2023: A Matical Mystery Tour

MATIC, like many altcoins in 2023, has recovered a decent chunk of its market cap that it hemorrhaged in 2023. But can the upswing last in these ranging market conditions?

There have been a flurry of massive Polygon transactions over the past week, in particular. These 8 transactions valued at $33M or more was the main inspiration for checking in on the 9th ranked market cap asset today.

But where are the tokens? Are they moving to smart money? Or is the smart money actually trying to rid themselves of their supply by moving to exchanges?

Well, this below exchange wallet address has accumulated back a bit today after dumping hard last Wednesday right at the local price top. As you can see by their holdings (illustrated in pink), there definitely seems to be some notable correlation between how many coins they hold vs. the price of $MATIC (illustrated in yellow):

Overall, the percentage of supply for MATIC on exchanges continues to move in the right direction (down). The current 7.1% of supply is the lowest it has been since the coin's introduction four years ago, and this does imply limited continued selloff opportunities that should put investors somewhat at ease.

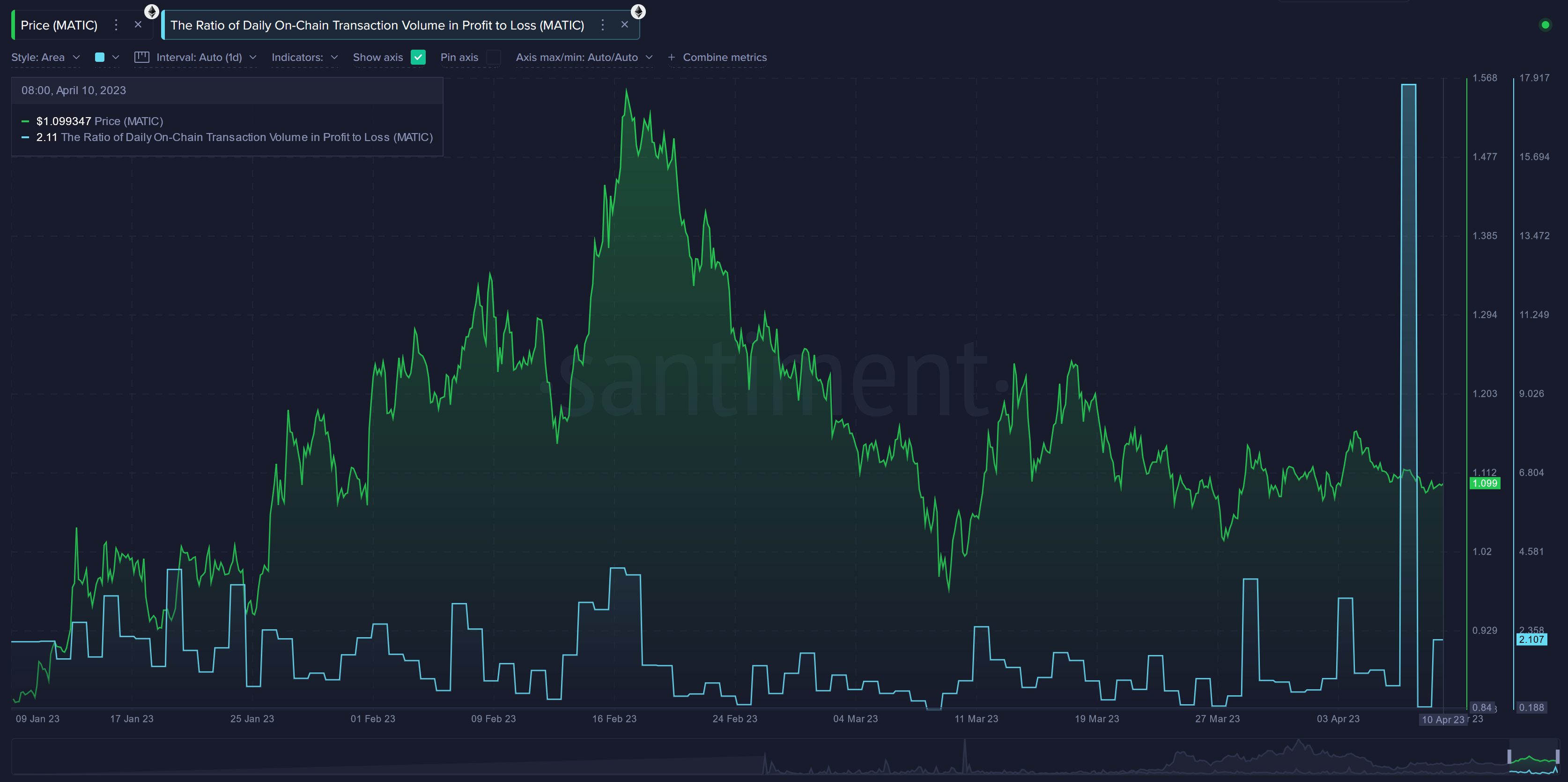

It's also a great idea to keep an eye on the Ratio of Daily On-Chain Tx. Volume in Profit to Loss metric for MATIC. On Saturday, there was a huge spike that indicated there was quite a bit of profit taking. These spikes can often have a short-term negative impact on price, and may have had something to do with the ~$49M transaction on the network, the 8th largest so far this year.

Dormant money is also showing some signs of moving with multiple large dips happening on the mean dollar invested age curve. Typically, when this curve flattens out, it's a sign that some old addresses are circulating coins again, which is typically a positive for an asset. If we start to see another massive drop in this mean dollar invested age curve like we did back in January, 2021, ready your 🚀 🚀 🚀 emojis!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from brianq!

Get 'early bird' alerts for new insights from this author

Conversations (0)