Bitfinex adds support for LN - what does the data say?

Looks like Bitfinex is taking the Lightning Network mainstream.

Earlier today, one of the world’s biggest exchanges announced their upcoming support of Bitcoin transactions on the Lightning Network - an industry first for a major cryptocurrency exchange.

What this basically means is that Bitfinex users can now withdraw and deposit BTC on the exchange via the Lightning Network, a second layer scaling solution on the Bitcoin blockchain. For the users, benefits will include near-instant transactions and almost zero fees to send ther funds via Lightning.

“LN and LN assets are not only the best P2P micro-payments solution, but an impressive settlement layer for B2B. Bitfinex leads the way.”, said Paolo Ardoino, the platform’s CTO following the announcement.

Doubling down on their support for LN, Bitfinex says they’re currently working on launching USDT and Tether Gold onto the network as well.

This also appears to be the first of two major announcements that the exchange has been teasing recently. While the second part remains a mystery, according to Bitfinex: “When this feature is live, the way you spend crypto will change forever”

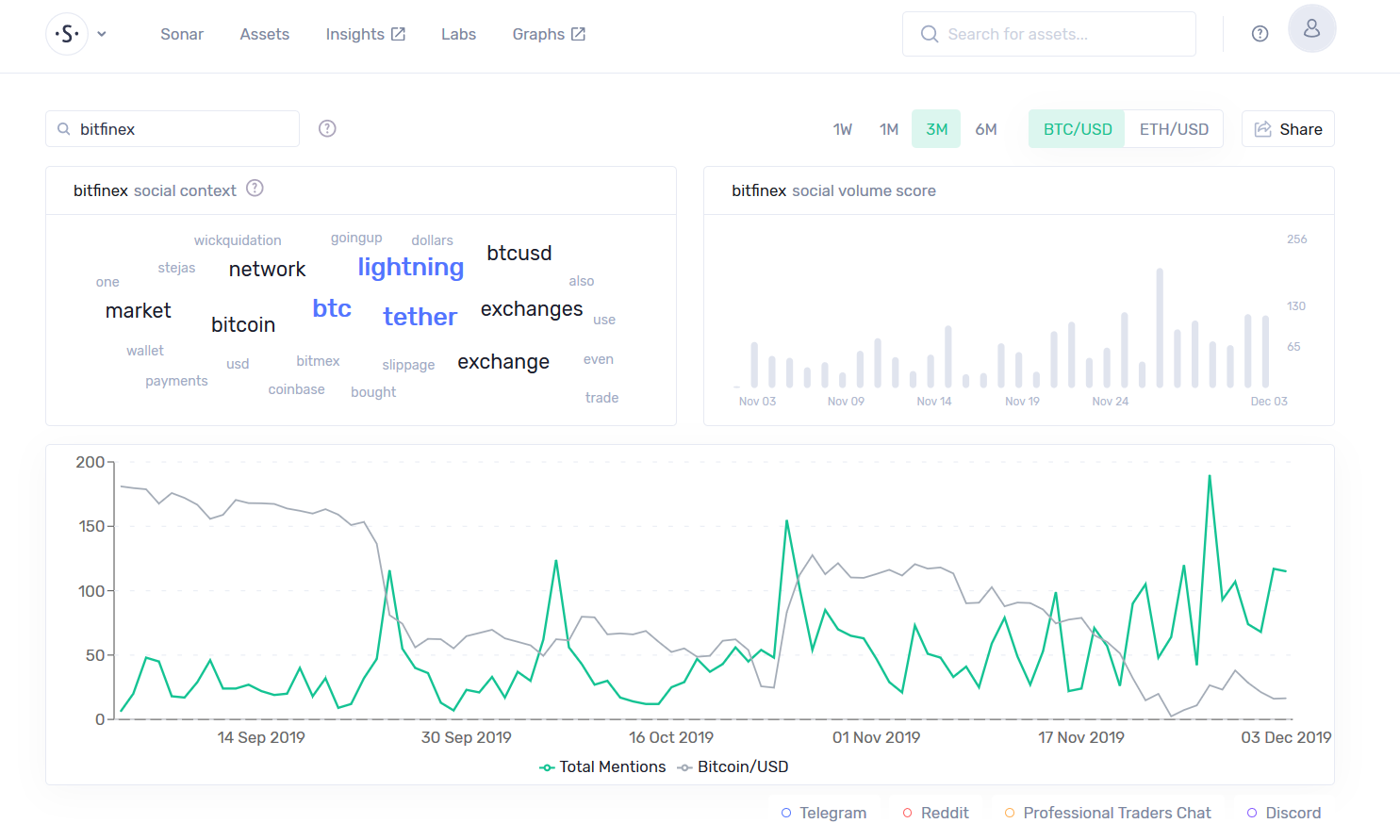

The news has quickly propelled 'Bitfinex' to our daily list of top 10 emerging words on crypto social media:

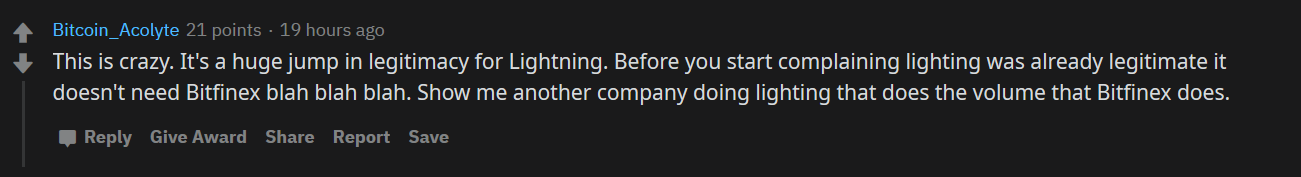

As expected, the news of further LN adoption was welcomed with open arms over on r/bitcoin, which called it a major milestone for the network:

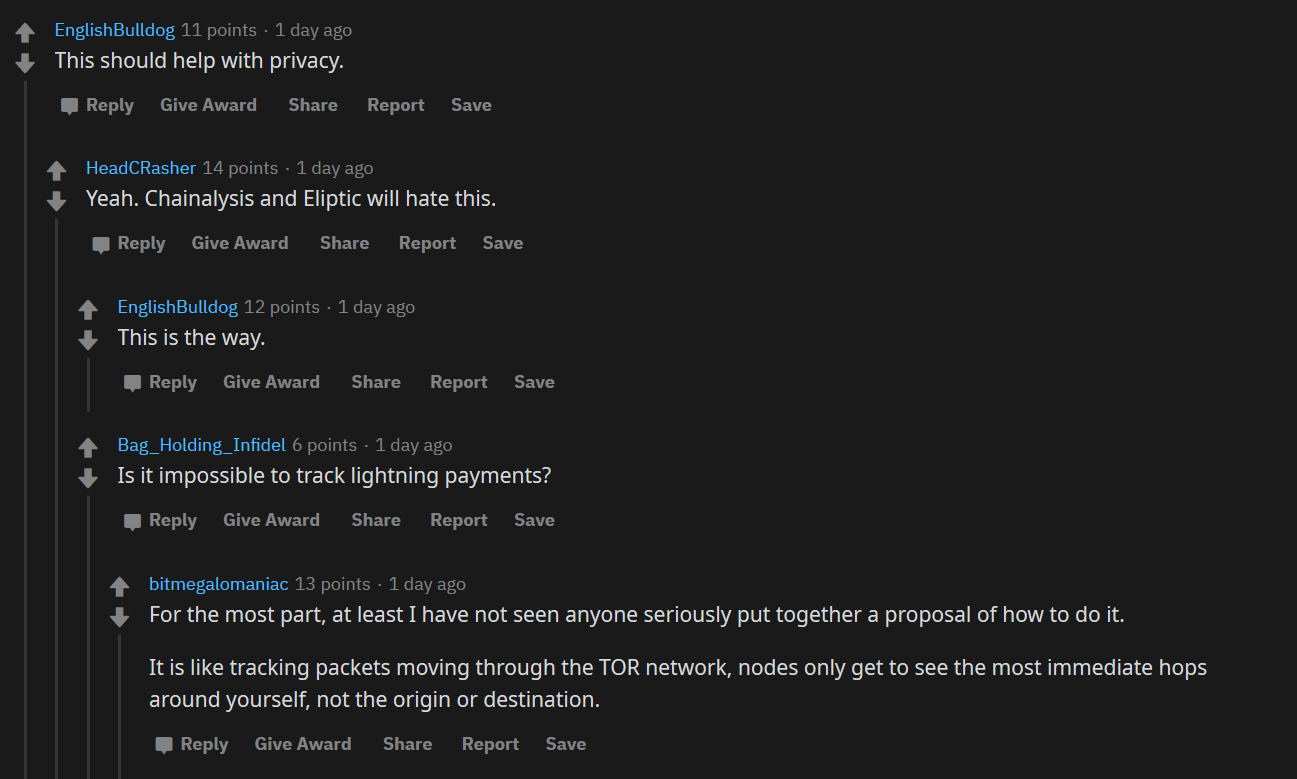

The community also noted the major benefits of the approach, including heightened transaction privacy:

And the facilitation of instant exchange-to-exchange transactions, which should help with arbitrage and quicker market entry:

In light of the news, some have already called on other major exchanges and hardware wallets to follow suit:

Elsewhere online - like the NANO subreddit - the significance of the announcement as well as the Lightning Network itself were considerably toned down:

Although it lit up the bitcoin subreddits, the LN news proved less impactful on the top coin’s intraday PA. Bitcoin continued to trade sideways for most of the day, testing the $7400 resistance twice before retreating.

This, however, came as little surprise to the BTC community:

Still, it will be interesting to keep an eye out on the amount and volume of Bitcoin deposit and withdrawals on Bitfinex in the coming days, which you can track on Sandata.

For the time being, there hasn’t been a noticeable change in the amount of active deposit or withdrawal addresses interacting with Bitfinex following the news:

Nor have we seen a significant change in the BTC inflow and outlfow volumes to the exchange:

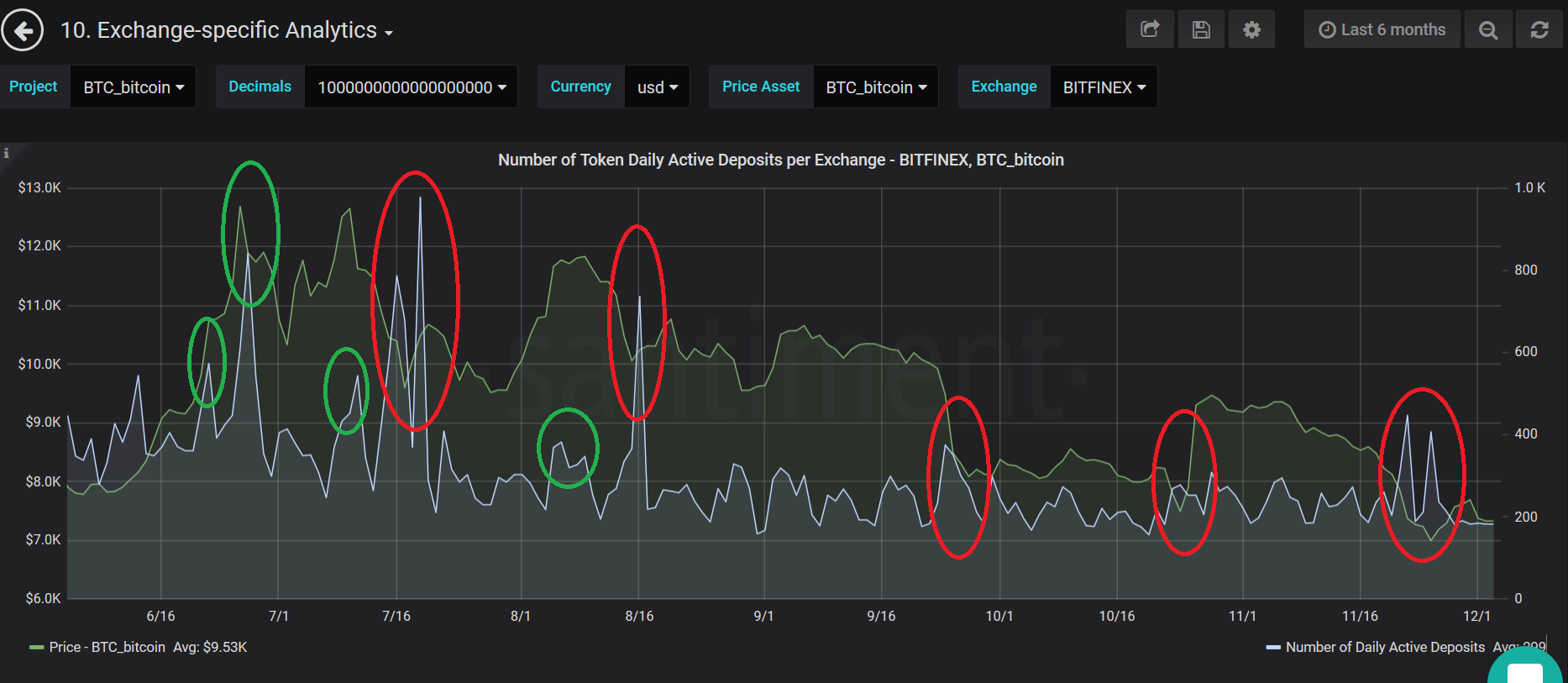

Going out on a fascinating tangent for just a moment, the Bitcoin deposit and withdrawal charts for Bitfinex have been incredibly interesting from a speculative POV over the last 6 months.

Virtually every spike in daily deposits over the past half a year has signaled a clear trend reversal for Bitcoin’s short-term PA - either a forming top or impending market capitulation:

The trends are even more interesting when separating inflow and outflow volumes: on several occasions, a spike in which the incoming volume of BTC to Bitfinex dominated the withdrawal volumes (labeled green) correlated squarely with the forming top, as traders moved in with the rally to sell their bags and claim profit.

On the other hand, the spikes in which the withdrawal volumes dominated the incoming BTC volumes mirrored the local bottom in multiple instances, and signaled a swift bounceback.

That’s how it works with Sandata sometimes - you check in to see how the news has impacted the charts, and end up discovering a whole new bottom/top indicator.

Hint hint - Sandata is 30% off until the end of the week (Cyber Week Special). If you want to get access to the above data for every exchange, make sure to e-mail [email protected] to find out more about the promo.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Ibis!

Get 'early bird' alerts for new insights from this author

Conversations (0)