What the SUSHI is going on?

Well, well, not since the genesis of YFI have we experienced such an interesting experiment play out before us in the DeFi space - Enter the vampire protocol: Sushiswap.

What is SUSHI?

SUSHI is the native token for Sushiswap - A fork of Uniswap but with liquidity mining (SUSHI) and a better trading fee distribution model.

In SushiSwap, 0.25% of trading fees go directly to the active liquidity providers, while the remaining 0.05% get converted back to SUSHI (through SushiSwap) and is distributed to SUSHI token holders.

10% of every SUSHI distribution is set aside for the development & future iterations, including security audit.

Even though it's a Uniswap fork, it actually leverages on Uniswap's existing infrastructure to harvest liquidity before migrating over to its own protocol. And since Uniswap does not have a token, it is vulnerable to such attacks.

You can read more details about SUSHI's launch here.

SUSHI tokenomics

The current circulating supply is 89,749,008 / 92,984,986.

It is inflationary over time and does not have a supply ceiling at the moment. This however can be changed via governance.

Each block produces 100 SUSHI tokens and is distributed to all liquidity providers.

However, for the first 100,000 blocks (~2 weeks), the amount of SUSHI tokens produced will be 10x to attract liquidity providers. The extra rewards will end at block #10850000, which is in 2 days time.

Also, 2M SUSHI will be rewarded to liquidity providers that staked their LP tokens through the migration process.

The high emission rate is a genuine concern for the community and they are working on addressing this fast before price goes to shit and LPs leave the protocol.

Below is one proposal by adamscochran that saw overwhelming support:

To follow the discussion, head over to the #tokenomics-discussion channel on their Discord

Total value locked (TVL)

Following the successful liquidity migration from Uniswap, Sushiswap now ranks #2 in TVL in the DeFi space with a TVL of around $1.3B at the time of writing.

Here's a look at how TVL changed pre/post Sushiswap for Uniswap:

So did Sushiswap really steal liquidity from Uniswap?

Considering that prior to Sushiswap, Uniswap had a TVL of around $313M and now it's sitting at $472.18M. Sushiswap merely migrated their yield farmers as pointed out by Andre (creator of YFI).

That aside, let's take a look at the marketcap in relation to TVL.

If we were to take the top 9 projects with a marketcap from the list above, SUSHI is ranked #6 by marketcap, indicating that perhaps SUSHI is undervalued by at least by 2x when compared to other projects above it that has similar TVL.

So, is SUSHI really undervalued or did the market priced in certain factors?

1. The constant sell pressure by liquidity providers farming SUSHI and dumping them. Which is likely to continue until high emission rate settles down.

2. Uncertainty whether LPs will stay after incentives are lowered/gone.

3. Uncertainty around vampire protocol attacks on Sushiswap (Oh the irony).

Perhaps this might be early teething issues that SUSHI will have to work through and if it survives, it might just have a place in the cryptomarkets as pretty much all of the projects have gone through it one way or another.

E.g:

YFI - Liquidity mining done and Emission completed. Entered price discovery.

LEND - No liquidity mining, 96% of supply is circulating. Gone through bull and bear market, resulting in token being sufficiently distributed.

MKR - No liquidity mining, 90% of supply is circulating. Gone through bull and bear market, resulting in token being sufficiently distributed.

Even Compound, the OG DeFi project that kicked off the yield farming mania recently passed a proposal to reduce emission by 20%.

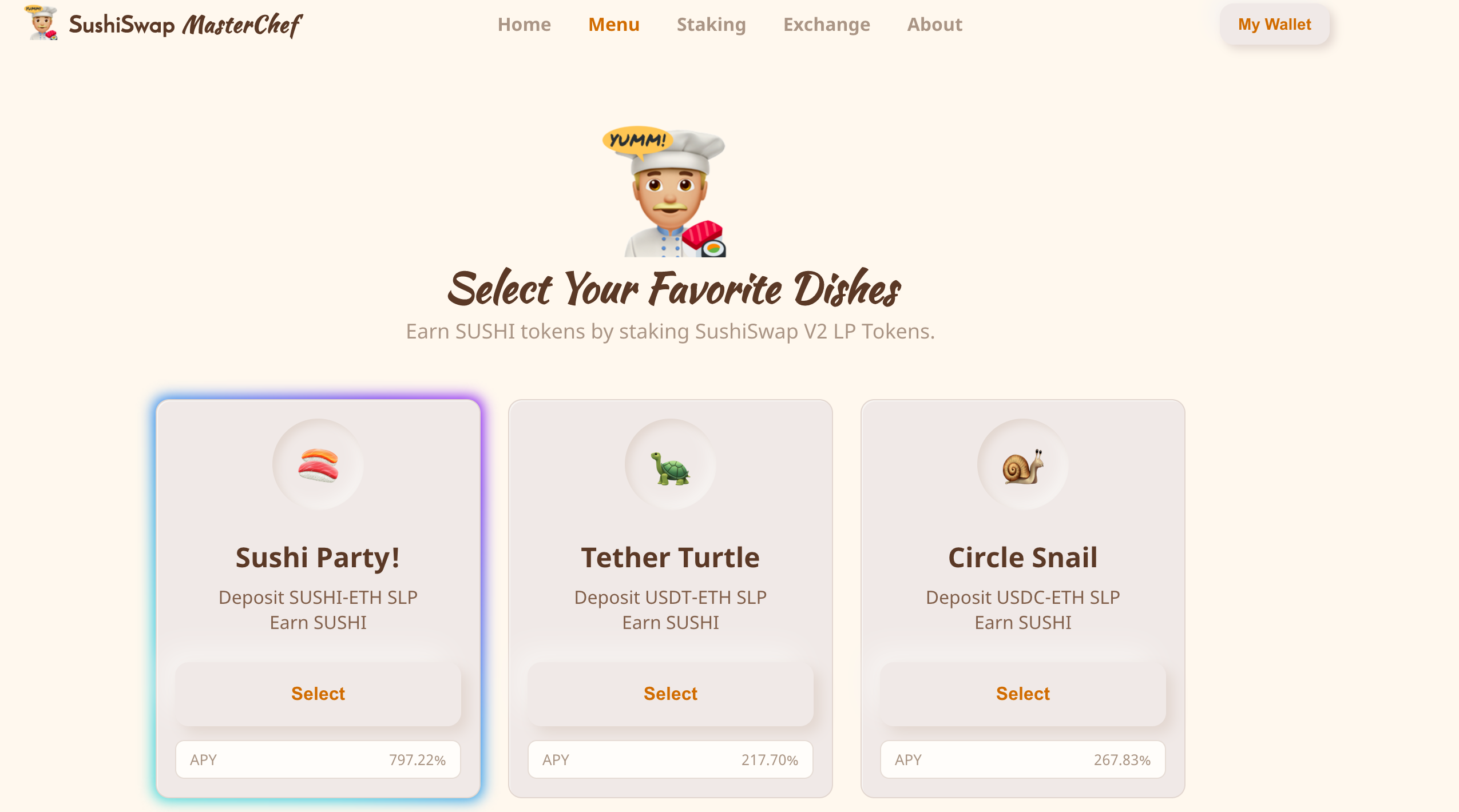

Liquidity pools and APY

While Uniswap is permissionless and supports any token under the sun, Sushiswap launched with an initial number of liquidity pools and new ones will have to be voted in to be eligible for SUSHI liquidity mining.

Currently, the available pools are as follows (high APY pools highlighted in bold):

SUSHI/ETH APY 797.33%

ETH/USDT APY 217.44%

USDC/ETH APY 266.94%

DAI/ETH APY 406.40%

sUSD/ETH APY 454.53%

UMA/ETH APY 827.9%

BAND/ETH APY 869.08%

LINK/ETH APY 392.43%

ETH/AMPL APY 805.74

COMP/ETH APY 635.3%

LEND/ETH APY 476%

SNX/ETH APY 529.85%

YFI/ETH APY 470.78%

REN/ETH APY 378.28%

SRM/ETH APY 367.85%

YAMv2/ETH APY 388.90%

CRV/ETH APY 567.9%

Do note that the high APY is not constant and will change drastically once the SUSHI 10x boost ends.

To keep track of APY and other SUSHI stats, here's a nice dashboard. For Sushiswap protocol analytics, use this. Both are created by community member Zippo.

The drama

Now, what good experiment is without a good amount of drama that's better than any Netflix release this month?

There's so much that happened that we will probably not be able to fit it all in this post. So, here's a TLDR version.

Chef Nomi exits

Chef Nomi, the creator of Sushiswap, abruptly moved SUSHI from the Dev fund and cashed them into 17,971 ETH (Approx. $13M USD at time of transfer). This happened even though he gave his "word" that he is a "good guy" and would not be doing so.

Chef Nomi followed up with justifications of his move. With one of the reasons being that "there was alot of FUD around the Dev Fund, so they sold to remove any FUD."

This was no surprise to some as it was forewarned by AdamScochran.

But i guess everyone's just too busy farming the high yields and watching SUSHI's price rally. It wasn't until the rapid decline of SUSHI's price that shit really hit the fans. Probably freaked Chef Nomi out to make such a move too.

He pretty much sold at the bottom.

Sanbase

The 17,971 ETH still sits in the dev fund wallet, you can track movements of it using this and clicking "Generate an alert".

Chef Nomi have remained relatively quiet since, his last action was a retweet for the migration.

Look at me, look at me, I'm the chef now: SBF_Alameda

Shortly after the Chef Nomi debacle, SBF_Alameda was quick to step up and fill in the chef role....temporarily.

He called out Chef Nomi for his BS and proposed a new way forward for Sushi. Eventually, Chef Nomi transferred the Sushiswap keys over to SBF.

Which is then transferred to a multi-sig wallet with elected signers by the community.

Now, you might be wondering why SBF_Alameda is so heavily involved in this.

Well, he has a vested interest in the success of Sushi or rather, in ensuring that the $1.2B liquidity ends up his ecosystem (Serum, Solona, FTX). Also, he has skin in the game to pursue that, seeing how he's one of the large holders of SUSHI.

He handled the entire Sushiswap migration and it was a success.

Meet the SUSHI multi-sig signers

With the successful migration, it also came with the new multi-sig signers as SBF_Alameda was just a temporary head chef.

More details on the election can be found here.

The road ahead

High emission = dump fest

As mentioned earlier, there's no real incentive for SUSHI token holders to hold their token especially when they know that the price is just going to keep falling without strong tokenomic changes.

Not to mention, there's also the 2M SUSHI airdrop for those that staked their LP during migration.

Looking at the Holders distribution - Combined balance, we can see that a majority are just using SUSHI as a cashcow, milking it to the max (thanks to generous high emissions incentive) and dumping it daily.

A good amount of SUSHI eventually ends up on the exchanges when observing the % of supply in exchanges growing since genesis. Currently 36.76% of supply are on exchanges.

Perhaps a positive thing is that it seems to have plateaued as we are not observing any further increase since 6th Sept.

You can observe the above behavior here.

Also, looking at the trading volume, we can see that there has been a lot of SUSHI dumping lately but who's absorbing all that SUSHI?

Just look at the volume profile above. It's either wash trading or we are seeing weak hands selling into whales.

Is the crowd gone?

Interestingly, even though the Sushiswap migration was considered a major event in the space, there were very very little mentions of "SUSHI" during this period (after the price dumped).

This reminds me of the classic wall st cheat sheet.

It didn't even make it to our Santrends. Interesting indeed....

Perhaps the crowd got burned and left?

Will LPs stay?

one of the biggest concern that remains is whether liquidity will remain once the generous incentives are gone?

After all, yield farmers are.... well yield farmers... and the only loyalty is to yield. Where there's safe and high yield, that is where you'll find them. And... there are plenty of choices out there at the moment.... if you know how to sniff them out.

E.g Aelf's own version of Sushiswap titled Sashimiswap (Not very original, i know.) which is currently offering 8,701.80% APY on their Sashimi/ETH pool.

And that's not the main competitor Sushiswap has to worry about. Uniswap's founder has hinted something is in the works too.

Now that Sushiswap has blew their incentive load rather early, if Uniswap launched with a token incentive + V3 (hopefully with diffierent weightage pools), it'll be a difficult one to defend against. Oh the irony, that'll be a fun one witness.

The following weeks will be interesting to watch as incentives dry up.

Doubt the game ended, so grab your popcorn and enjoy the ride!

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)