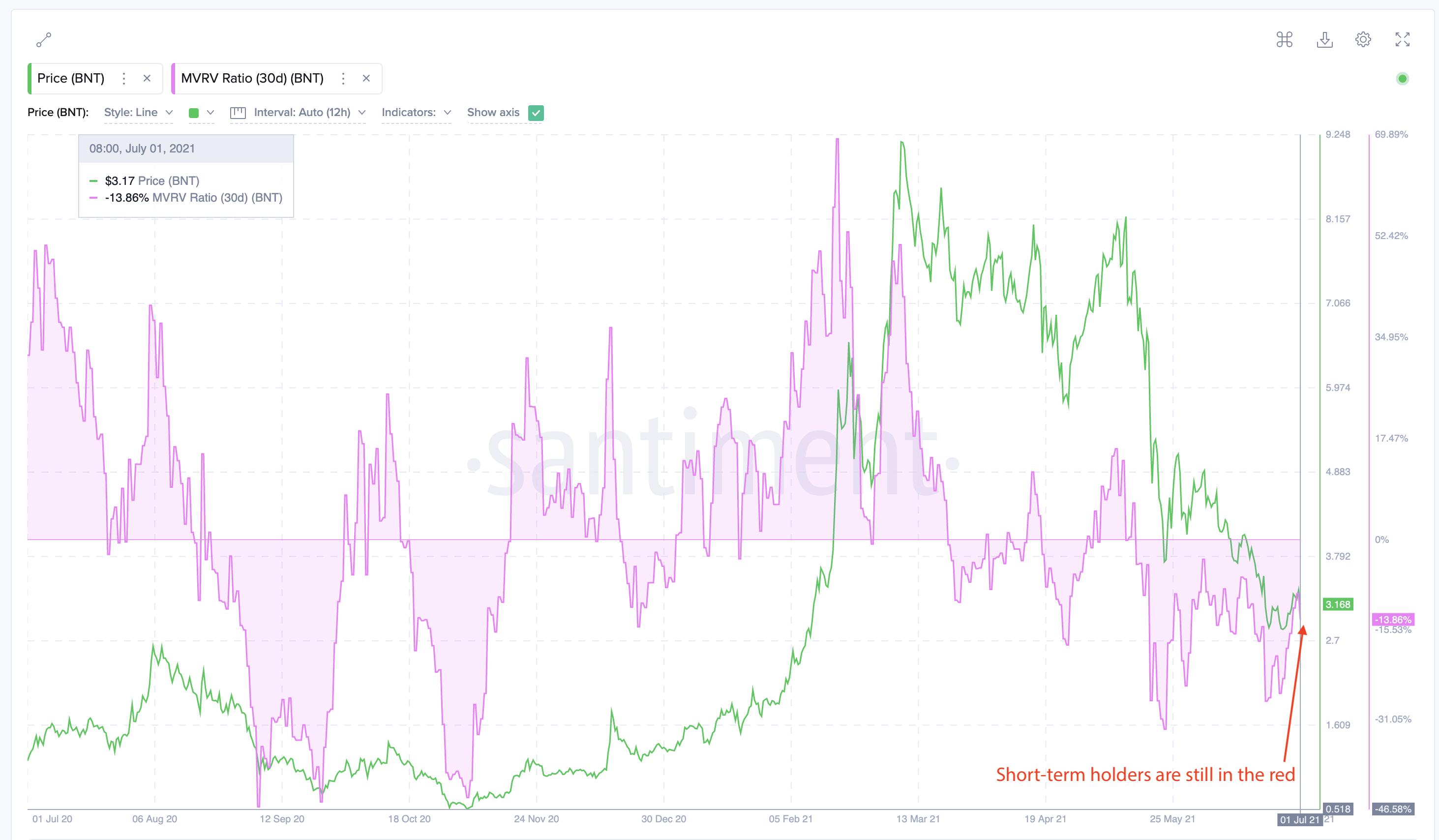

Short-term holders (MVRV30D) are still in the red.

As for the long-term holders (MVRV 365D), we recently saw the MVRV 365D hitting the lowest levels in 1 year.

The pain is real for long term holders.

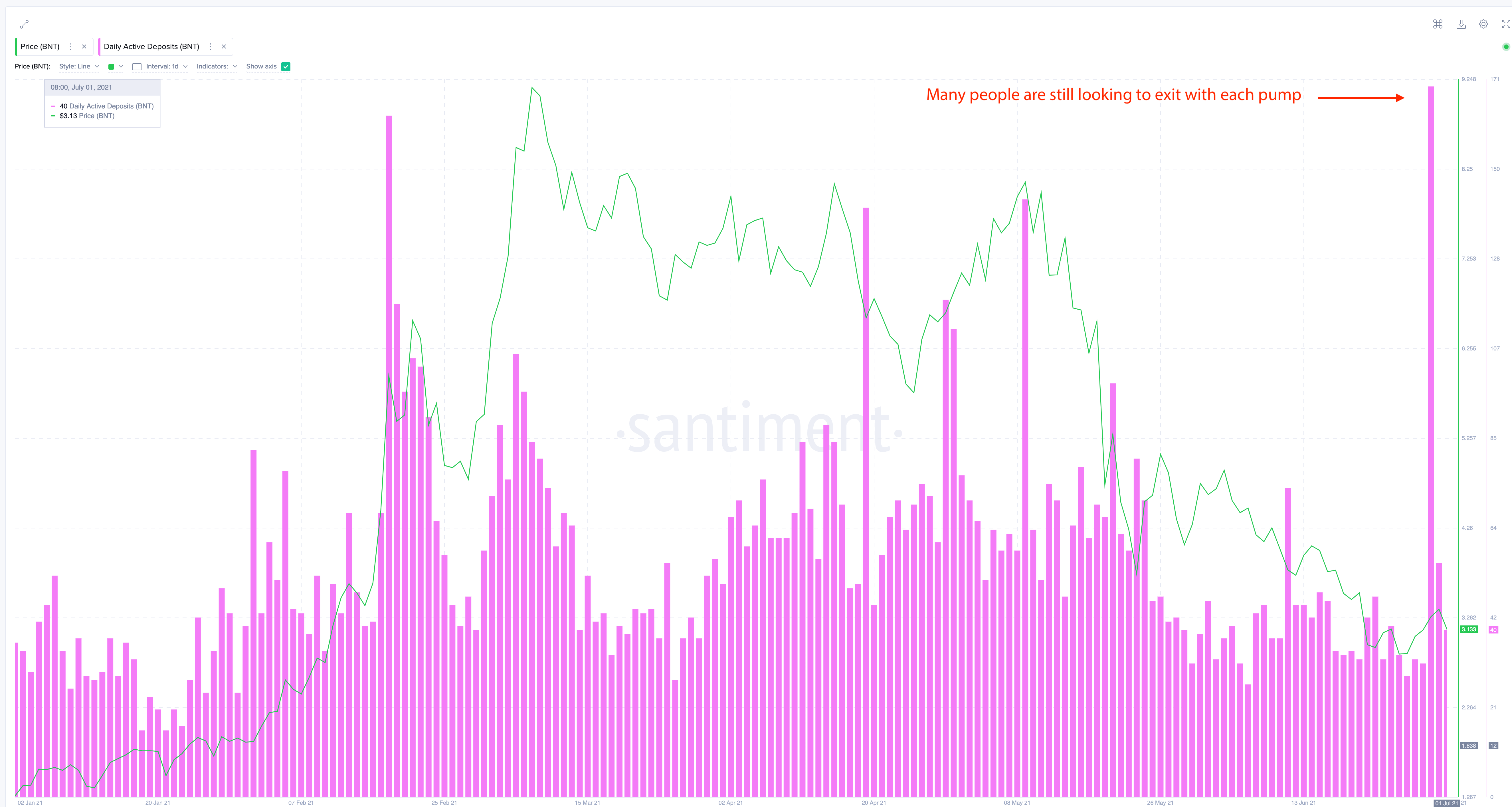

BNT's Daily Active Deposits is still showing signs of constant sell pressure as people rush to deposit each time the price pumps.

Given that we are in a downtrend, it's likely that people are using any chance available to cut their losses.

In summary

As with most alts in the market, BNT's price found some support but is still struggling to show strength.

Onchain metrics are still showing signs of pain and people are eager to cut their losses where possible.

Given that the market is still in a bear trend, any speculative juice (Bancor V3) will only give it a temporary boost before continuing down. It is likely, we'll see a similar behavior (people rushing to cut losses at pumps) when that happens.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)